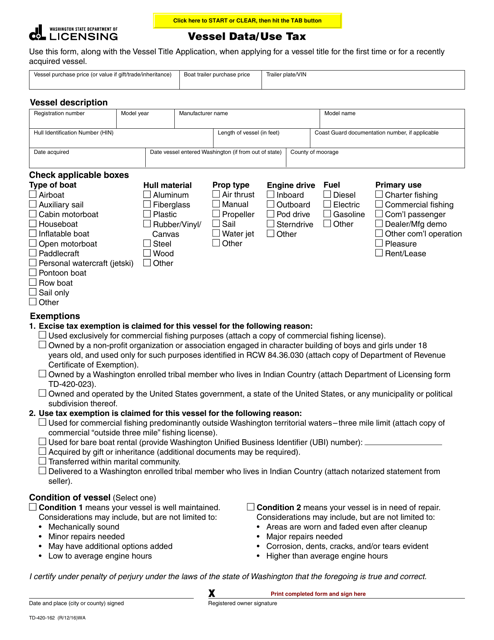

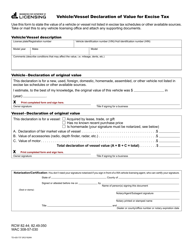

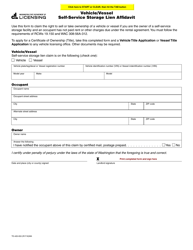

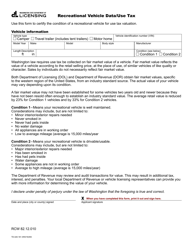

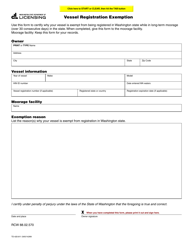

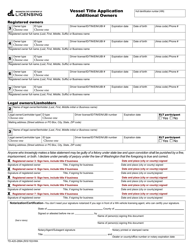

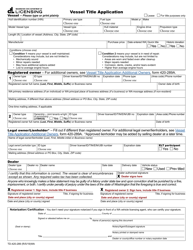

Form TD-420-162 Vessel Data / Use Tax - Washington

What Is Form TD-420-162?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TD-420-162?

A: Form TD-420-162 is a Vessel Data/Use Tax form used in Washington.

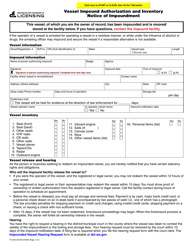

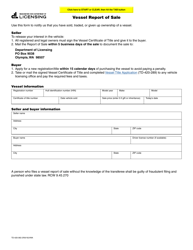

Q: What is the purpose of Form TD-420-162?

A: The purpose of Form TD-420-162 is to report and pay use tax on vessels.

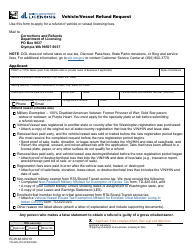

Q: Who needs to file Form TD-420-162?

A: Anyone who purchases a vessel for use in Washington and did not pay Washington sales tax at the time of purchase needs to file Form TD-420-162.

Q: What is use tax?

A: Use tax is a tax on the use of goods or services in Washington State that were purchased without paying Washington sales tax.

Q: When is Form TD-420-162 due?

A: Form TD-420-162 is due within 30 days of bringing a vessel into Washington for use.

Q: What happens if I don't file Form TD-420-162?

A: Failure to file Form TD-420-162 or pay the use tax may result in penalties and interest.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TD-420-162 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.