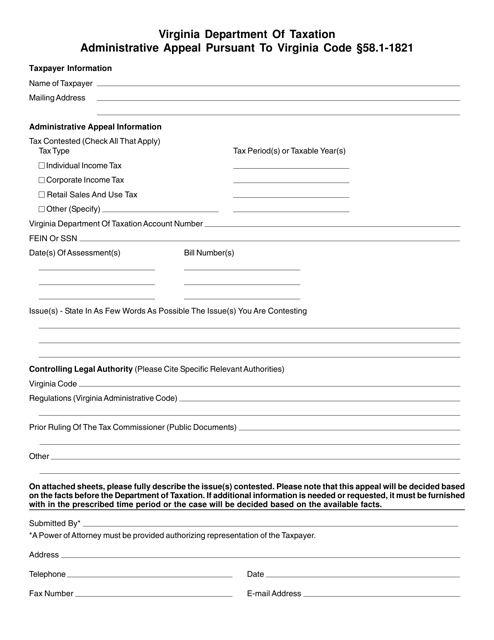

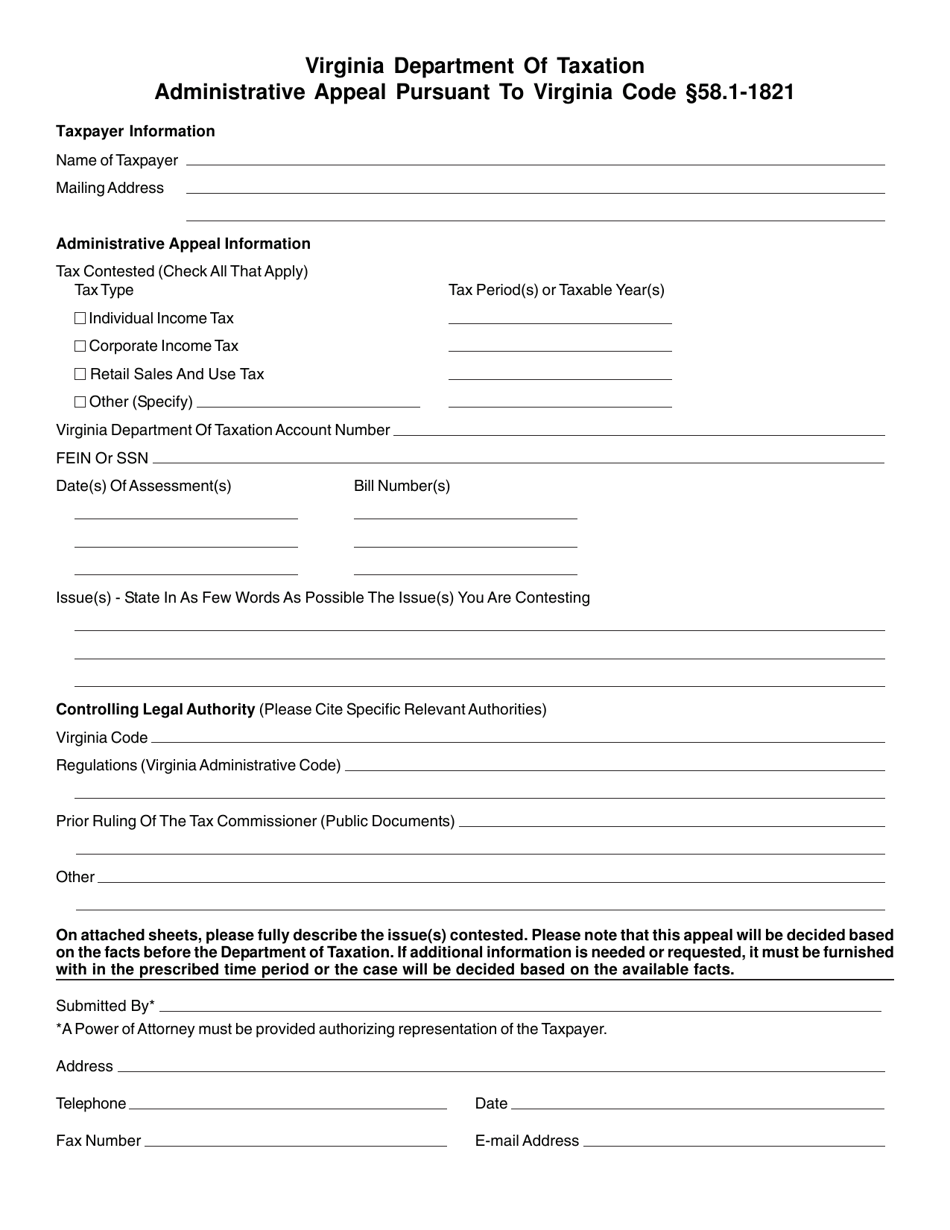

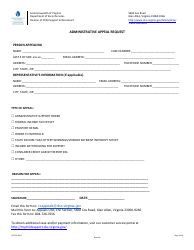

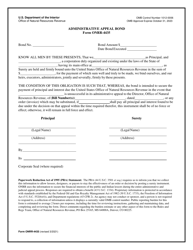

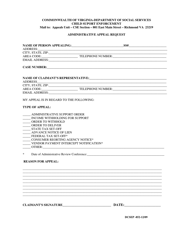

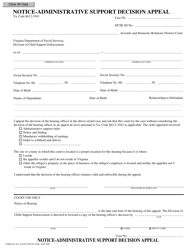

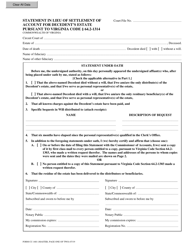

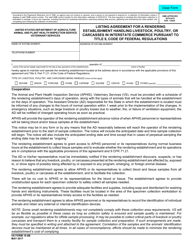

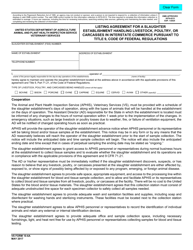

Administrative Appeal Pursuant to Virginia Code 58.1-1821 - Virginia

Administrative Appeal Pursuant to Virginia Code 58.1-1821 is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is the Virginia Administrative Appeal?

A: The Virginia Administrative Appeal is a process provided by Virginia Code 58.1-1821 for challenging certain decisions made by state administrative agencies.

Q: What is the purpose of an administrative appeal?

A: The purpose of an administrative appeal is to provide individuals and businesses with a mechanism to challenge agency actions or decisions that they believe are incorrect or unfair.

Q: What types of decisions can be appealed through the administrative appeal process?

A: The administrative appeal process can be used to challenge decisions related to taxes, licenses, permits, and other matters determined by state administrative agencies.

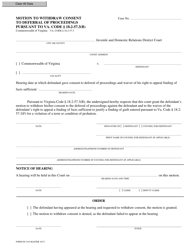

Q: How does the administrative appeal process work?

A: The administrative appeal process generally involves filing a written appeal with the appropriate administrative agency, providing supporting documentation or evidence, and participating in a hearing or review conducted by the agency or an administrative law judge.

Q: Is there a deadline for filing an administrative appeal?

A: Yes, there is typically a deadline for filing an administrative appeal, which is usually specified in the agency's decision or the applicable statute or regulation.

Q: Can I have legal representation during the administrative appeal process?

A: Yes, individuals and businesses have the right to be represented by an attorney during the administrative appeal process.

Q: What happens after the administrative appeal?

A: After the administrative appeal, the agency or administrative law judge will issue a decision, which may affirm, modify, or reverse the original decision.

Q: Can I further appeal the decision made in the administrative appeal?

A: In some cases, the decision made in the administrative appeal can be further appealed to the courts.

Form Details:

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.