This version of the form is not currently in use and is provided for reference only. Download this version of

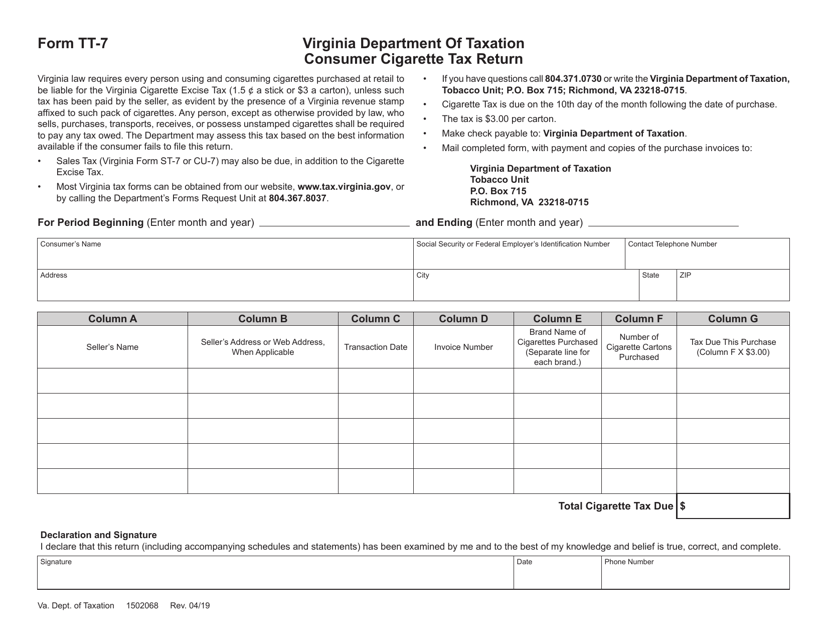

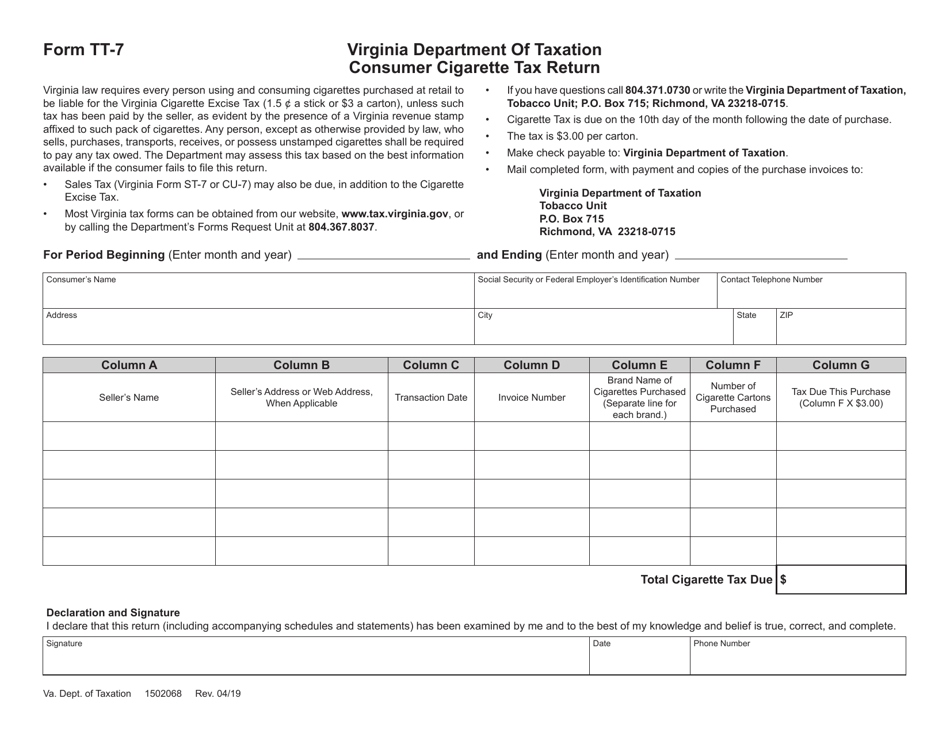

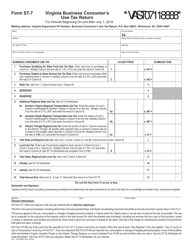

Form TT-7

for the current year.

Form TT-7 Consumer Cigarette Tax Return - Virginia

What Is Form TT-7?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-7?

A: Form TT-7 is the Consumer Cigarette Tax Return for the state of Virginia.

Q: Who needs to file Form TT-7?

A: Anyone who sells cigarettes directly to consumers in Virginia needs to file Form TT-7.

Q: What is the purpose of Form TT-7?

A: Form TT-7 is used to report and pay the consumer cigarette tax collected.

Q: When is Form TT-7 due?

A: Form TT-7 is due on or before the 20th day of the month following the end of the reporting period.

Q: What information do I need to complete Form TT-7?

A: You will need to provide details about the number of cigarettes sold and the amount of consumer cigarette tax collected.

Q: Are there any penalties for late filing of Form TT-7?

A: Yes, there are penalties for late filing, including interest on the unpaid tax amount.

Q: Do I need to include payment with Form TT-7?

A: Yes, you must include payment for the consumer cigarette tax collected with your Form TT-7.

Q: Are there any exemptions or deductions available on Form TT-7?

A: No, there are no exemptions or deductions available on Form TT-7. The full amount of consumer cigarette tax collected must be reported and paid.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TT-7 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.