This version of the form is not currently in use and is provided for reference only. Download this version of

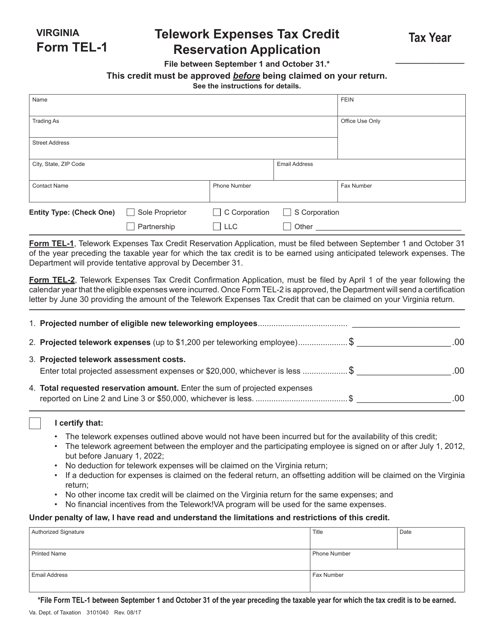

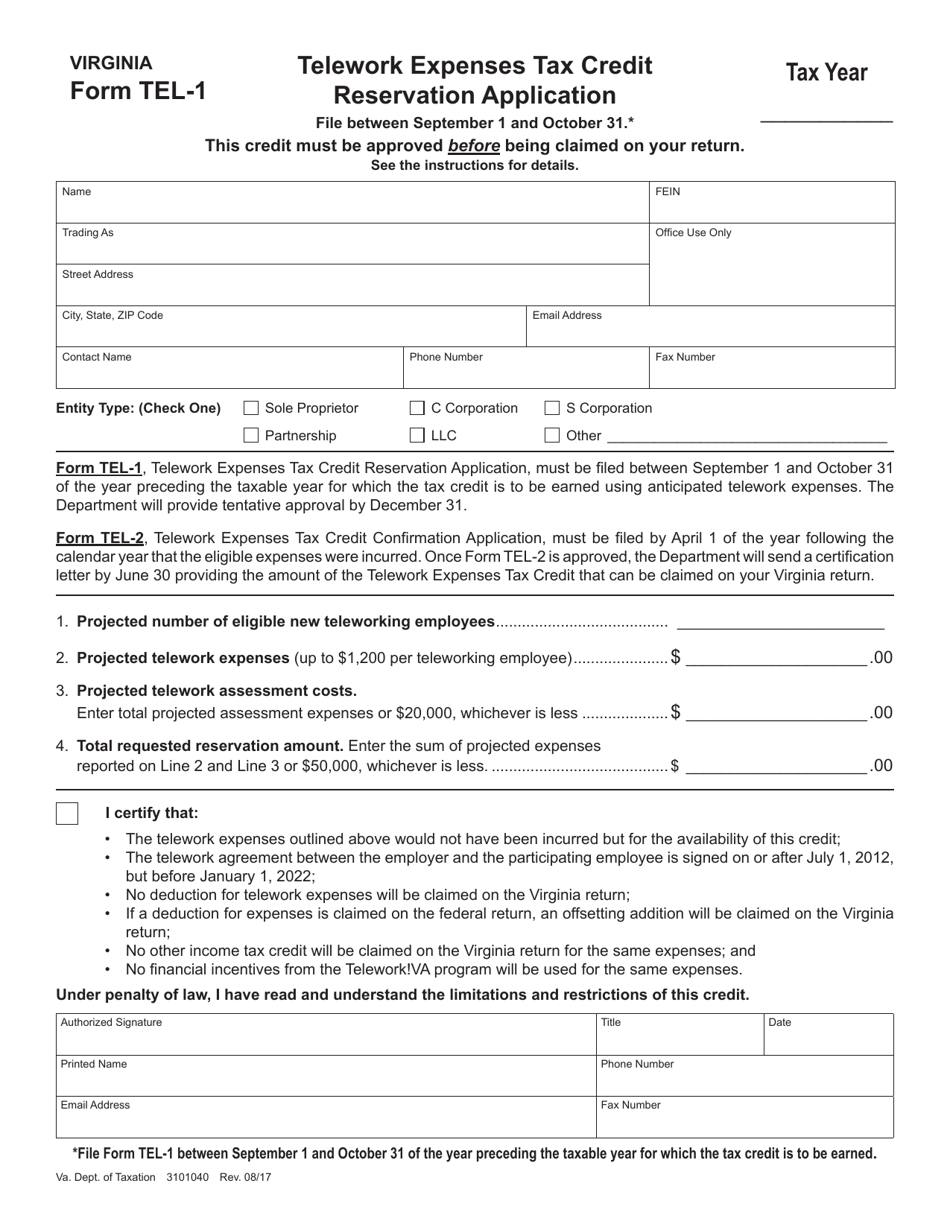

Form TEL-1

for the current year.

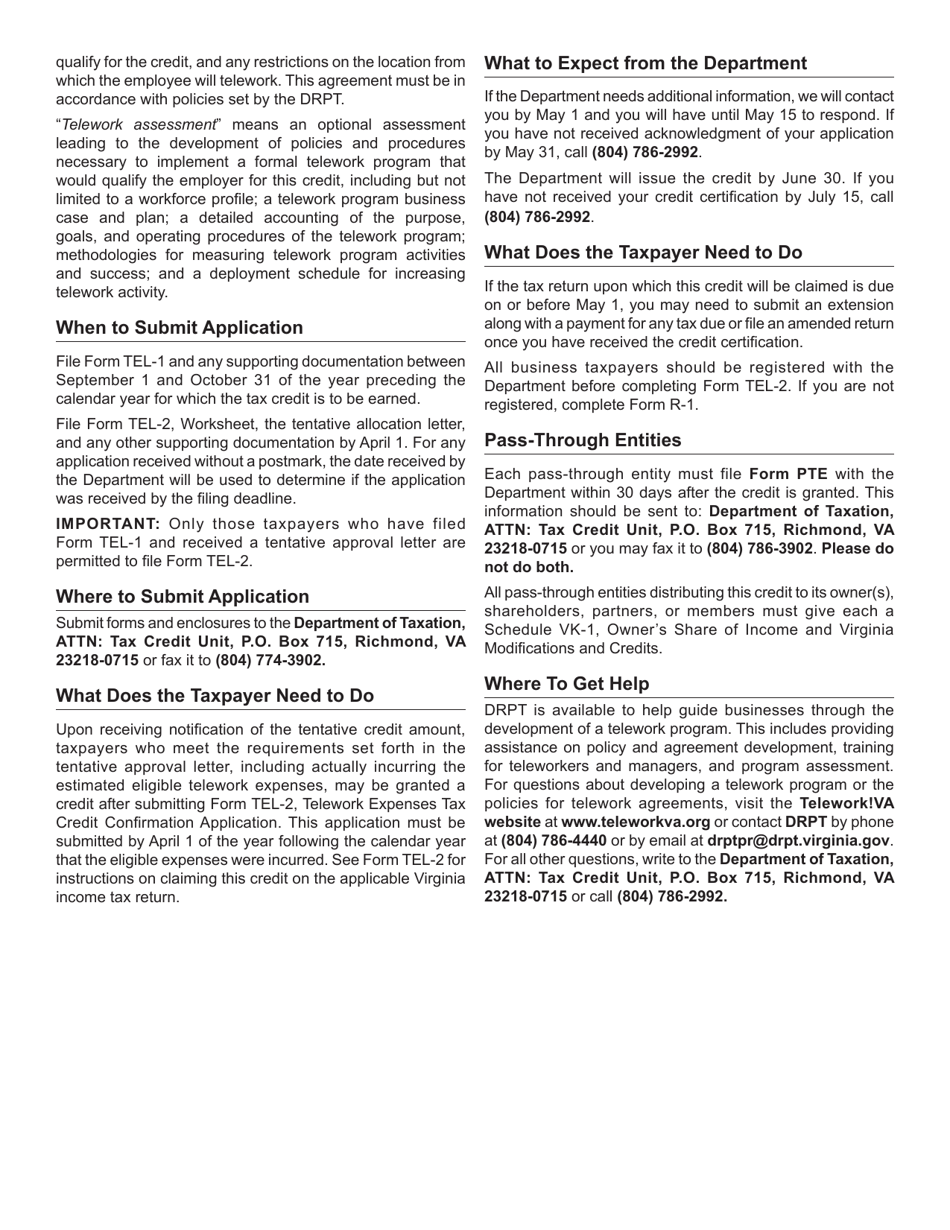

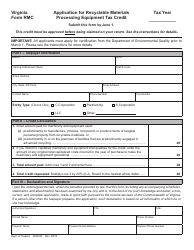

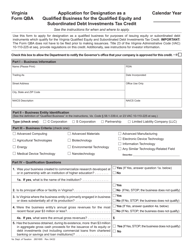

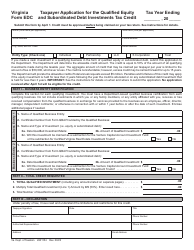

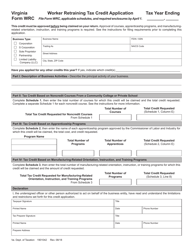

Form TEL-1 Telework Expenses Tax Credit Reservation Application - Virginia

What Is Form TEL-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TEL-1?

A: Form TEL-1 is the Telework Expenses Tax Credit Reservation Application.

Q: What is the purpose of Form TEL-1?

A: The purpose of Form TEL-1 is to apply for the Telework Expenses Tax Credit Reservation in Virginia.

Q: Who needs to fill out Form TEL-1?

A: Individuals who want to claim the Telework Expenses Tax Credit in Virginia need to fill out Form TEL-1.

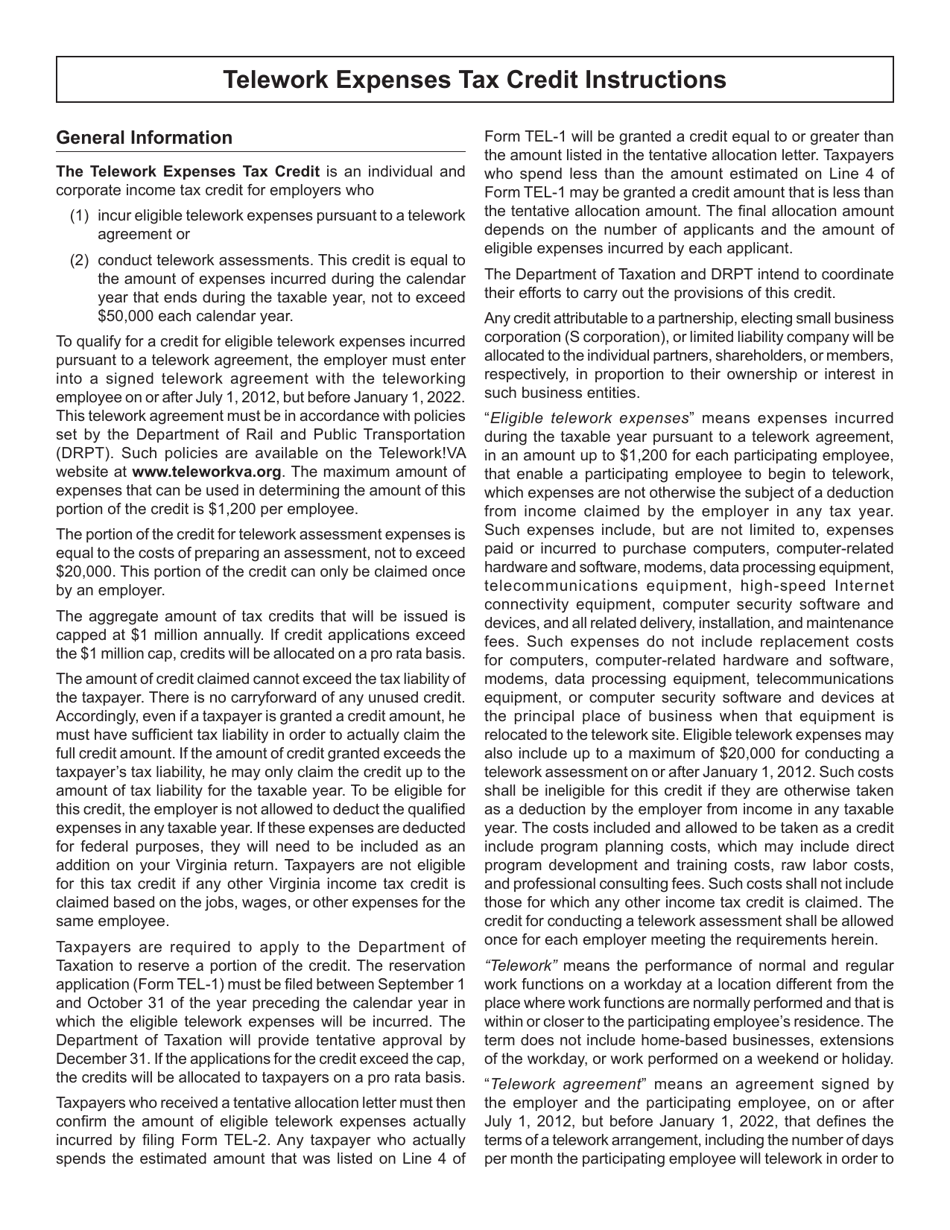

Q: What is the Telework Expenses Tax Credit?

A: The Telework Expenses Tax Credit is a tax credit available to individuals in Virginia who telework and incur certain eligible expenses.

Q: What types of expenses are eligible for the Telework Expenses Tax Credit?

A: Eligible expenses for the Telework Expenses Tax Credit include costs related to purchasing or leasing computer or telecommunications equipment, internet access, and other necessary supplies.

Q: How can I claim the Telework Expenses Tax Credit?

A: To claim the Telework Expenses Tax Credit, you need to submit Form TEL-1 to the Virginia Department of Taxation.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TEL-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.