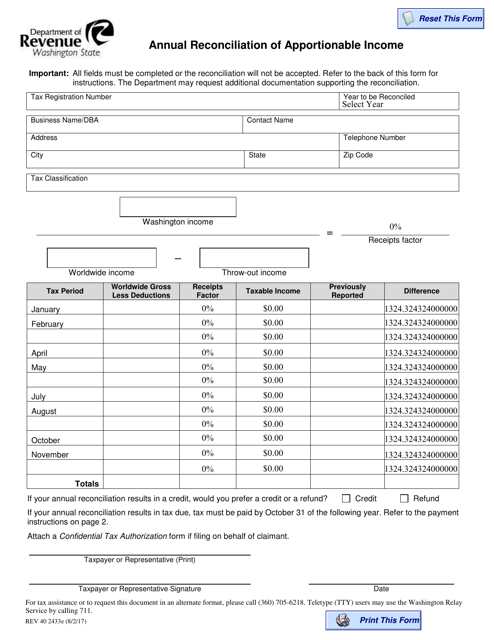

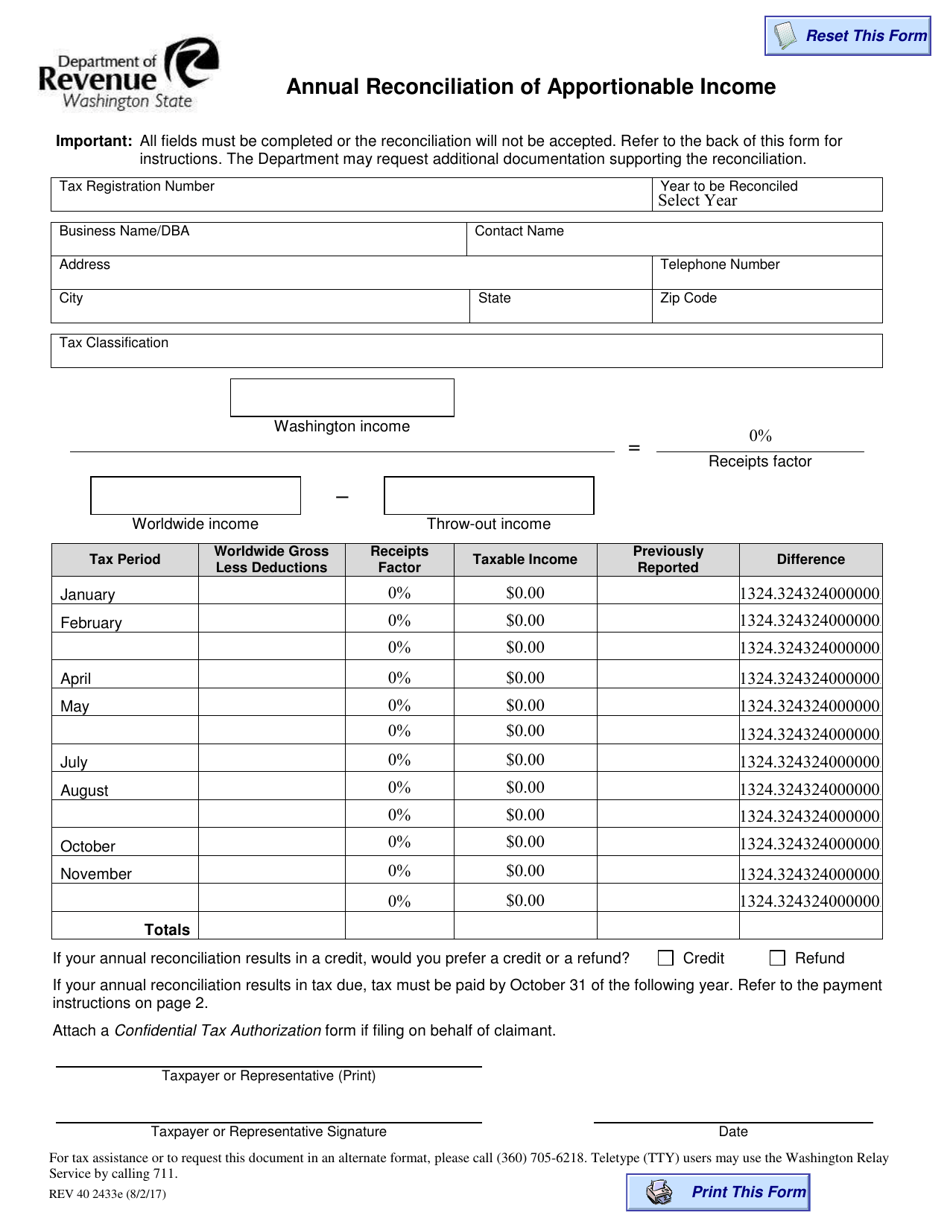

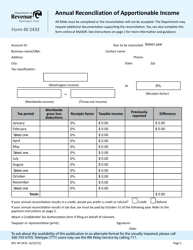

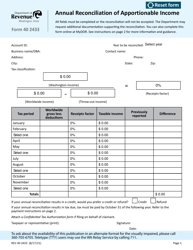

Form REV40 2433E Annual Reconciliation of Apportionable Income - Washington

What Is Form REV40 2433E?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV40 2433E?

A: Form REV40 2433E is the Annual Reconciliation of Apportionable Income for Washington.

Q: Who needs to file Form REV40 2433E?

A: Any taxpayer that has apportionable income in Washington needs to file Form REV40 2433E.

Q: What is apportionable income?

A: Apportionable income is income that is derived from business activities conducted in multiple states.

Q: When is Form REV40 2433E due?

A: Form REV40 2433E is due on or before January 31st of the following year.

Q: Is there a penalty for not filing Form REV40 2433E?

A: Yes, there may be penalties for late or non-filing of Form REV40 2433E.

Q: Do I need to include additional documents with Form REV40 2433E?

A: You may need to include additional documents, such as supporting schedules and worksheets, depending on your specific circumstances.

Q: Can I get an extension to file Form REV40 2433E?

A: Yes, you can request an extension to file Form REV40 2433E. The request must be made before the original due date.

Q: What should I do if I have questions about Form REV40 2433E?

A: If you have questions about Form REV40 2433E, you should contact the Washington State Department of Revenue for assistance.

Form Details:

- Released on August 2, 2017;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV40 2433E by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.