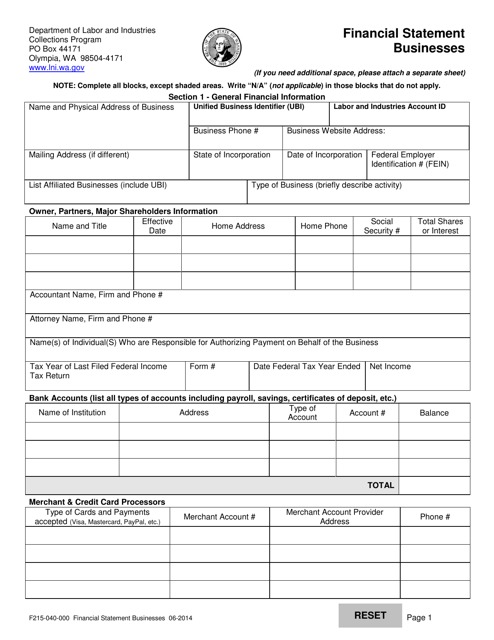

Form F215-040-000 Financial Statement Businesses - Washington

What Is Form F215-040-000?

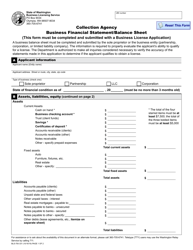

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form F215-040-000?

A: Form F215-040-000 is a financial statement form for businesses in Washington.

Q: Who needs to fill out this form?

A: Businesses in Washington need to fill out this form if they are required to provide a financial statement.

Q: What is the purpose of form F215-040-000?

A: The purpose of form F215-040-000 is to provide financial information about businesses operating in Washington.

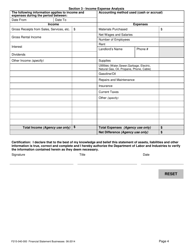

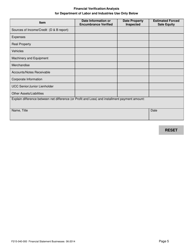

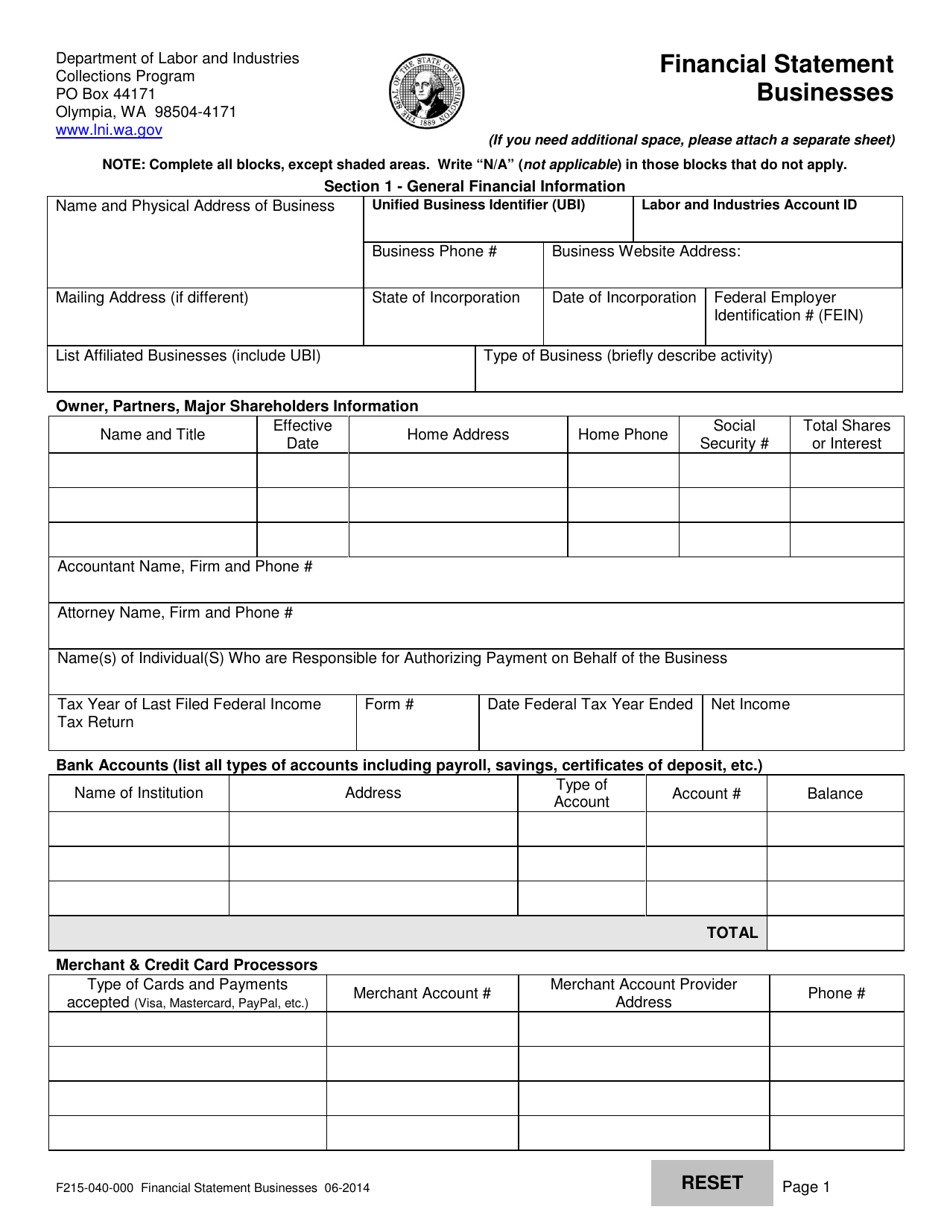

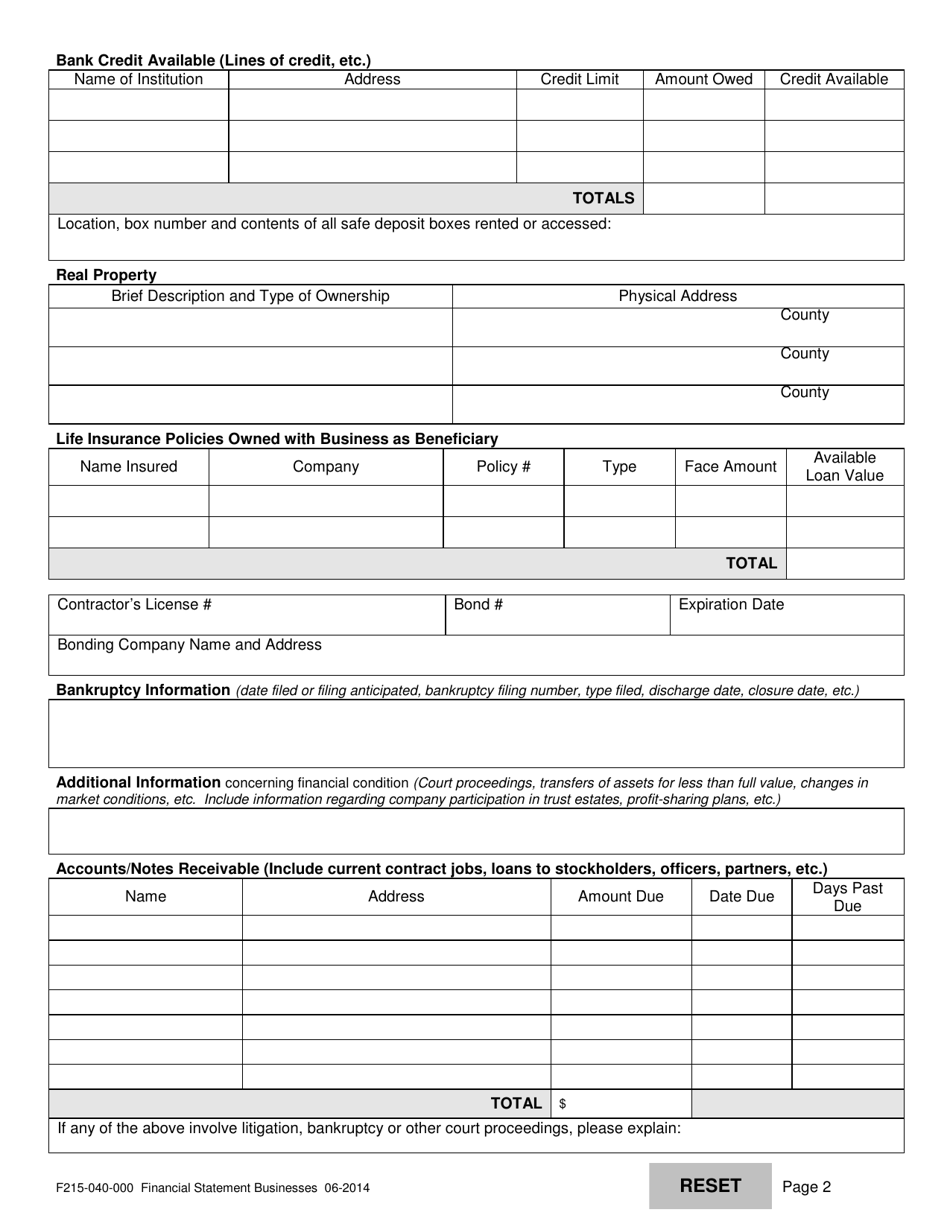

Q: What information is required on this form?

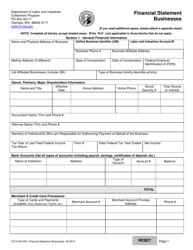

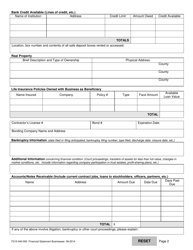

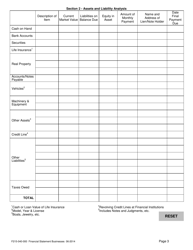

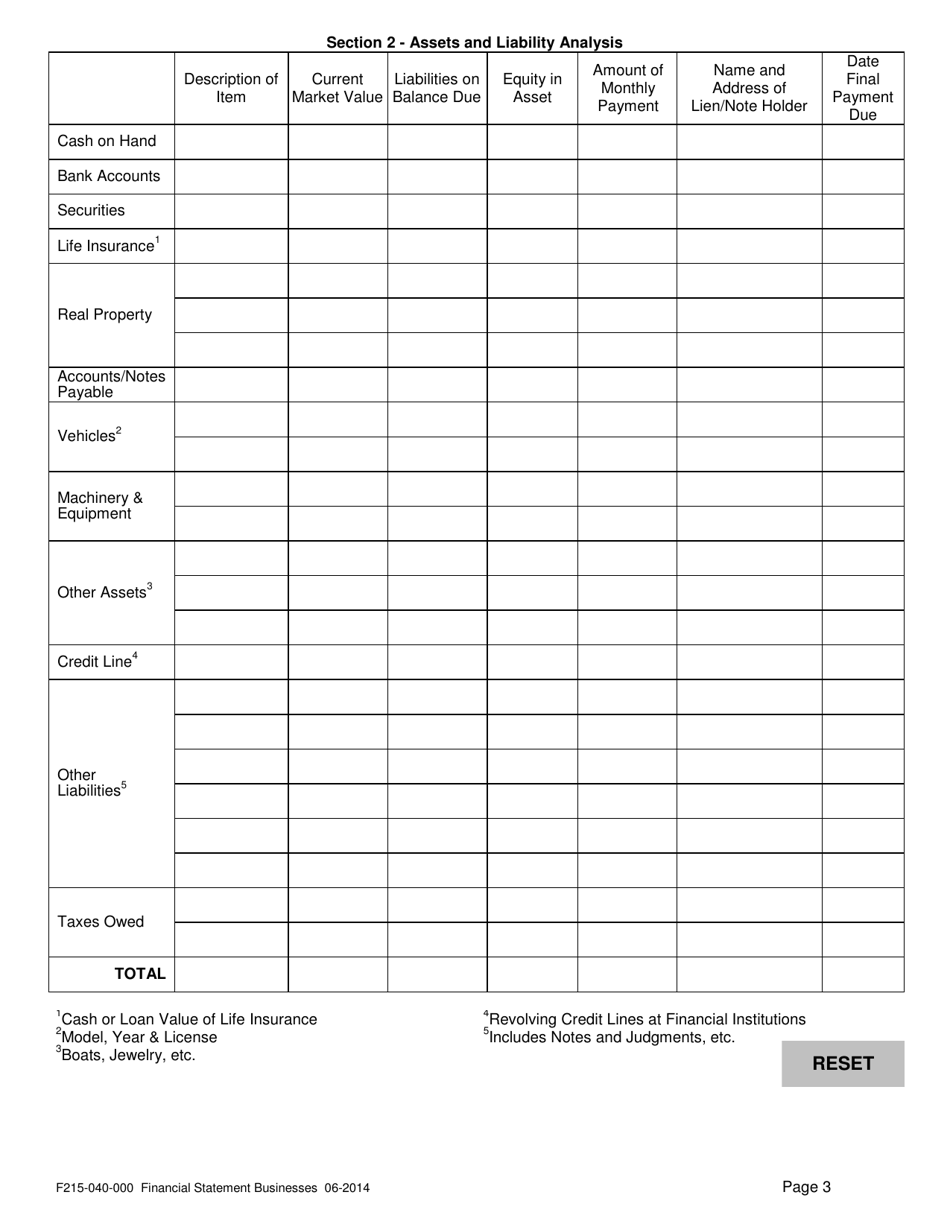

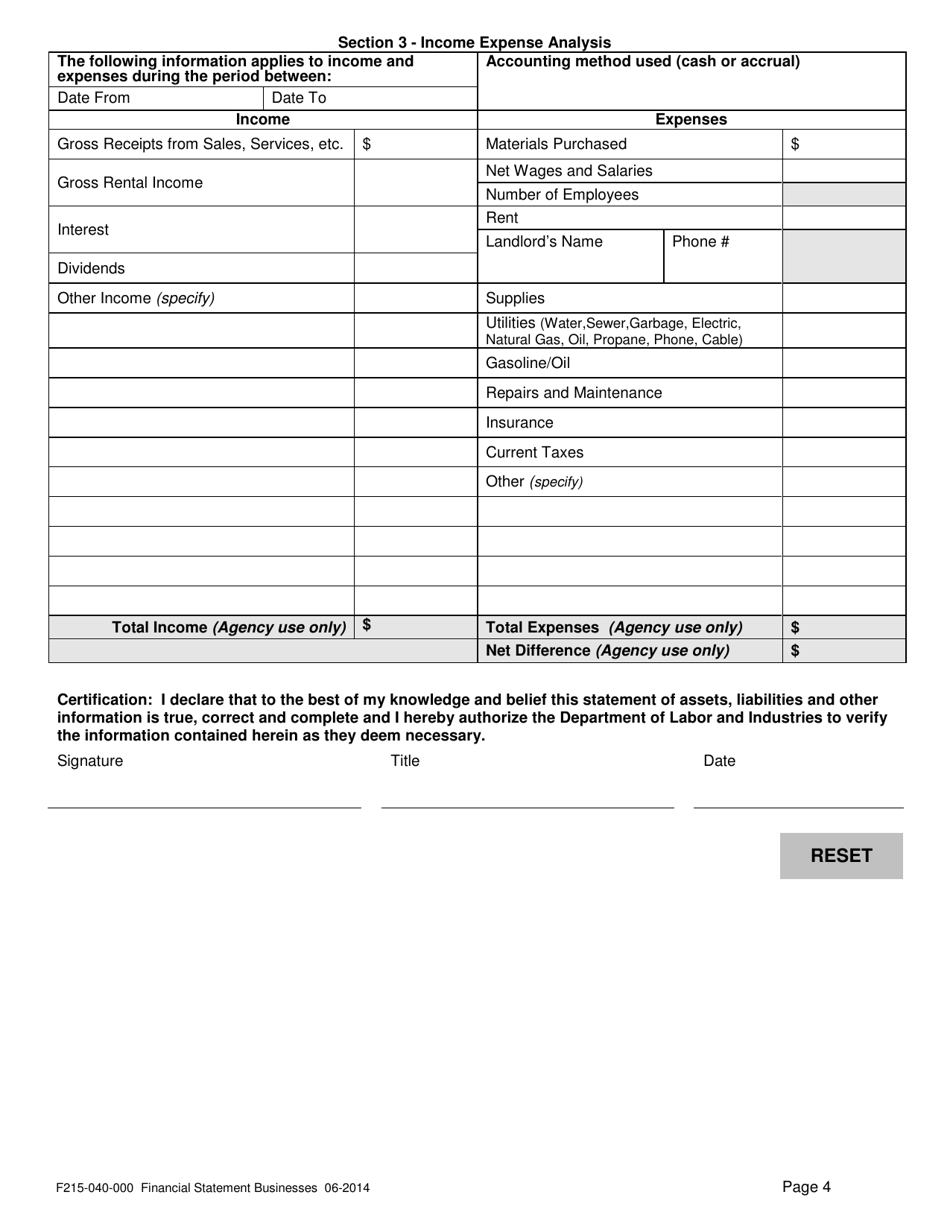

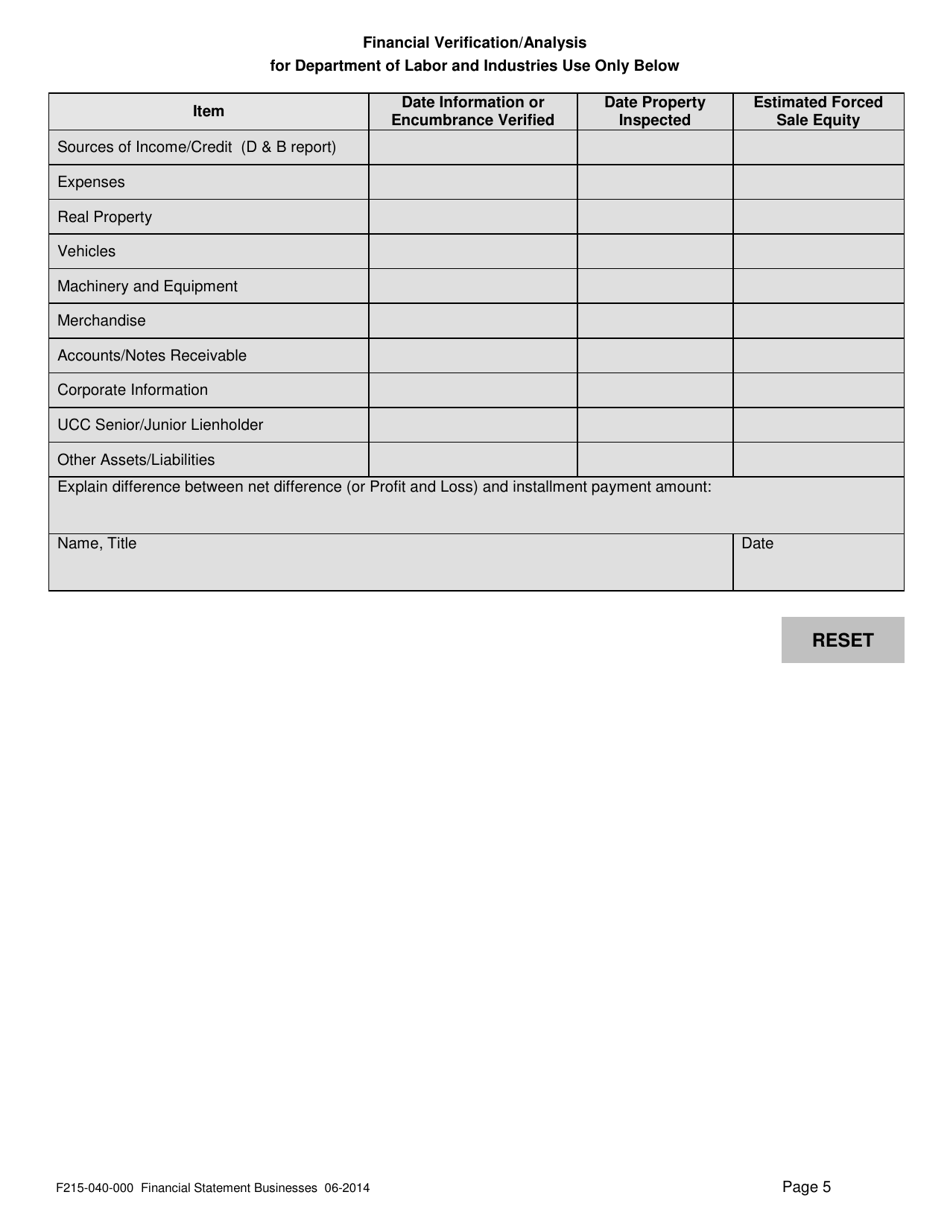

A: This form requires information such as assets, liabilities, income, and expenses of the business.

Q: Are there any fees associated with filing this form?

A: There may be filing fees associated with submitting this form, depending on the type and size of the business.

Q: When is the deadline for filing this form?

A: The deadline for filing form F215-040-000 varies and should be specified by the Washington State Department of Revenue or on the form itself.

Q: Are there any penalties for late filing?

A: Late filing of form F215-040-000 may result in penalties or fines, so it is important to submit the form by the designated deadline.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F215-040-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.