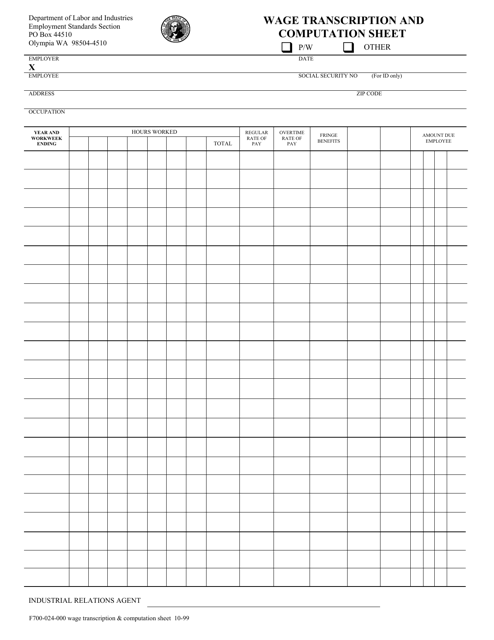

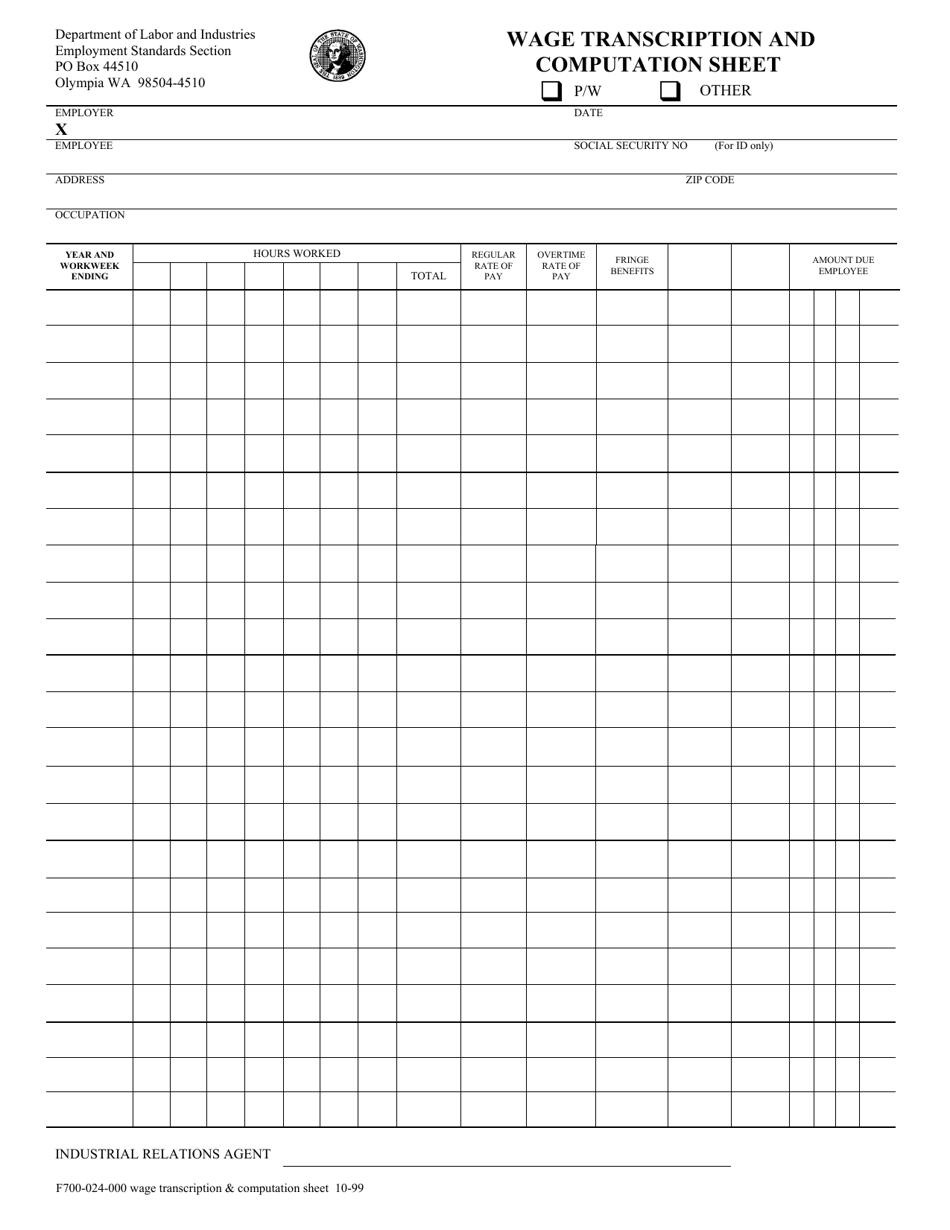

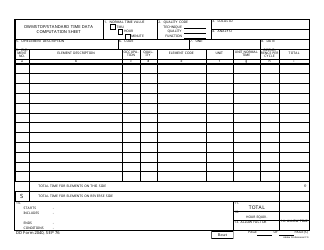

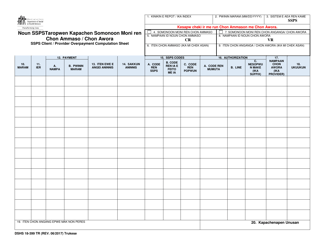

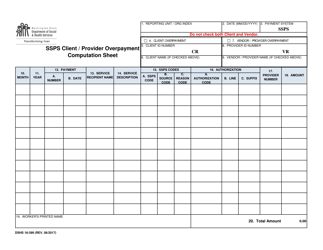

Form F700-024-000 Wage Transcription and Computation Sheet - Washington

What Is Form F700-024-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F700-024-000?

A: Form F700-024-000 is the Wage Transcription and Computation Sheet used in Washington.

Q: What is the purpose of Form F700-024-000?

A: The purpose of Form F700-024-000 is to transcribe and compute wages for employees in Washington.

Q: Who uses Form F700-024-000?

A: Employers in Washington use Form F700-024-000 to record and calculate employee wages.

Q: How do I fill out Form F700-024-000?

A: You should fill out Form F700-024-000 by entering the required information, such as employee names, hours worked, and wages earned.

Q: Are there any deadlines for submitting Form F700-024-000?

A: Yes, Form F700-024-000 must be submitted by the due date specified by the Washington State Employment Security Department.

Q: What should I do if I have questions about Form F700-024-000?

A: If you have questions about Form F700-024-000, you should contact the Washington State Employment Security Department for assistance.

Form Details:

- Released on October 1, 1999;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F700-024-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.