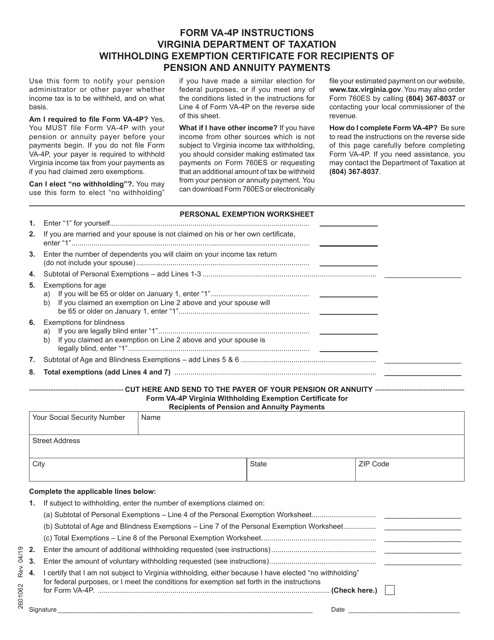

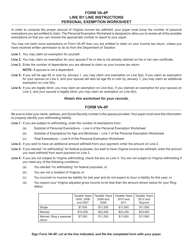

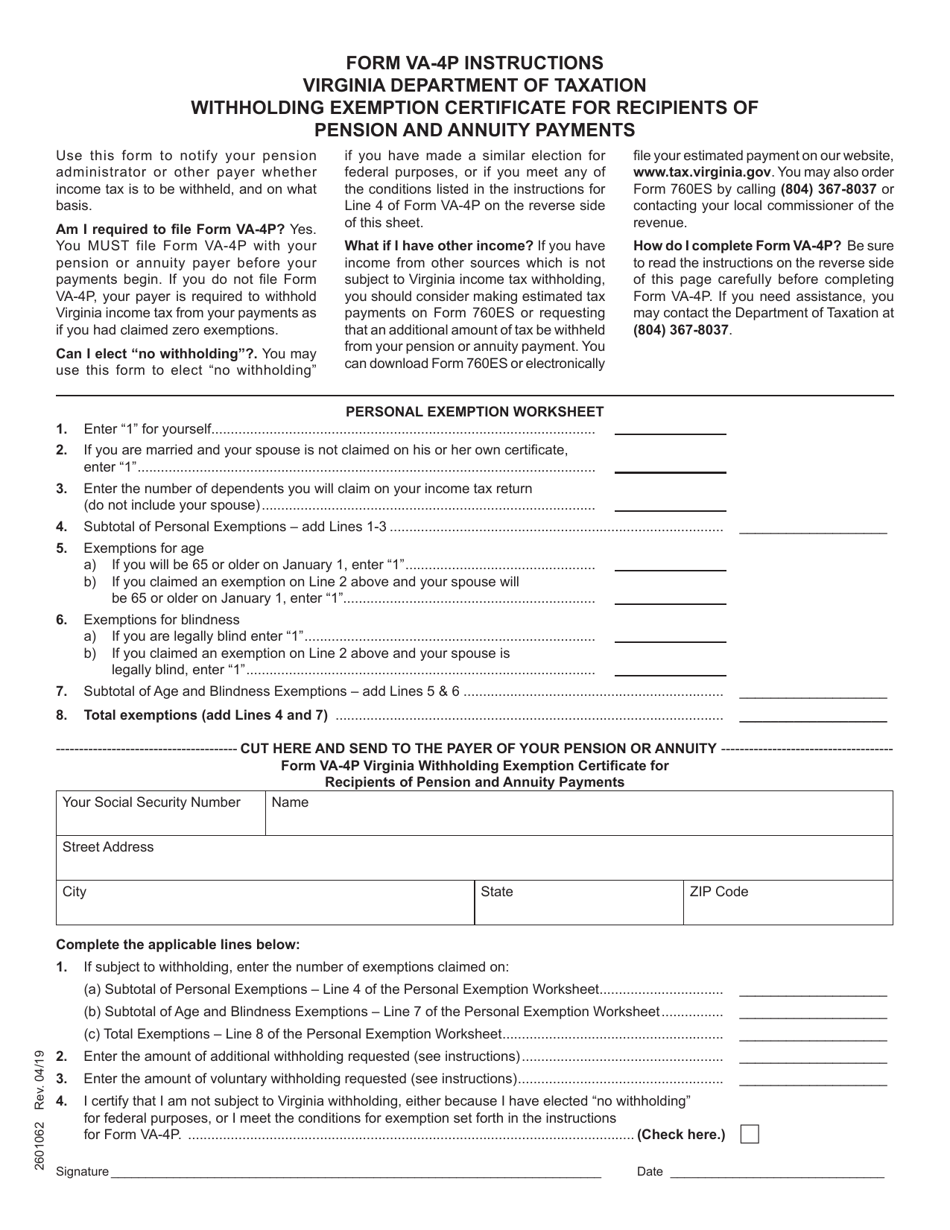

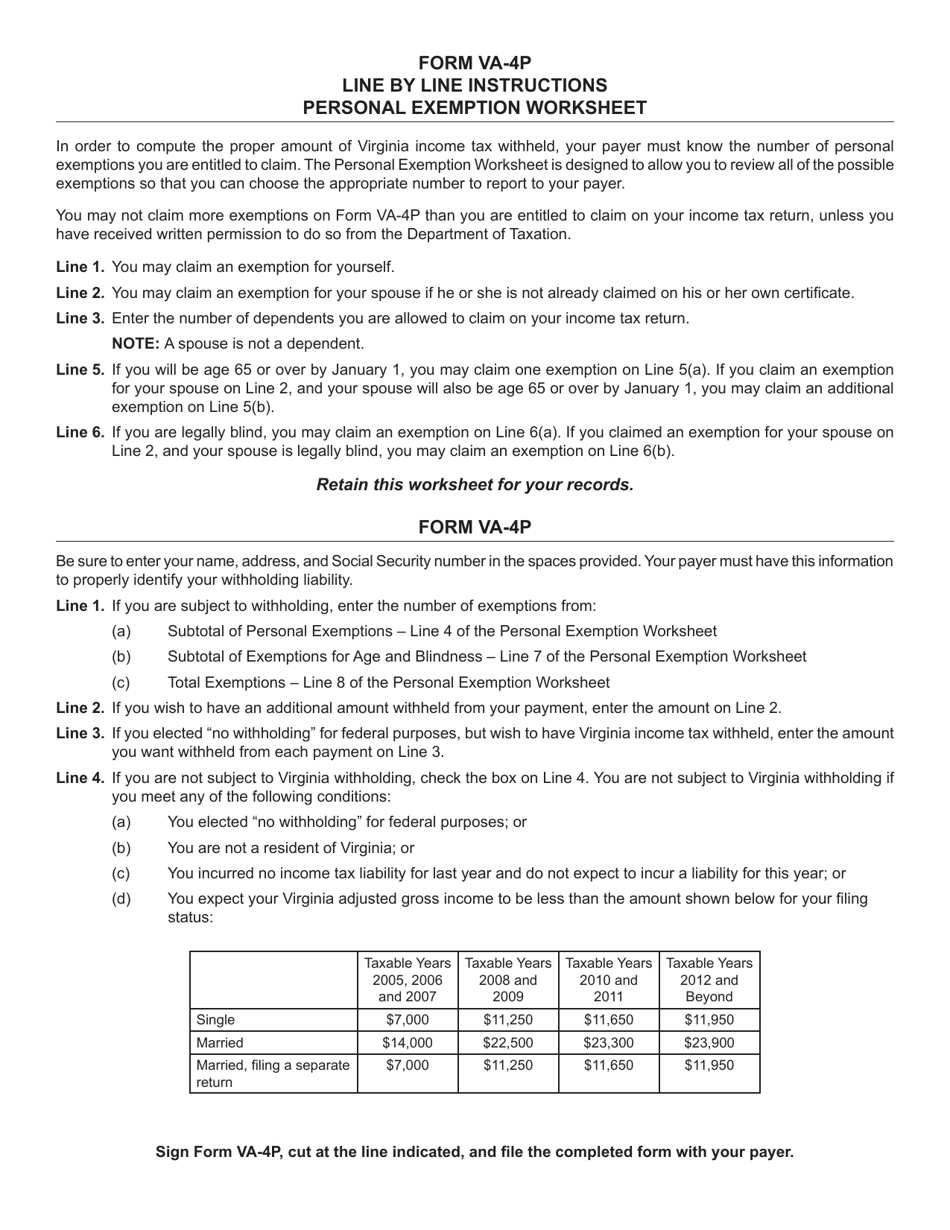

Form VA-4P Withholding Exemption Certificate for Recipients of Pension and Annuity Payments - Virginia

What Is Form VA-4P?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VA-4P?

A: Form VA-4P is the Withholding Exemption Certificate for Recipients of Pension and Annuity Payments in Virginia.

Q: Who needs to fill out Form VA-4P?

A: Form VA-4P should be filled out by individuals who receive pension and annuity payments in Virginia and want to claim an exemption from withholding.

Q: Why would someone want to claim an exemption from withholding?

A: Someone may want to claim an exemption from withholding if they expect their annual income to be below the threshold for owing state taxes.

Q: When should I submit Form VA-4P?

A: Form VA-4P should be submitted to your payer of pension or annuity payments as soon as possible, preferably before any withholding occurs.

Q: Is Form VA-4P only for residents of Virginia?

A: Yes, Form VA-4P is specifically for individuals who receive pension and annuity payments in Virginia.

Q: Can I claim an exemption from withholding for federal taxes as well?

A: No, Form VA-4P is only for claiming an exemption from state withholding taxes in Virginia.

Q: What happens if I don't submit Form VA-4P?

A: If you don't submit Form VA-4P, your payer will withhold state taxes from your pension or annuity payments according to the default withholding rate.

Q: Can I change my withholding exemption status later?

A: Yes, you can update your withholding exemption status by submitting a new Form VA-4P to your payer.

Q: Do I need to submit Form VA-4P every year?

A: No, you only need to submit Form VA-4P once unless you want to change your withholding exemption status in the future.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VA-4P by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.