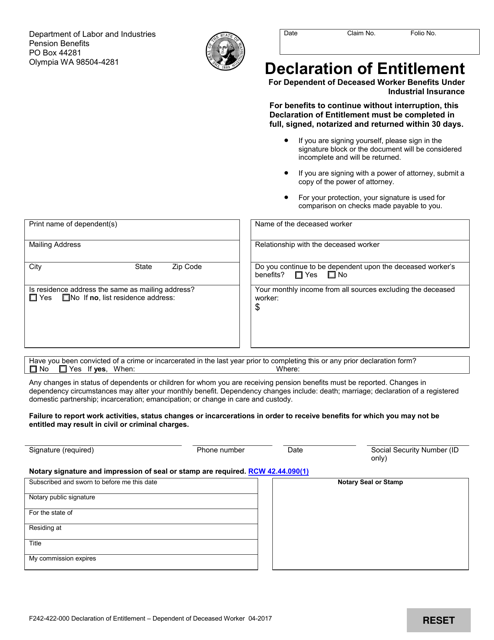

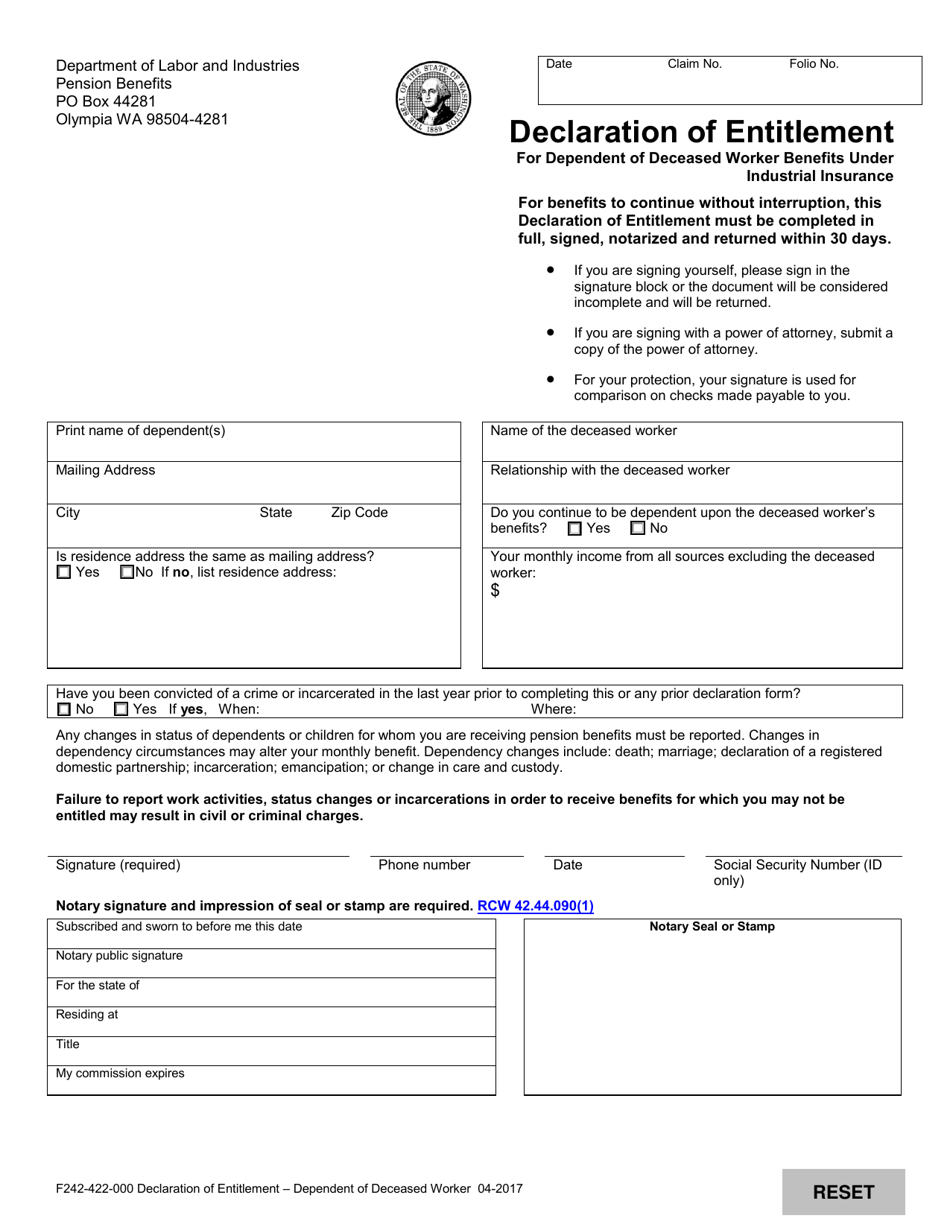

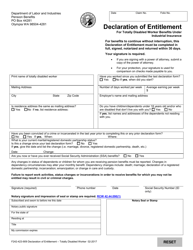

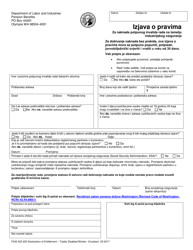

Form F242-422-000 Declaration of Entitlement for Dependent of Deceased Worker Benefits Under Industrial Insurance - Washington

What Is Form F242-422-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F242-422-000?

A: Form F242-422-000 is the Declaration of Entitlement for Dependent of Deceased Worker Benefits Under Industrial Insurance in Washington.

Q: What is the purpose of Form F242-422-000?

A: The purpose of Form F242-422-000 is to establish the entitlement of dependents to receive benefits under industrial insurance for a deceased worker in Washington.

Q: Who can use Form F242-422-000?

A: Form F242-422-000 can be used by dependents of a deceased worker in Washington who are seeking to claim benefits under industrial insurance.

Q: Is there a fee to submit Form F242-422-000?

A: No, there is no fee to submit Form F242-422-000.

Q: What documents are required to be submitted with Form F242-422-000?

A: The specific documents required to be submitted with Form F242-422-000 may vary depending on the individual case. It is recommended to refer to the instructions provided with the form or contact the Washington State Department of Labor & Industries for guidance.

Q: What happens after I submit Form F242-422-000?

A: After submitting Form F242-422-000, the Washington State Department of Labor & Industries will review the application and supporting documents to determine the eligibility of the dependents for benefits.

Q: How long does it take to process Form F242-422-000?

A: The processing time for Form F242-422-000 may vary depending on various factors. It is recommended to contact the Washington State Department of Labor & Industries for an estimate of the processing timeline.

Q: Can I appeal if my application for benefits is denied?

A: Yes, if your application for benefits is denied, you have the right to appeal the decision. The Washington State Department of Labor & Industries can provide information on the appeals process.

Q: Are the benefits taxable?

A: The taxability of benefits received under industrial insurance in Washington may depend on various factors. It is recommended to consult a tax professional or refer to IRS guidelines for specific tax-related questions.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F242-422-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.