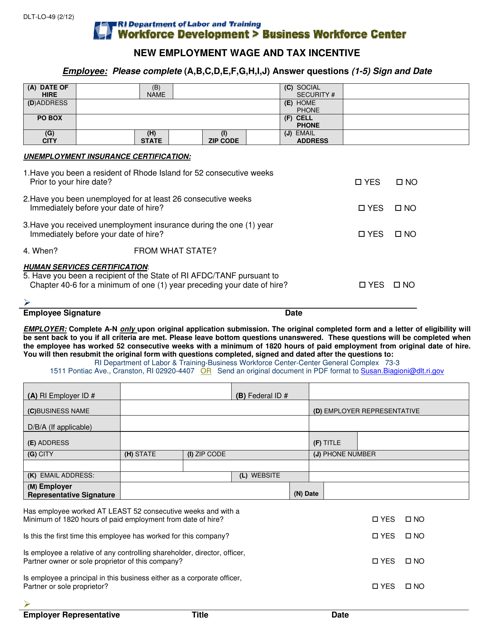

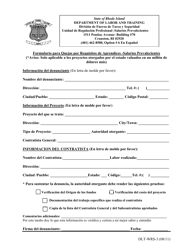

Form DLT-LO-49 New Employment Wage and Tax Incentive - Rhode Island

What Is Form DLT-LO-49?

This is a legal form that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DLT-LO-49?

A: Form DLT-LO-49 is the New Employment Wage and Tax Incentive form used in Rhode Island.

Q: What is the purpose of Form DLT-LO-49?

A: The purpose of Form DLT-LO-49 is to apply for the New Employment Wage and Tax Incentive in Rhode Island.

Q: Who is eligible for the New Employment Wage and Tax Incentive?

A: Employers who create new jobs in Rhode Island may be eligible for the New Employment Wage and Tax Incentive.

Q: What are the benefits of the New Employment Wage and Tax Incentive?

A: The New Employment Wage and Tax Incentive provides tax credits for employers who hire new employees in Rhode Island.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the Rhode Island Department of Labor and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DLT-LO-49 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.