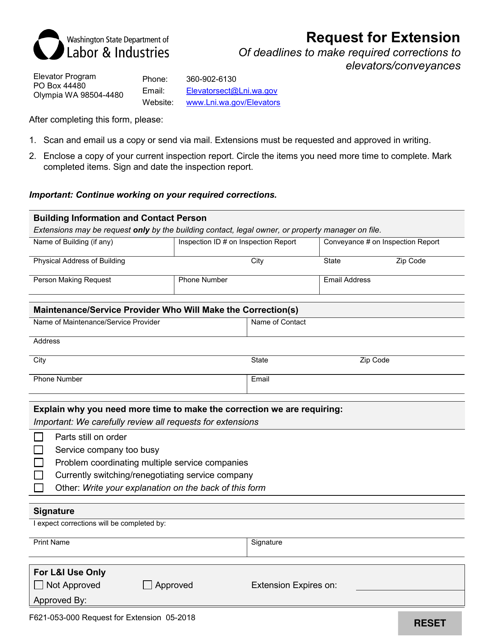

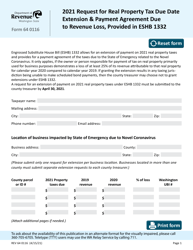

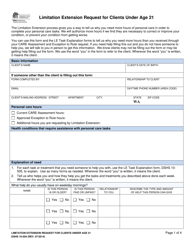

Form F621-053-000 Request for Extension - Washington

What Is Form F621-053-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F621-053-000?

A: Form F621-053-000 is a request for extension form in Washington.

Q: Who needs to fill out Form F621-053-000?

A: Individuals or businesses in Washington who need more time to file their tax return.

Q: When is the deadline to submit Form F621-053-000?

A: The deadline to submit Form F621-053-000 is typically the same as the deadline for filing your tax return.

Q: What information is required on Form F621-053-000?

A: You will need to provide your name, tax identification number, tax year, and the reason for requesting an extension on Form F621-053-000.

Q: Is there a fee for filing Form F621-053-000?

A: There is no fee for filing Form F621-053-000.

Q: How long of an extension does Form F621-053-000 provide?

A: Form F621-053-000 provides a six-month extension for filing your tax return in Washington.

Q: What happens if I don't file Form F621-053-000?

A: If you don't file Form F621-053-000 and fail to file your tax return by the deadline, you may be subject to penalties and interest.

Q: Can I file Form F621-053-000 if I have already filed my tax return?

A: No, you can only file Form F621-053-000 before the deadline for filing your tax return.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F621-053-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.