This version of the form is not currently in use and is provided for reference only. Download this version of

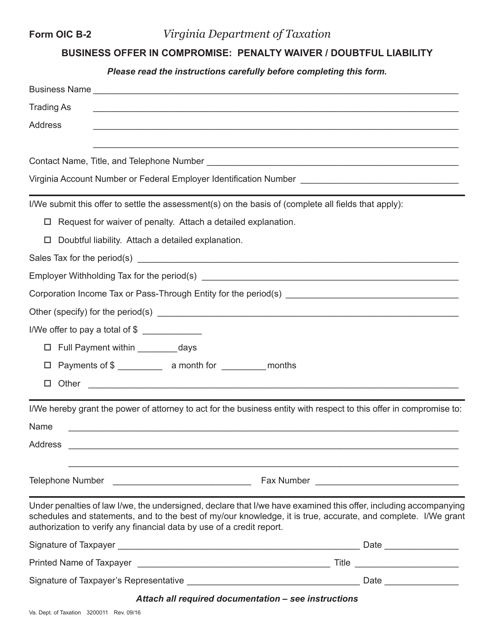

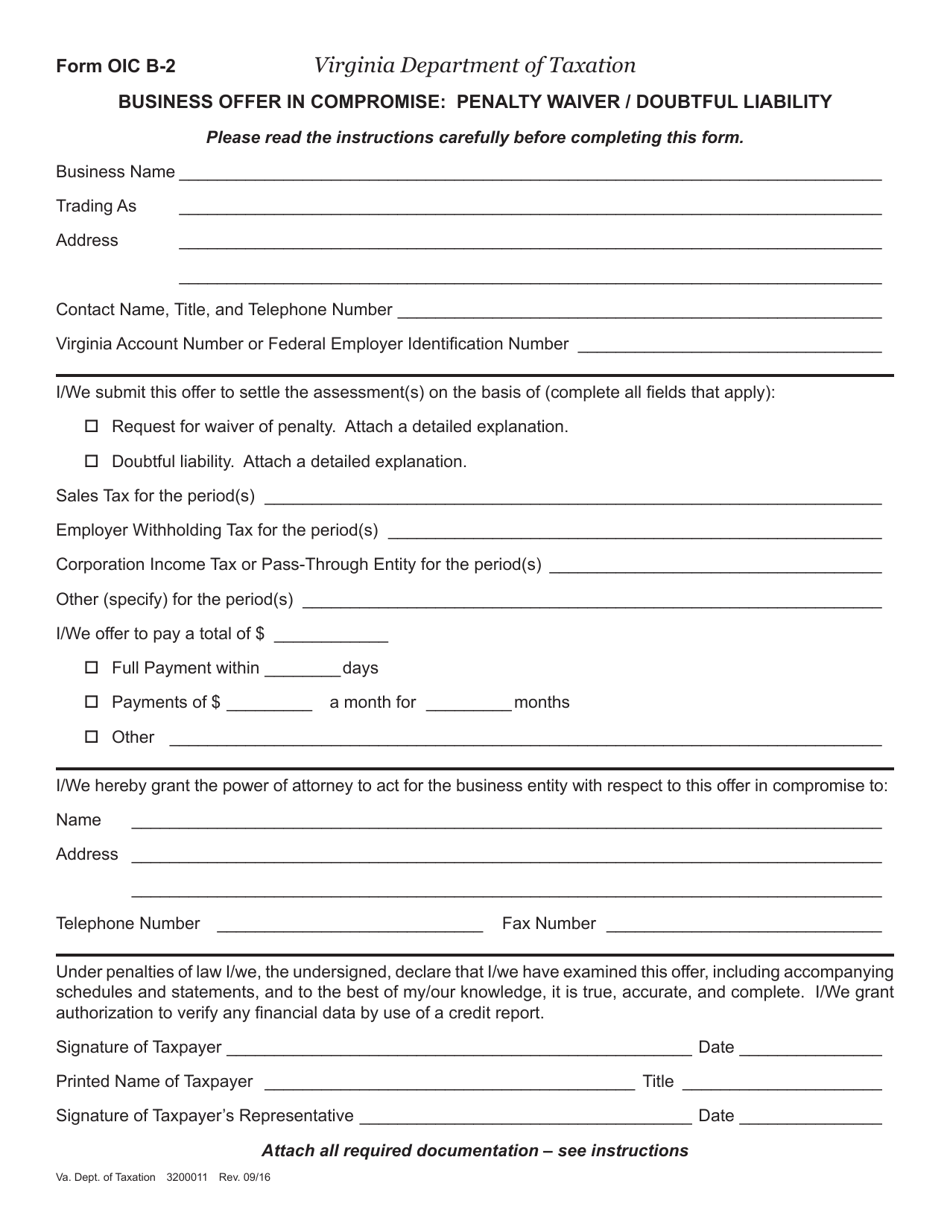

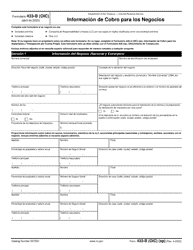

Form OIC B-2

for the current year.

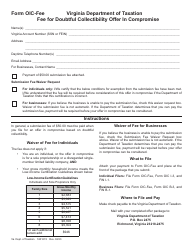

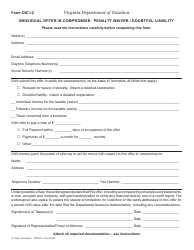

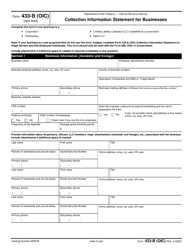

Form OIC B-2 Business Offer in Compromise: Penalty Waiver / Doubtful Liability - Virginia

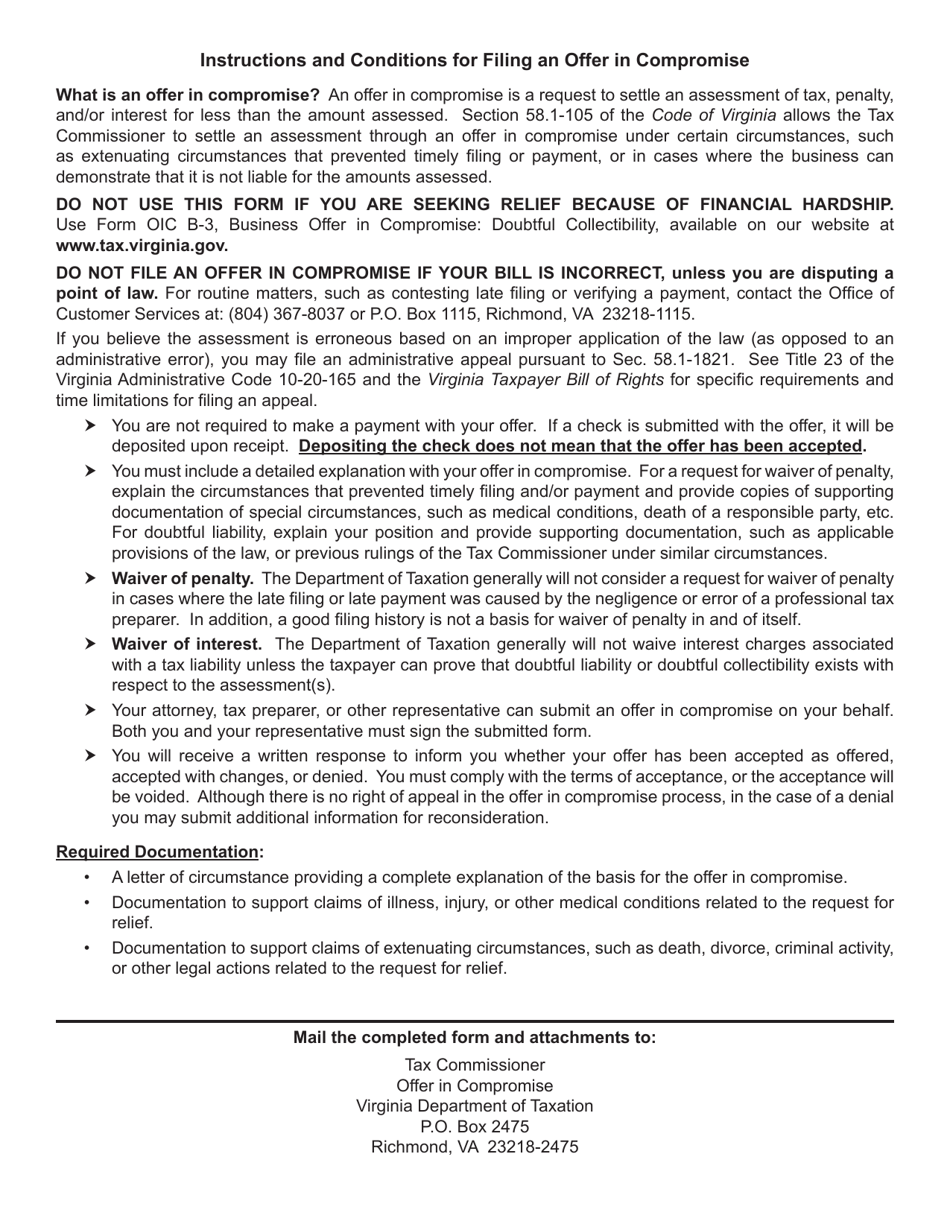

What Is Form OIC B-2?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OIC B-2?

A: Form OIC B-2 is a Business Offer in Compromise specifically for the state of Virginia.

Q: What does Form OIC B-2 allow you to do?

A: Form OIC B-2 allows you to request a Penalty Waiver and/or a Doubtful Liability determination.

Q: What is a Penalty Waiver?

A: A Penalty Waiver is a request to have the penalties associated with your tax liability forgiven or reduced.

Q: What is a Doubtful Liability determination?

A: A Doubtful Liability determination is a request for the tax authorities to review whether the amount of tax you owe is accurate or in dispute.

Q: Who can use Form OIC B-2?

A: Form OIC B-2 is specifically for businesses in the state of Virginia who are seeking a Penalty Waiver and/or Doubtful Liability determination.

Q: Are there any fees associated with submitting Form OIC B-2?

A: Yes, there is a non-refundable fee of $35 for submitting Form OIC B-2.

Q: How long does it take to process Form OIC B-2?

A: The processing time for Form OIC B-2 may vary, but it typically takes several weeks to months.

Q: Can I submit Form OIC B-2 electronically?

A: No, Form OIC B-2 cannot be submitted electronically. It must be completed and mailed to the Virginia Department of Taxation.

Q: Is there a deadline for submitting Form OIC B-2?

A: There is no specific deadline for submitting Form OIC B-2, but it is recommended to submit it as soon as possible to address your tax liability concerns.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OIC B-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.