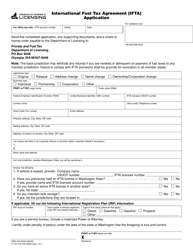

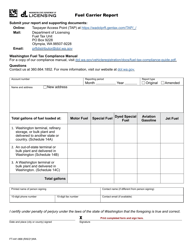

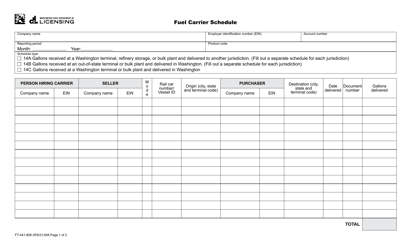

Form FT-441-541 Fuel Tax Bond - Washington

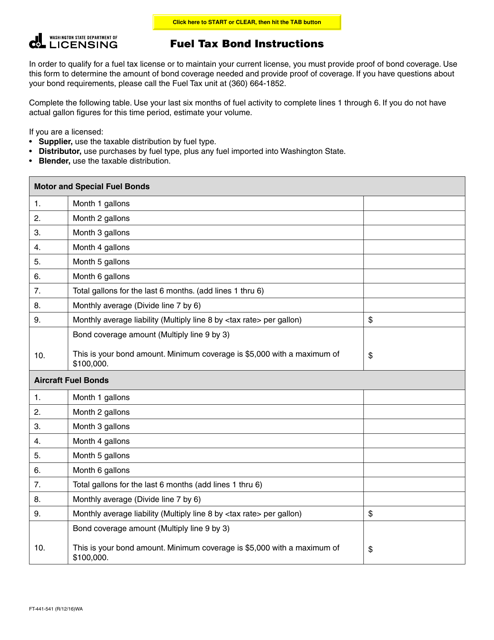

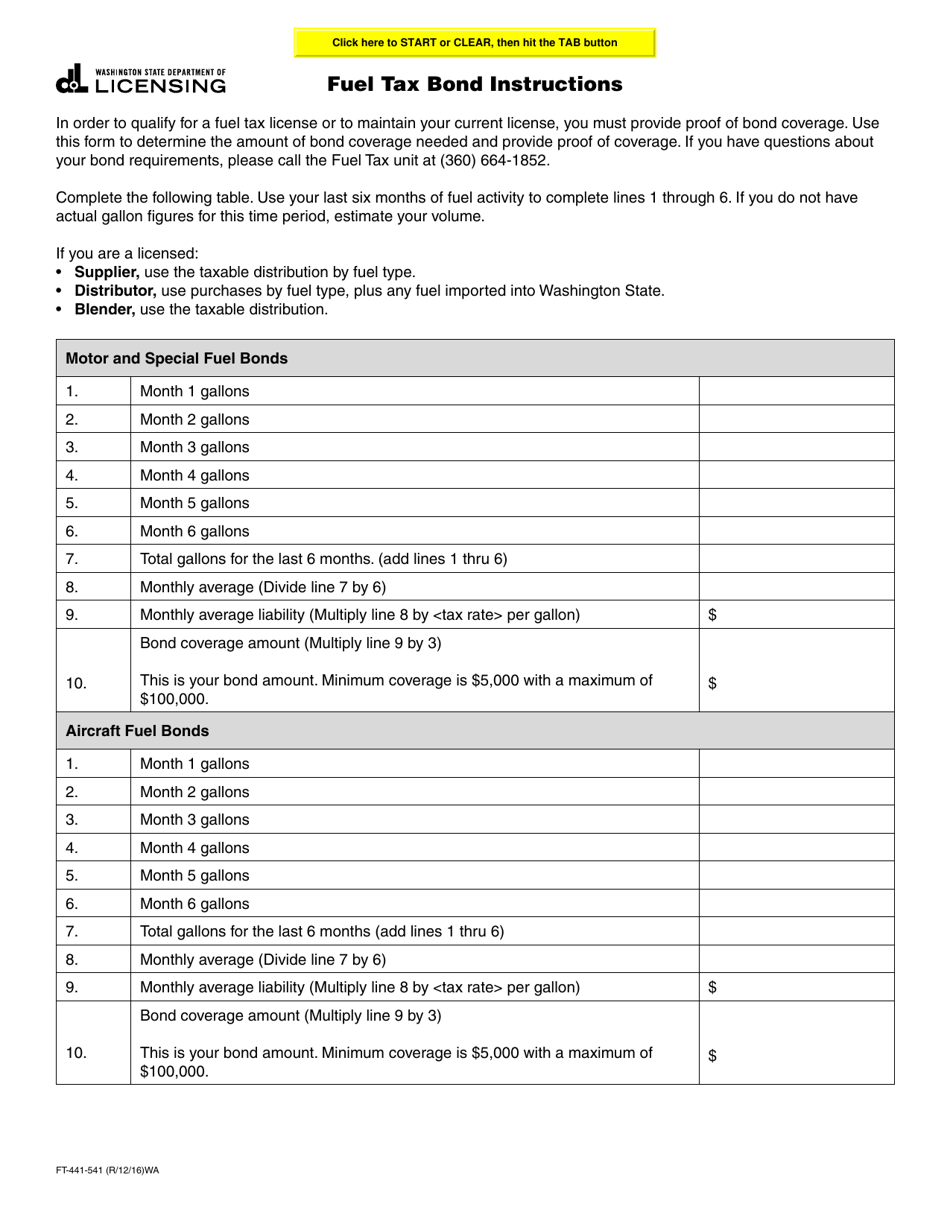

What Is Form FT-441-541?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-541?

A: Form FT-441-541 is the Fuel Tax Bond required by the state of Washington.

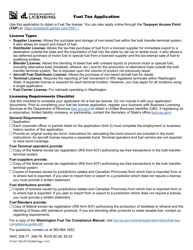

Q: Who needs to file Form FT-441-541?

A: Businesses that engage in activities subject to fuel tax in Washington are required to file Form FT-441-541.

Q: What is the purpose of the Fuel Tax Bond?

A: The Fuel Tax Bond serves as a guarantee that the business will pay the required fuel taxes to the state.

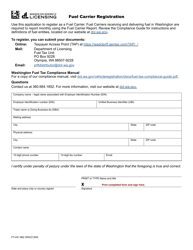

Q: When do I need to file Form FT-441-541?

A: Form FT-441-541 needs to be filed before engaging in activities subject to fuel tax in Washington.

Q: What happens if I don't file Form FT-441-541?

A: Failure to file Form FT-441-541 can result in penalties, fines, and legal consequences.

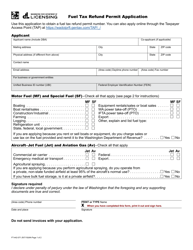

Q: Is the Fuel Tax Bond refundable?

A: No, the Fuel Tax Bond is not refundable. It is a requirement to ensure compliance with fuel tax obligations.

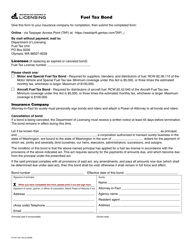

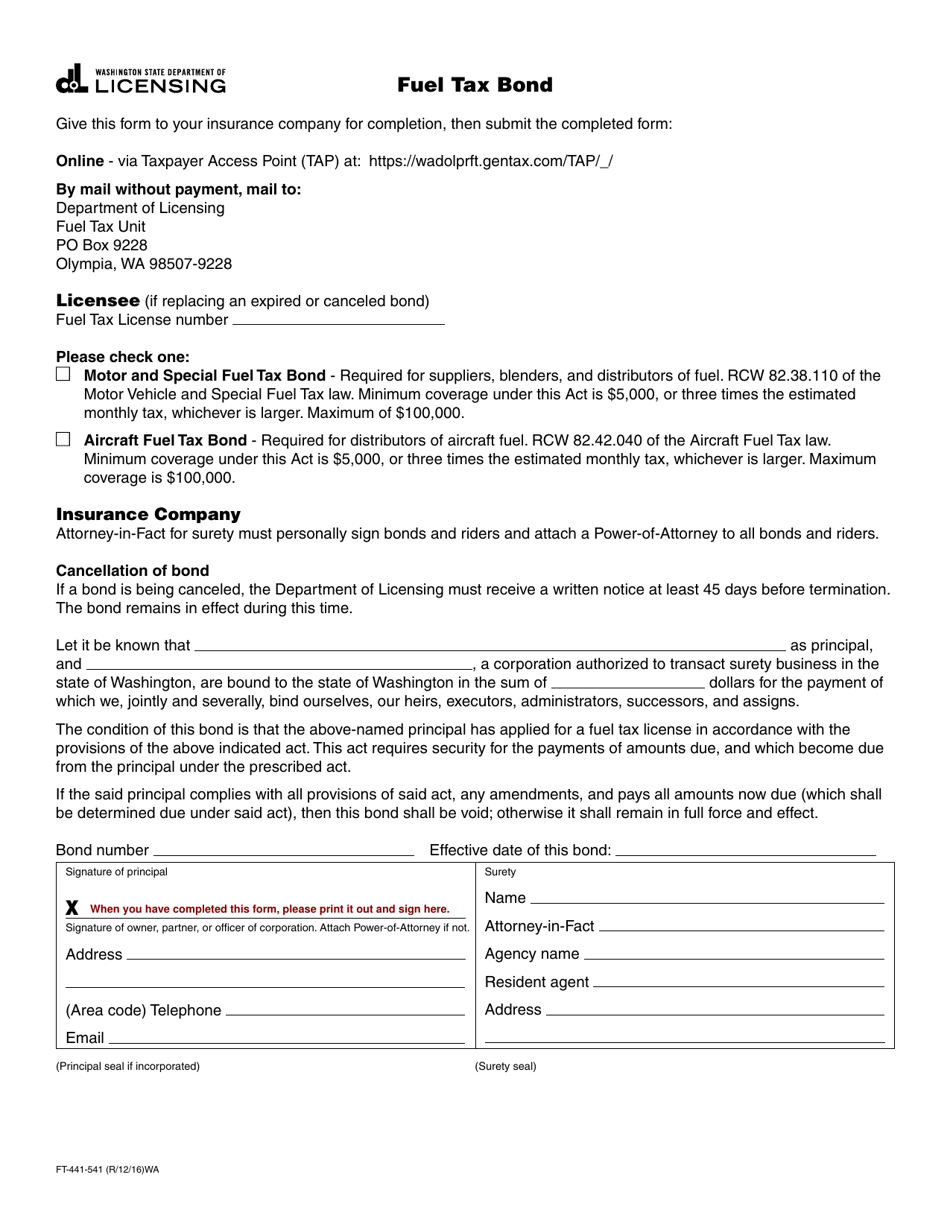

Q: Can I use a surety bond instead of cash for the Fuel Tax Bond?

A: Yes, businesses have the option to use a surety bond instead of a cash bond for the Fuel Tax Bond.

Q: How much does the Fuel Tax Bond cost?

A: The cost of the Fuel Tax Bond varies depending on factors such as the amount of fuel tax liability and the financial strength of the business.

Q: How long is the Fuel Tax Bond valid for?

A: The Fuel Tax Bond remains valid as long as the business continues to engage in activities subject to fuel tax in Washington.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-541 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.