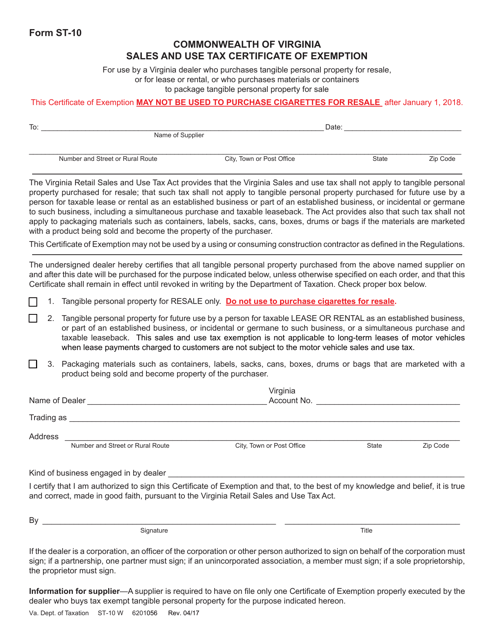

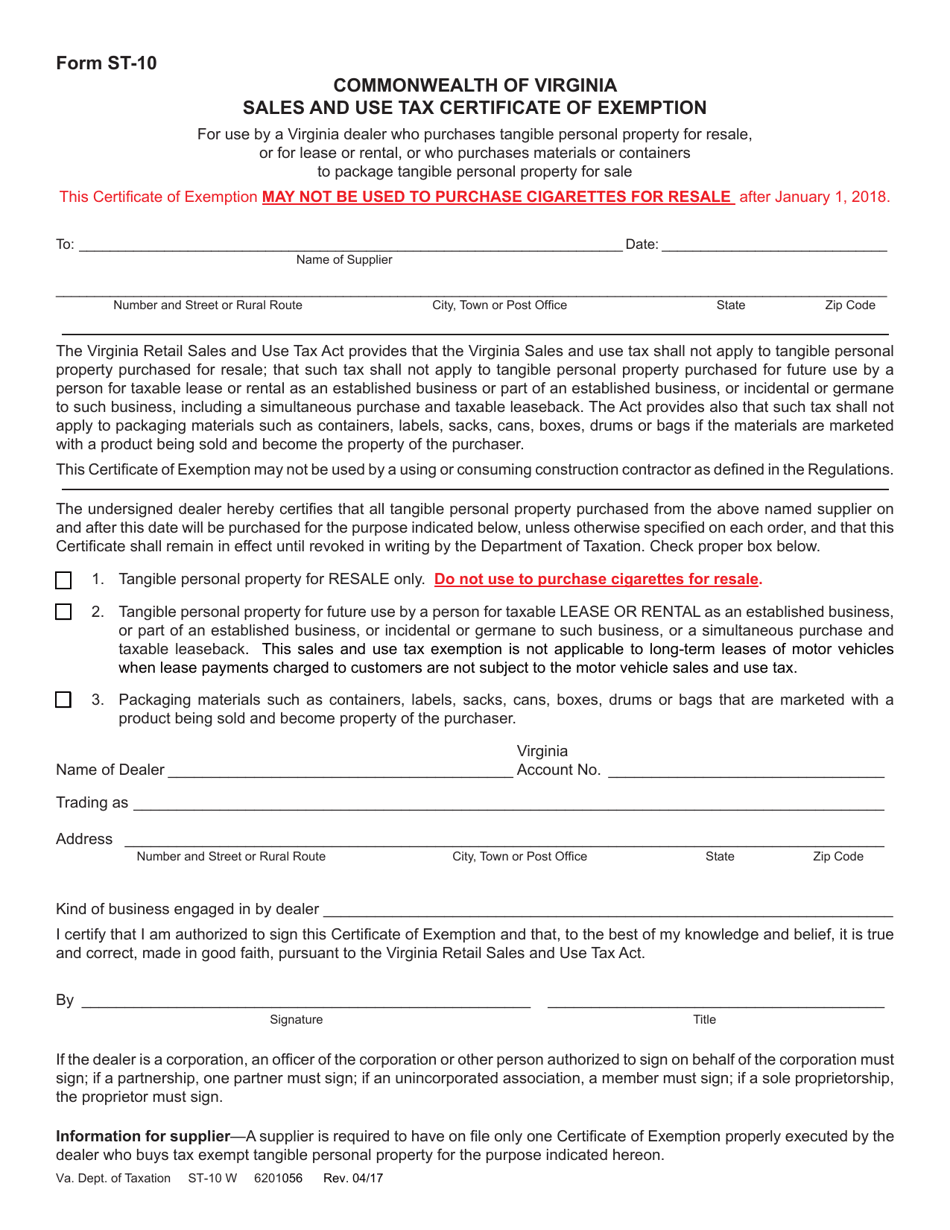

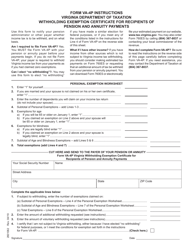

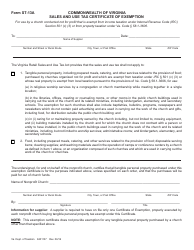

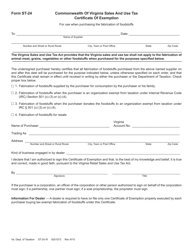

Form ST-10 Exemption Certificate for Certain Purchases by Virginia Dealers - Virginia

What Is Form ST-10?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-10?

A: Form ST-10 is an Exemption Certificate for Certain Purchases by Virginia Dealers.

Q: Who is eligible to use Form ST-10?

A: Virginia dealers who meet certain criteria are eligible to use Form ST-10.

Q: What is the purpose of Form ST-10?

A: The purpose of Form ST-10 is to claim an exemption from certain taxes on purchases by Virginia dealers.

Q: What taxes can be exempted using Form ST-10?

A: Form ST-10 can be used to exempt sales tax on certain purchases by Virginia dealers.

Q: How should Form ST-10 be completed?

A: Form ST-10 should be completed by providing relevant information about the purchaser and the nature of the purchases.

Q: Can Form ST-10 be used for all types of purchases?

A: No, Form ST-10 can only be used for certain purchases by Virginia dealers.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.