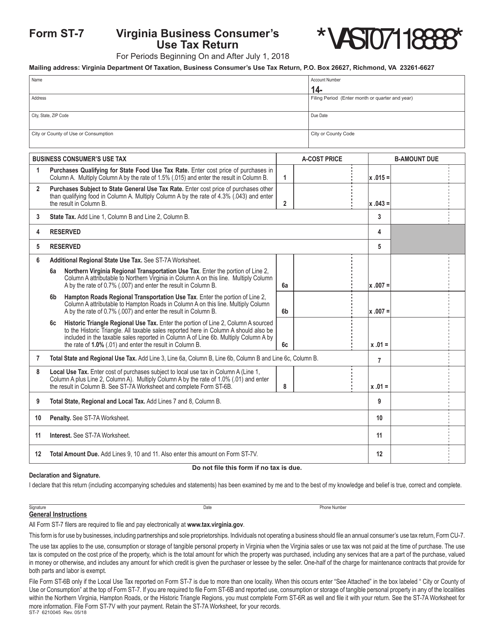

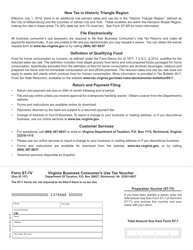

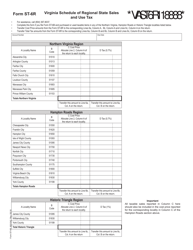

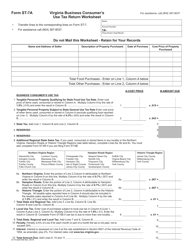

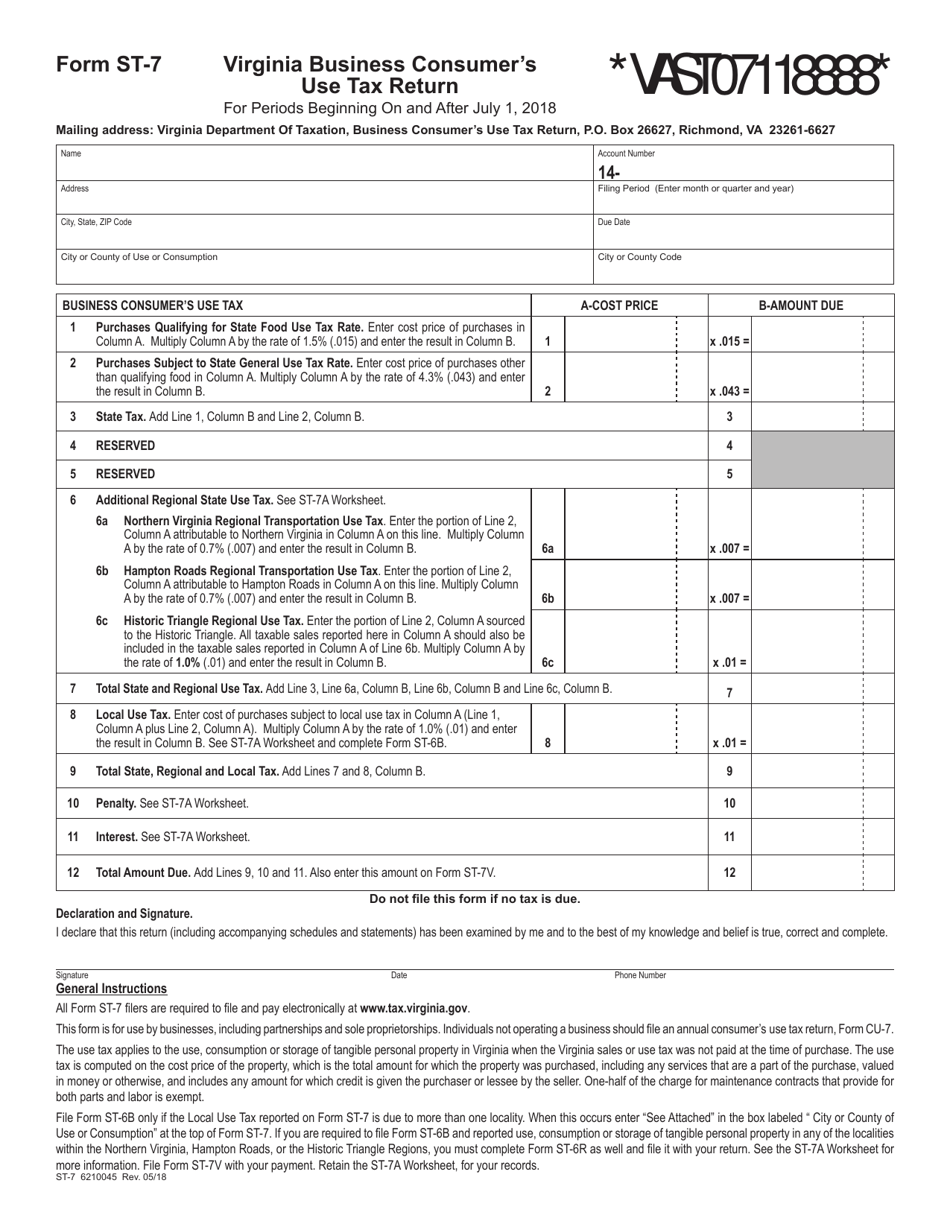

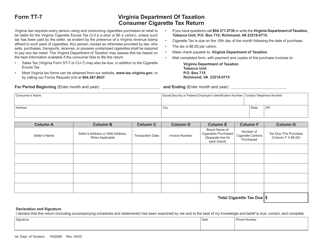

Form ST-7 Business Consumer's Use Tax Return - Virginia

What Is Form ST-7?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ST-7 Business Consumer's Use Tax Return?

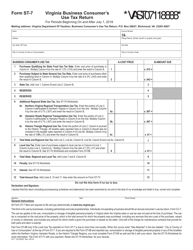

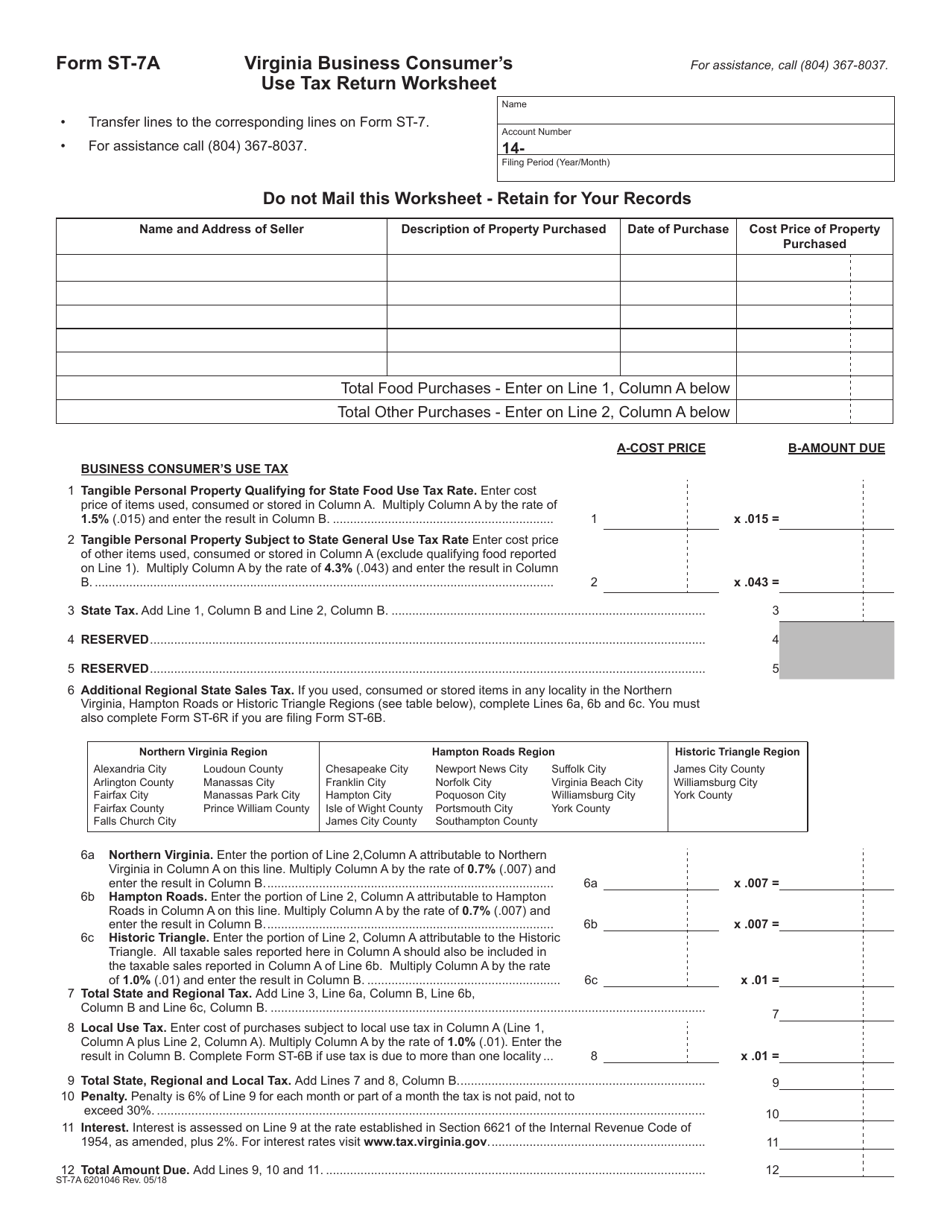

A: The ST-7 Business Consumer's Use Tax Return is a form used by businesses in Virginia to report and remit consumer use tax.

Q: What is consumer use tax?

A: Consumer use tax is a tax on tangible personal property that is used, stored, or consumed in Virginia and for which sales tax was not collected at the time of purchase.

Q: Who needs to file the ST-7 Business Consumer's Use Tax Return?

A: Businesses that owe consumer use tax in Virginia must file the ST-7 form.

Q: When is the deadline for filing the ST-7 Business Consumer's Use Tax Return?

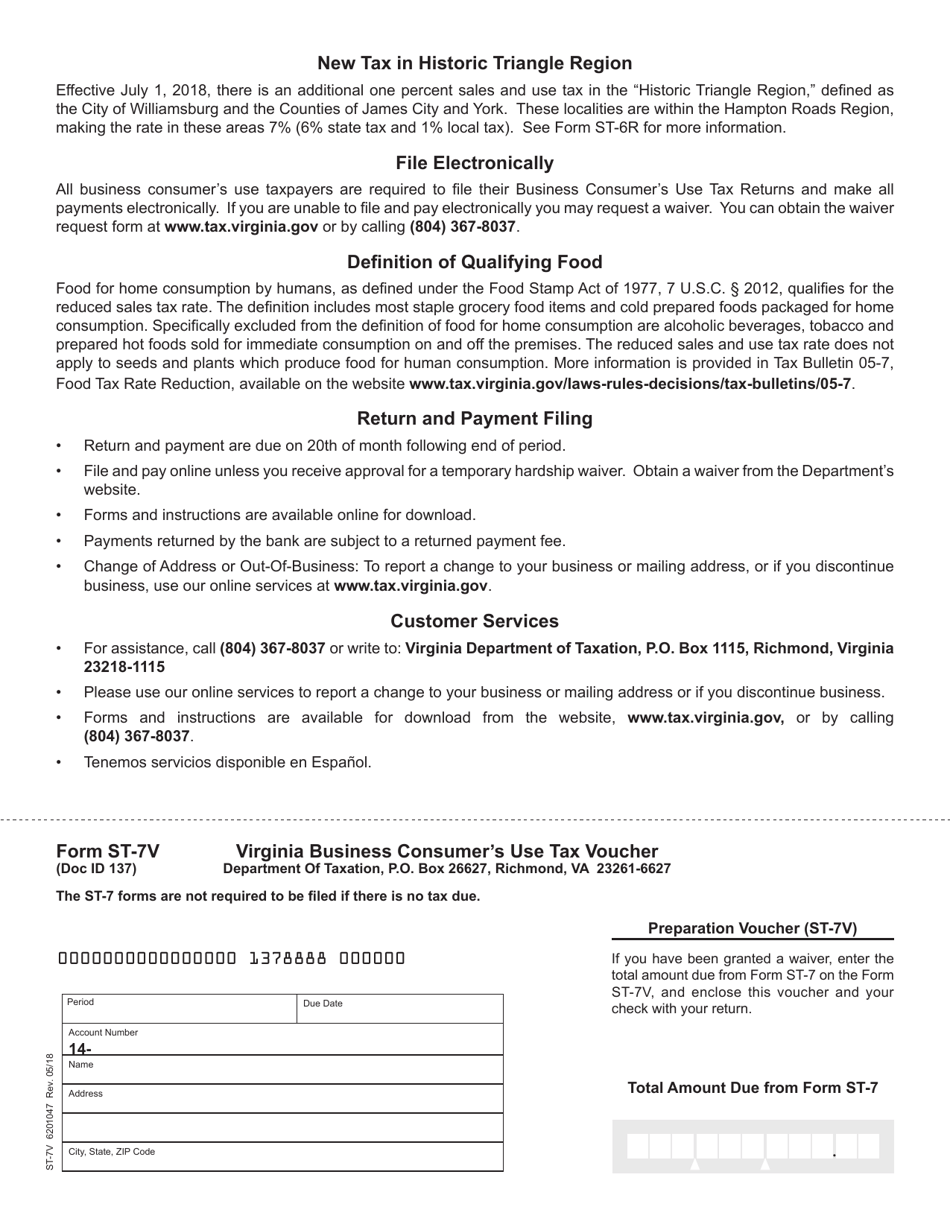

A: The deadline for filing the ST-7 form is the 20th day of the month following the end of the reporting period.

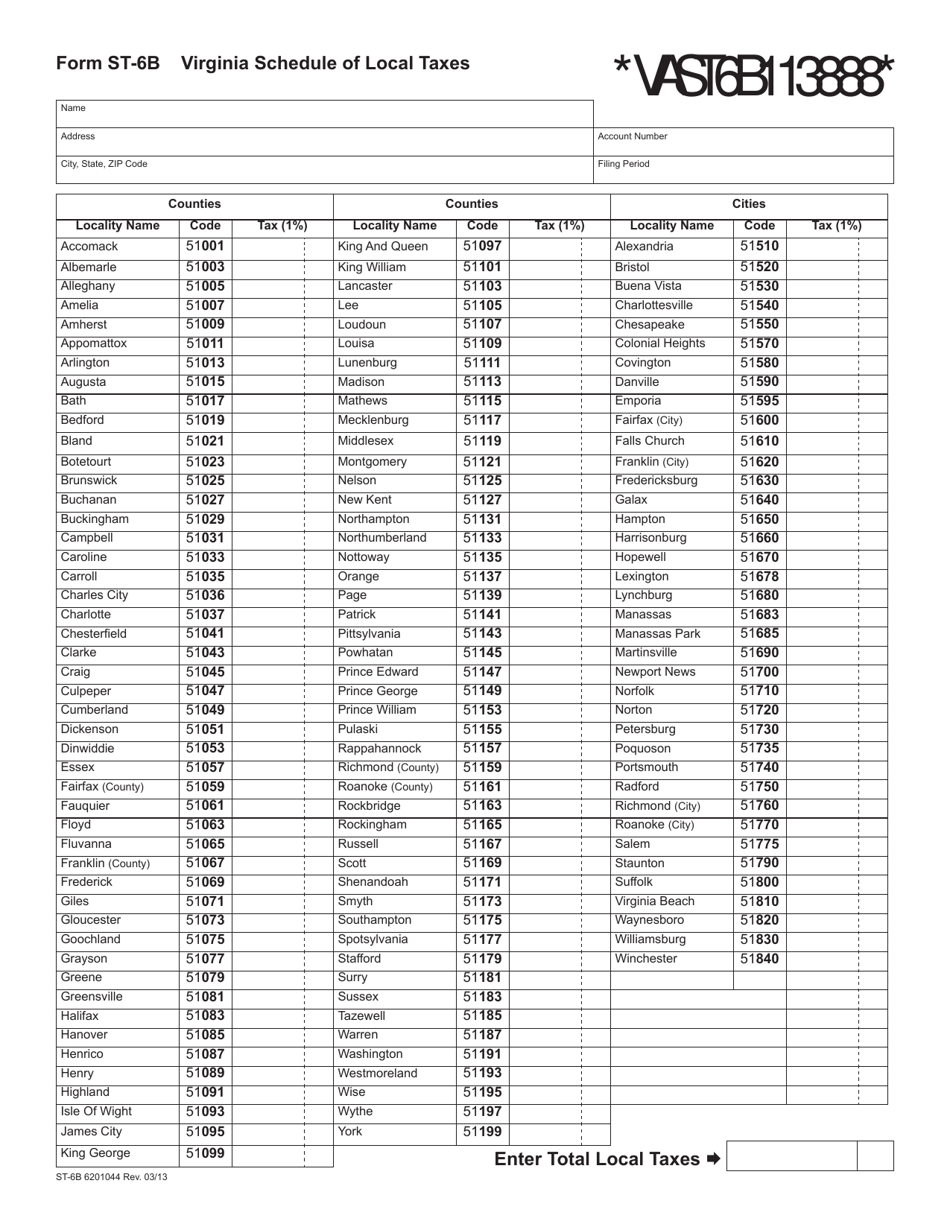

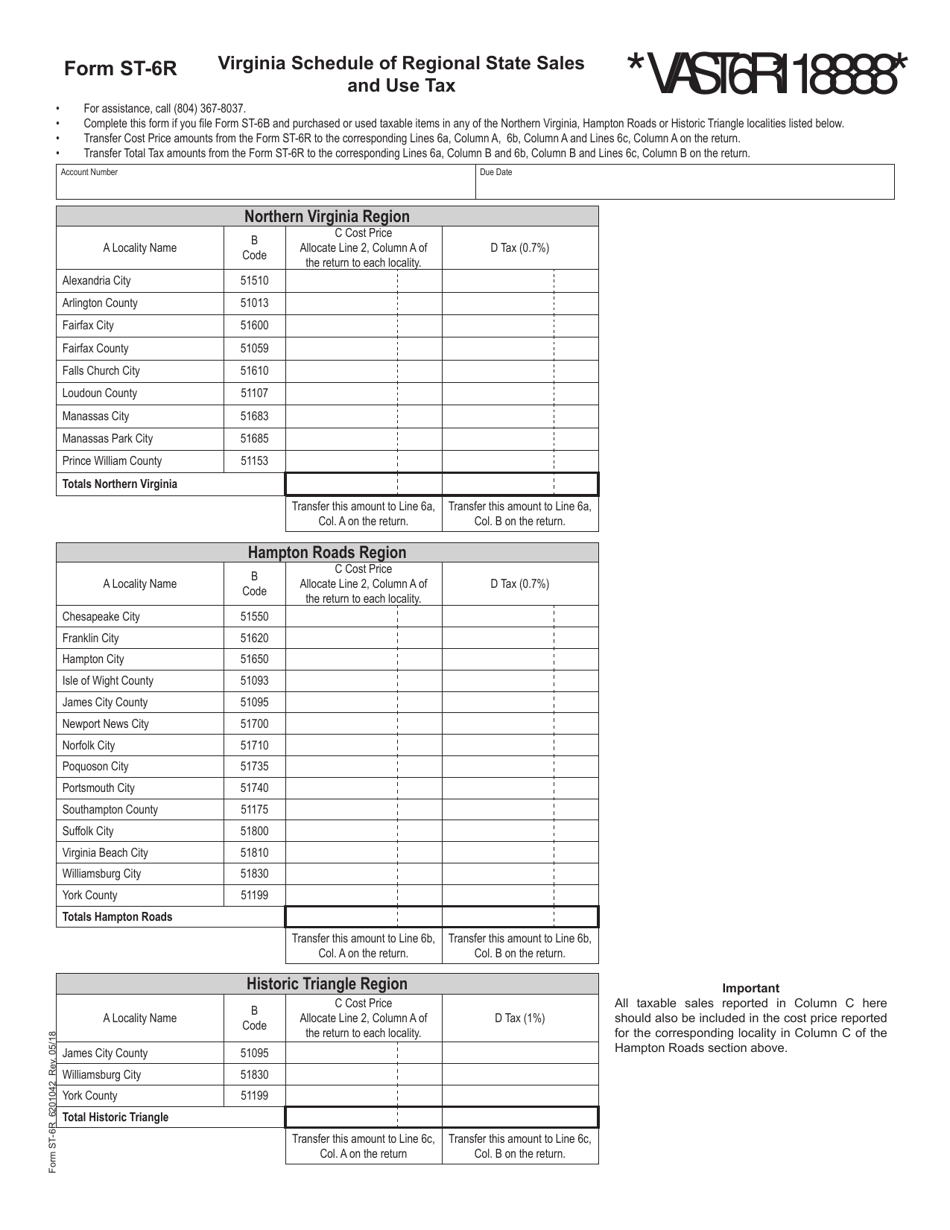

Q: What information is required on the ST-7 form?

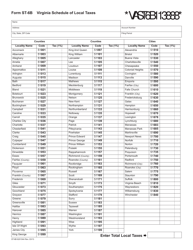

A: The ST-7 form requires businesses to provide details about their purchases subject to use tax, as well as their total use tax liability.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing and non-compliance with consumer use tax requirements. It is important to file the ST-7 form on time to avoid these penalties.

Q: Is the ST-7 Business Consumer's Use Tax Return required for all businesses?

A: The ST-7 form is generally required for businesses that owe consumer use tax in Virginia, but it is always best to consult with a tax professional or the Virginia Department of Taxation to determine specific filing requirements.

Q: Can I claim any exemptions on the ST-7 form?

A: Yes, certain exemptions may apply to consumer use tax. It is important to review the instructions provided with the ST-7 form or consult with the Virginia Department of Taxation for more information on exemptions.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-7 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.