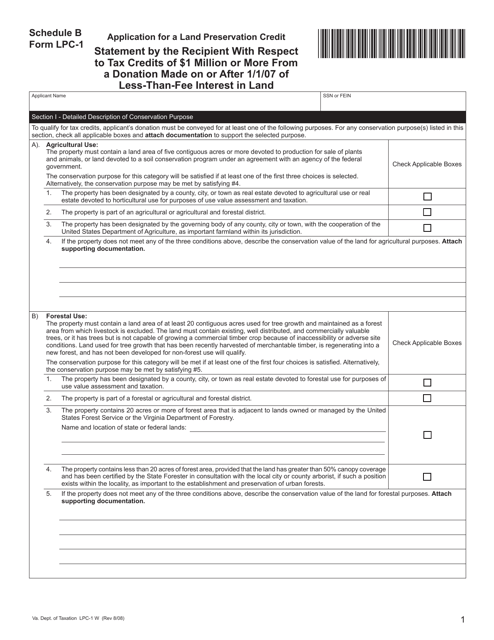

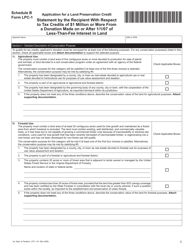

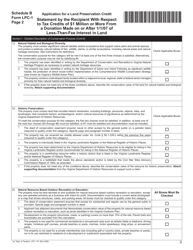

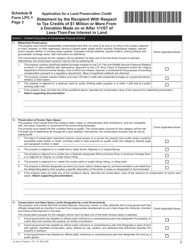

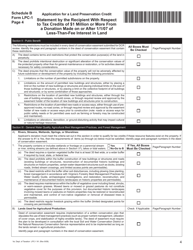

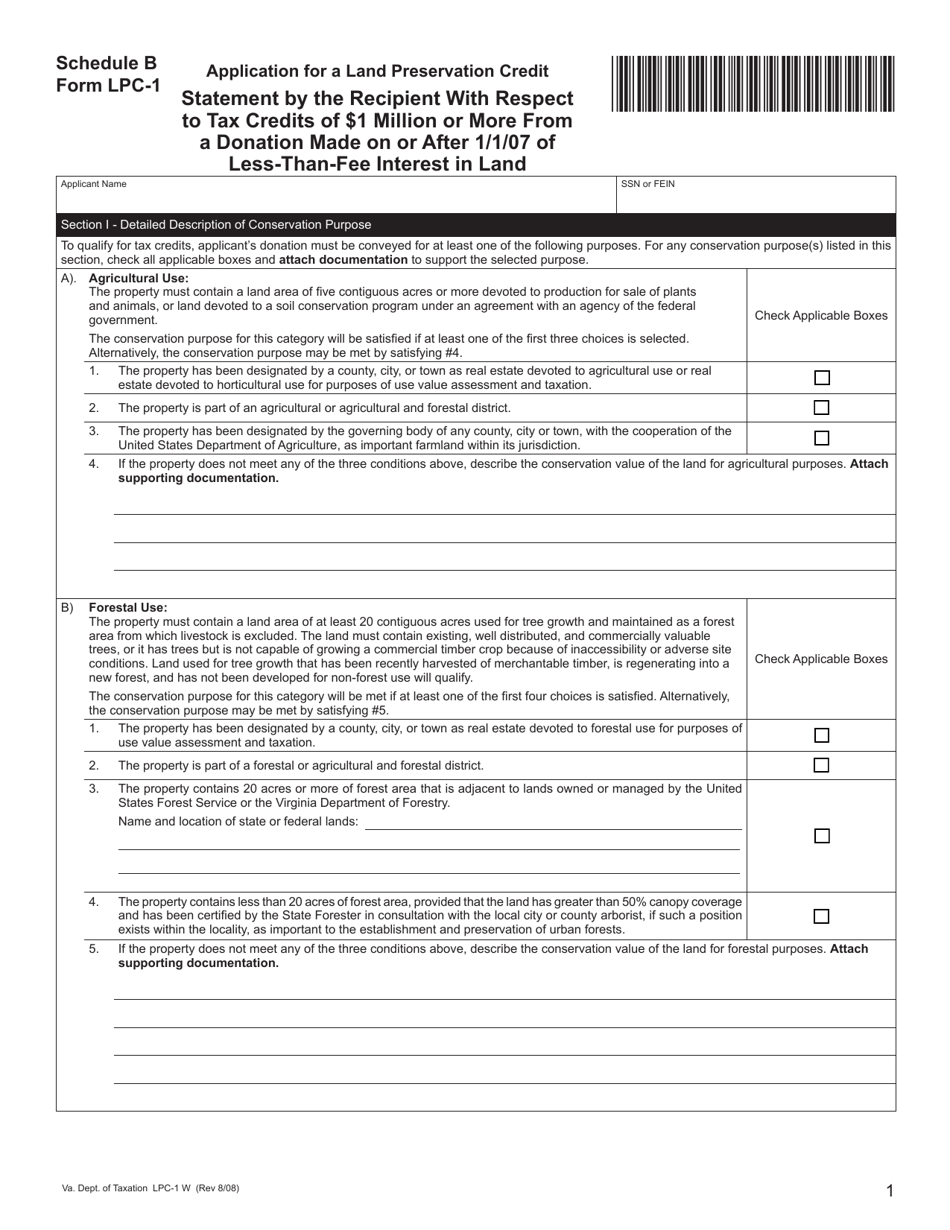

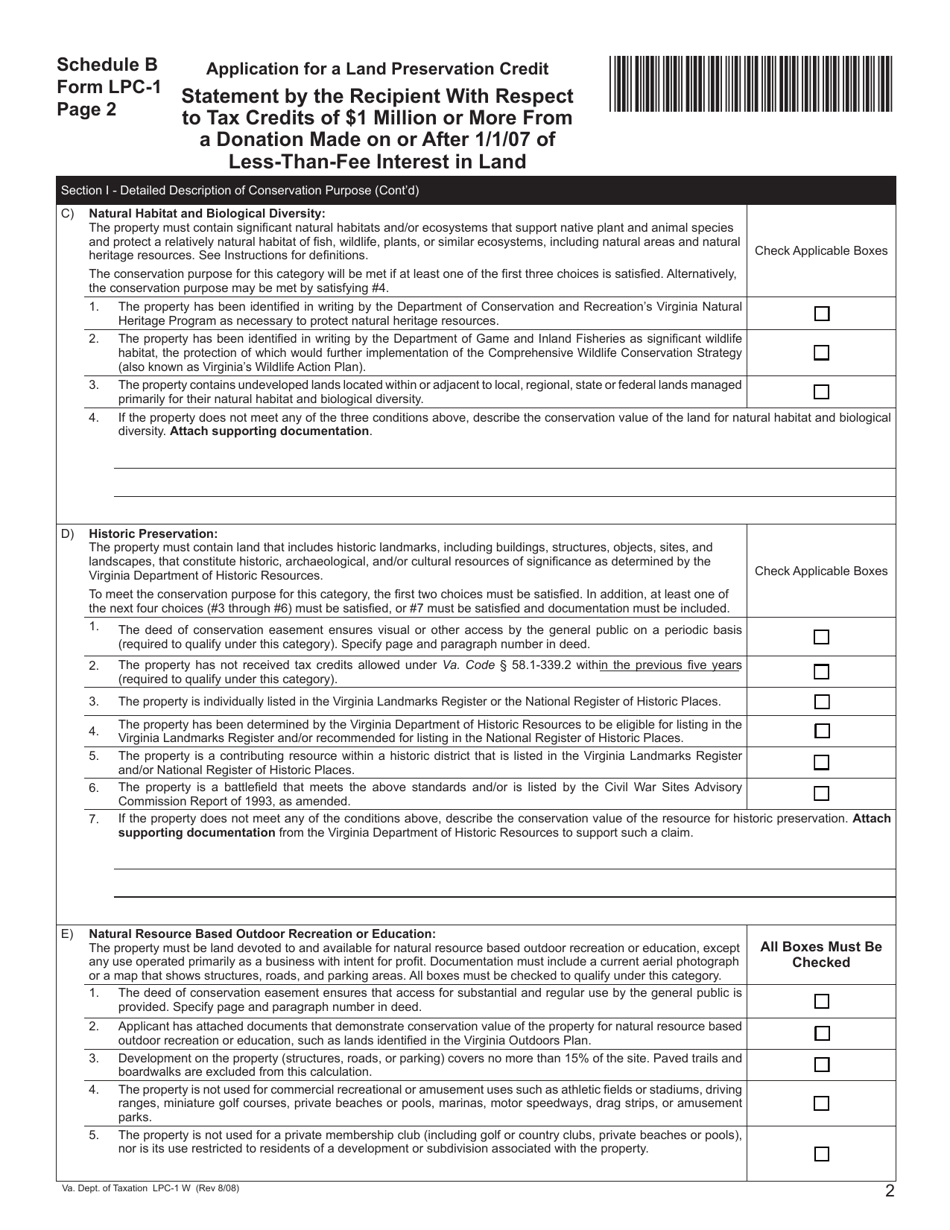

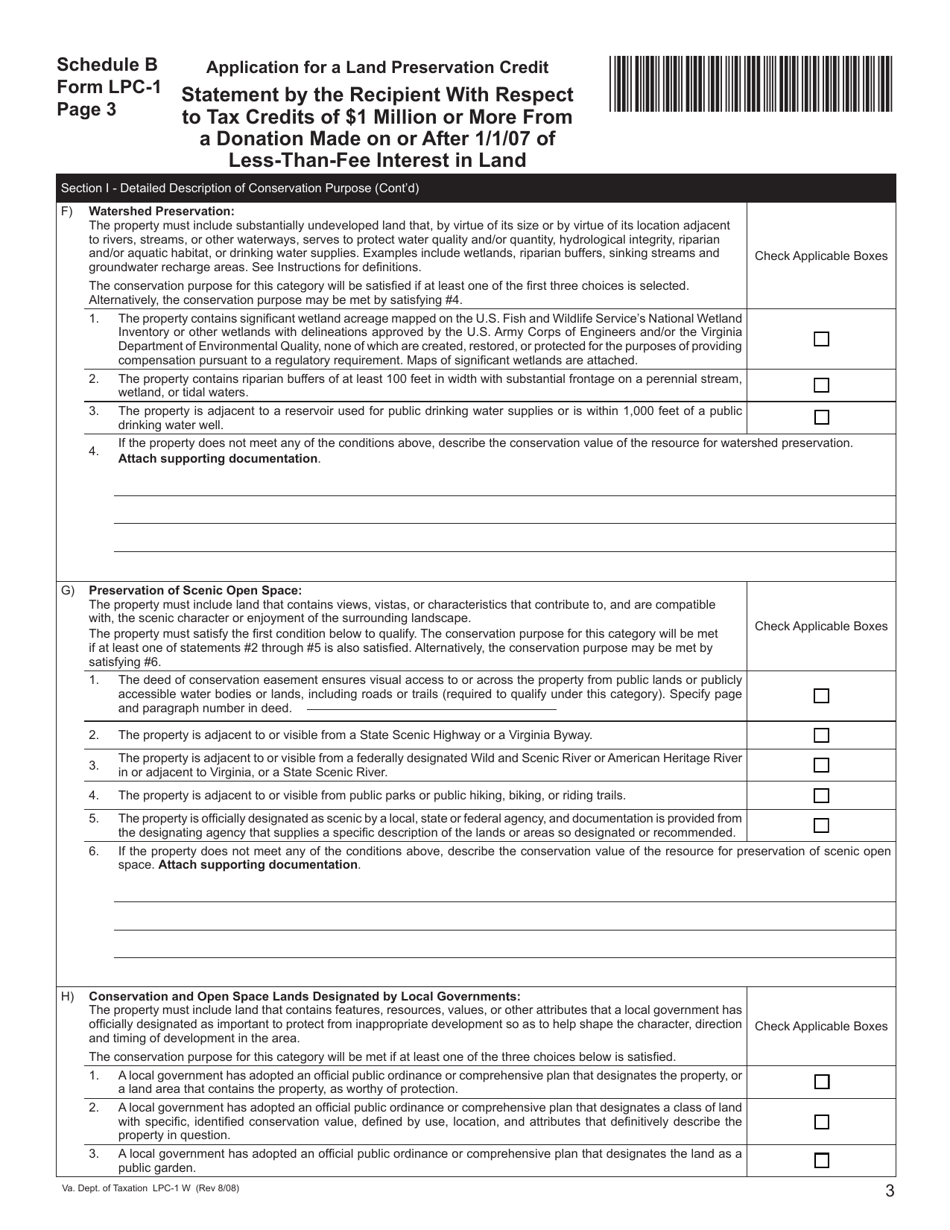

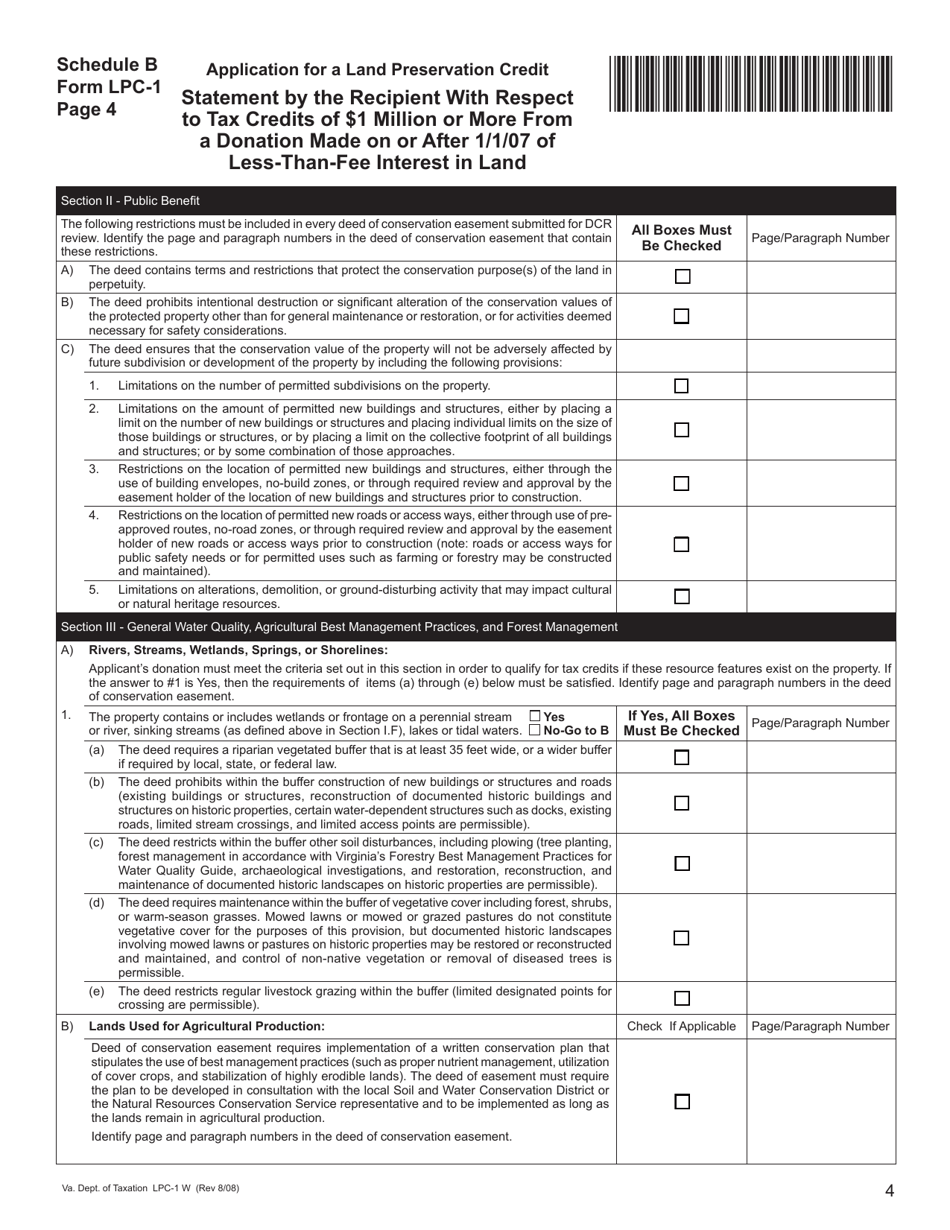

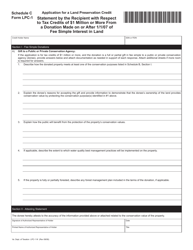

Form LPC-1 Schedule B Statement by the Recipient With Respect to Tax Credits of $1 Million or More From a Donation Made on or After 1 / 1 / 07 of Less-Than-Fee Interest in Land - Virginia

What Is Form LPC-1 Schedule B?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form LPC-1, Application for a Land Preservation Credit. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LPC-1 Schedule B?

A: Form LPC-1 Schedule B is a statement that needs to be filled by the recipient of tax credits of $1 million or more from a donation made on or after 1/1/07 of a less-than-fee interest in land in Virginia.

Q: Who is required to fill out Form LPC-1 Schedule B?

A: The recipient of tax credits of $1 million or more from a donation made on or after 1/1/07 of a less-than-fee interest in land in Virginia is required to fill out Form LPC-1 Schedule B.

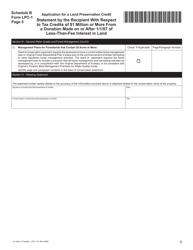

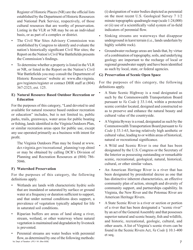

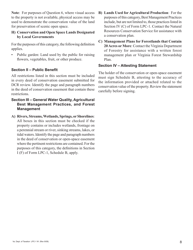

Q: What information needs to be provided in Form LPC-1 Schedule B?

A: Form LPC-1 Schedule B requires the recipient to provide a statement with respect to the tax credits received from the donation of a less-than-fee interest in land in Virginia.

Q: What is the purpose of Form LPC-1 Schedule B?

A: The purpose of Form LPC-1 Schedule B is to report and document tax credits of $1 million or more received from a donation of a less-than-fee interest in land in Virginia.

Q: What is a less-than-fee interest in land?

A: A less-than-fee interest in land refers to a partial ownership or restricted ownership of a land property, where the donor retains some level of control over the land.

Q: When should Form LPC-1 Schedule B be filled out?

A: Form LPC-1 Schedule B should be filled out by the recipient of tax credits of $1 million or more from a donation made on or after 1/1/07 of a less-than-fee interest in land in Virginia.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPC-1 Schedule B by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.