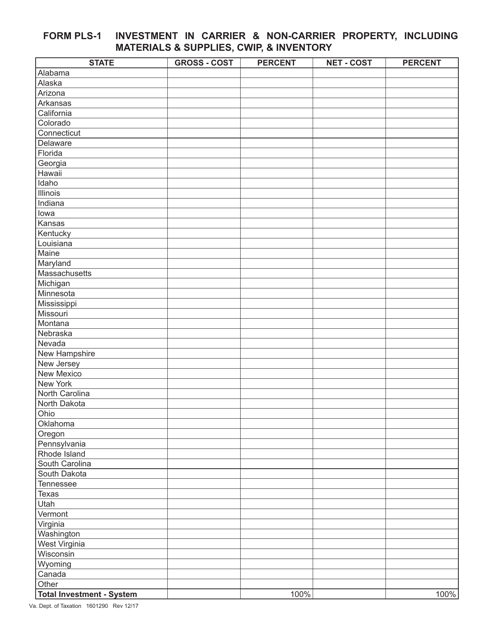

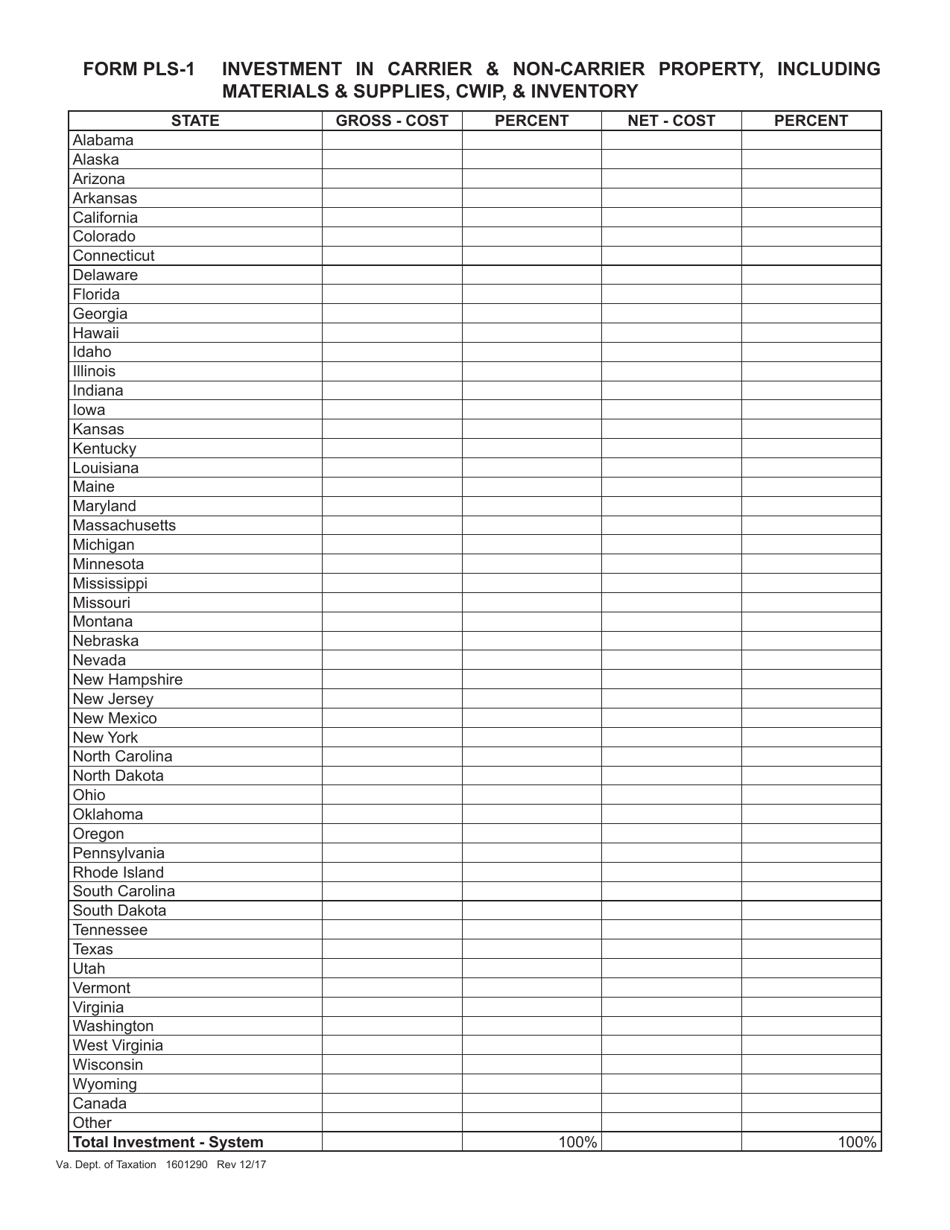

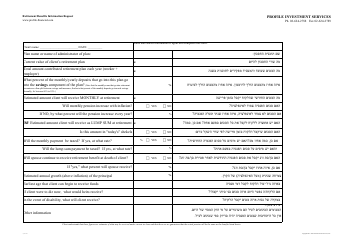

Form PLS-1 Investment in Carrier & Non-carrier Property, Including Materials & Supplies, Cwip, & Inventory - Virginia

What Is Form PLS-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PLS-1?

A: Form PLS-1 is a form used for reporting investment in carrier and non-carrier property, including materials and supplies, construction work in progress (CWIP), and inventory.

Q: What does Form PLS-1 cover?

A: Form PLS-1 covers investment in carrier and non-carrier property in Virginia, including materials and supplies, CWIP, and inventory.

Q: Who needs to file Form PLS-1?

A: Any person or entity that has investment in carrier and non-carrier property, including materials and supplies, CWIP, and inventory in Virginia, needs to file Form PLS-1.

Q: What is the purpose of filing Form PLS-1?

A: The purpose of filing Form PLS-1 is to report the investment in carrier and non-carrier property, including materials and supplies, CWIP, and inventory in Virginia.

Q: Are there any deadlines for filing Form PLS-1?

A: Yes, Form PLS-1 must be filed by the due date specified by the Virginia Department of Taxation.

Q: Are there any penalties for late filing of Form PLS-1?

A: Yes, there may be penalties for late filing of Form PLS-1. It is important to file the form by the specified due date.

Q: Is Form PLS-1 applicable to both carrier and non-carrier property?

A: Yes, Form PLS-1 is applicable to both carrier and non-carrier property in Virginia.

Q: What information is required to be reported on Form PLS-1?

A: Form PLS-1 requires detailed information about the investment in carrier and non-carrier property, including materials and supplies, CWIP, and inventory.

Q: Is Form PLS-1 specific to Virginia only?

A: Yes, Form PLS-1 is specific to reporting investment in carrier and non-carrier property, including materials and supplies, CWIP, and inventory in Virginia.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PLS-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.