This version of the form is not currently in use and is provided for reference only. Download this version of

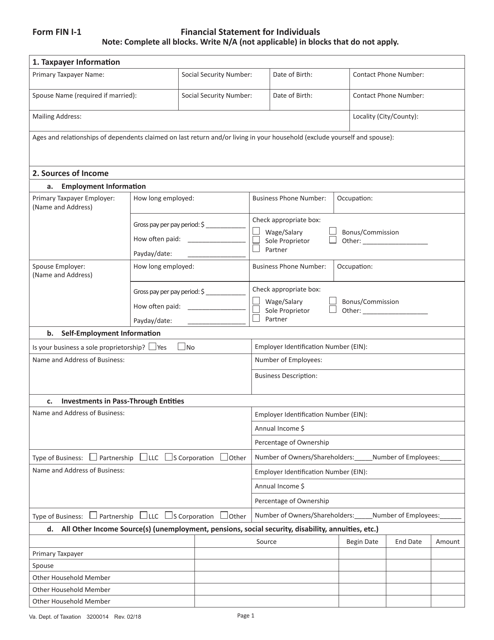

Form FIN I-1

for the current year.

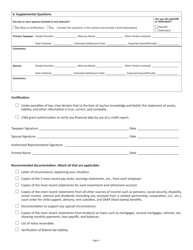

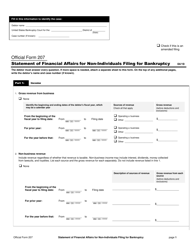

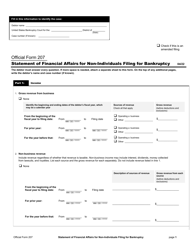

Form FIN I-1 Financial Statement for Individuals - Virginia

What Is Form FIN I-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FIN I-1 form?

A: The FIN I-1 form is a financial statement for individuals.

Q: Who is required to file the FIN I-1 form?

A: Residents of Virginia who want to apply for certain government benefits may be required to file the FIN I-1 form.

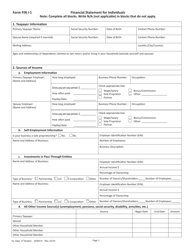

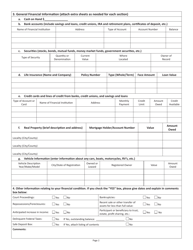

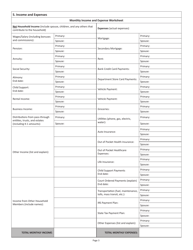

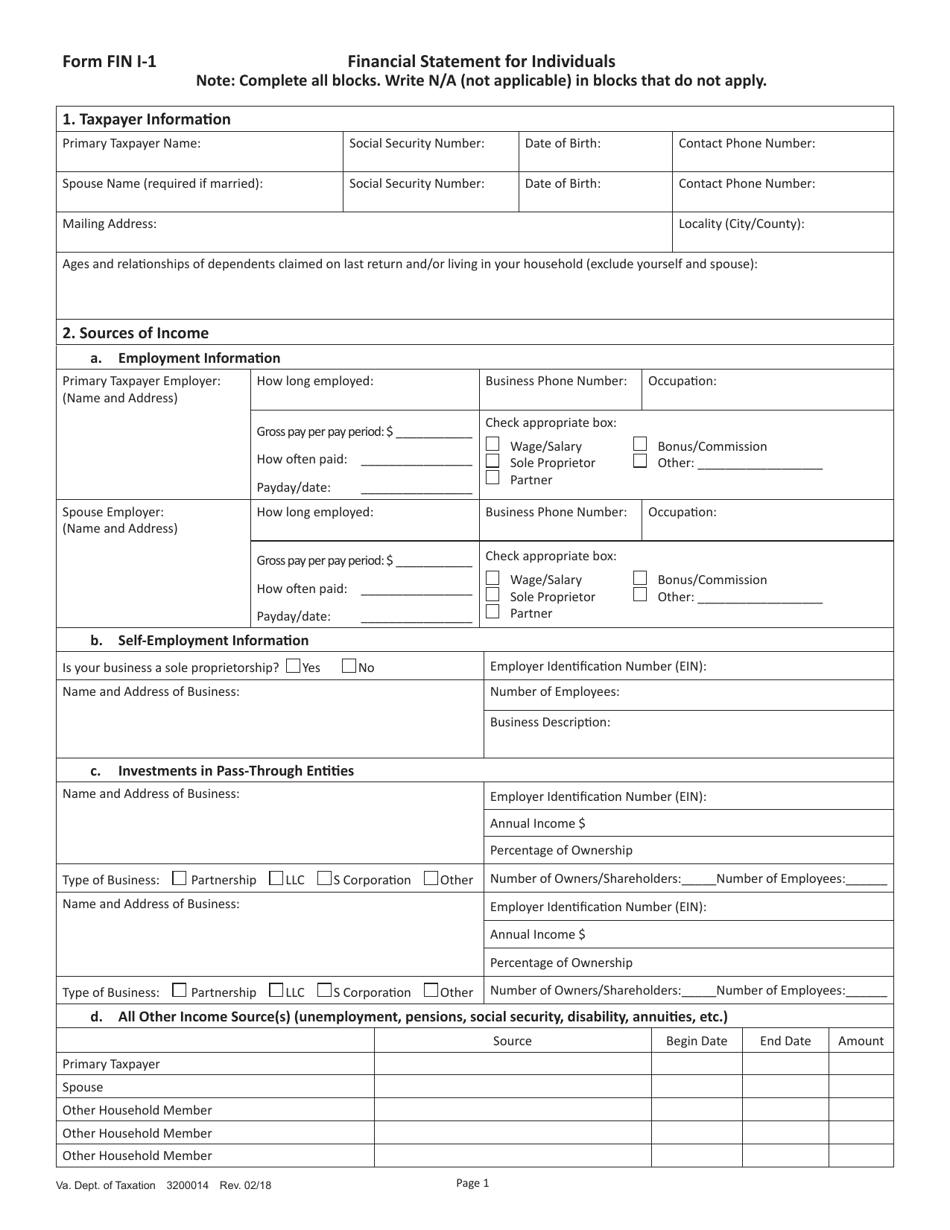

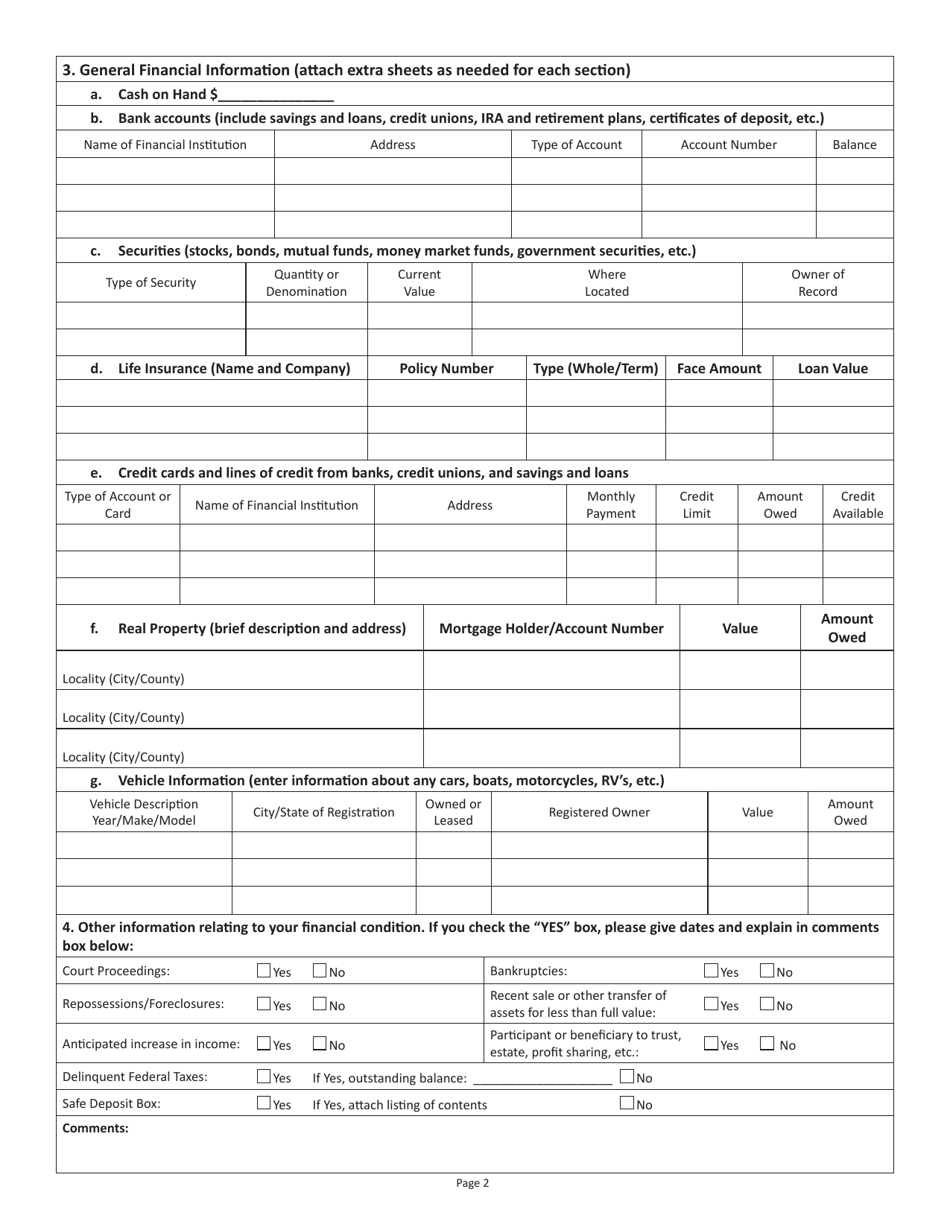

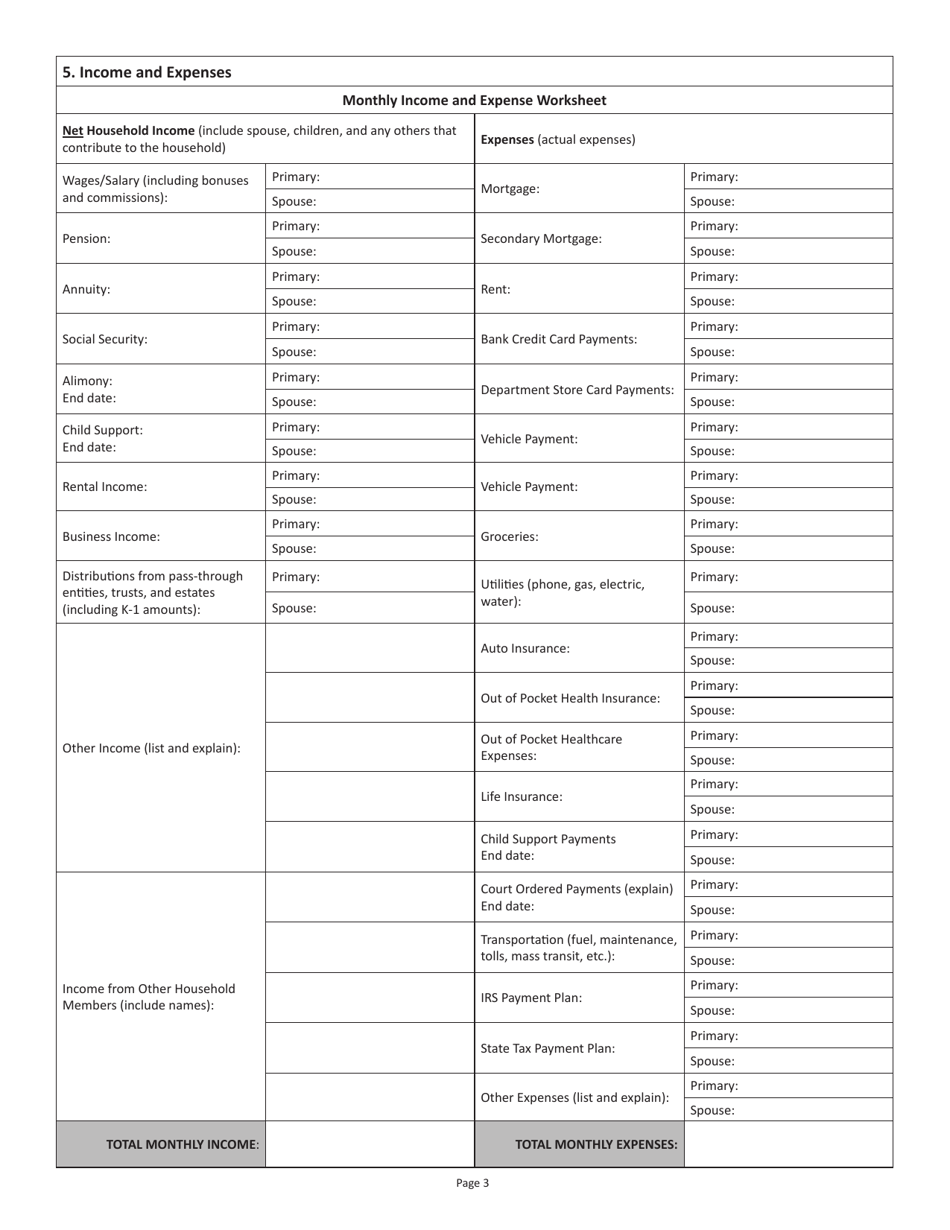

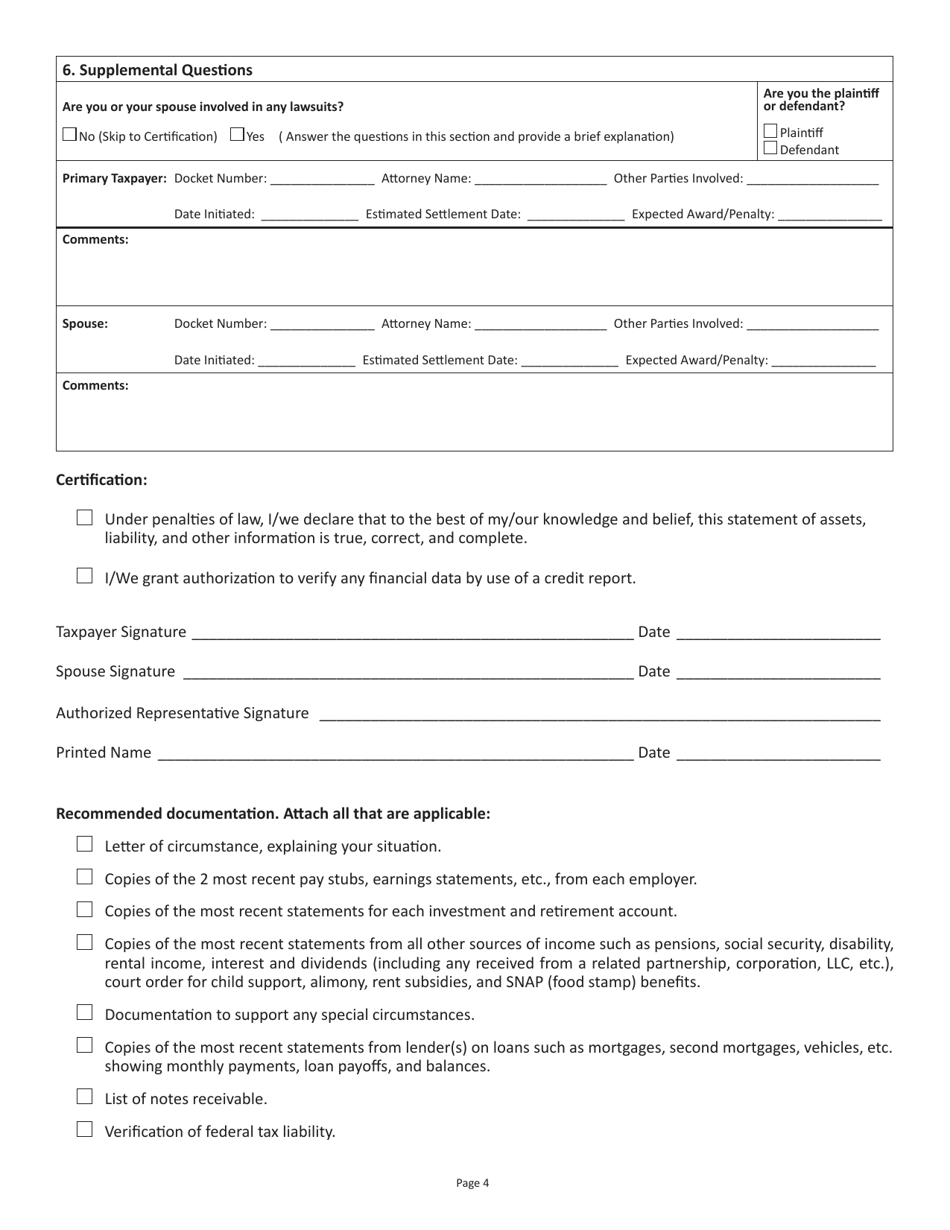

Q: What information is included in the FIN I-1 form?

A: The FIN I-1 form requires individuals to provide detailed information about their income, assets, and expenses.

Q: What is the purpose of the FIN I-1 form?

A: The purpose of the FIN I-1 form is to determine eligibility for various government benefits and assistance programs.

Q: Are there any deadlines for filing the FIN I-1 form?

A: Yes, there are deadlines for filing the FIN I-1 form. It is important to check with the Virginia Department of Social Services for the specific deadlines.

Q: Do I need to include supporting documents with the FIN I-1 form?

A: Yes, you may be required to include supporting documents such as pay stubs, bank statements, and proof of expenses with the FIN I-1 form.

Q: What happens after I submit the FIN I-1 form?

A: After you submit the FIN I-1 form, the Virginia Department of Social Services will review your application and notify you of your eligibility for the requested benefits.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIN I-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.