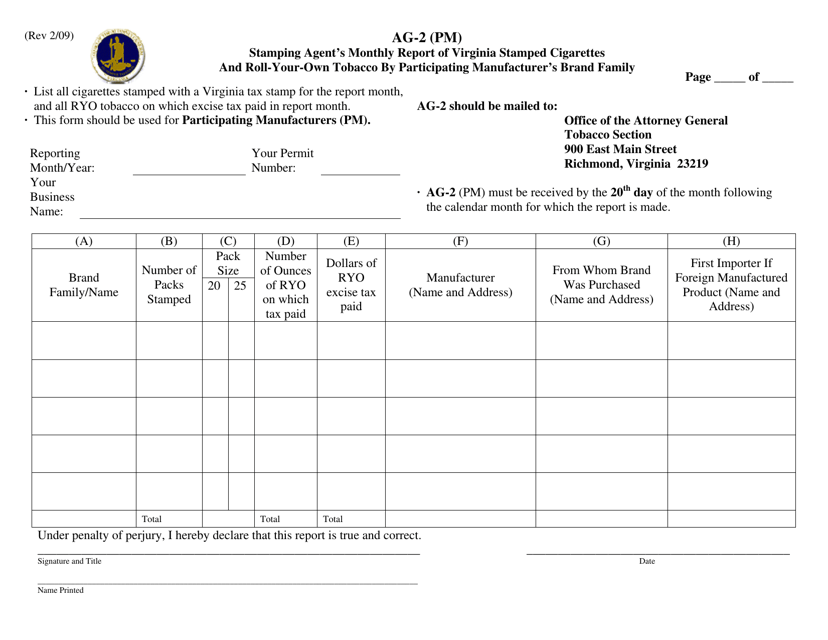

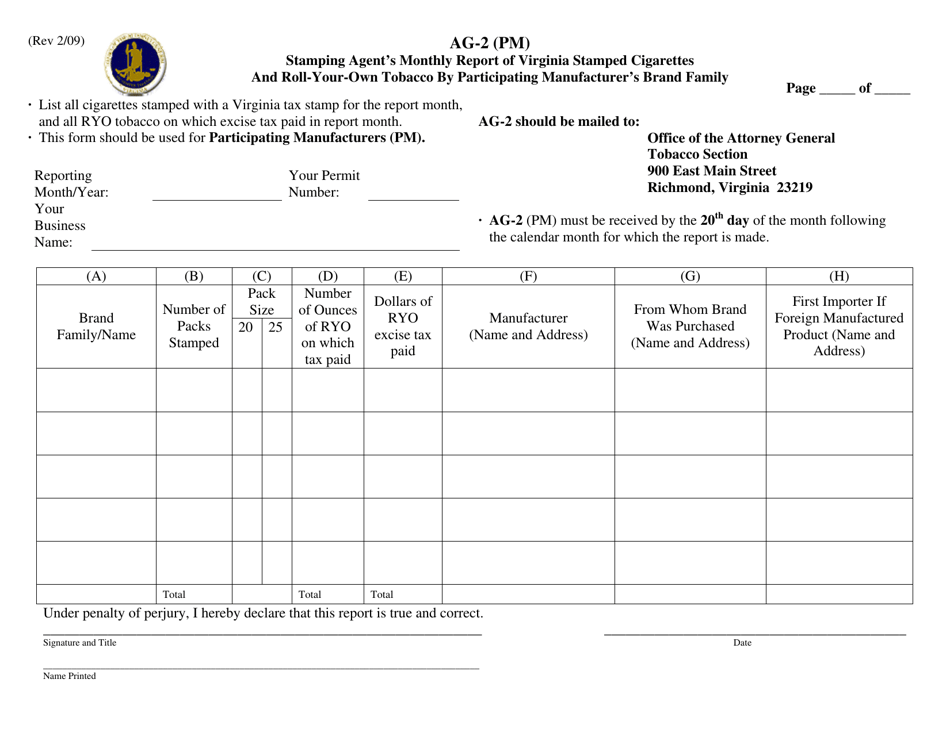

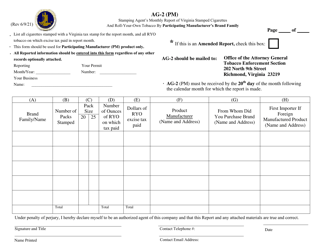

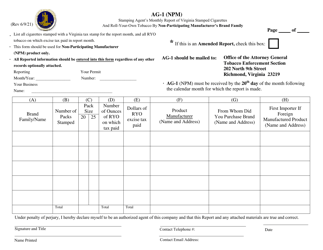

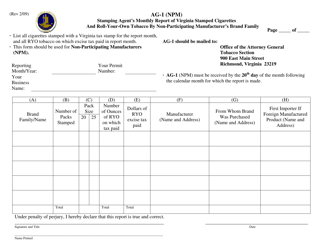

Form AG-2 Stamping Agent's Monthly Report of Virginia Stamped Cigarettes and Roll-Your-Own Tobacco by Participating Manufacturer's Brand Family - Virginia

What Is Form AG-2?

This is a legal form that was released by the Attorney General of Virginia - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AG-2?

A: Form AG-2 is a monthly report used by stamping agents in Virginia to report the sales of stamped cigarettes and roll-your-own tobacco.

Q: Who uses Form AG-2?

A: Stamping agents in Virginia use Form AG-2.

Q: What is the purpose of Form AG-2?

A: The purpose of Form AG-2 is to report the sales of stamped cigarettes and roll-your-own tobacco by participating manufacturer's brand family.

Q: What is a stamping agent?

A: A stamping agent is a person or entity authorized by the Virginia Department of Taxation to affix tax stamps on cigarettes and roll-your-own tobacco packages.

Q: What is a participating manufacturer's brand family?

A: A participating manufacturer's brand family refers to a group of cigarette or roll-your-own tobacco brands produced by a specific manufacturer.

Q: How often is Form AG-2 submitted?

A: Form AG-2 is submitted on a monthly basis.

Q: Are there any filing deadlines for Form AG-2?

A: Yes, Form AG-2 must be filed by the 20th day of the month following the reporting month.

Q: Are there any penalties for not filing Form AG-2?

A: Yes, failure to file Form AG-2 or filing it late can result in penalties and interest.

Q: Is there any other information required to be included in the report?

A: Yes, along with the sales information, stamping agents are also required to provide information on the purchase and distribution of tax stamps.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Attorney General of Virginia;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AG-2 by clicking the link below or browse more documents and templates provided by the Attorney General of Virginia.