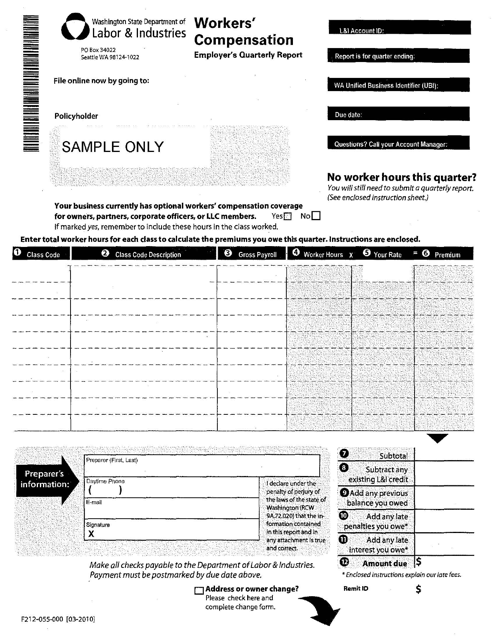

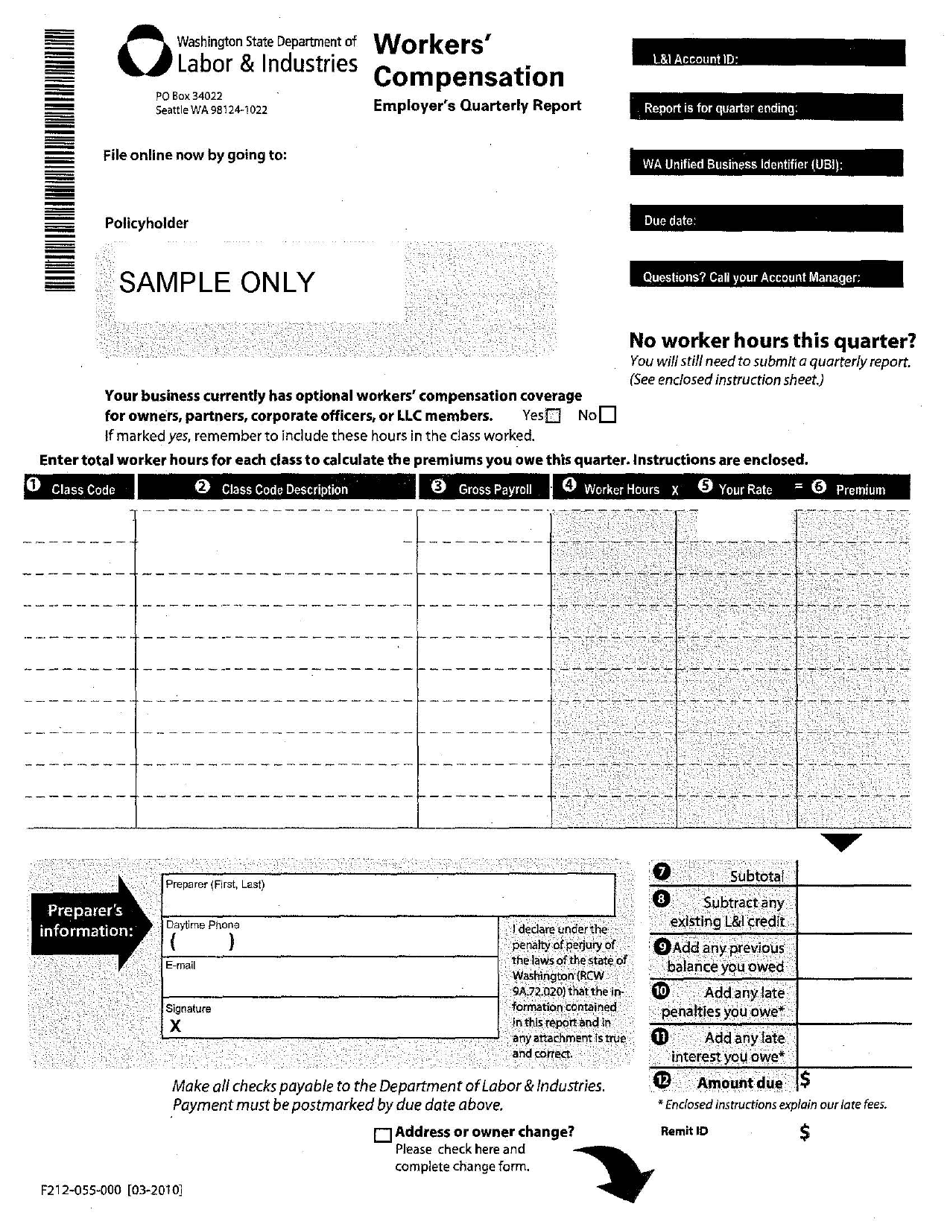

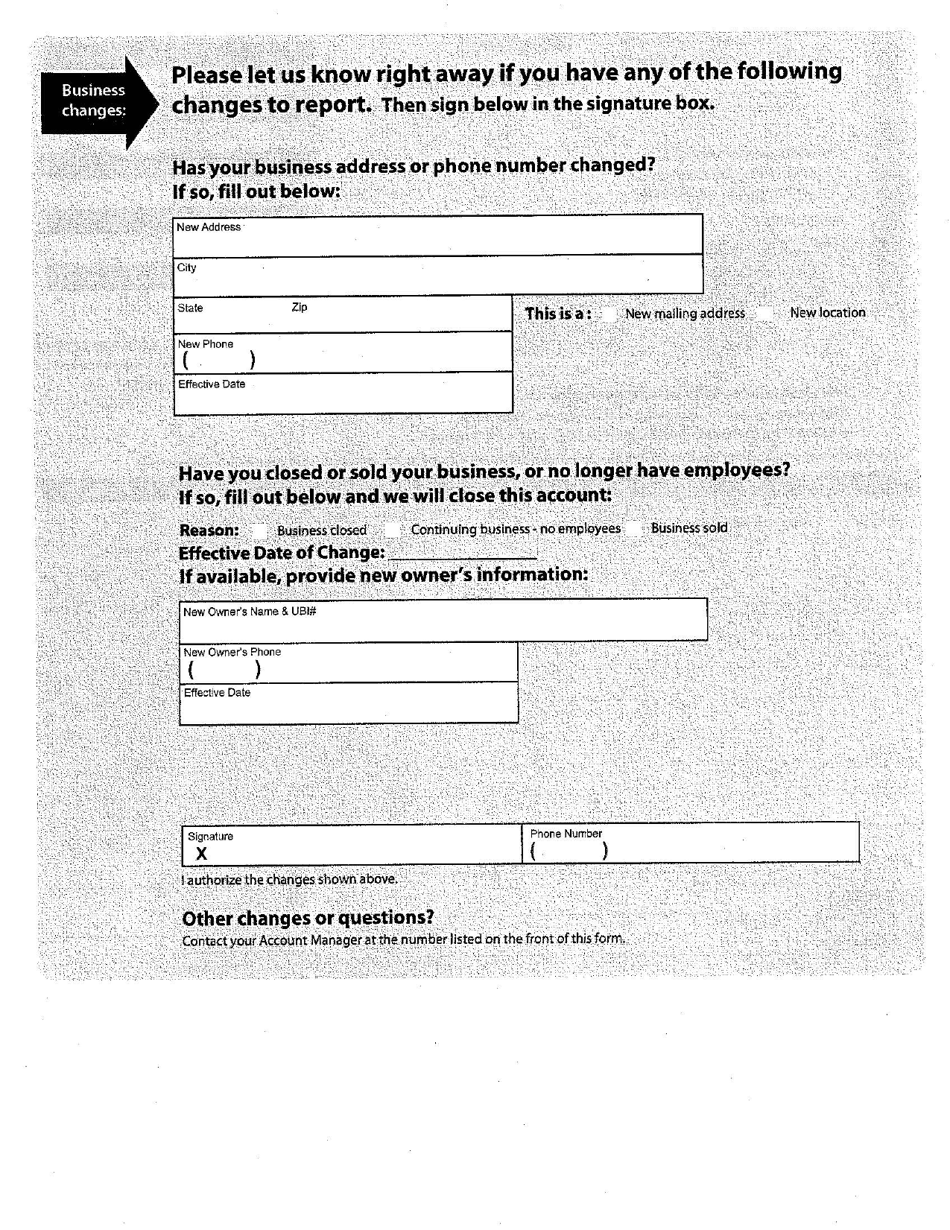

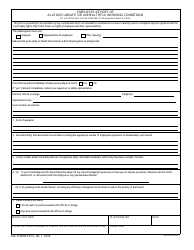

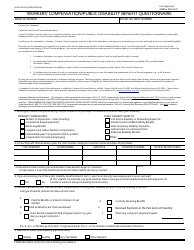

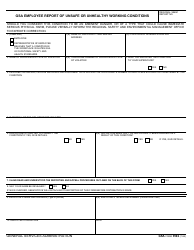

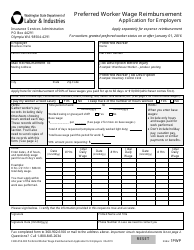

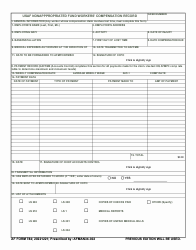

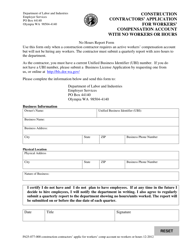

Form F212-055-000 Workers' Compensation Employer's Quarterly Report - Washington

What Is Form F212-055-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F212-055-000?

A: Form F212-055-000 is the Workers' Compensation Employer's Quarterly Report in the state of Washington.

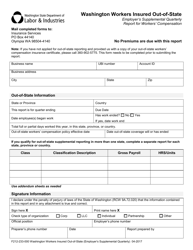

Q: Who is required to file Form F212-055-000?

A: Employers in Washington state are required to file Form F212-055-000.

Q: What is the purpose of Form F212-055-000?

A: The purpose of Form F212-055-000 is to report quarterly information related to workers' compensation in Washington state.

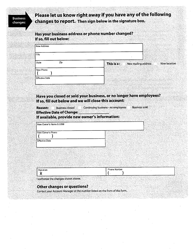

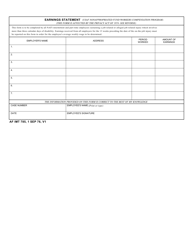

Q: What information needs to be provided on Form F212-055-000?

A: Form F212-055-000 requires employers to provide details about their workforce, including number of employees, payroll amounts, and workers' compensation insurance information.

Q: When is Form F212-055-000 due?

A: Form F212-055-000 is due on a quarterly basis. The specific due dates are determined by the Washington State Department of Labor and Industries.

Q: Are there any penalties for not filing Form F212-055-000?

A: Yes, there can be penalties for not filing Form F212-055-000 or filing it late. It is important to comply with the filing requirements to avoid any penalties or legal issues.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F212-055-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.