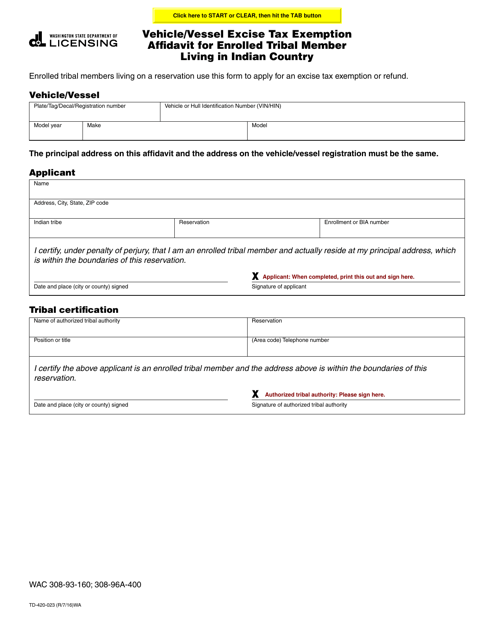

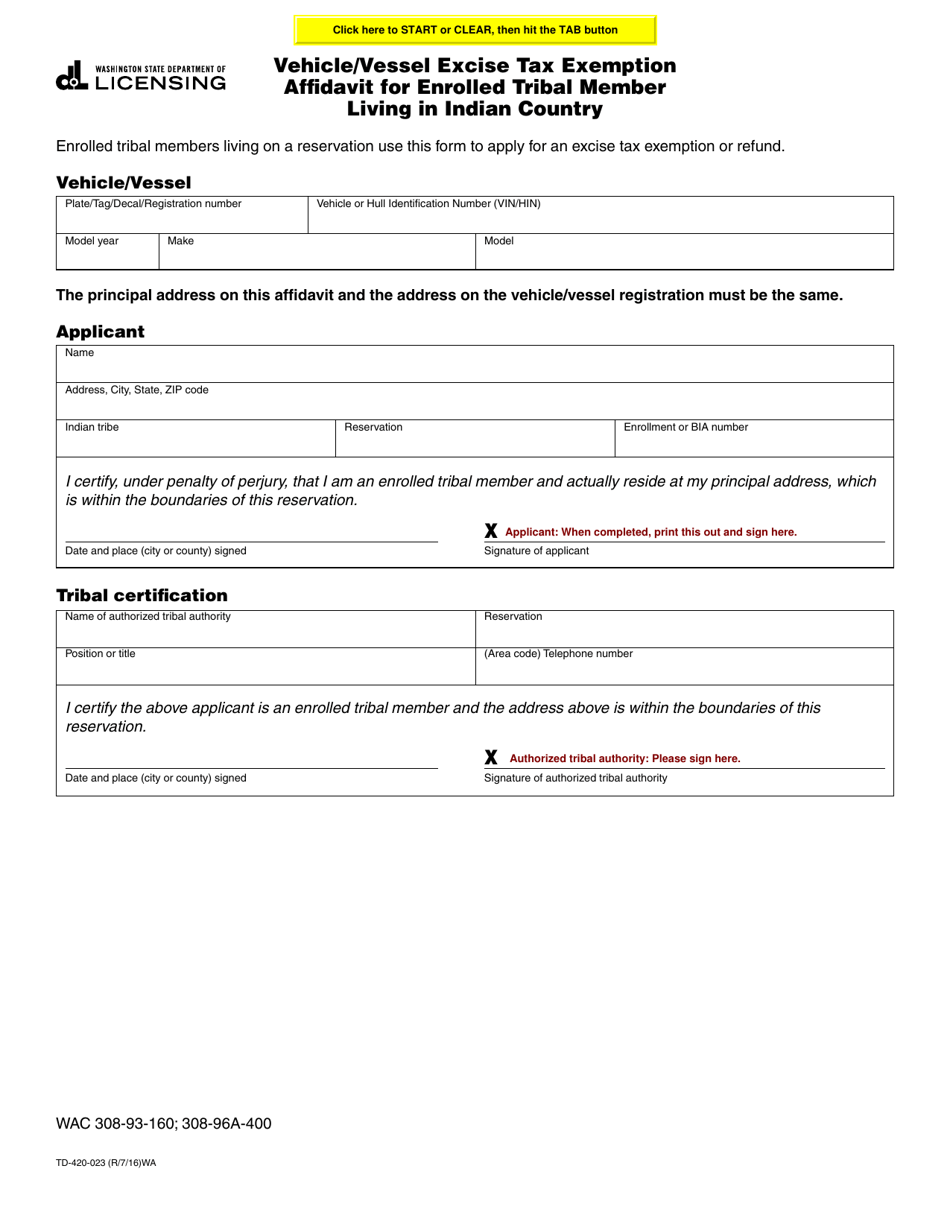

Form TD-420-023 Vehicle / Vessel Excise Tax Exemption Affidavit for Enrolled Tribal Member Living in Indian Country - Washington

What Is Form TD-420-023?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TD-420-023?

A: Form TD-420-023 is the Vehicle/Vessel Excise Tax Exemption Affidavit for Enrolled Tribal Member Living in Indian Country in Washington.

Q: Who can use Form TD-420-023?

A: Enrolled tribal members living in Indian Country in Washington can use Form TD-420-023 to claim an excise tax exemption on a vehicle or vessel.

Q: What is the purpose of Form TD-420-023?

A: The purpose of Form TD-420-023 is to provide enrolled tribal members with an exemption from vehicle/vessel excise tax when purchasing or transferring ownership of a vehicle or vessel.

Q: How do I fill out Form TD-420-023?

A: You need to provide your personal information, tribal enrollment information, vehicle/vessel information, and sign the affidavit to complete Form TD-420-023.

Q: What documents do I need to submit with Form TD-420-023?

A: You may need to submit supporting documents such as tribal ID, proof of residency in Indian Country, and proof of enrollment in a federally recognized tribe.

Q: Are there any fees associated with filing Form TD-420-023?

A: No, there are no fees associated with filing Form TD-420-023.

Q: How long does it take to process Form TD-420-023?

A: The processing time for Form TD-420-023 may vary, but you should receive a response from the Department of Licensing within a few weeks.

Q: Can I apply for an excise tax exemption retroactively?

A: No, you must apply for the excise tax exemption at the time of purchase or transfer of ownership. Retroactive exemptions are not allowed.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TD-420-023 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.