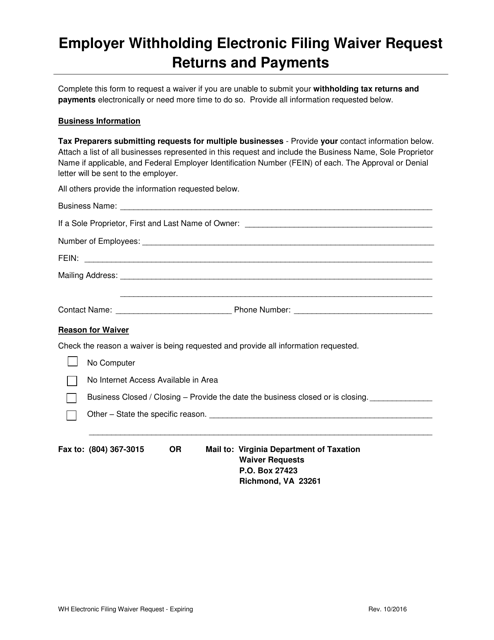

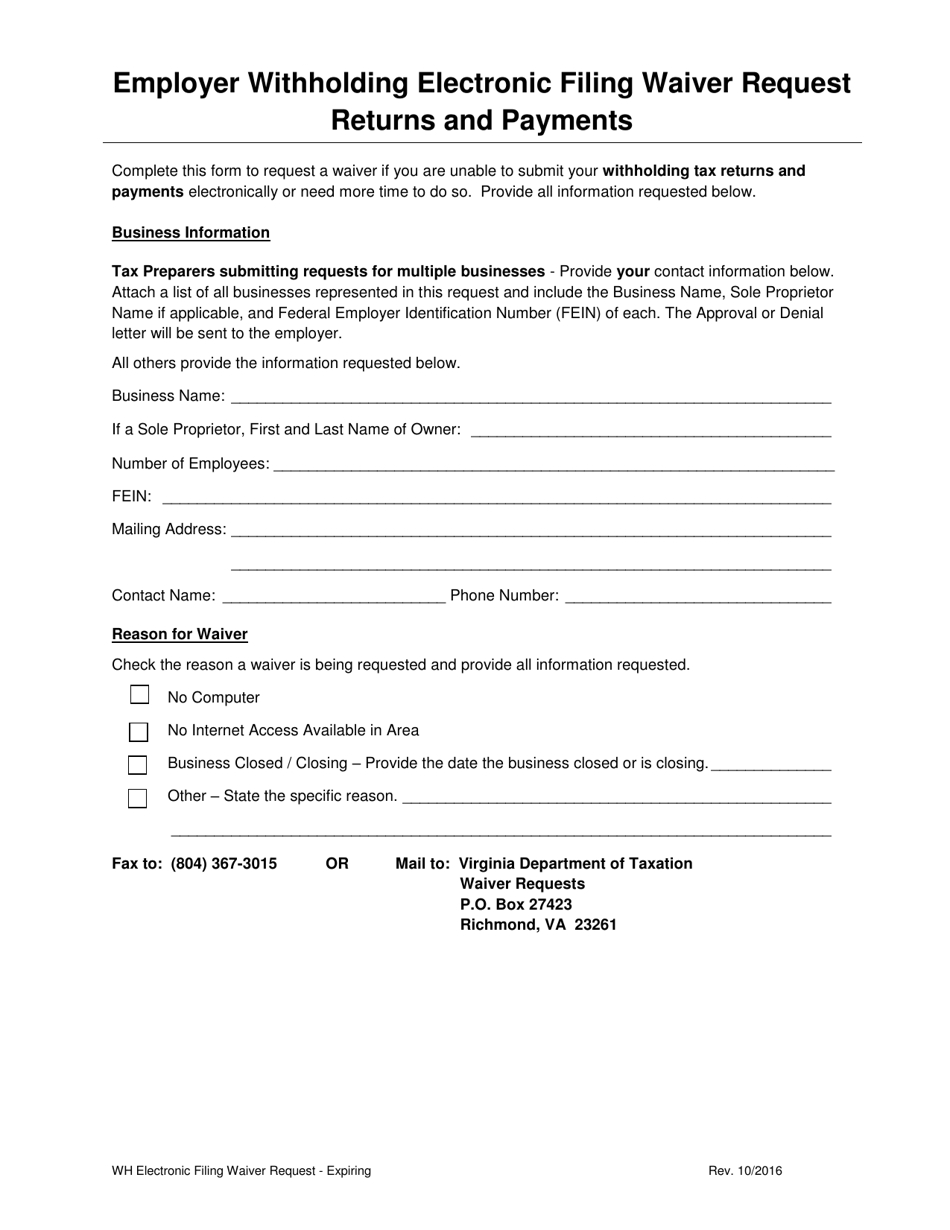

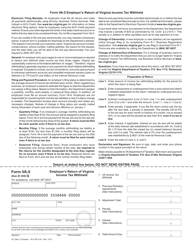

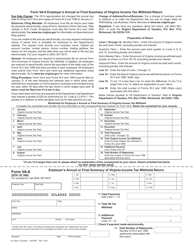

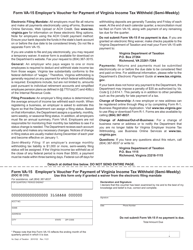

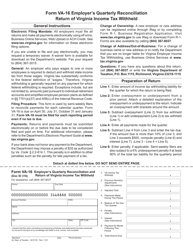

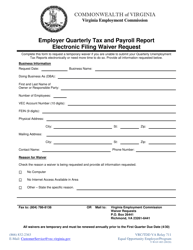

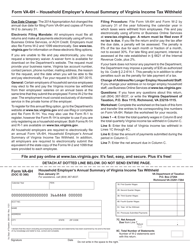

Employer Withholding Electronic Filing Waiver Request - Returns and Payments - Virginia

Employer Withholding Electronic Filing Waiver Request - Returns and Payments is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

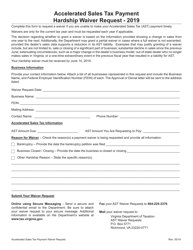

Q: What is an Employer Withholding Electronic Filing Waiver Request?

A: An Employer Withholding Electronic Filing Waiver Request is a form used by employers in Virginia to request a waiver from the requirement to electronically file their withholding tax returns and payments.

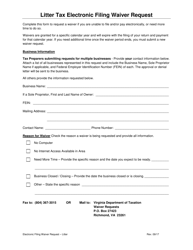

Q: Who needs to file an Employer Withholding Electronic Filing Waiver Request?

A: Employers in Virginia who are unable to electronically file their withholding tax returns and payments need to file an Employer Withholding Electronic Filing Waiver Request.

Q: Why would an employer need to request a waiver from electronic filing?

A: An employer may need to request a waiver from electronic filing if they are unable to meet the electronic filing requirements due to technological limitations or other extenuating circumstances.

Q: How can an employer file an Employer Withholding Electronic Filing Waiver Request?

A: Employers can file an Employer Withholding Electronic Filing Waiver Request by completing the form and submitting it to the Virginia Department of Taxation by mail or fax.

Q: What information is required on the Employer Withholding Electronic Filing Waiver Request?

A: The Employer Withholding Electronic Filing Waiver Request form requires information such as the employer's name, address, contact information, and a description of the reason for the waiver request.

Q: Is there a deadline for filing the Employer Withholding Electronic Filing Waiver Request?

A: Yes, the Employer Withholding Electronic Filing Waiver Request should be filed at least 30 days before the due date of the first tax return and payment affected by the waiver request.

Q: Is there a fee associated with filing the Employer Withholding Electronic Filing Waiver Request?

A: No, there is no fee associated with filing the Employer Withholding Electronic Filing Waiver Request.

Q: How long does it take to process the Employer Withholding Electronic Filing Waiver Request?

A: The processing time for the Employer Withholding Electronic Filing Waiver Request may vary, but the Virginia Department of Taxation aims to process requests within 30 days of receipt.

Q: What happens if the Employer Withholding Electronic Filing Waiver Request is approved?

A: If the Employer Withholding Electronic Filing Waiver Request is approved, the employer will be granted a waiver from the requirement to electronically file their withholding tax returns and payments for the specified period.

Q: What happens if the Employer Withholding Electronic Filing Waiver Request is denied?

A: If the Employer Withholding Electronic Filing Waiver Request is denied, the employer will be required to electronically file their withholding tax returns and payments as per the regular requirements.

Form Details:

- Released on October 1, 2016;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.