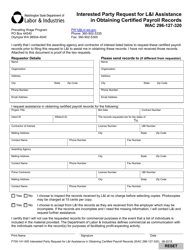

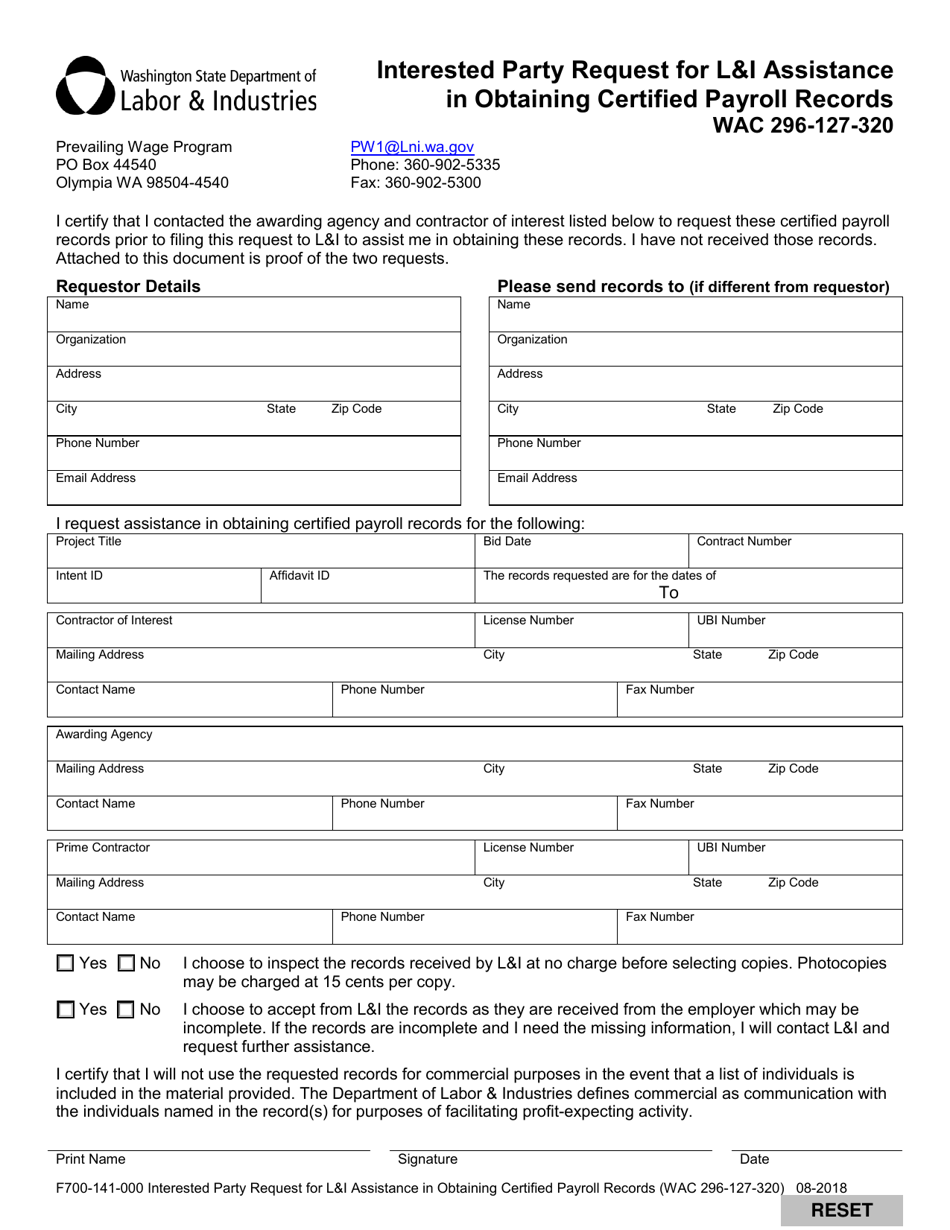

Form F700-141-000 Interested Party Request for L&i Assistance in Obtaining Certified Payroll Records - Washington

What Is Form F700-141-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F700-141-000?

A: Form F700-141-000 is an Interested PartyRequest for L&i Assistance in Obtaining Certified Payroll Records in Washington.

Q: What is the purpose of Form F700-141-000?

A: The purpose of Form F700-141-000 is to request assistance from the Washington Department of Labor & Industries (L&I) in obtaining certified payroll records.

Q: Who can use Form F700-141-000?

A: Any interested party, such as an employee or a labor union, can use Form F700-141-000 to request assistance in obtaining certified payroll records.

Q: What are certified payroll records?

A: Certified payroll records are documents that show the wages paid to employees by a contractor or subcontractor on a public works project.

Q: Why would someone need certified payroll records?

A: Someone might need certified payroll records to verify that workers are being paid the correct prevailing wage rates on public works projects.

Q: How can someone obtain certified payroll records?

A: Someone can use Form F700-141-000 to request assistance from L&I in obtaining certified payroll records.

Q: Is there a fee for requesting assistance with obtaining certified payroll records?

A: Yes, there is a fee for requesting assistance with obtaining certified payroll records. The fee is listed on the form.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F700-141-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.