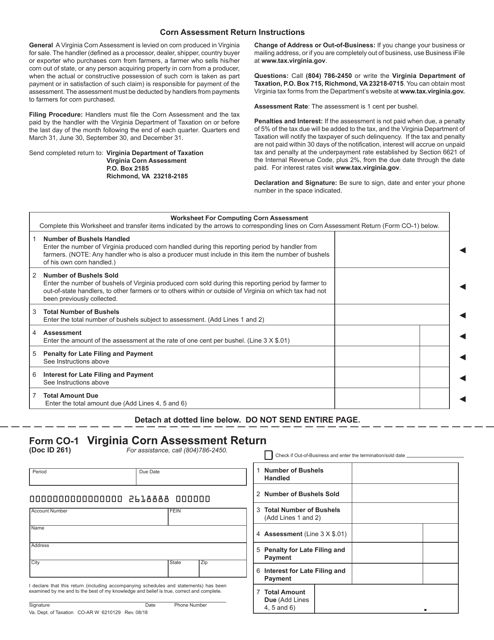

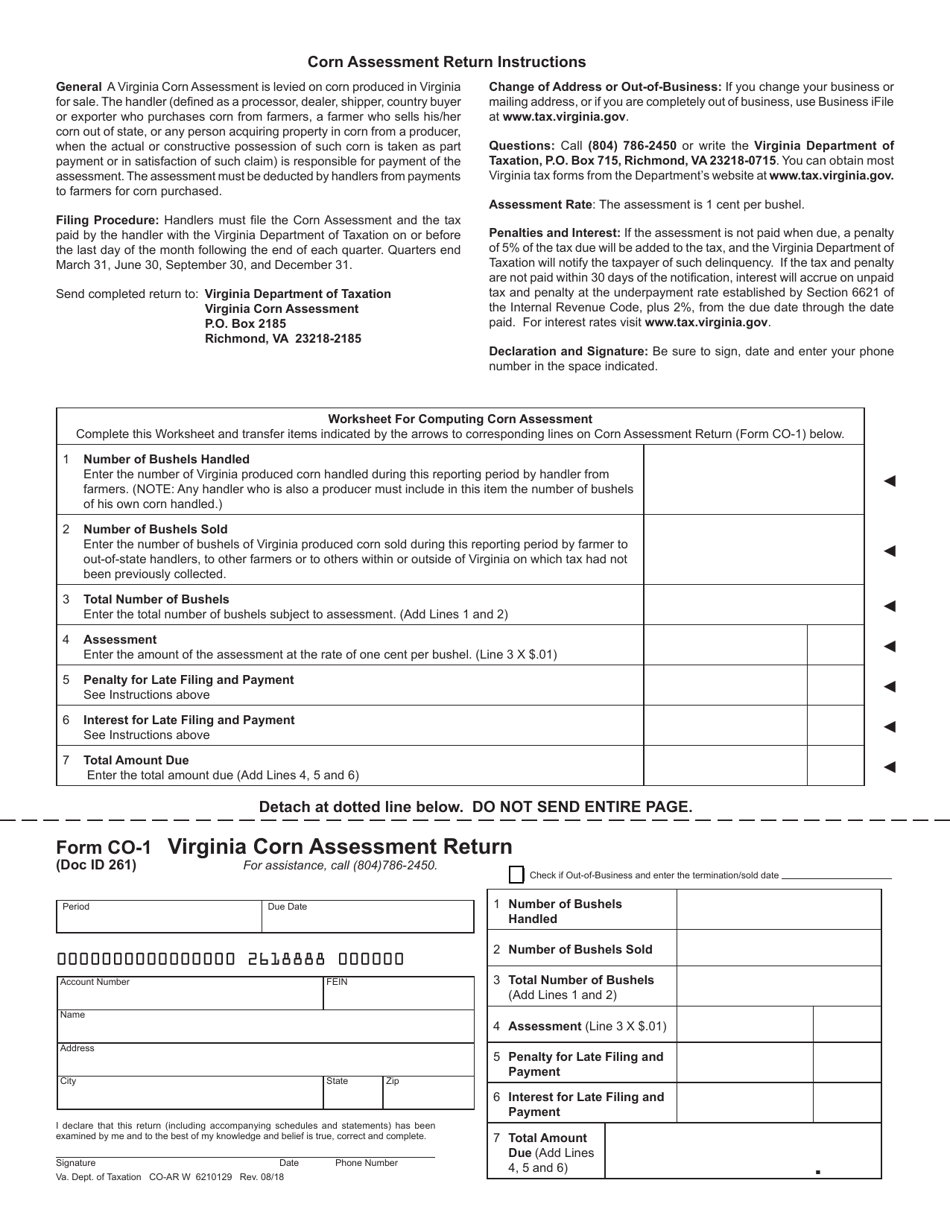

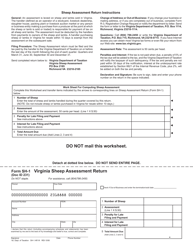

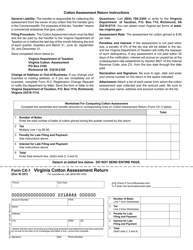

Form CO-1 Virginia Corn Assessment Return - Virginia

What Is Form CO-1?

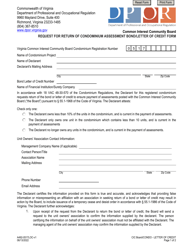

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CO-1 Virginia Corn Assessment Return?

A: The CO-1 Virginia Corn Assessment Return is a form used in Virginia to report and pay the corn assessment.

Q: What is the purpose of the corn assessment?

A: The corn assessment is used to fund research, promotion, and education programs to support the corn industry in Virginia.

Q: Who needs to file the CO-1 Virginia Corn Assessment Return?

A: Anyone who is engaged in the production of corn in Virginia and has a gross annual income from corn sales of $1,000 or more needs to file the form.

Q: How often do you need to file the CO-1 Virginia Corn Assessment Return?

A: The form needs to be filed annually, with the due date being January 15th of the following year.

Q: Are there any penalties for not filing the form?

A: Yes, failure to file the form or pay the assessment by the due date may result in penalties and interest.

Q: Are there any exemptions or credits available?

A: Yes, there are certain exemptions and credits available. Please refer to the instructions on the form for more information.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.