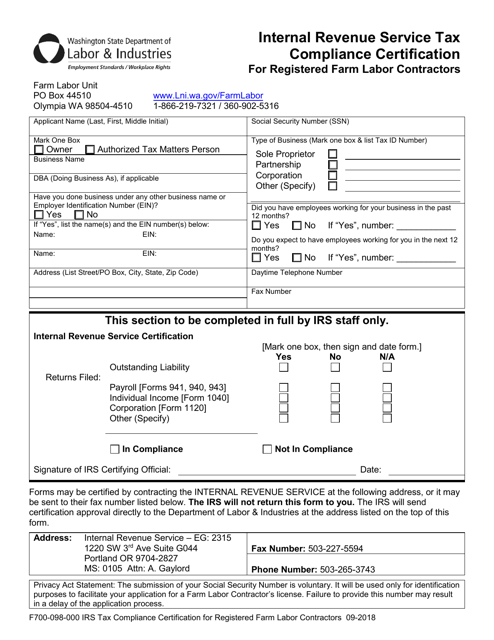

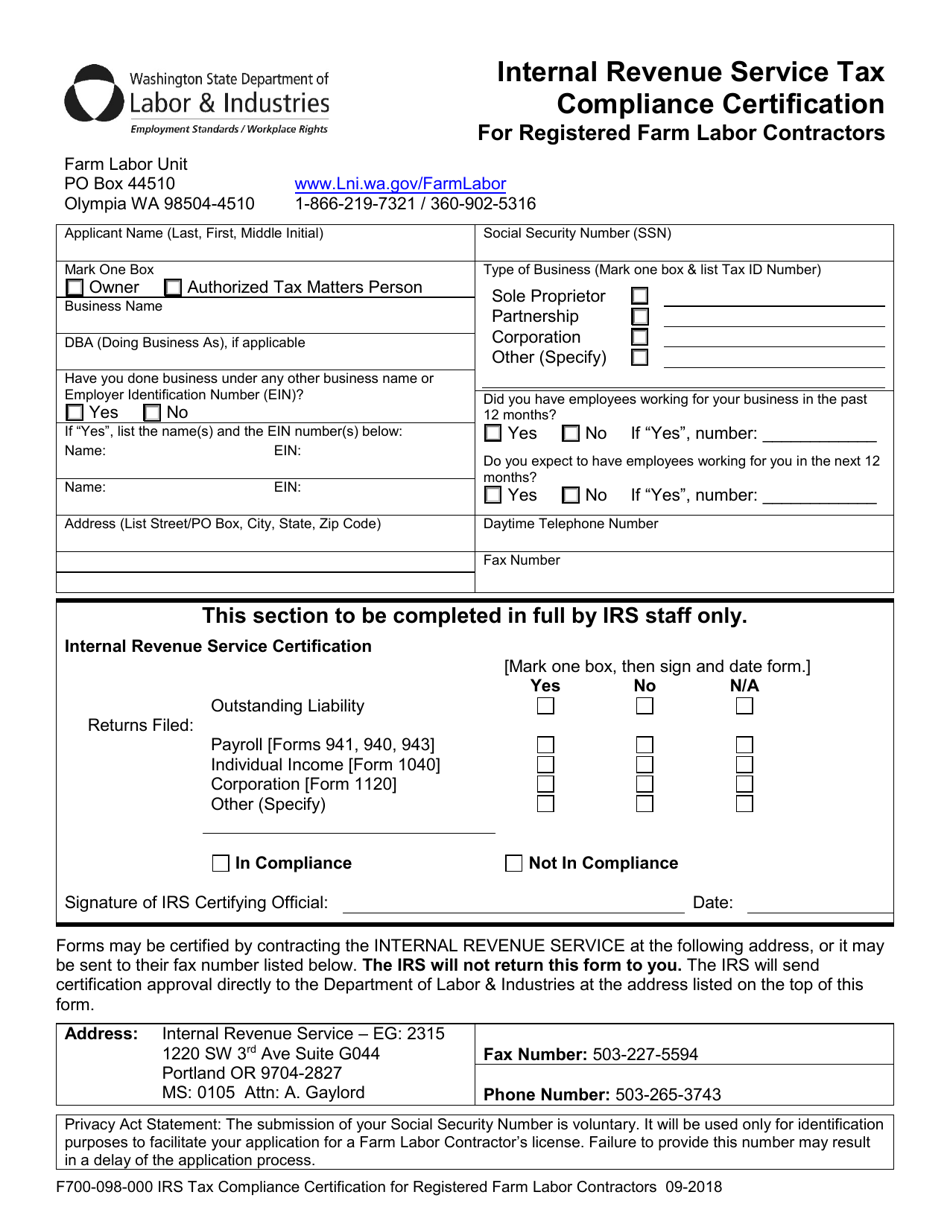

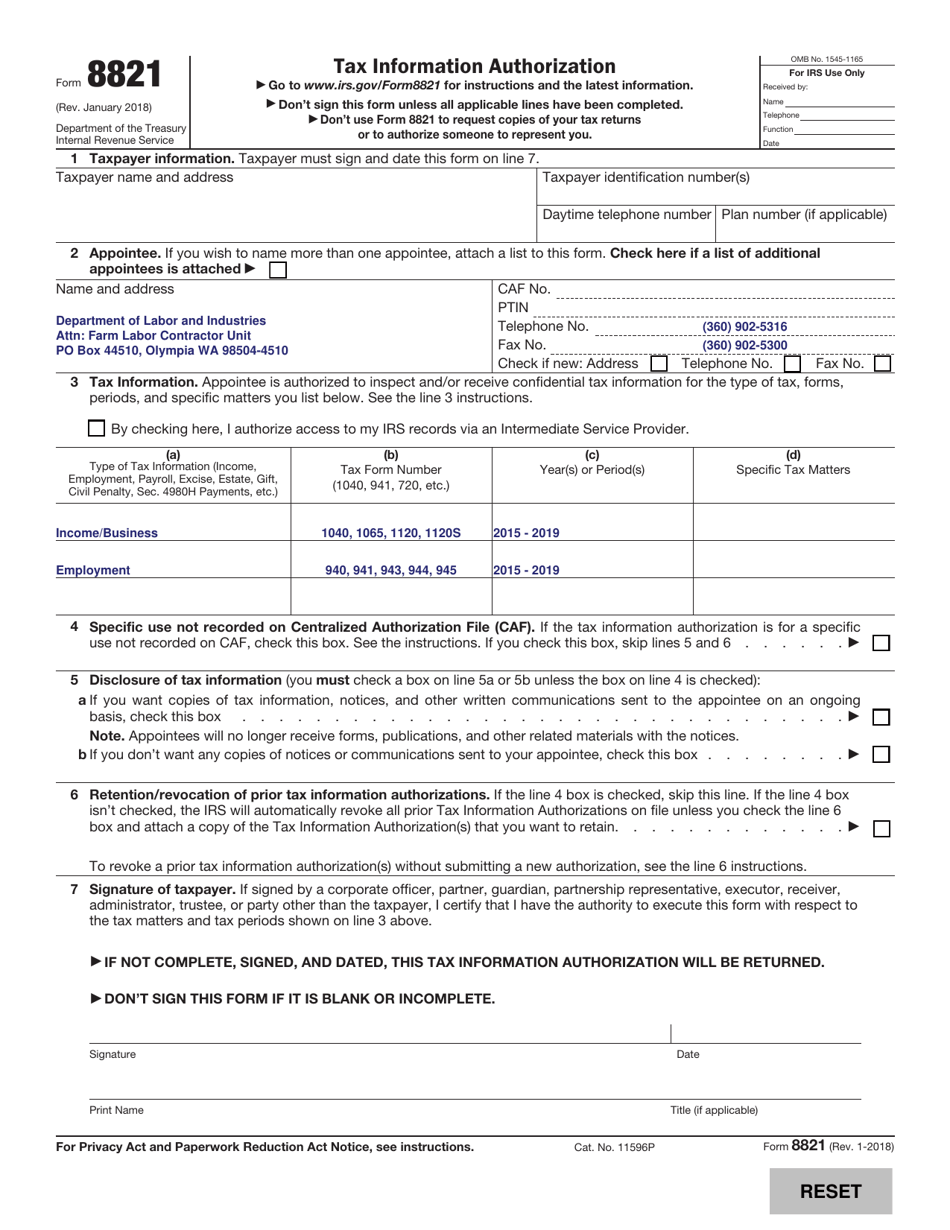

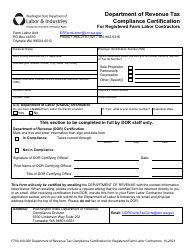

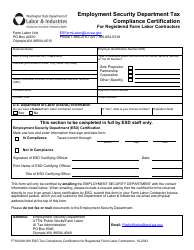

Form F700-098-000 Internal Revenue Service Tax Compliance Certification for Registered Farm Labor Contractors - Washington

What Is Form F700-098-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F700-098-000?

A: Form F700-098-000 is the Internal Revenue Service Tax Compliance Certification for Registered Farm Labor Contractors in Washington.

Q: Who needs to file Form F700-098-000?

A: Registered Farm Labor Contractors in Washington need to file Form F700-098-000.

Q: What is the purpose of Form F700-098-000?

A: The purpose of Form F700-098-000 is to certify compliance with tax laws for Farm Labor Contractors in Washington.

Q: Is Form F700-098-000 specific to Washington?

A: Yes, Form F700-098-000 is specific to Farm Labor Contractors in Washington.

Q: What are the consequences of not filing Form F700-098-000?

A: Failure to file Form F700-098-000 may result in penalties or loss of registration as a Farm Labor Contractor in Washington.

Q: When is the deadline to file Form F700-098-000?

A: The deadline to file Form F700-098-000 is typically on or before the registration renewal date for Farm Labor Contractors in Washington.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F700-098-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.