This version of the form is not currently in use and is provided for reference only. Download this version of

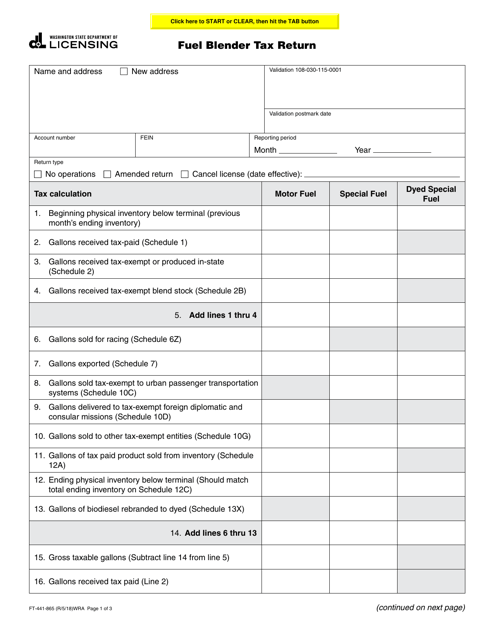

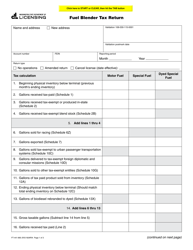

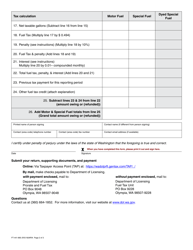

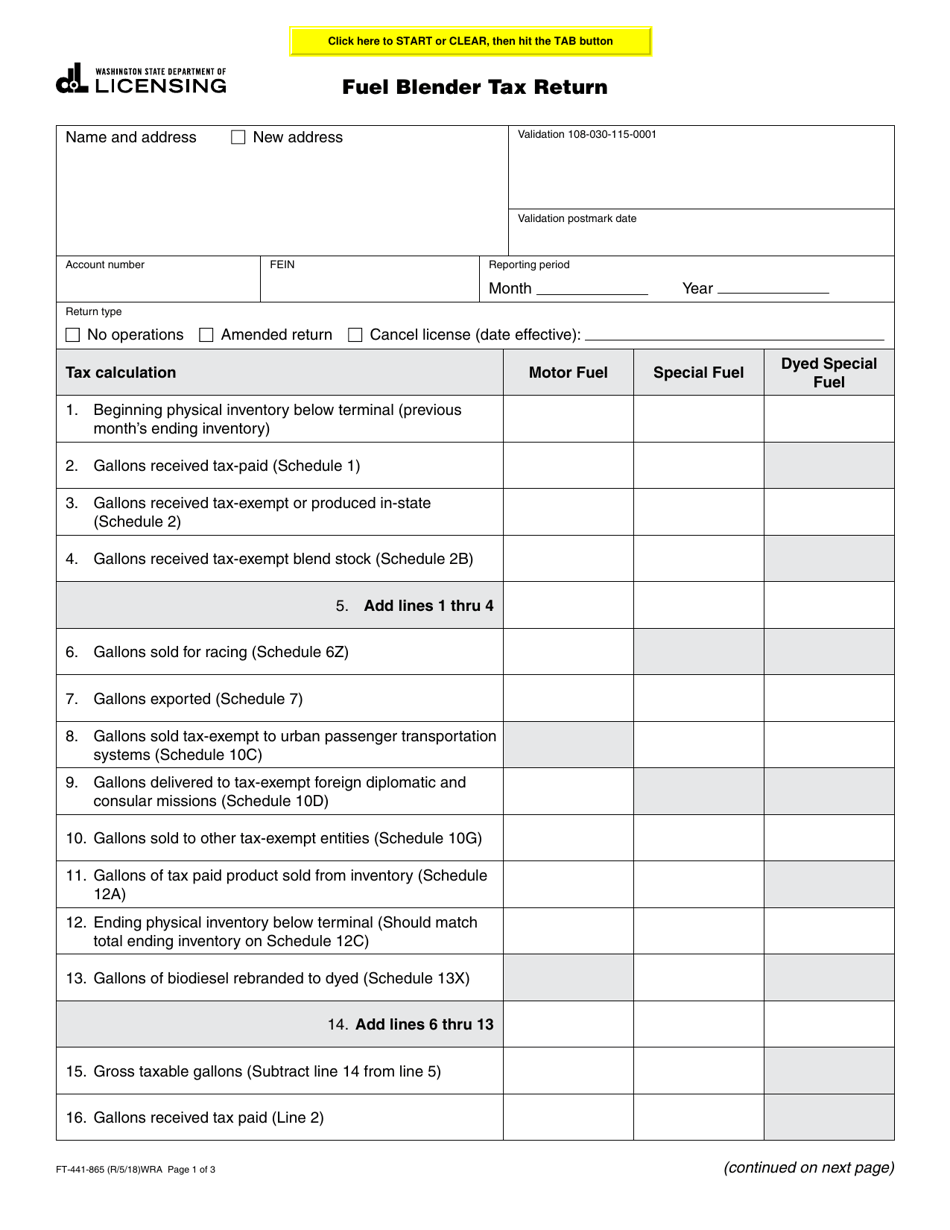

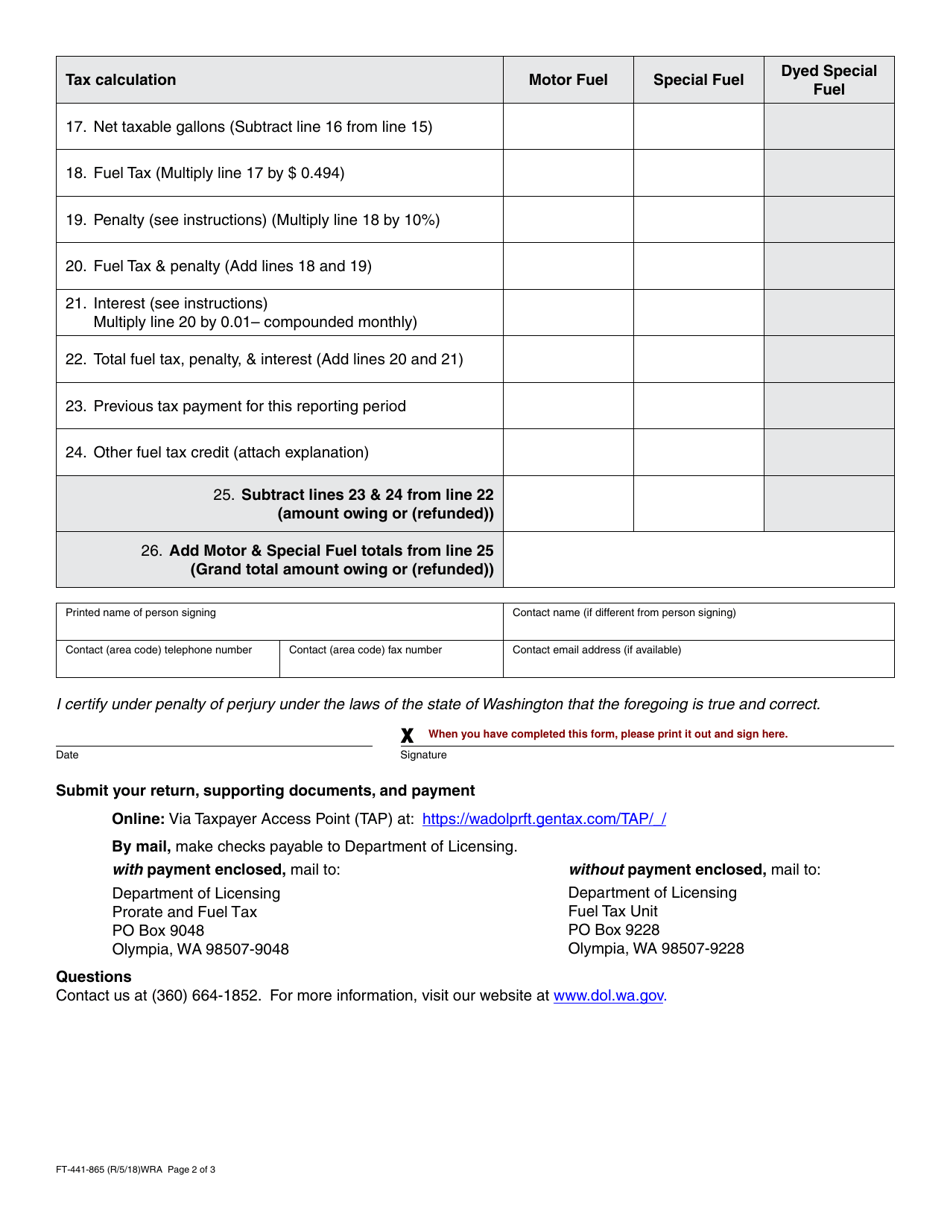

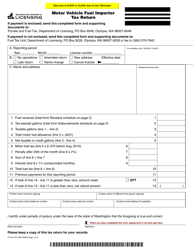

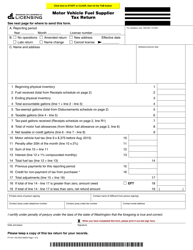

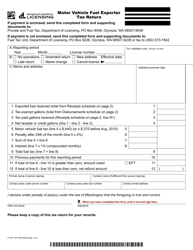

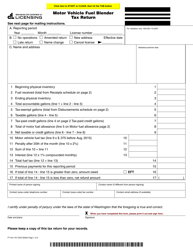

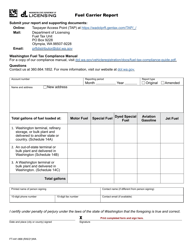

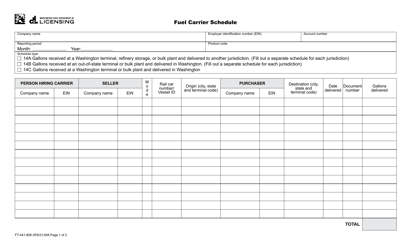

Form FT-441-865

for the current year.

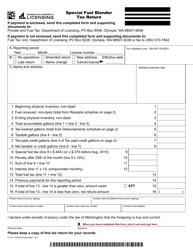

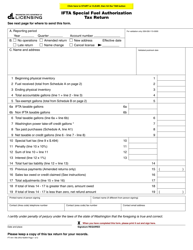

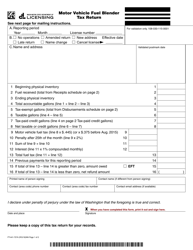

Form FT-441-865 Fuel Blender Tax Return - Washington

What Is Form FT-441-865?

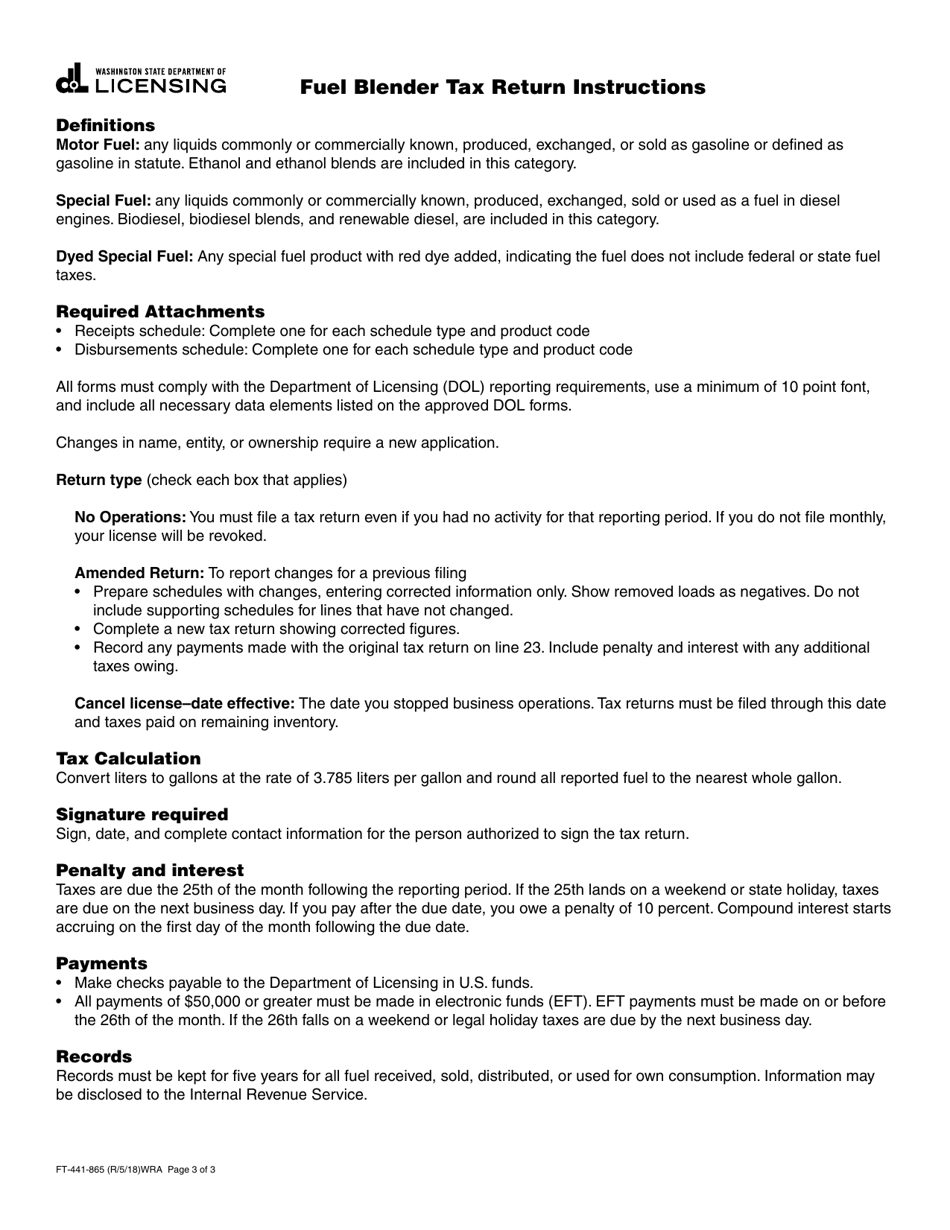

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-865?

A: Form FT-441-865 is the Fuel Blender Tax Return specifically for Washington state.

Q: Who needs to file Form FT-441-865?

A: Fuel blenders operating in Washington state need to file Form FT-441-865.

Q: What is the purpose of Form FT-441-865?

A: The purpose of this form is to report and pay the fuel blender tax in Washington state.

Q: When is Form FT-441-865 due?

A: Form FT-441-865 is due on a quarterly basis, with the due dates falling on the last day of April, July, October, and January.

Q: Are there any penalties for not filing or paying the fuel blender tax?

A: Yes, there are penalties for late filing or payment, as determined by Washington state tax regulations.

Q: Do I need to include any supporting documentation with Form FT-441-865?

A: It is recommended to keep records and supporting documentation for at least five years, but you do not need to attach them to the form when filing.

Q: Can I request an extension to file Form FT-441-865?

A: Extensions may be granted upon request, but it is best to contact the Washington State Department of Revenue for specific instructions on how to request an extension.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-865 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.