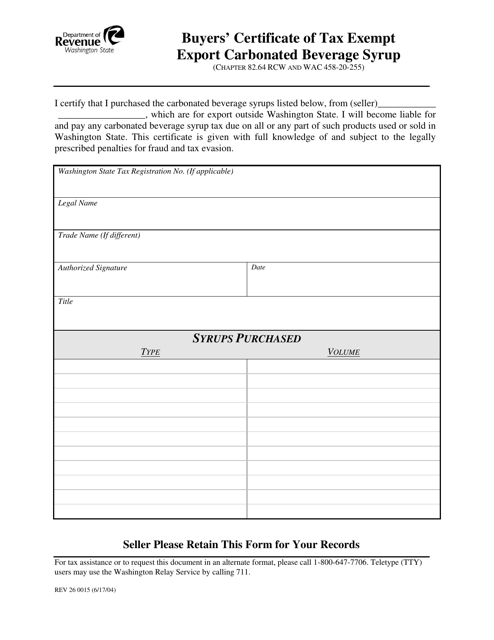

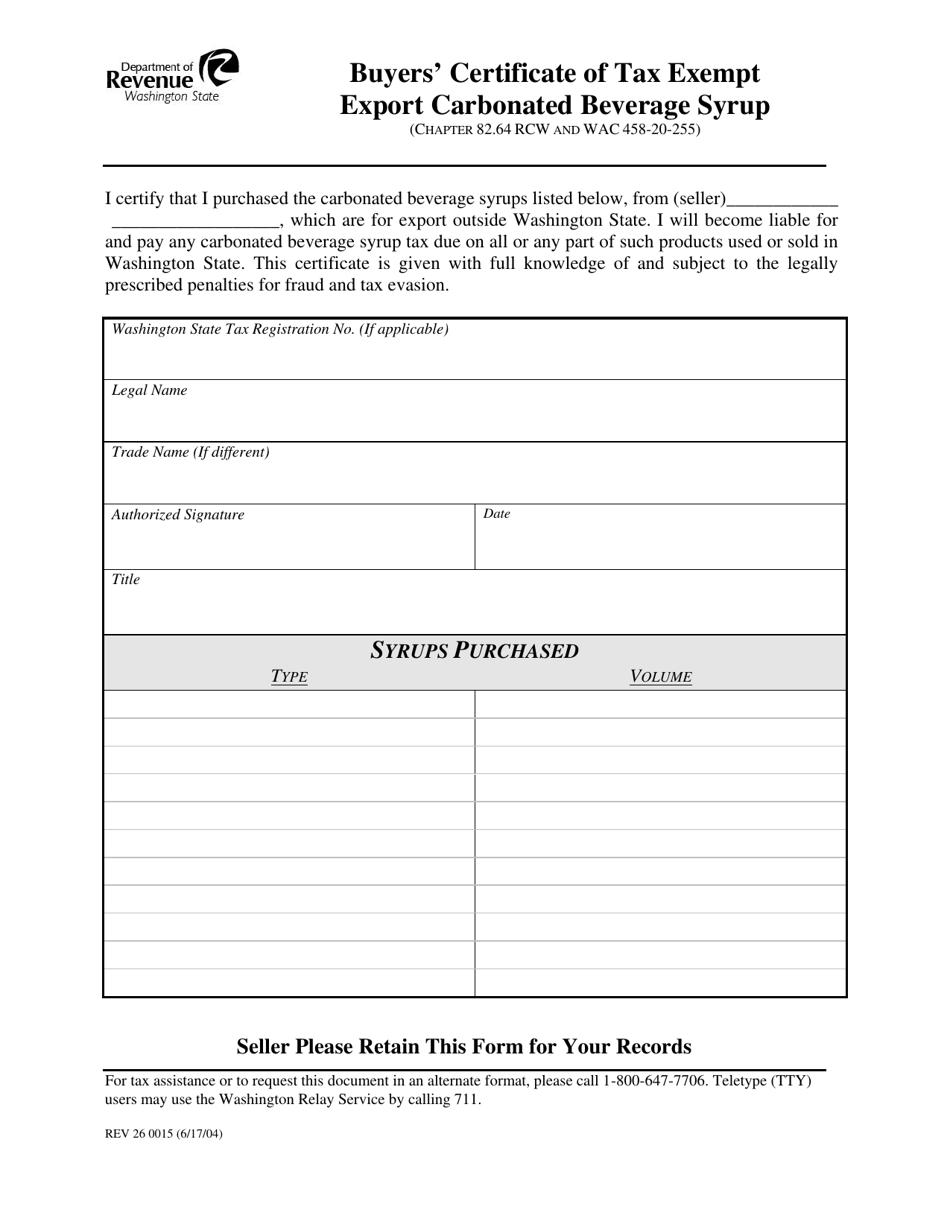

Form REV26 0015 Buyer's Certificate of Tax Exempt Export Carbonated Beverage Syrup - Washington

What Is Form REV26 0015?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV26 0015?

A: Form REV26 0015 is the Buyer's Certificate of Tax Exempt Export Carbonated Beverage Syrup specific to Washington.

Q: What is the purpose of Form REV26 0015?

A: The purpose of Form REV26 0015 is to certify that the buyer is eligible for tax exemption when exporting carbonated beverage syrup.

Q: Who needs to use Form REV26 0015?

A: Buyers who are exporting carbonated beverage syrup and wish to claim tax exemption in Washington need to use Form REV26 0015.

Q: Is Form REV26 0015 specific to Washington?

A: Yes, Form REV26 0015 is specific to Washington and is used for tax exemption within the state.

Form Details:

- Released on June 17, 2004;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV26 0015 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.