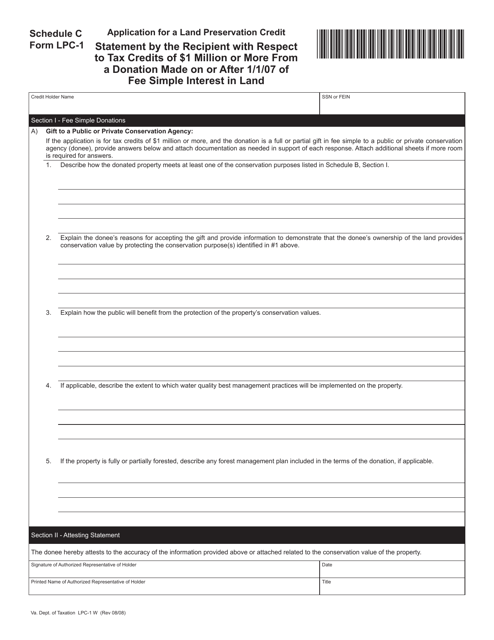

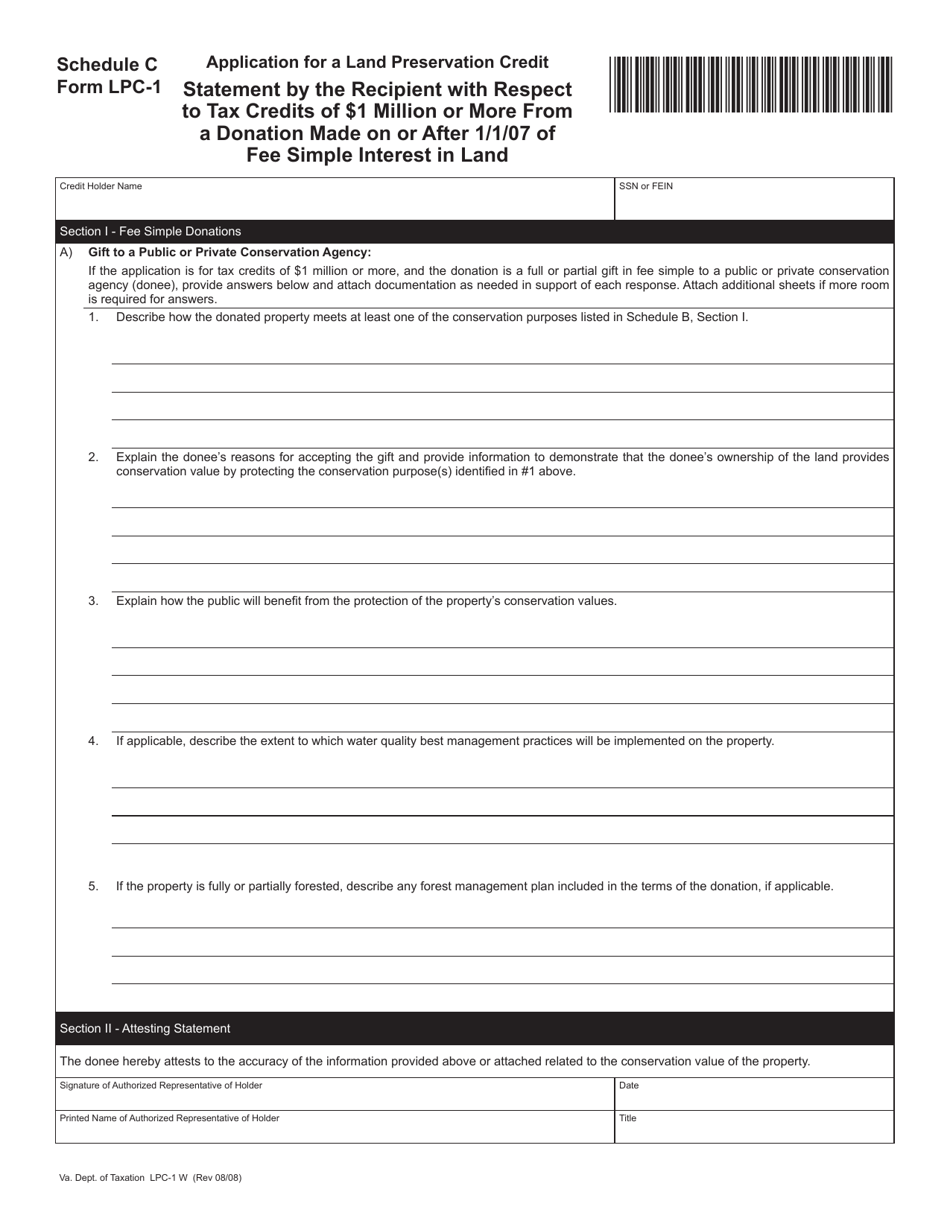

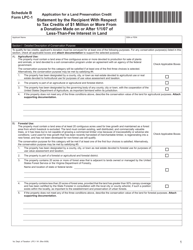

Form LPC-1 Schedule C Statement by the Recipient With Respect to Tax Credits of $1 Million or More From a Donation Made on or After 1 / 1 / 07 of Fee Simple Interest in Land - Virginia

What Is Form LPC-1 Schedule C?

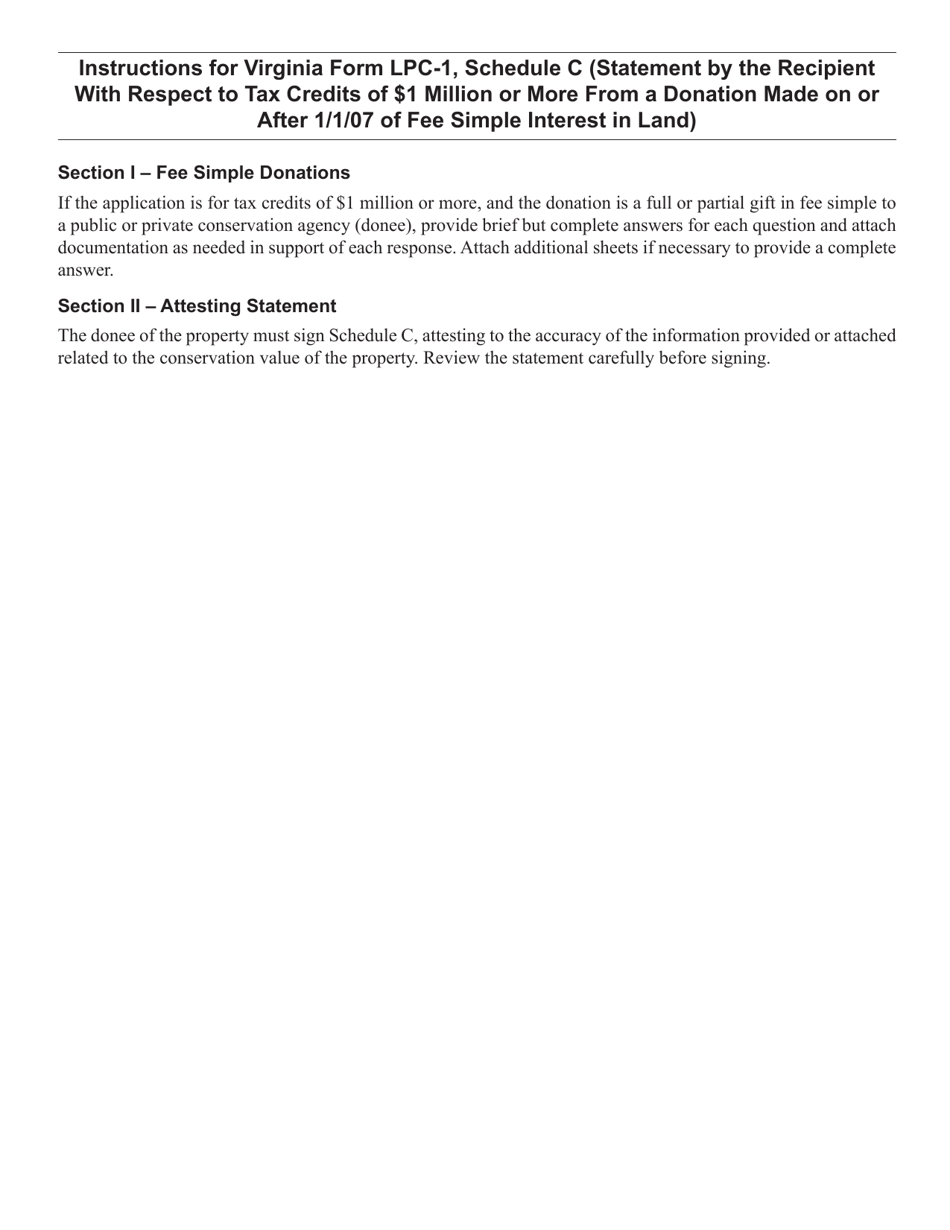

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form LPC-1, Application for a Land Preservation Credit. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LPC-1 Schedule C?

A: LPC-1 Schedule C is a statement by the recipient with respect to tax credits.

Q: What is the purpose of LPC-1 Schedule C?

A: The purpose of LPC-1 Schedule C is to report tax credits of $1 million or more.

Q: What qualifies for LPC-1 Schedule C?

A: LPC-1 Schedule C is for donations made on or after 1/1/07 of fee simple interest in land in Virginia.

Q: Who needs to file LPC-1 Schedule C?

A: Recipients who have received tax credits of $1 million or more need to file LPC-1 Schedule C.

Q: What information is included in LPC-1 Schedule C?

A: LPC-1 Schedule C includes information about the donation made and the tax credits received.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LPC-1 Schedule C by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.