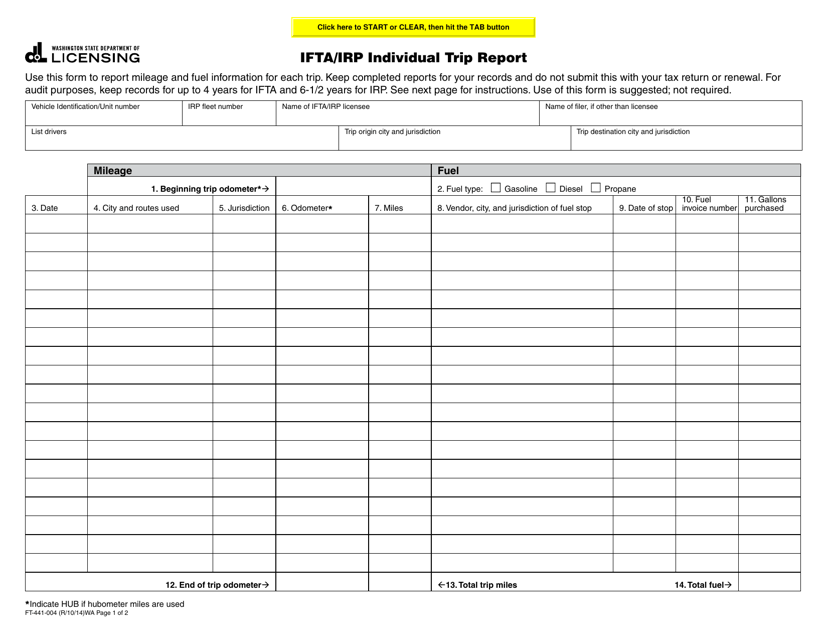

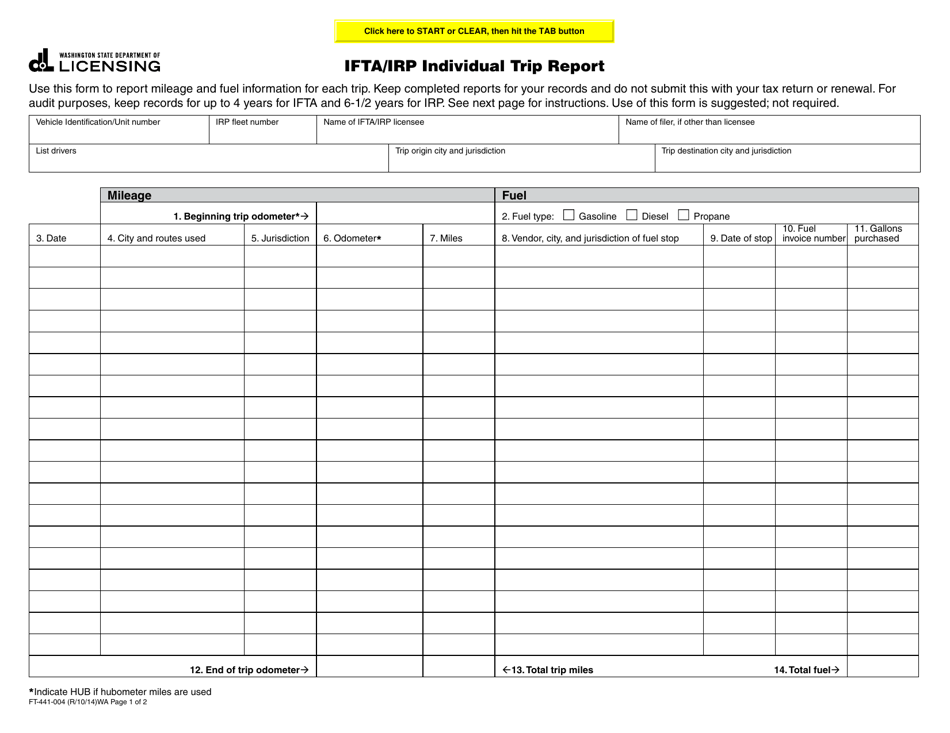

Form FT-441-004 Ifta / Irp Individual Trip Report - Washington

What Is Form FT-441-004?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-004?

A: Form FT-441-004 is the IFTA/IRP Individual Trip Report for Washington.

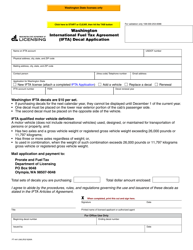

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement, it is an agreement between the United States and Canadian provinces that simplifies the reporting of fuel taxes for inter-jurisdictional motor carriers.

Q: What is IRP?

A: IRP stands for International Registration Plan, it is an agreement between the United States and Canadian provinces that allows for the registration of commercial motor vehicles for interstate travel.

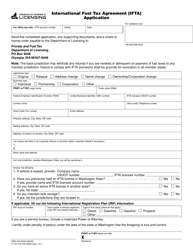

Q: What is the purpose of Form FT-441-004?

A: The purpose of Form FT-441-004 is to report the fuel taxes and mileage for each trip made in Washington by a motor carrier.

Q: Who needs to file Form FT-441-004?

A: Motor carriers who are registered under IFTA and/or IRP and operate in the state of Washington need to file Form FT-441-004.

Q: When is Form FT-441-004 due?

A: Form FT-441-004 is due on the last day of the month following the end of the reporting period.

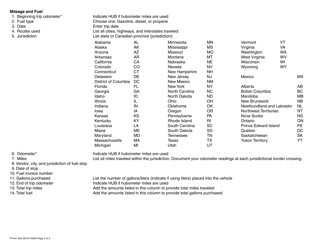

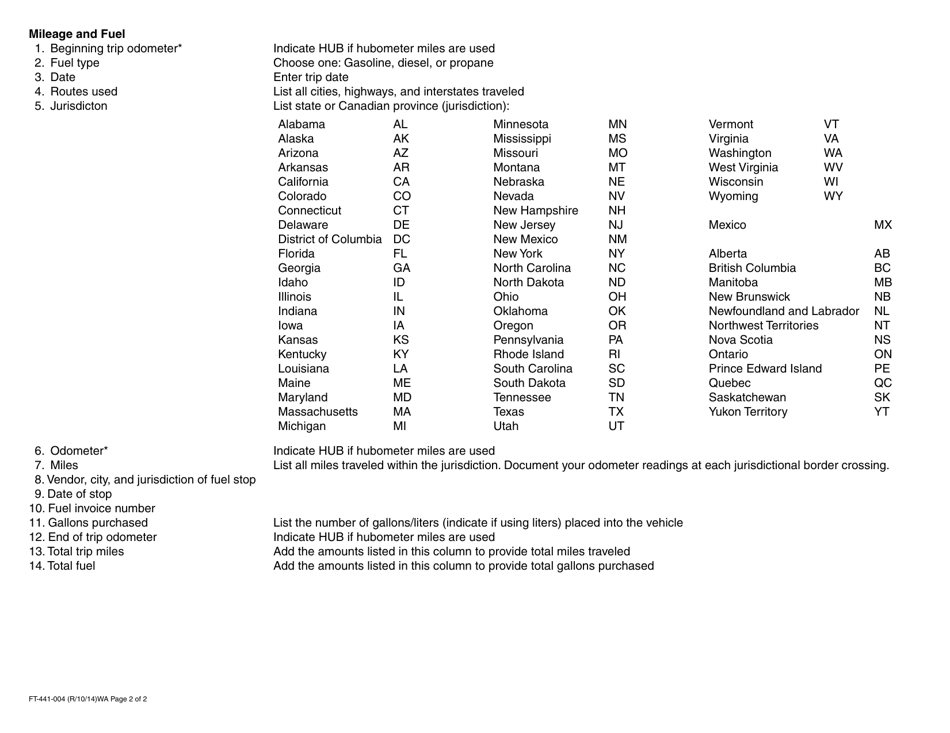

Q: What information is required on Form FT-441-004?

A: Form FT-441-004 requires information such as trip dates, starting and ending locations, distance traveled, fuel purchases, and fuel consumption.

Q: Are there any penalties for not filing Form FT-441-004?

A: Yes, there are penalties for not filing Form FT-441-004 or filing it late, including fees and possible suspension of IFTA/IRP privileges.

Q: Is there any fee for filing Form FT-441-004?

A: No, there is no fee for filing Form FT-441-004.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-004 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.