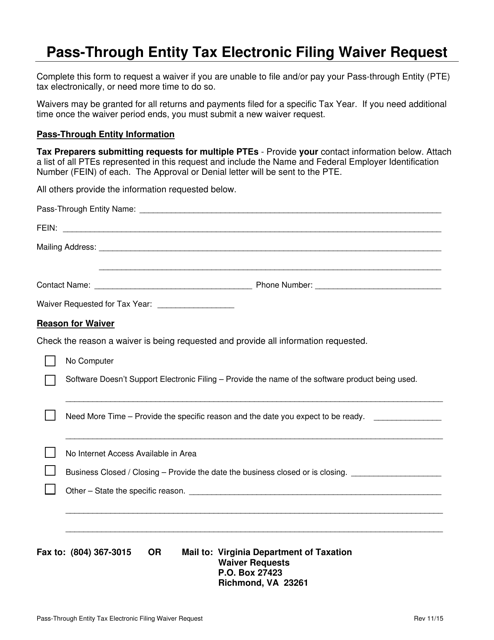

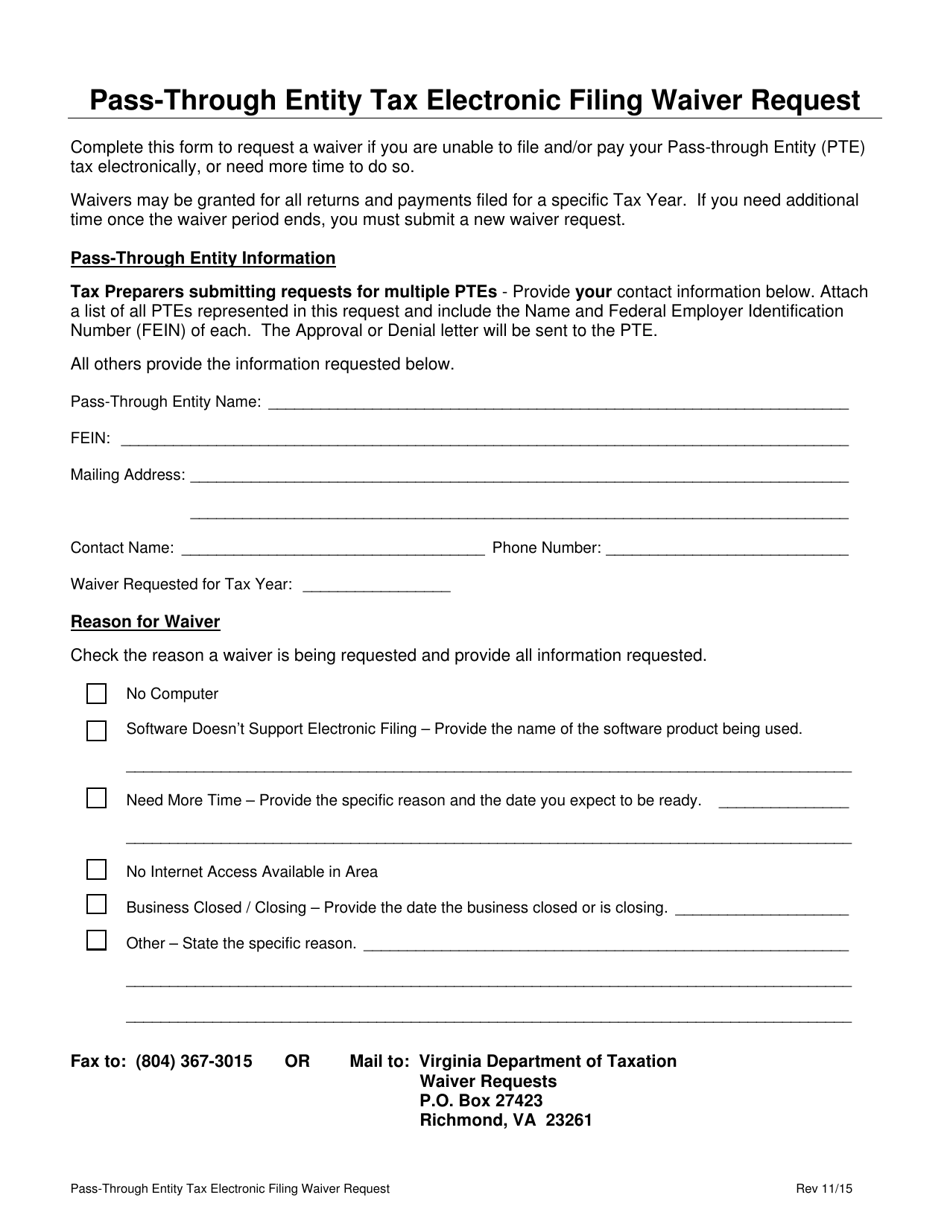

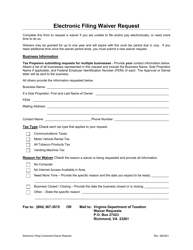

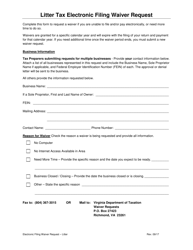

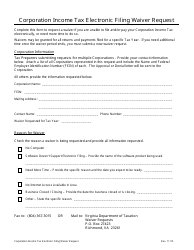

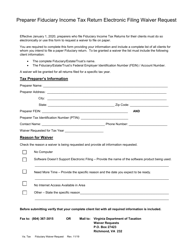

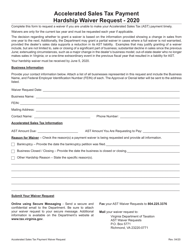

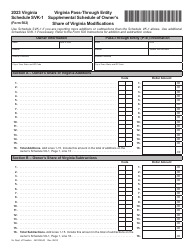

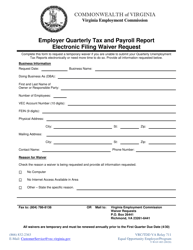

Pass-Through Entity Tax Electronic Filing Waiver Request Form - Virginia

Pass-Through Entity Tax Electronic Filing Waiver Request Form is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is the Pass-Through Entity Tax Electronic Filing Waiver Request Form?

A: The Pass-Through Entity Tax Electronic Filing Waiver Request Form is a form used in Virginia for requesting a waiver from electronically filing pass-through entity tax returns.

Q: Who needs to file the Pass-Through Entity Tax Electronic Filing Waiver Request Form?

A: Pass-through entities in Virginia who want to request a waiver from electronically filing their tax returns need to file this form.

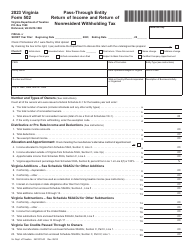

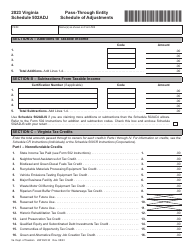

Q: What is a pass-through entity?

A: A pass-through entity is a business structure, such as a partnership, S corporation, or limited liability company (LLC), where the profits and losses of the business "pass through" to the owners and are reported on their individual tax returns.

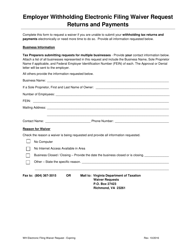

Q: Why would a pass-through entity want to request a waiver from electronically filing their tax returns?

A: There could be various reasons why a pass-through entity may want to request a waiver, such as technical difficulties or other extenuating circumstances that prevent them from electronically filing.

Q: Are there any requirements or conditions for requesting a waiver?

A: Yes, there are specific requirements and conditions outlined in the instructions for the form. Pass-through entities should review these instructions carefully before submitting their waiver request.

Q: What happens after submitting the Pass-Through Entity Tax Electronic Filing Waiver Request Form?

A: The Virginia Department of Taxation will review the waiver request and notify the pass-through entity of their decision.

Q: Is it guaranteed that a waiver will be granted?

A: No, the granting of a waiver is at the discretion of the Virginia Department of Taxation. Each waiver request is evaluated on a case-by-case basis.

Q: What should I do if my waiver request is denied?

A: If your waiver request is denied, you will need to electronically file your pass-through entity tax return as required by Virginia law.

Form Details:

- Released on November 1, 2015;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.