This version of the form is not currently in use and is provided for reference only. Download this version of

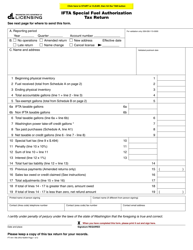

Form FT-441-750

for the current year.

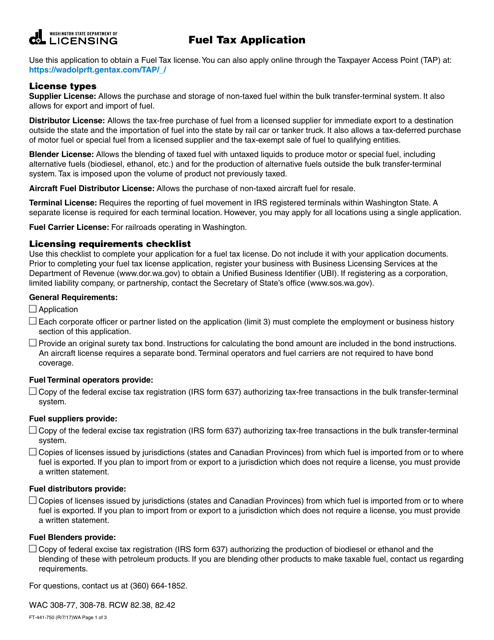

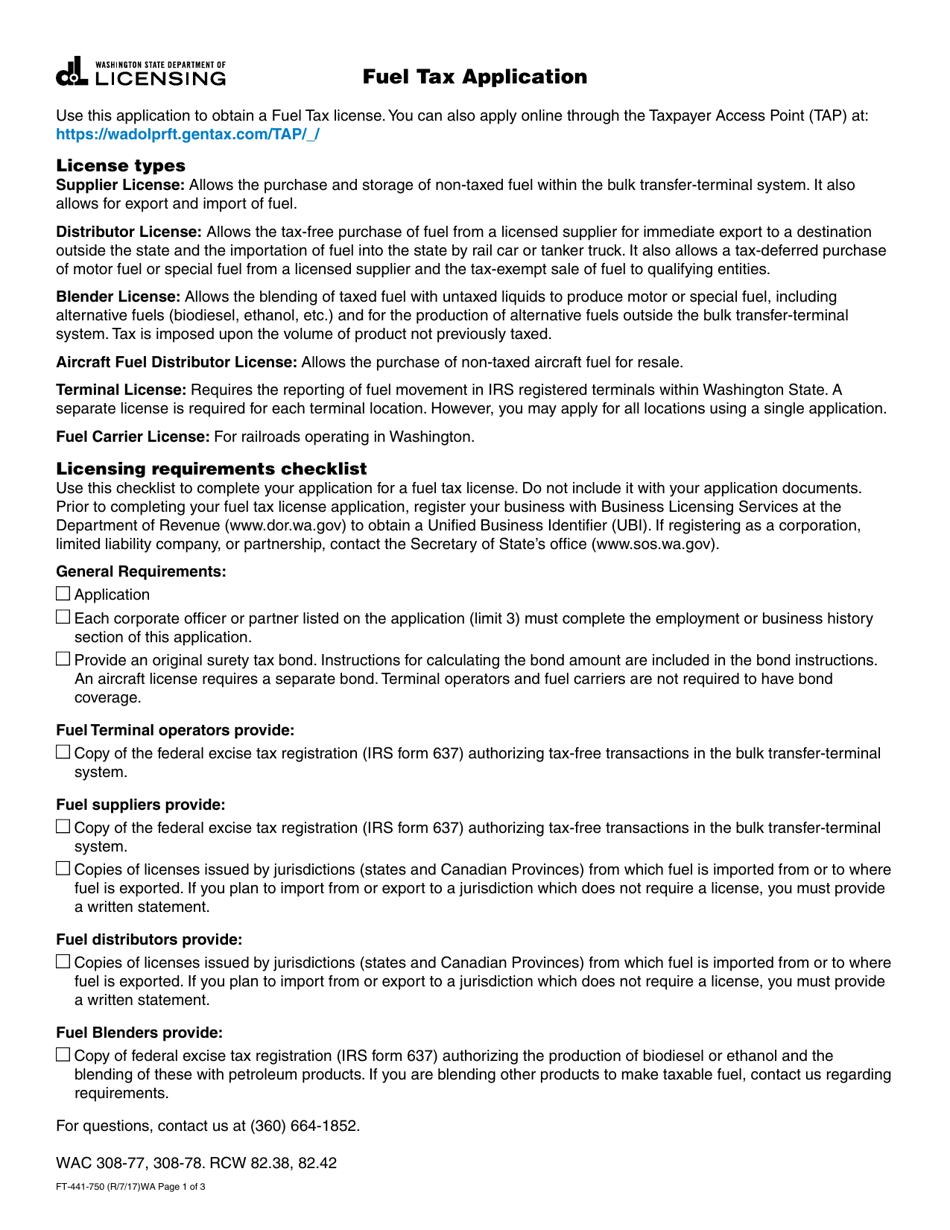

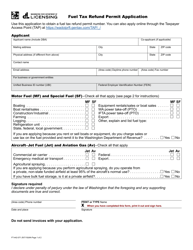

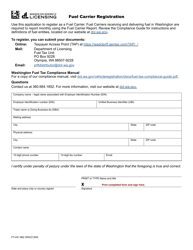

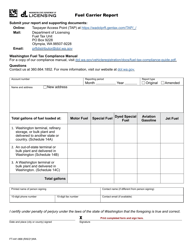

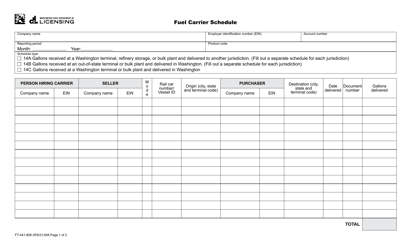

Form FT-441-750 Fuel Tax Application - Washington

What Is Form FT-441-750?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-750?

A: Form FT-441-750 is a fuel tax application used in the state of Washington.

Q: What is the purpose of Form FT-441-750?

A: The purpose of Form FT-441-750 is to apply for a fuel tax license in Washington.

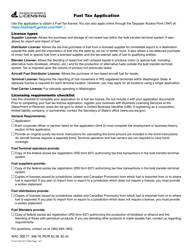

Q: Who is required to file Form FT-441-750?

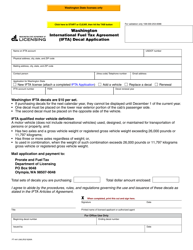

A: Anyone engaged in the business of selling or distributing fuel in Washington is required to file Form FT-441-750.

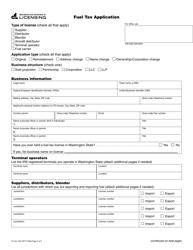

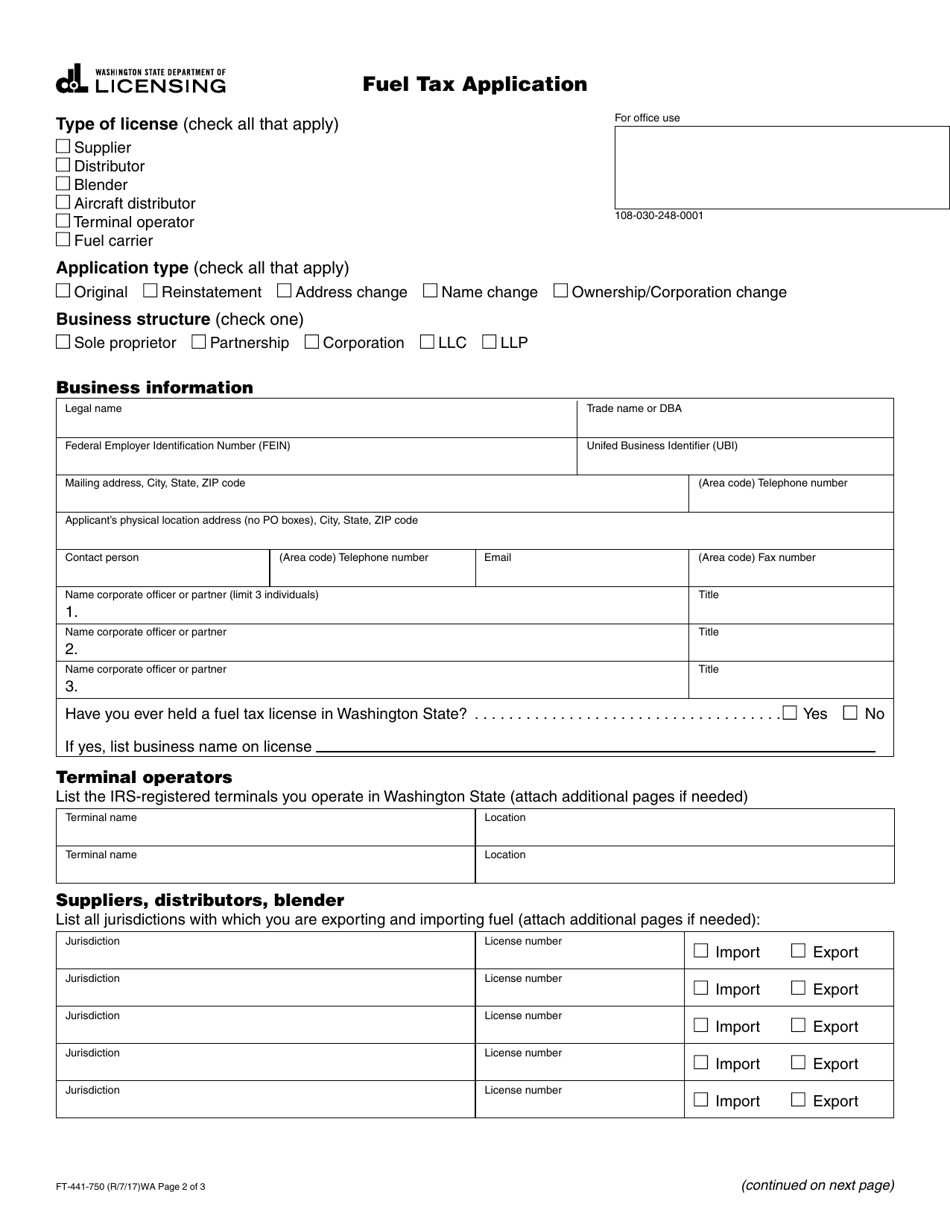

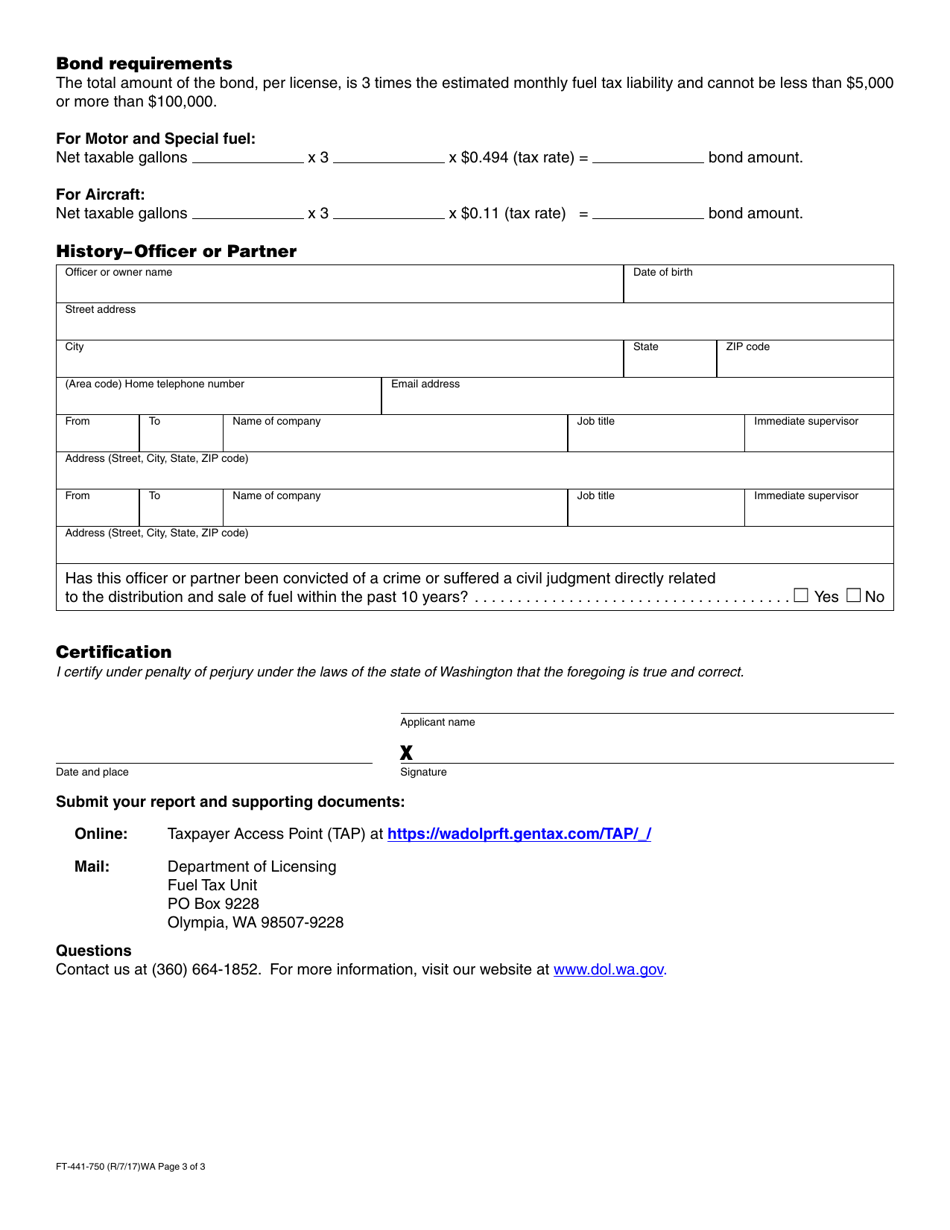

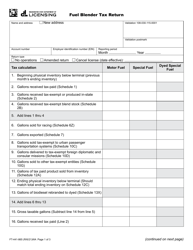

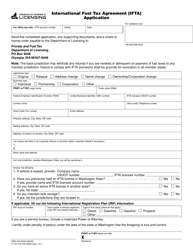

Q: What information is required on Form FT-441-750?

A: Form FT-441-750 requires information such as the applicant's name, business address, federal employer identification number, fuel type, and estimated gallons of fuel to be sold or distributed in Washington.

Q: When is Form FT-441-750 due?

A: Form FT-441-750 is due on the last day of the month following the end of the reporting period.

Q: Are there any fees associated with Form FT-441-750?

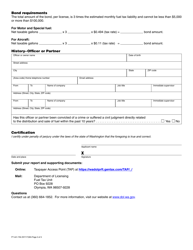

A: Yes, there is a fee of $50 for each fuel license application submitted with Form FT-441-750.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-750 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.