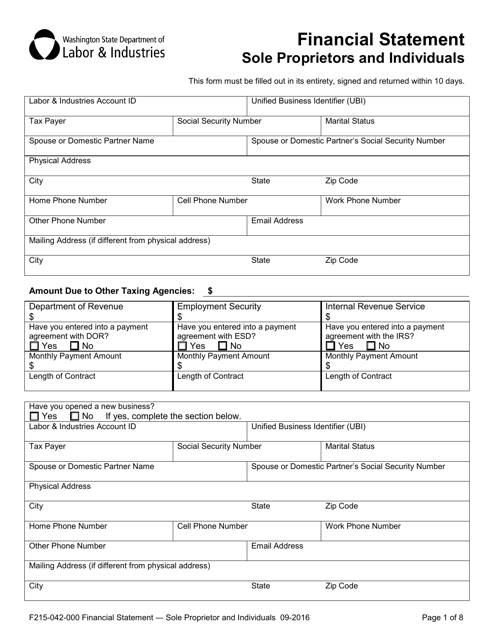

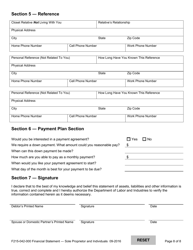

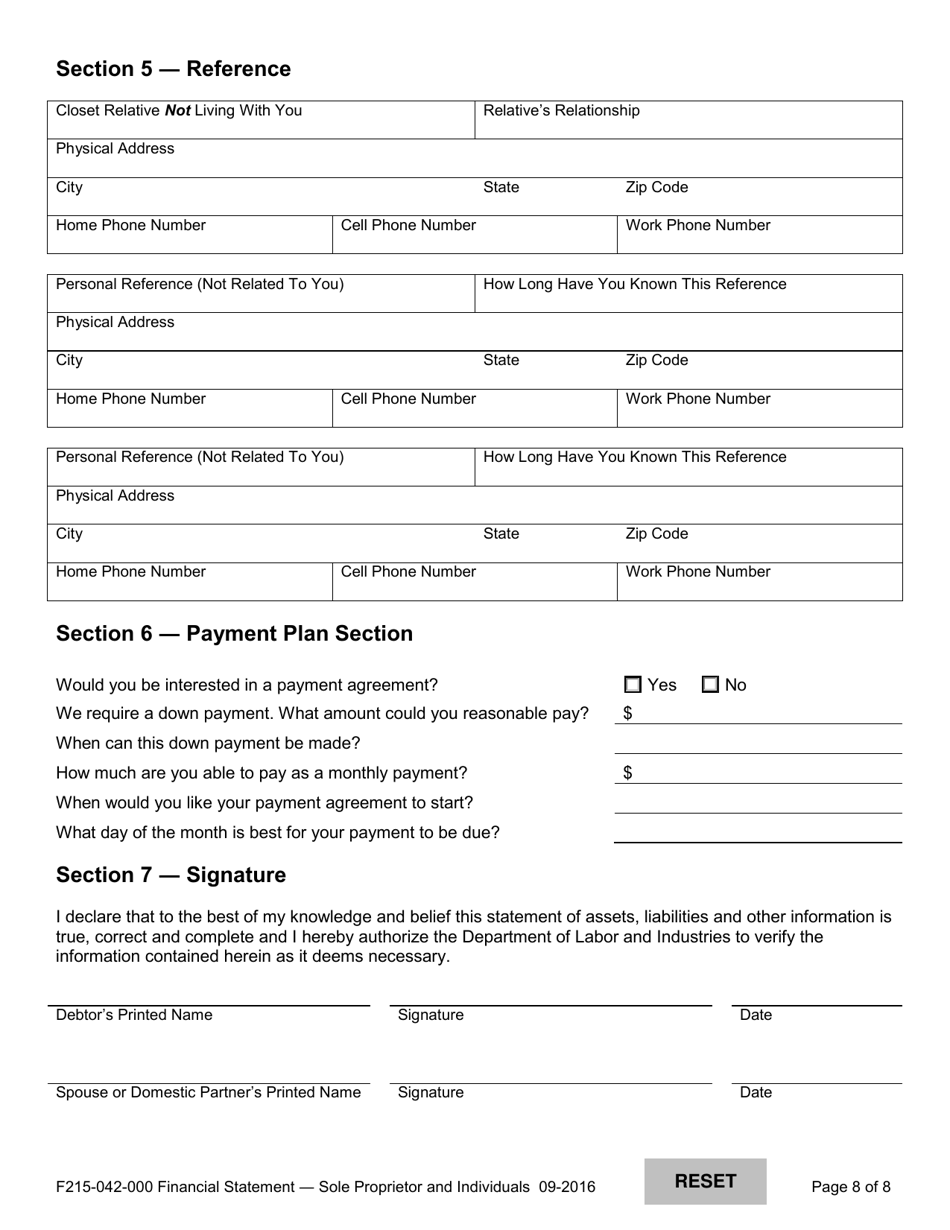

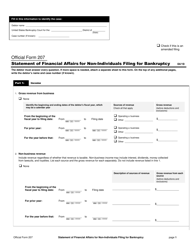

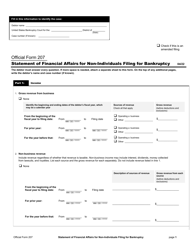

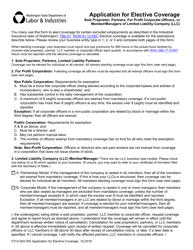

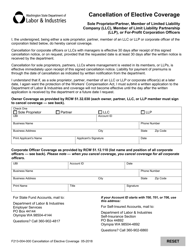

Form F215-042-000 Financial Statement - Sole Proprietor and Individuals - Washington

What Is Form F215-042-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F215-042-000?

A: Form F215-042-000 is a financial statement specifically designed for sole proprietors and individuals in Washington.

Q: Who needs to fill out Form F215-042-000?

A: Anyone who is a sole proprietor or an individual in Washington and needs to provide a financial statement.

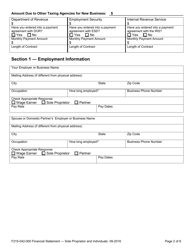

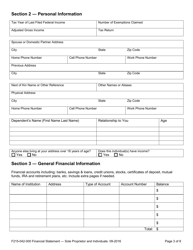

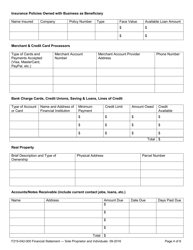

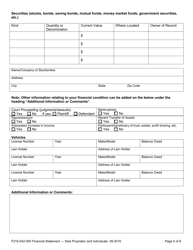

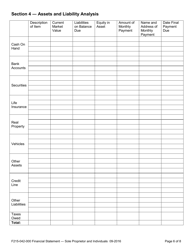

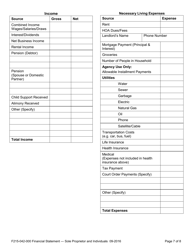

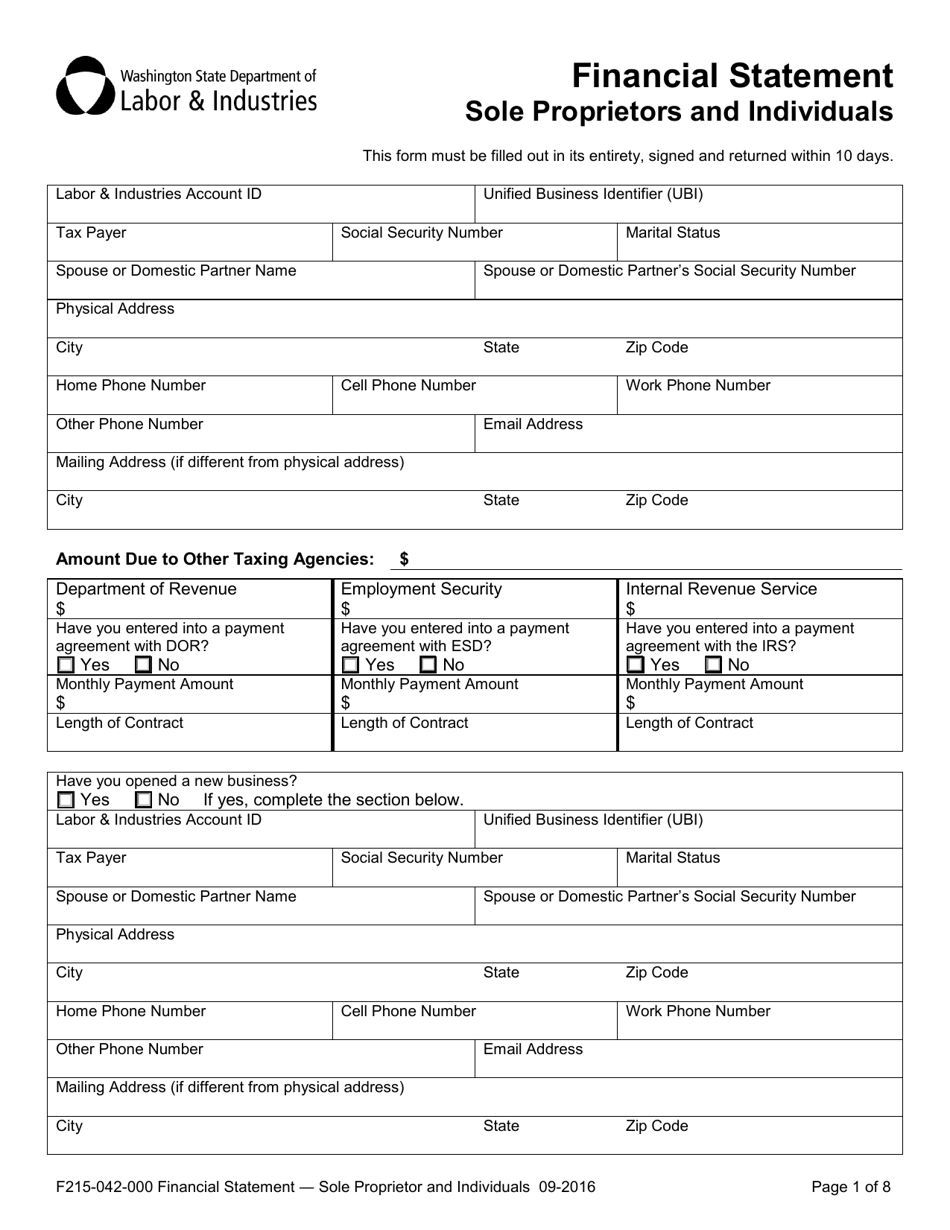

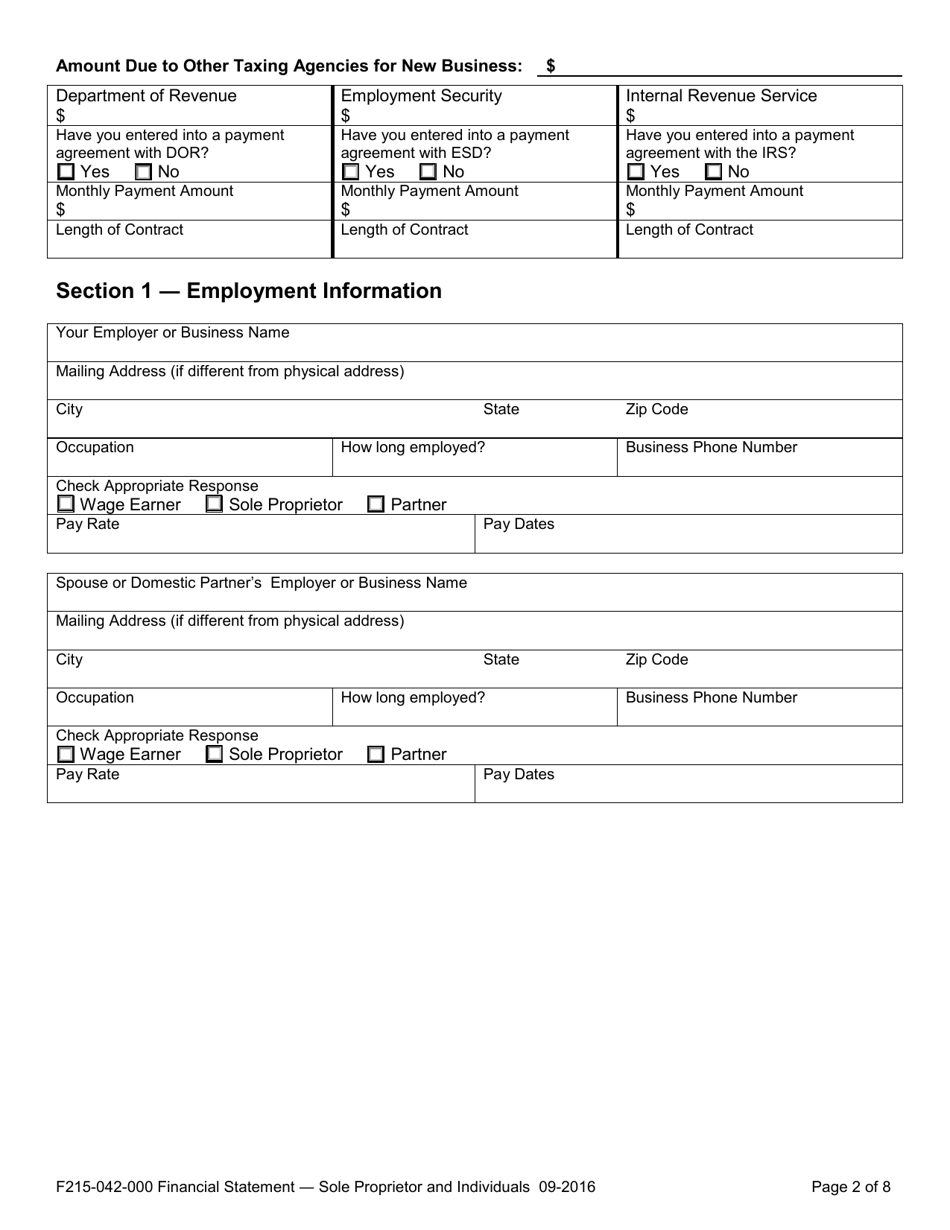

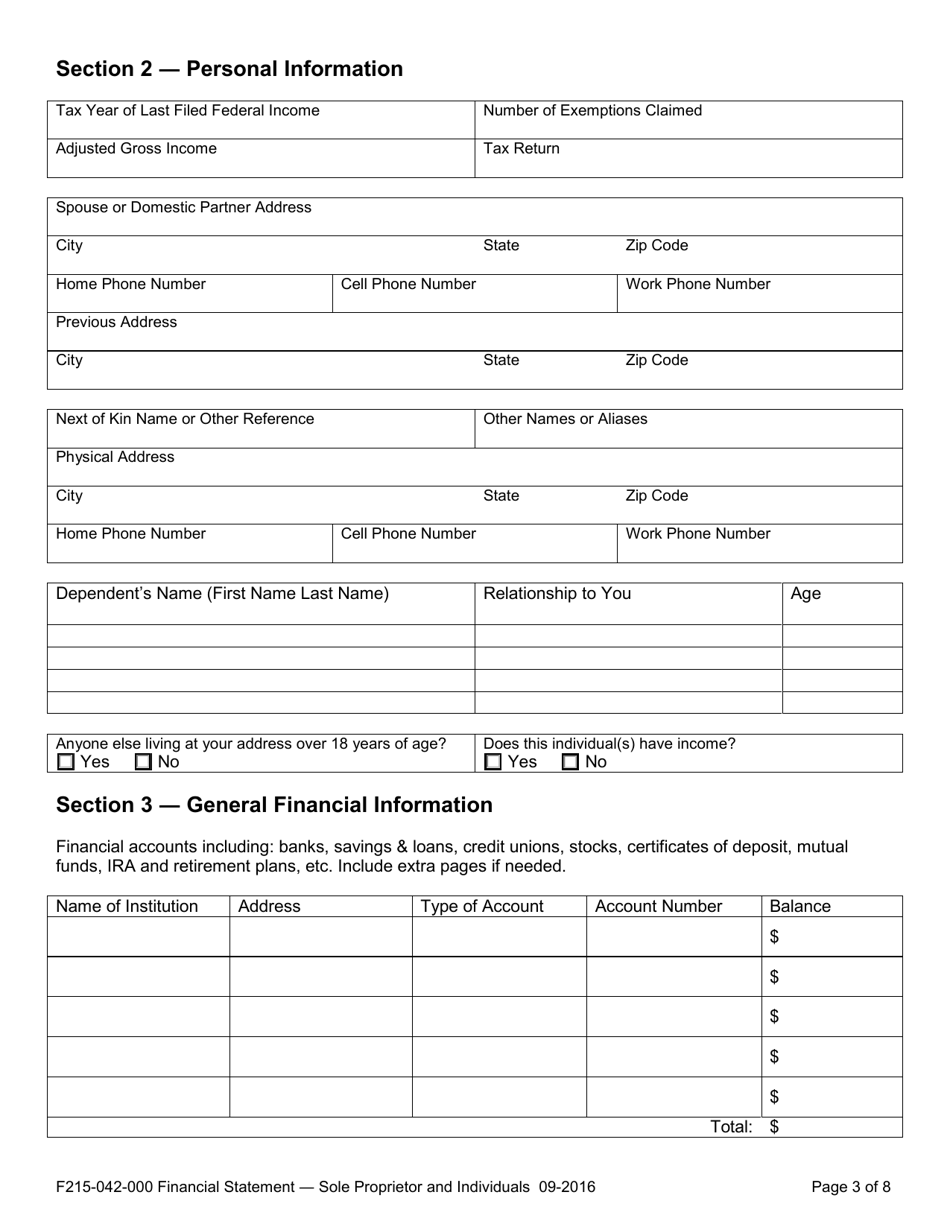

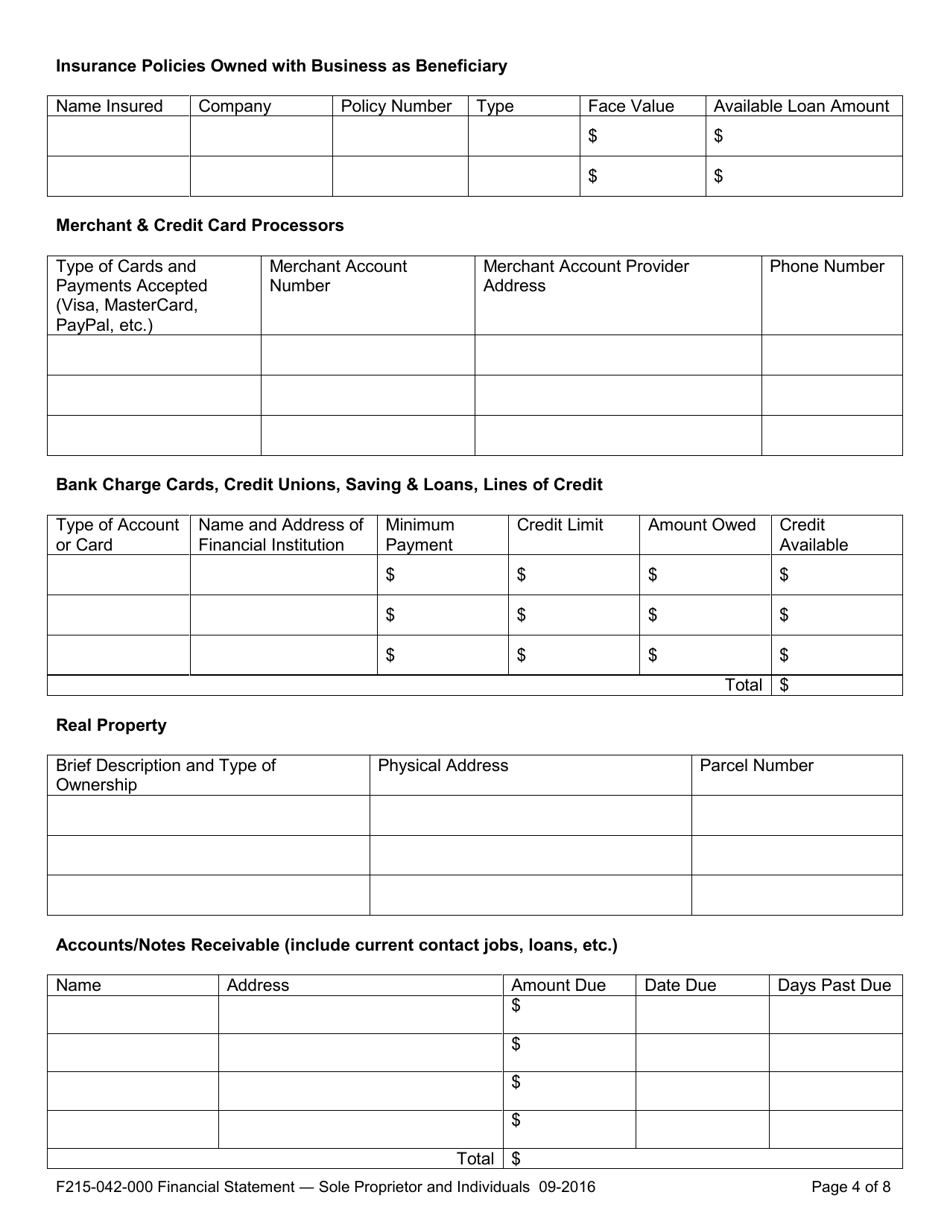

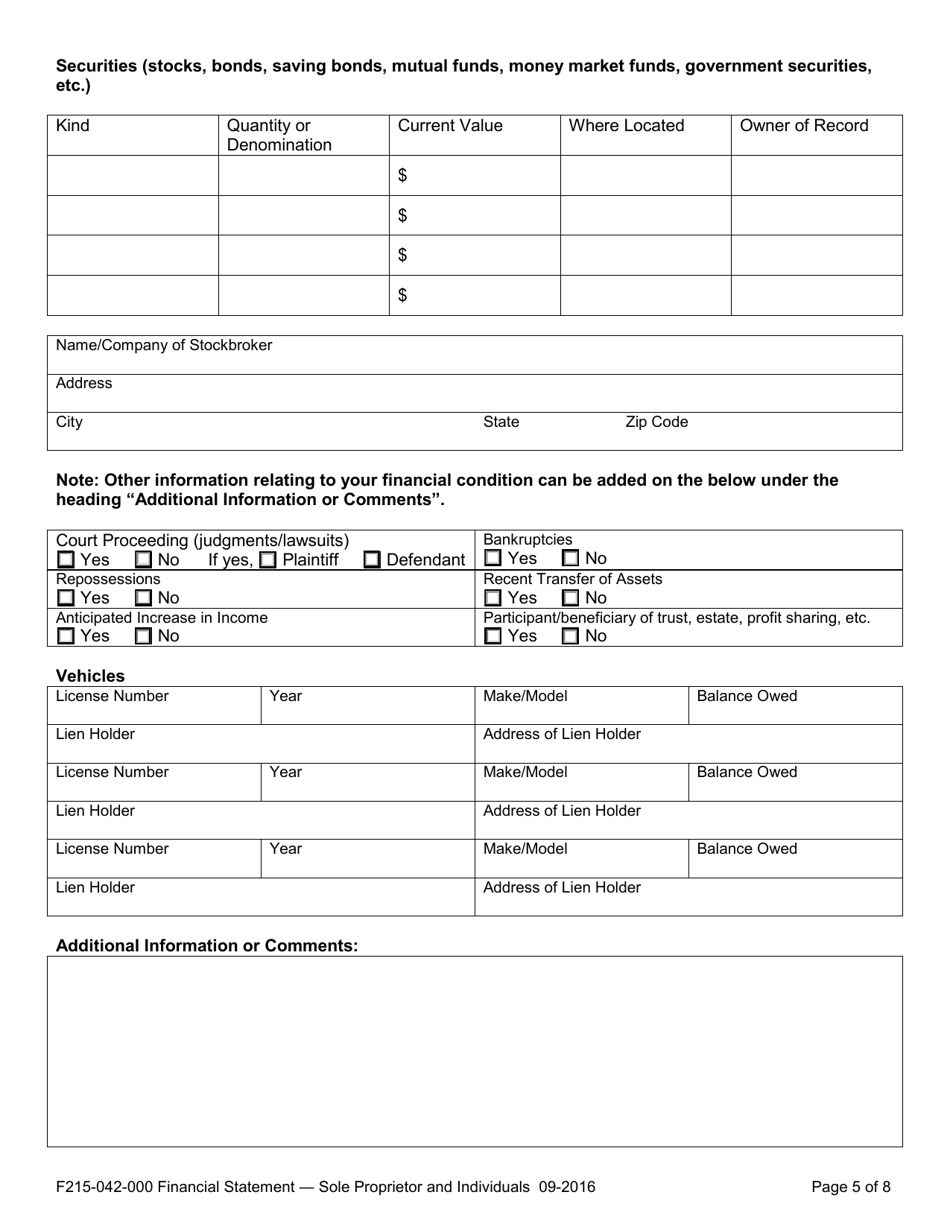

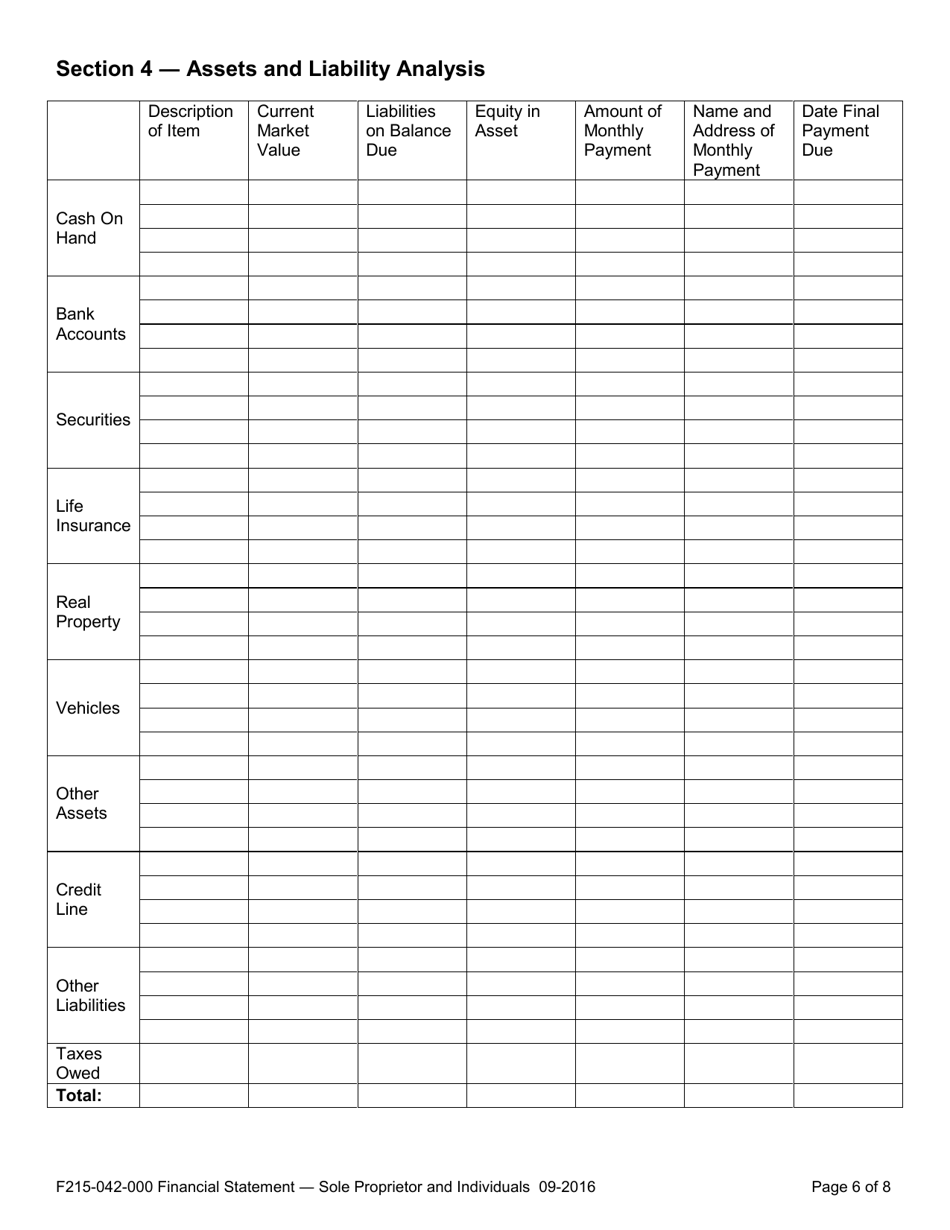

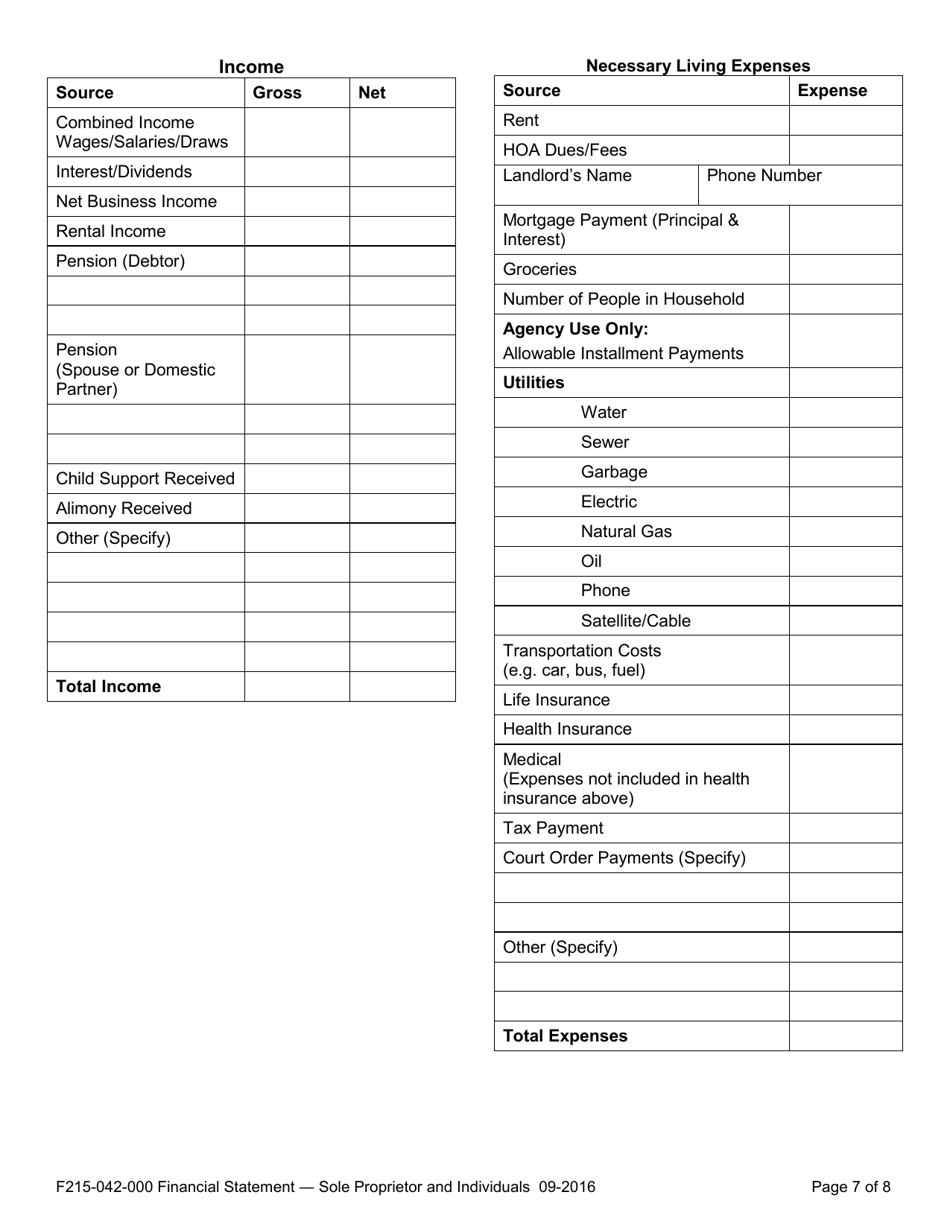

Q: What information is required in Form F215-042-000?

A: Form F215-042-000 requires information about a sole proprietor's or an individual's income, expenses, assets, liabilities, and other financial details.

Q: Are there any filing fees for Form F215-042-000?

A: No, there are no filing fees associated with Form F215-042-000.

Q: When is Form F215-042-000 due?

A: The due date for Form F215-042-000 varies depending on the specific circumstances, such as the type of business or individual. It is important to check the instructions or consult with the Washington State Department of Revenue for the exact due date.

Q: Can Form F215-042-000 be filed electronically?

A: Currently, Form F215-042-000 cannot be filed electronically. It must be submitted by mail or in person.

Q: What if I need help filling out Form F215-042-000?

A: If you need assistance with completing Form F215-042-000, you can contact the Washington State Department of Revenue or seek guidance from a tax professional.

Q: Is Form F215-042-000 the same as a personal tax return?

A: No, Form F215-042-000 is not the same as a personal tax return. It is a specific financial statement for sole proprietors and individuals in Washington to report their income and financial details.

Q: What happens if I don't file Form F215-042-000?

A: Failure to file Form F215-042-000 when required may result in penalties and potential legal consequences. It is important to comply with the filing requirements set by the Washington State Department of Revenue.

Q: Can I request an extension to file Form F215-042-000?

A: Currently, there is no provision for requesting an extension to file Form F215-042-000. It is important to submit the form by the designated due date.

Q: Is Form F215-042-000 confidential?

A: The information provided on Form F215-042-000 is generally considered confidential and protected. However, it may be subject to disclosure as required by law or in certain circumstances.

Q: Can I amend my Form F215-042-000 if I made a mistake?

A: Yes, you can file an amended Form F215-042-000 to correct any errors or omissions. It is recommended to consult with the Washington State Department of Revenue or a tax professional for guidance on the amendment process.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F215-042-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.