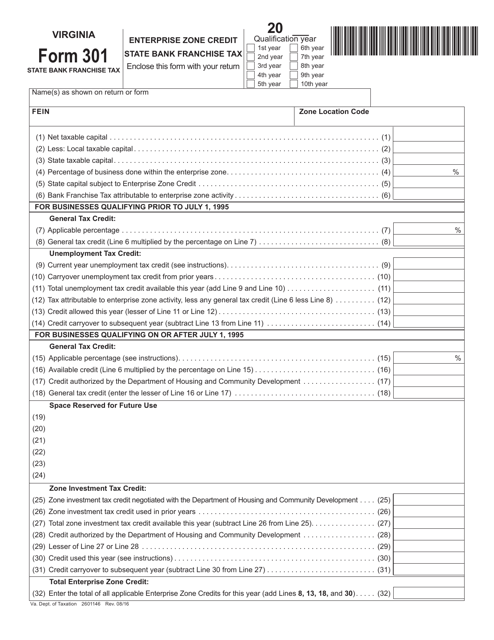

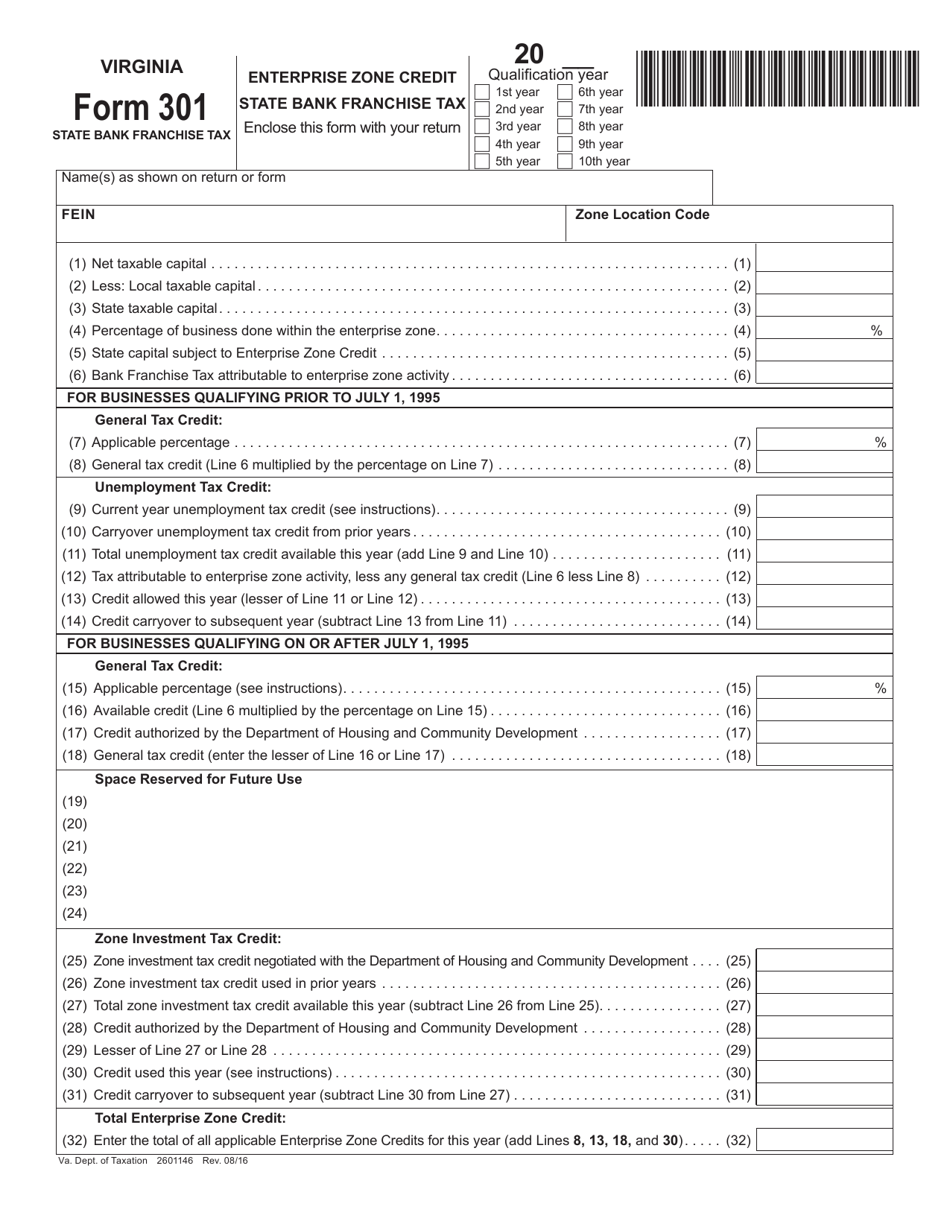

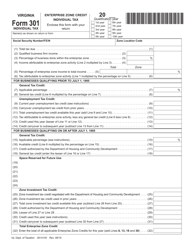

Form 301 Enterprise Zone Credit - Bank Franchise Tax - Virginia

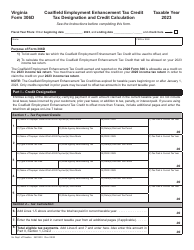

What Is Form 301?

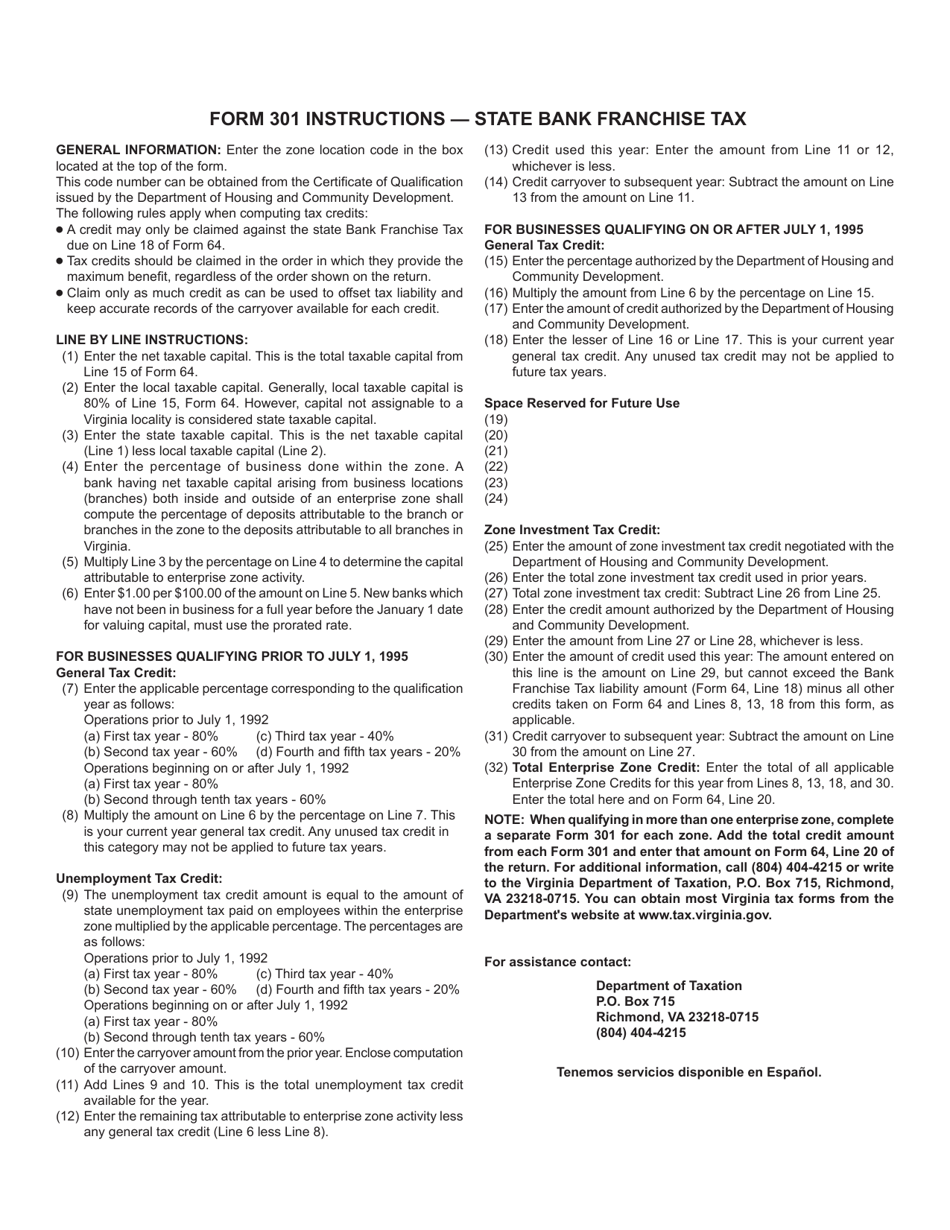

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 301 Enterprise Zone Credit?

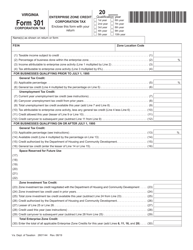

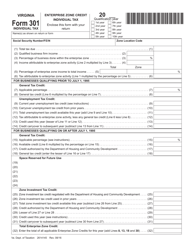

A: Form 301 Enterprise Zone Credit is a tax form used in Virginia to calculate and claim the Bank Franchise Tax credit for businesses operating within an enterprise zone.

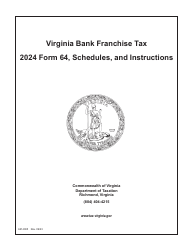

Q: What is the Bank Franchise Tax?

A: The Bank Franchise Tax is a tax imposed on banks and financial institutions in Virginia.

Q: Who is eligible for the Enterprise Zone Credit?

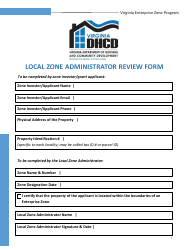

A: Businesses that operate within a designated enterprise zone in Virginia and meet certain criteria may be eligible for the Enterprise Zone Credit.

Q: What is the purpose of the Enterprise Zone Credit?

A: The Enterprise Zone Credit is designed to incentivize businesses to locate and expand within designated enterprise zones by providing tax benefits.

Q: How do I calculate the Enterprise Zone Credit?

A: The calculation of the Enterprise Zone Credit is done using Form 301, which incorporates various factors such as employment levels and investment in qualifying property.

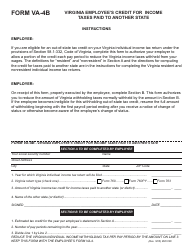

Q: How do I claim the Enterprise Zone Credit?

A: To claim the Enterprise Zone Credit, businesses must file Form 301 with the Virginia Department of Taxation along with the necessary supporting documentation.

Q: Are there any limitations or restrictions on the Enterprise Zone Credit?

A: Yes, there are certain limitations and restrictions on the Enterprise Zone Credit, including a cap on the total amount of credits that can be claimed and specific requirements for eligible expenditures.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 301 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.