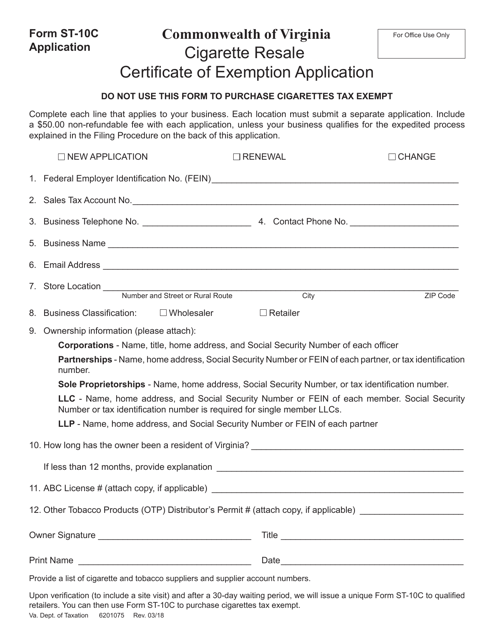

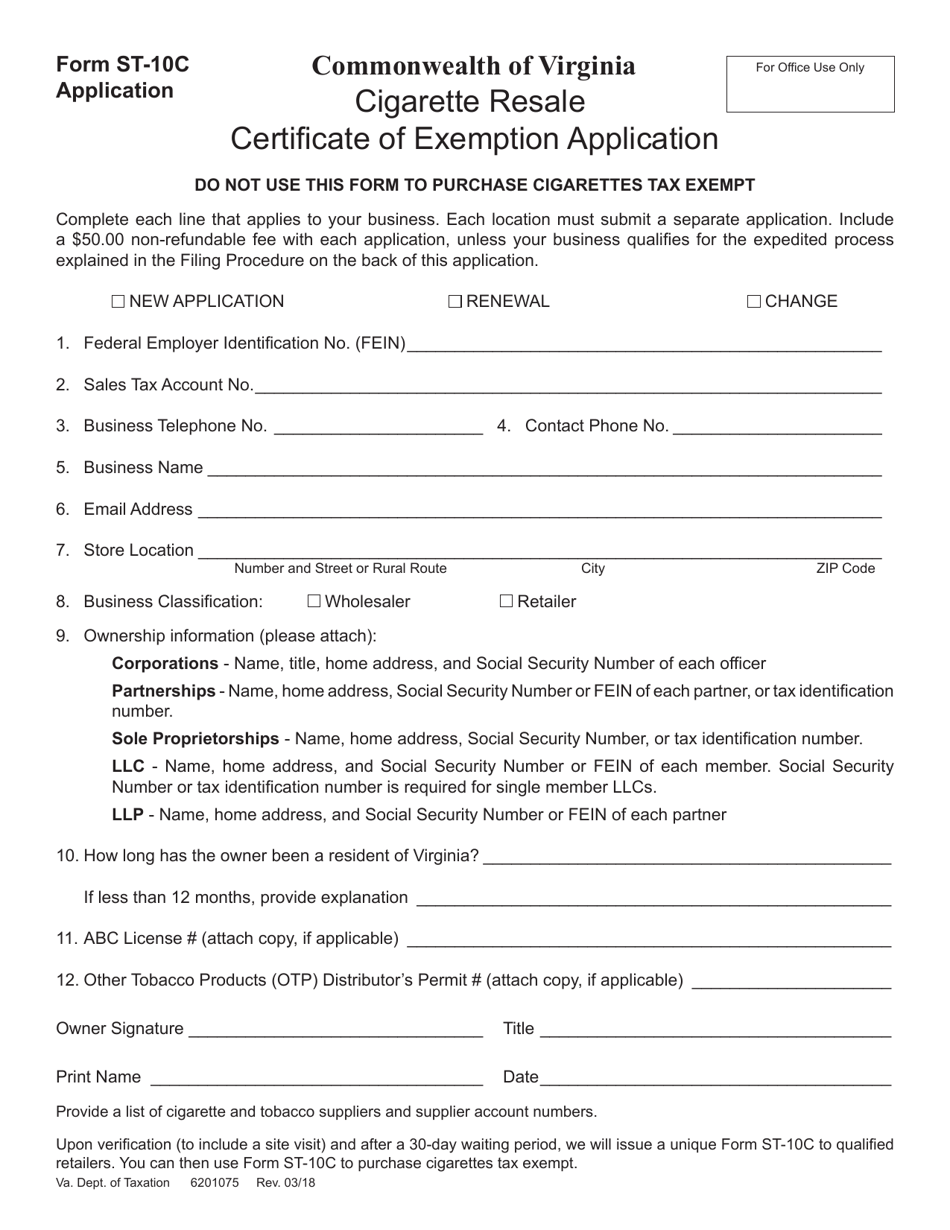

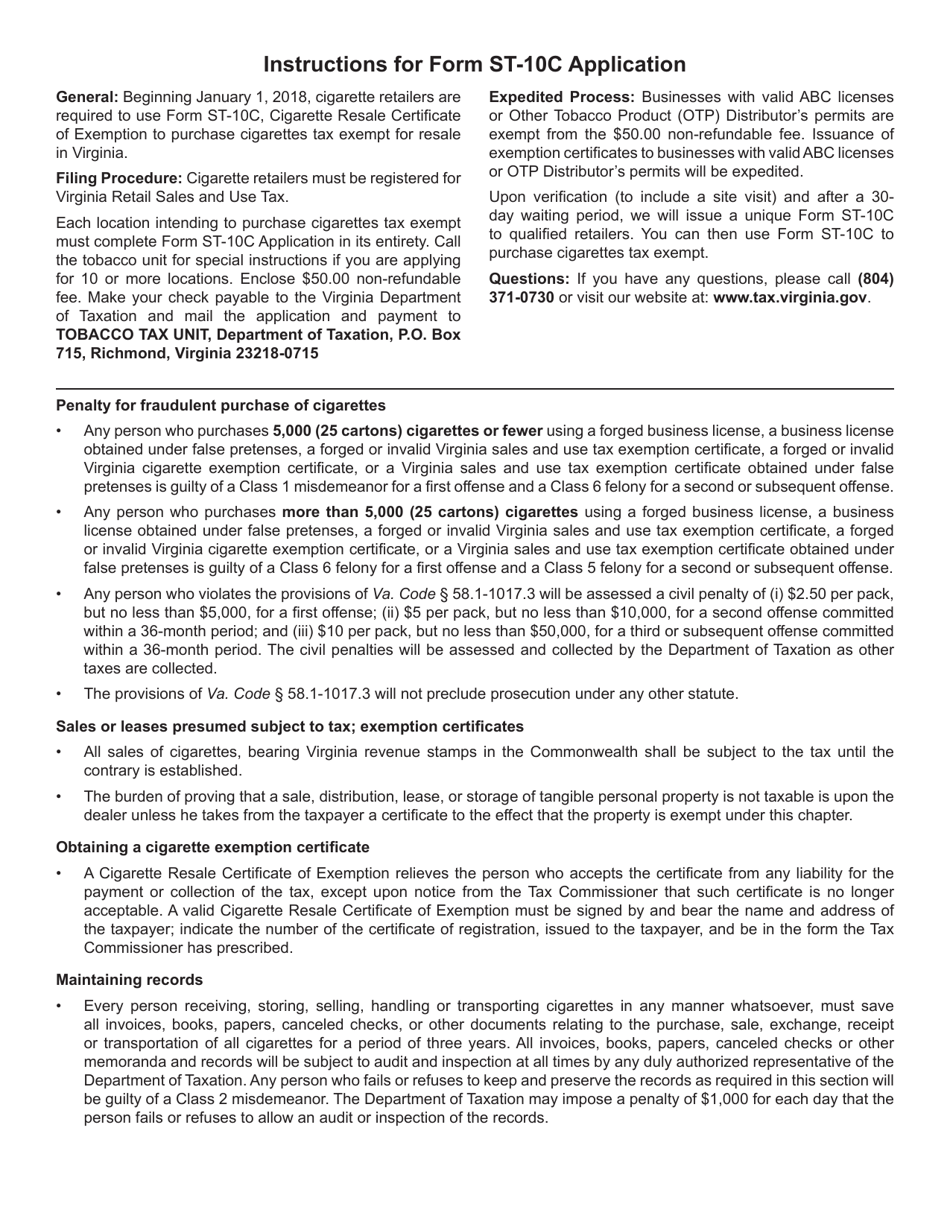

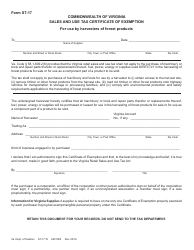

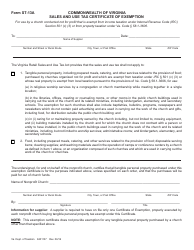

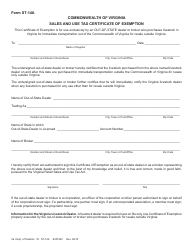

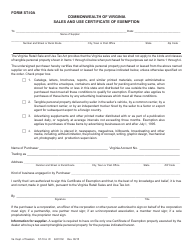

Form ST-10C Cigarette Resale Certificate of Exemption Application - Virginia

What Is Form ST-10C?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-10C?

A: The Form ST-10C is the Cigarette Resale Certificate of Exemption Application in Virginia.

Q: What is the purpose of Form ST-10C?

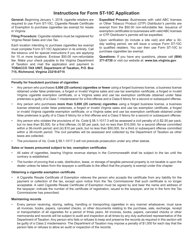

A: The purpose of Form ST-10C is to apply for a certificate of exemption from the Virginia Cigarette Tax on cigarette sales.

Q: Who needs to complete Form ST-10C?

A: Any reseller of cigarettes in Virginia who wants to claim an exemption from the state's cigarette tax needs to complete Form ST-10C.

Q: Are there any fees associated with Form ST-10C?

A: There are no fees associated with Form ST-10C.

Q: What information do I need to provide on Form ST-10C?

A: You will need to provide your business information, the reason for the exemption, and any supporting documentation with Form ST-10C.

Q: When do I need to submit Form ST-10C?

A: You need to submit Form ST-10C before making any sales of cigarettes with an exemption from the Virginia Cigarette Tax.

Q: How long does it take to process Form ST-10C?

A: The processing time for Form ST-10C may vary, but it generally takes a few weeks to receive the certificate of exemption from the Virginia Department of Taxation.

Q: Can I use my certificate of exemption from another state in Virginia?

A: No, you need to apply for a separate certificate of exemption using Form ST-10C specifically for Virginia.

Q: What should I do if I have more questions about Form ST-10C?

A: If you have more questions about Form ST-10C, you can contact the Virginia Department of Taxation for further assistance.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10C by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.