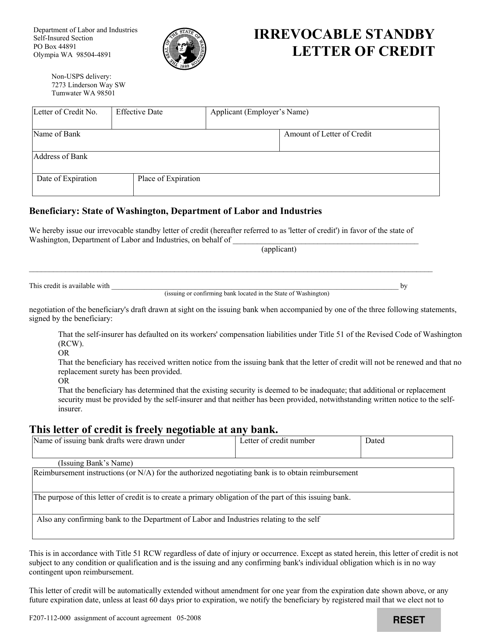

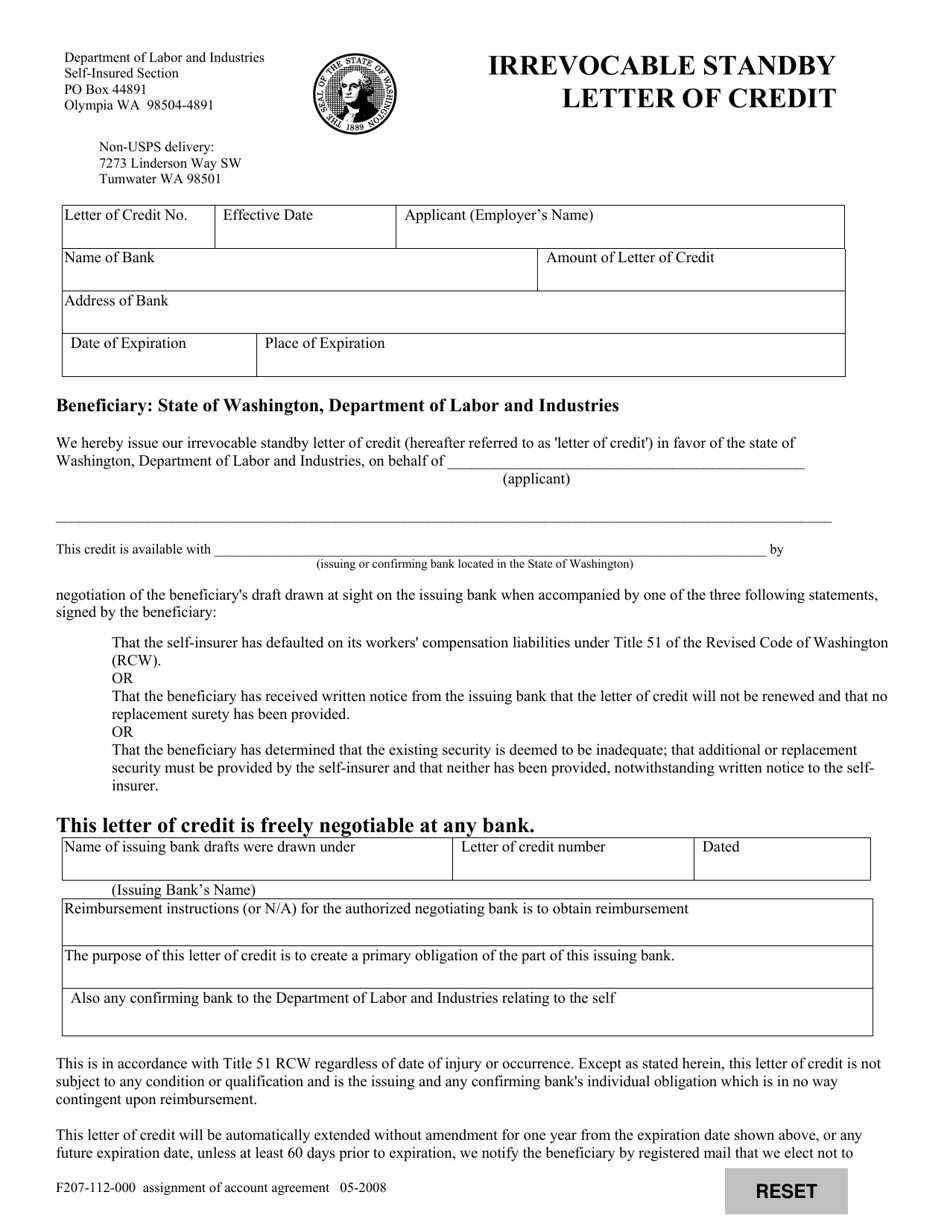

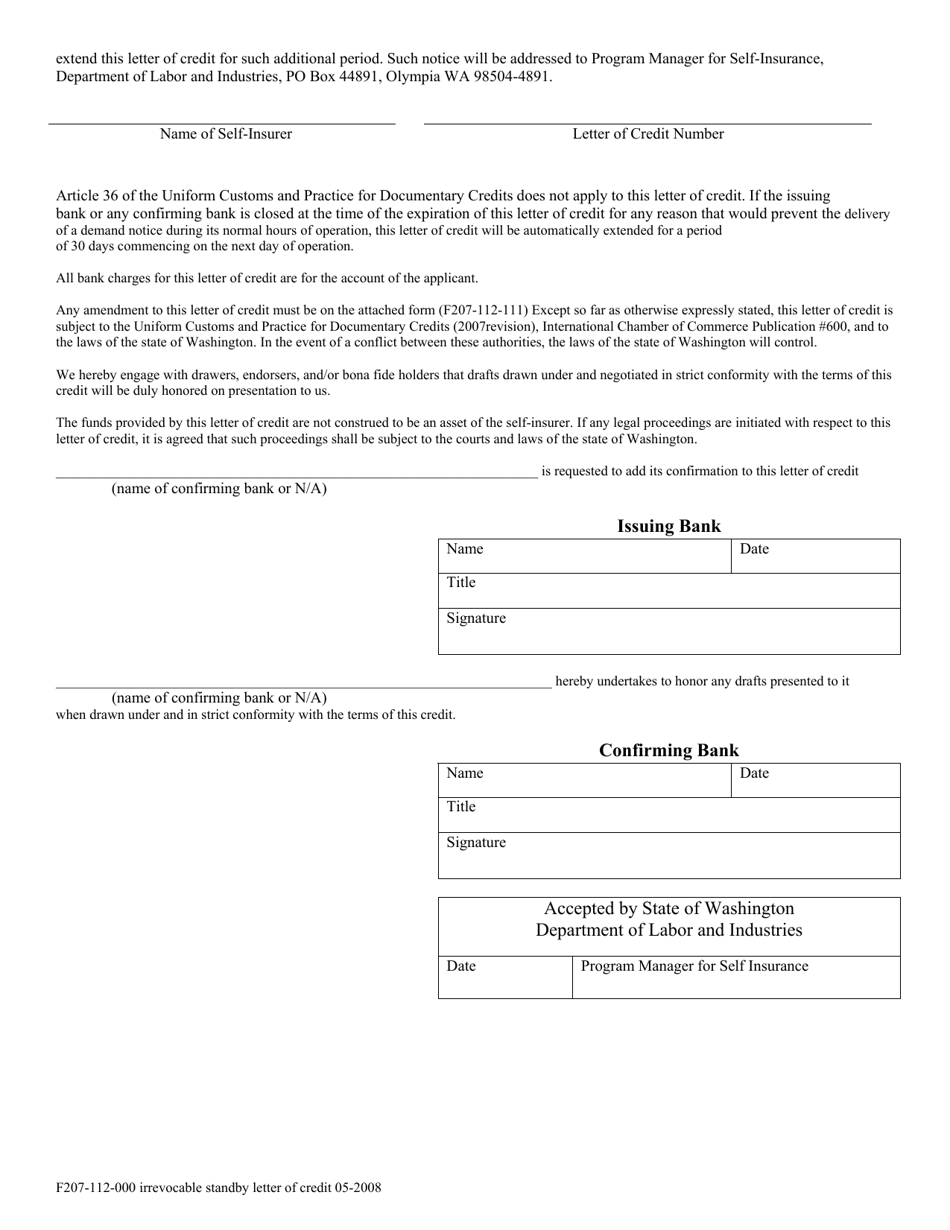

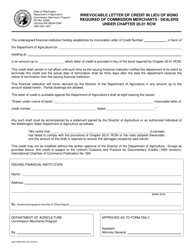

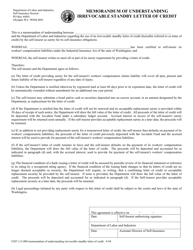

Form F207-112-000 Irrevocable Standby Letter of Credit - Washington

What Is Form F207-112-000?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F207-112-000?

A: Form F207-112-000 is the Irrevocable Standby Letter of Credit used in the state of Washington.

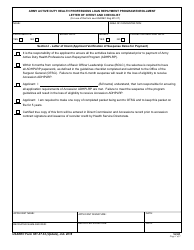

Q: What is an Irrevocable Standby Letter of Credit?

A: An Irrevocable Standby Letter of Credit is a financial instrument issued by a bank that guarantees payment to a beneficiary if certain conditions are met.

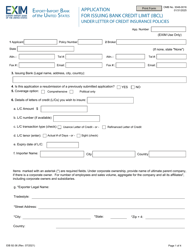

Q: Why would someone need to use an Irrevocable Standby Letter of Credit?

A: An Irrevocable Standby Letter of Credit can be used as a form of payment assurance in business transactions, contracts, or to guarantee performance of obligations.

Q: What is the purpose of Form F207-112-000?

A: Form F207-112-000 is used to document the terms and conditions of an Irrevocable Standby Letter of Credit in the state of Washington.

Q: What information is required in Form F207-112-000?

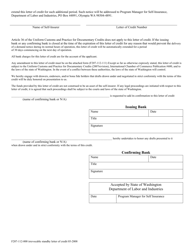

A: Form F207-112-000 typically requires information such as the names and addresses of the applicant and beneficiary, the amount and currency of the credit, the expiration date, and the conditions for drawing on the letter of credit.

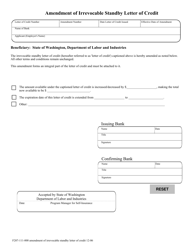

Q: Can Form F207-112-000 be modified or customized?

A: Yes, Form F207-112-000 can be modified or customized to meet specific needs, but it is important to ensure that any modifications are legally valid and enforceable.

Q: Is it necessary to have a lawyer review Form F207-112-000?

A: While not always required, it is advisable to have a lawyer review Form F207-112-000 to ensure that all terms and conditions are legally sound and protect your interests.

Q: Are there any fees associated with using an Irrevocable Standby Letter of Credit?

A: Yes, banks typically charge fees for issuing and maintaining an Irrevocable Standby Letter of Credit.

Q: Can a beneficiary draw on the Irrevocable Standby Letter of Credit without meeting the specified conditions?

A: No, the beneficiary can only draw on the Irrevocable Standby Letter of Credit if the conditions outlined in the letter of credit are met.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F207-112-000 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.