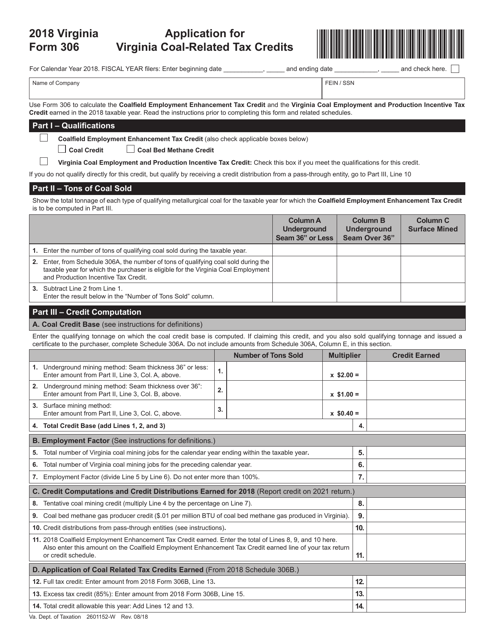

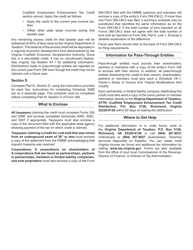

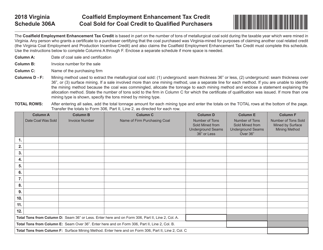

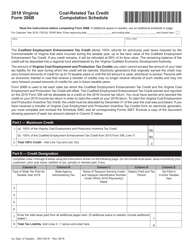

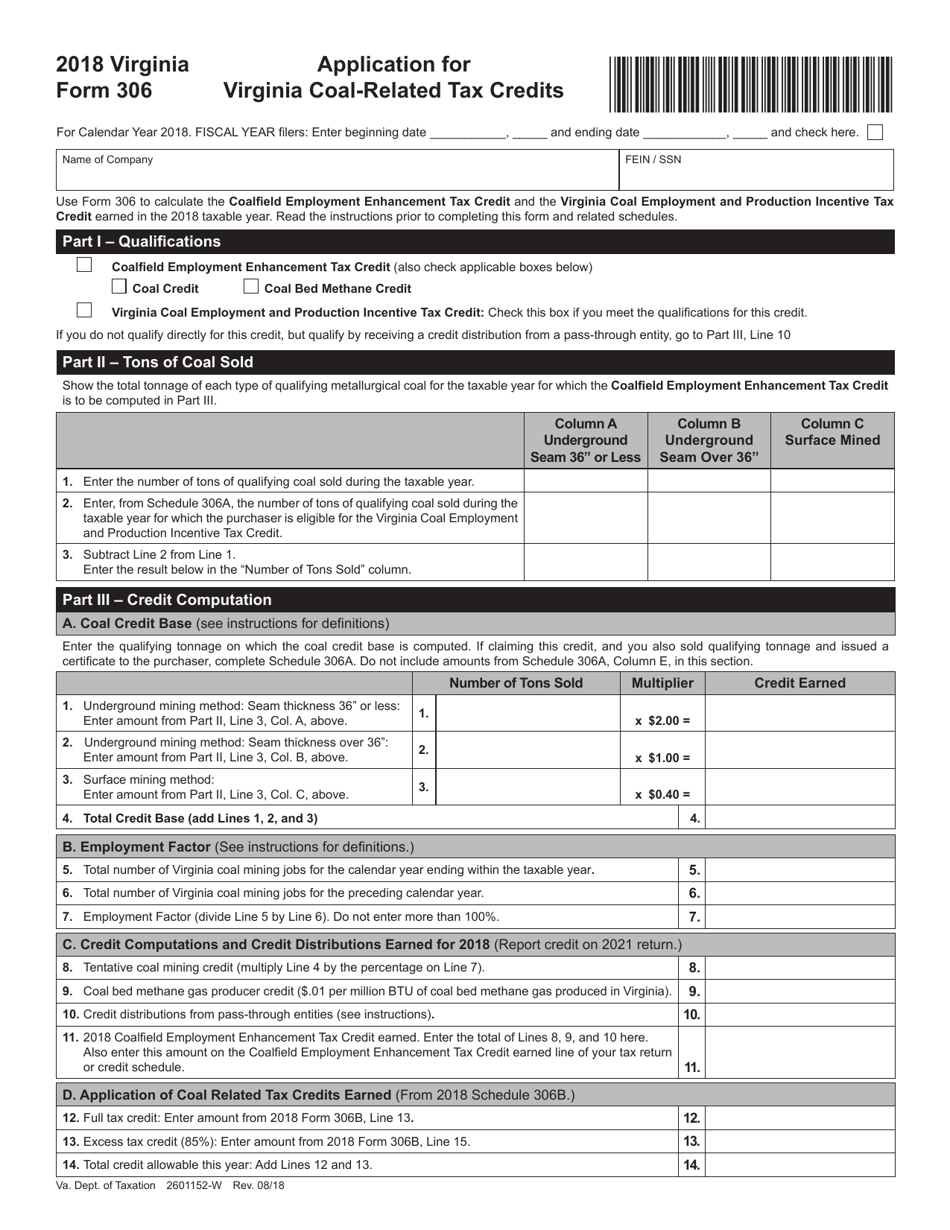

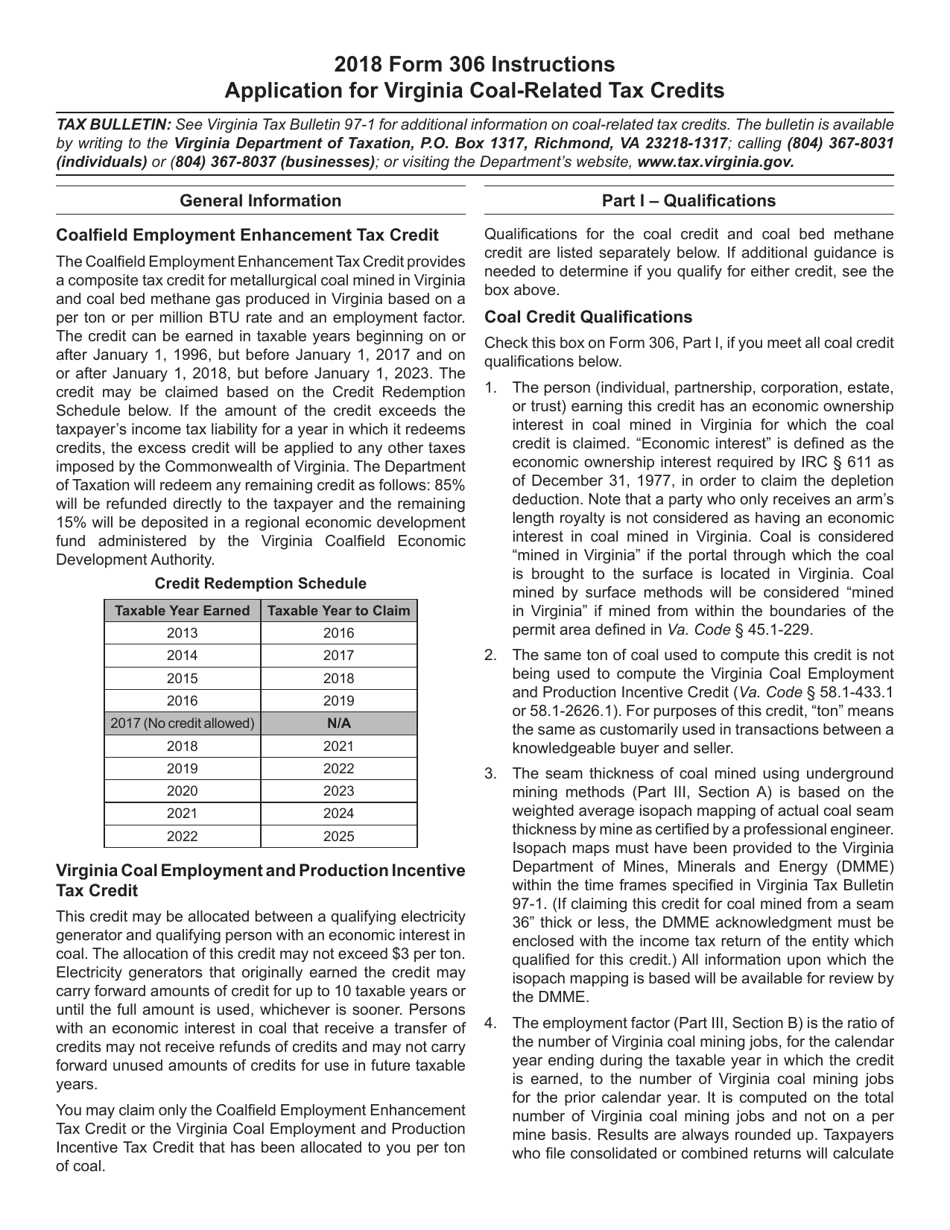

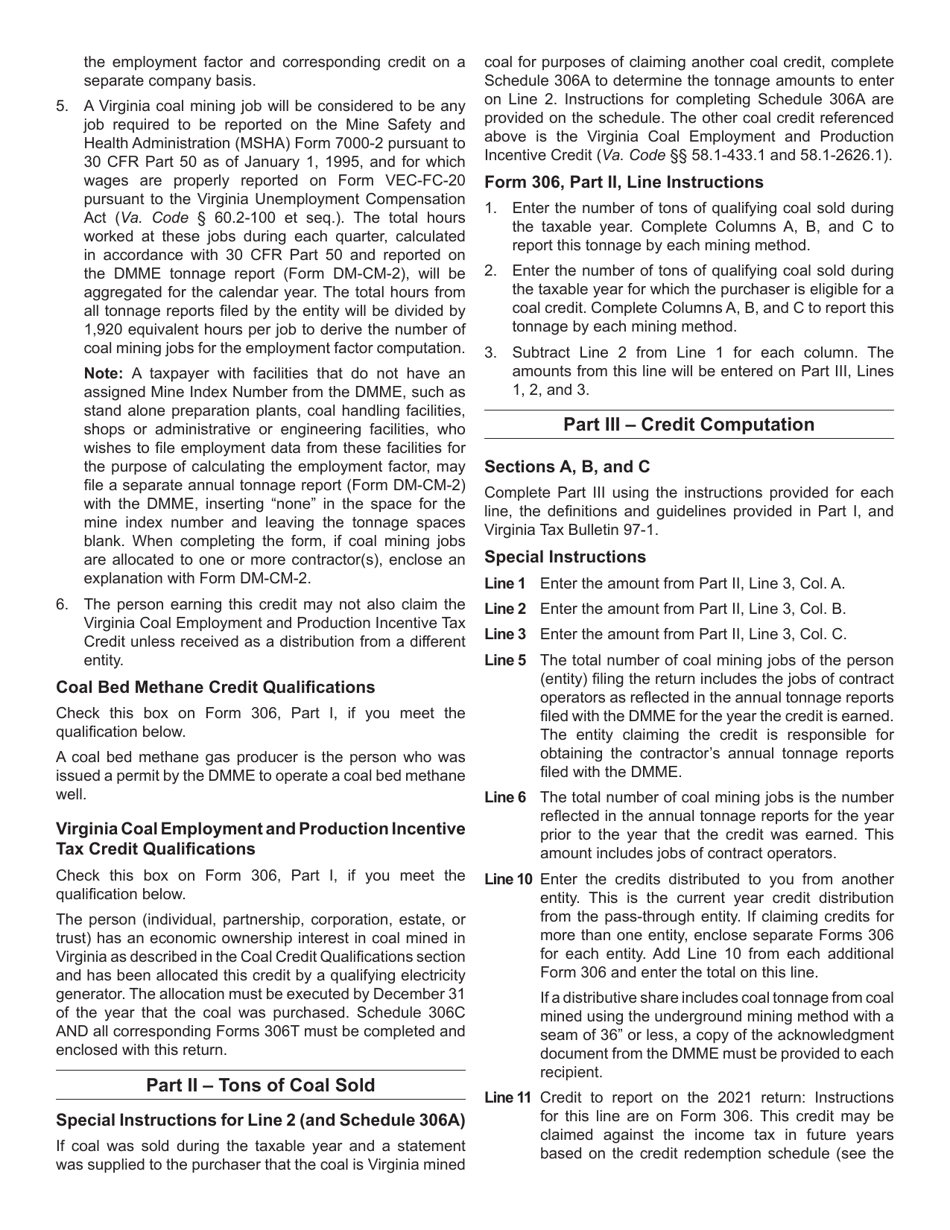

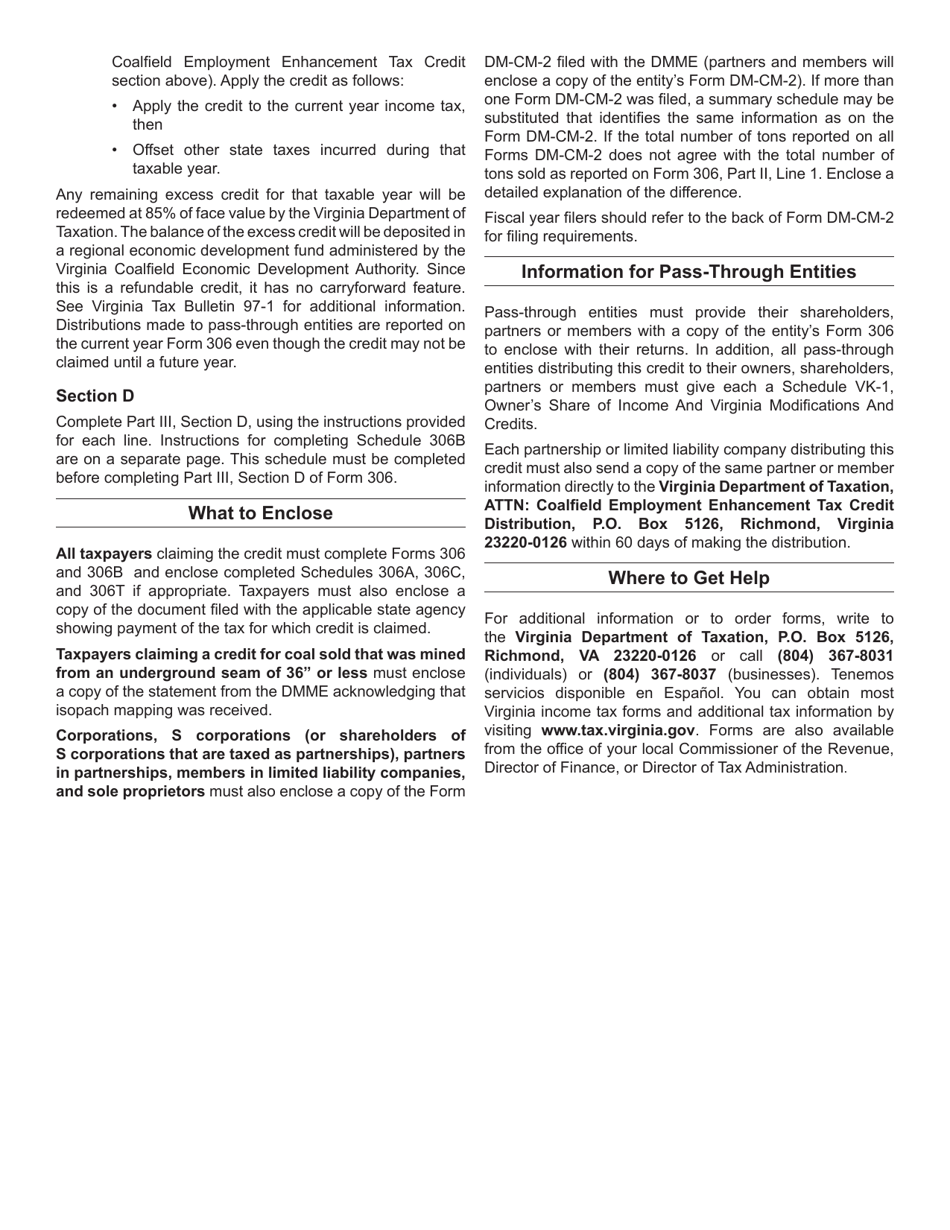

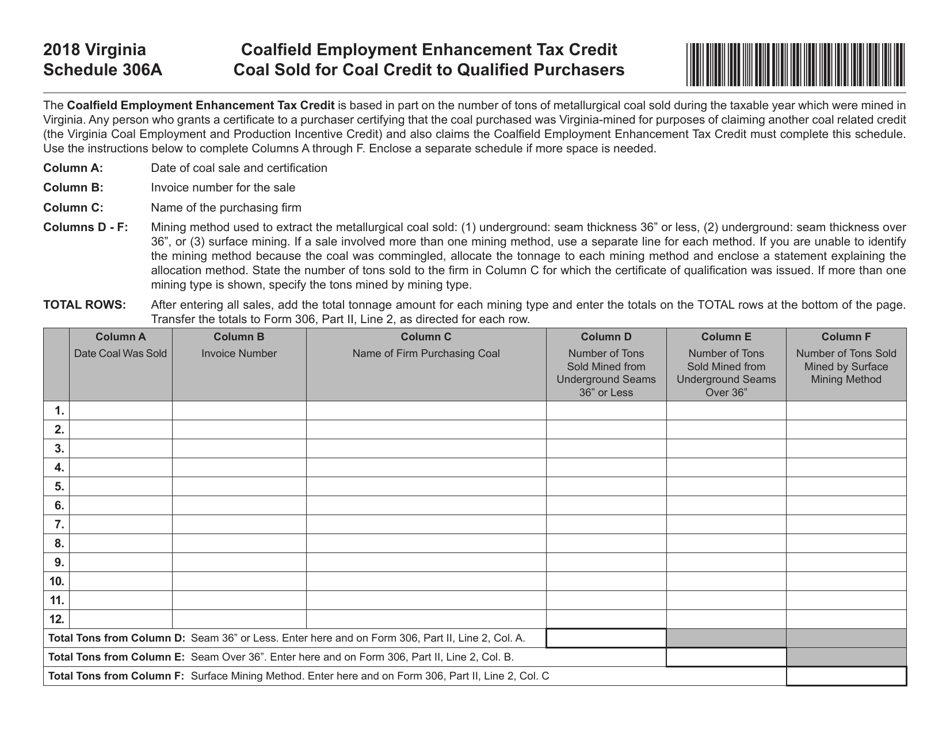

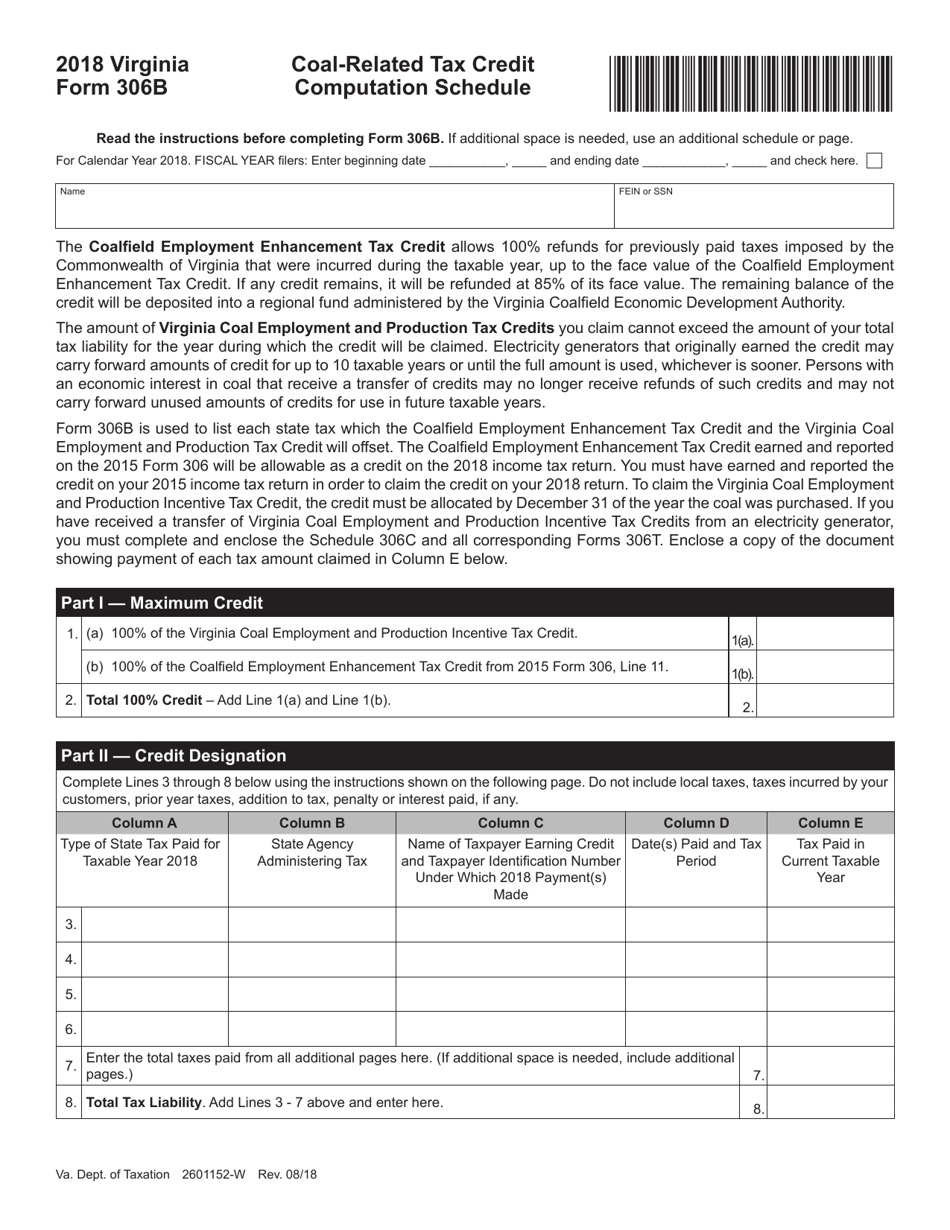

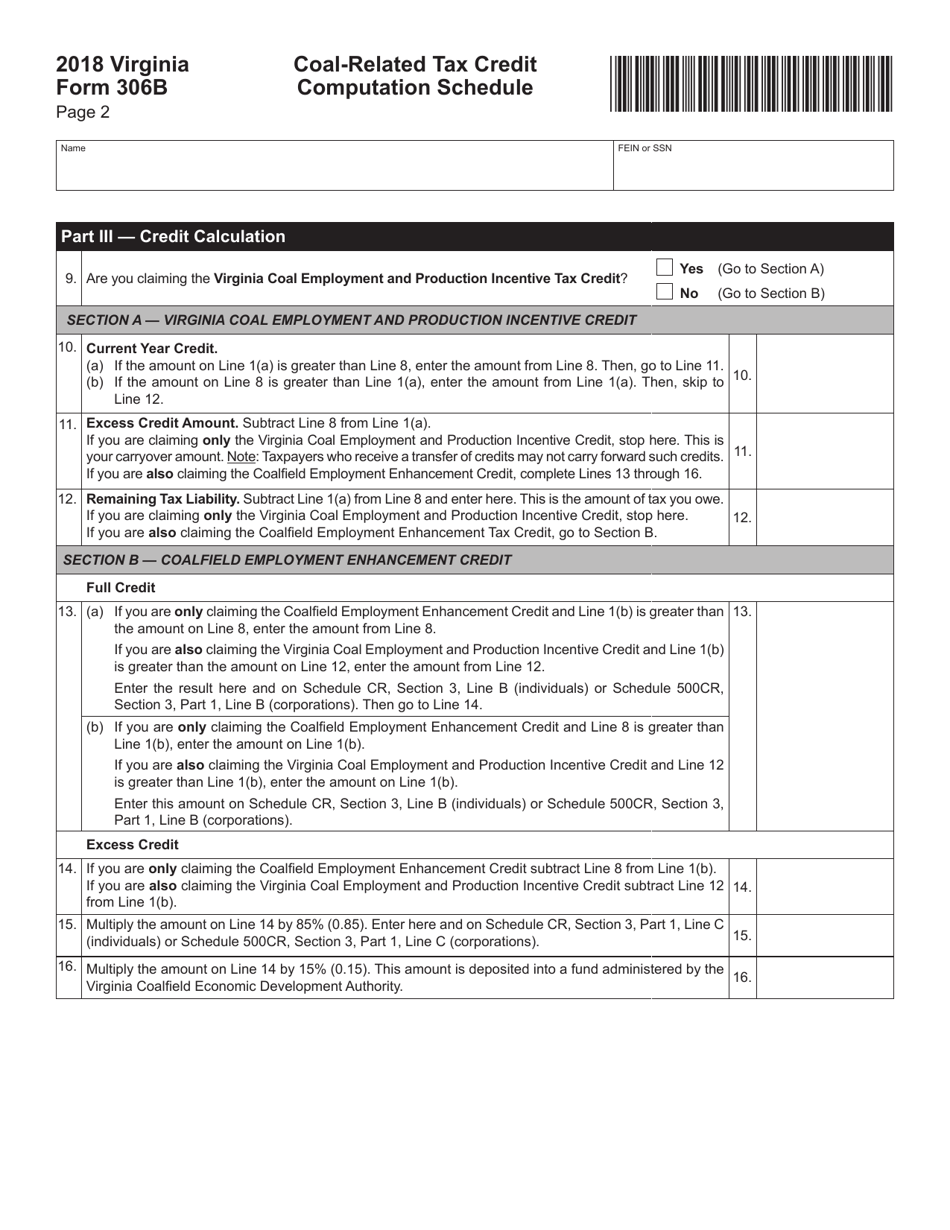

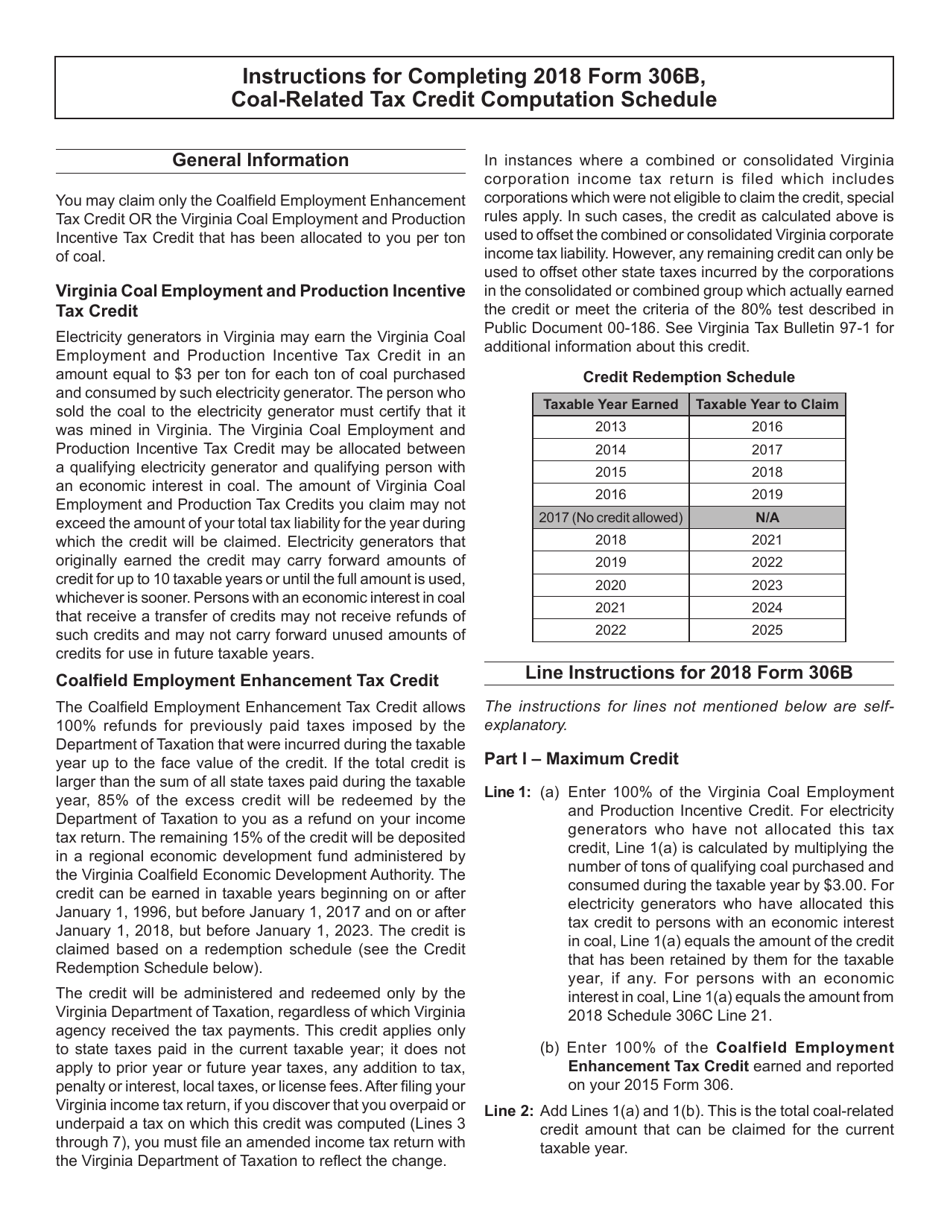

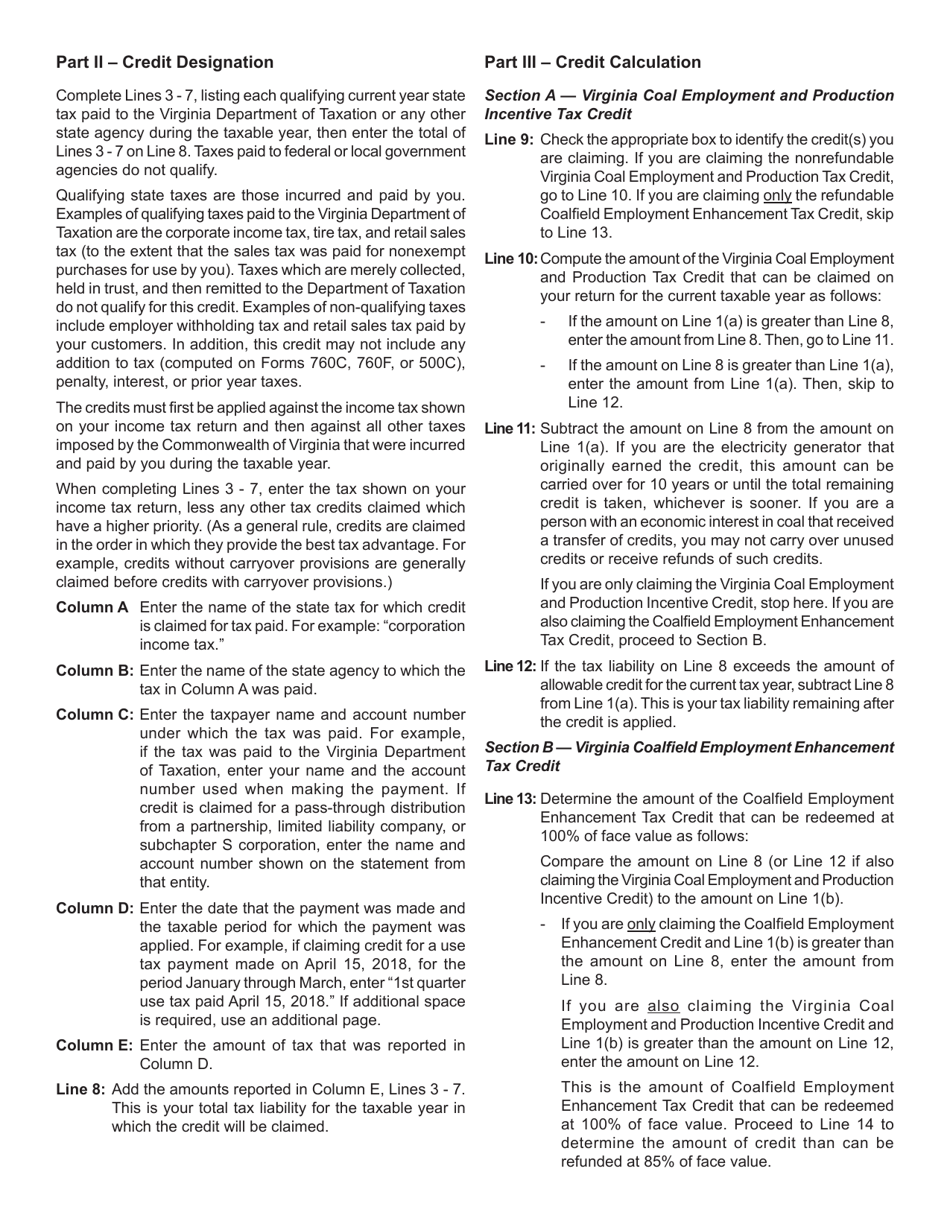

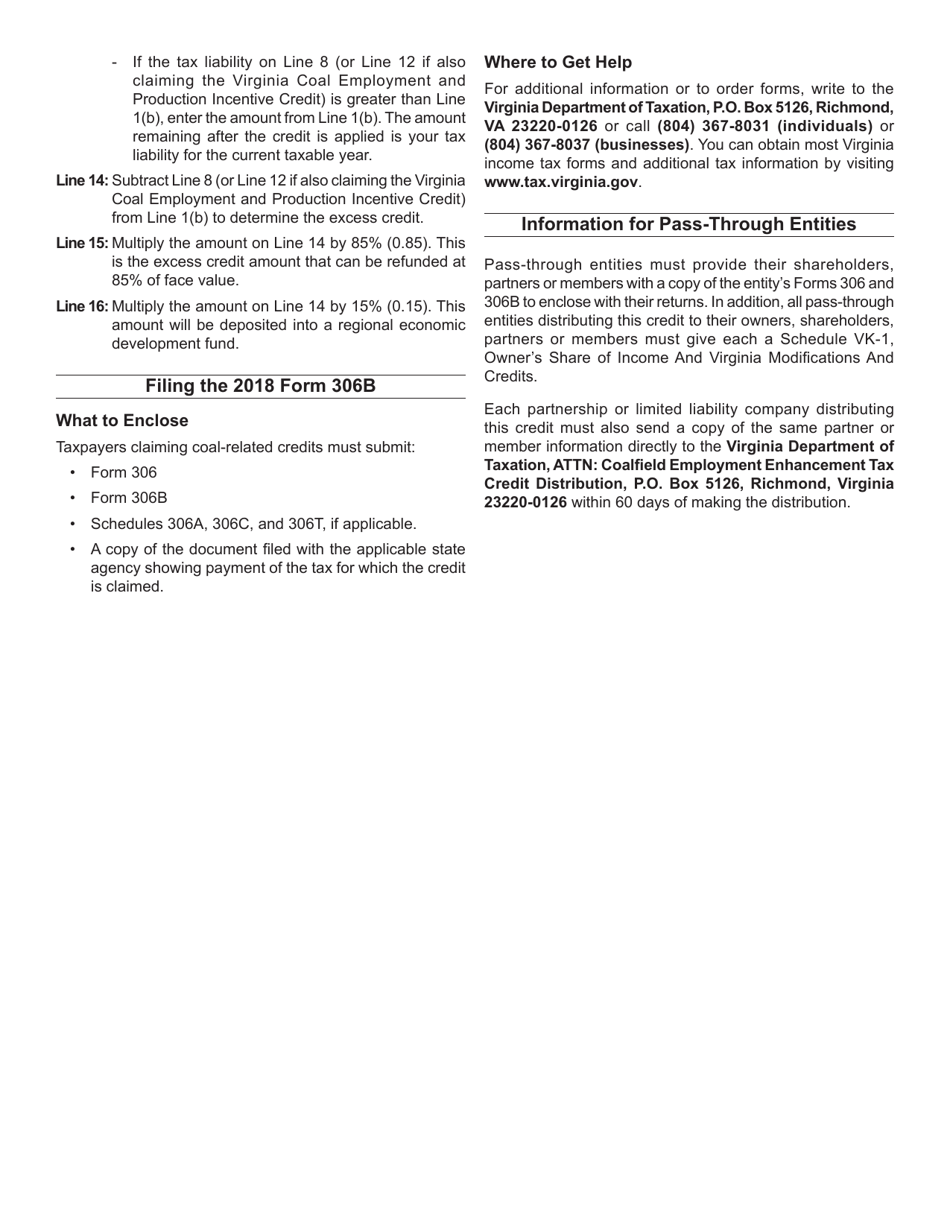

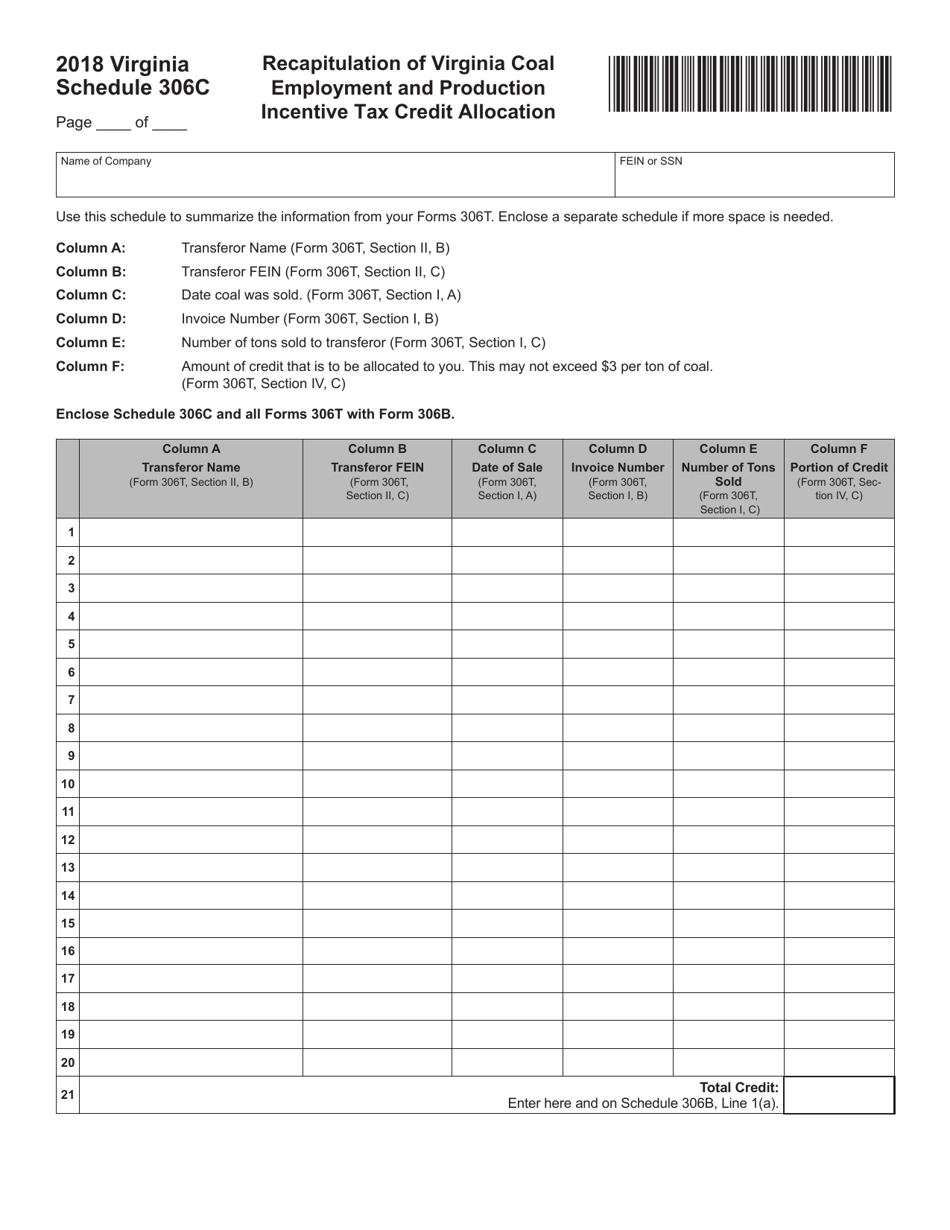

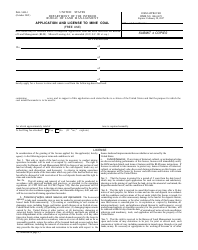

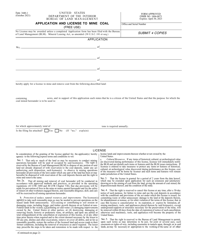

Form 306 Application for Virginia Coal-Related Tax Credits - Virginia

What Is Form 306?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 306?

A: Form 306 is the application for Virginia coal-related tax credits.

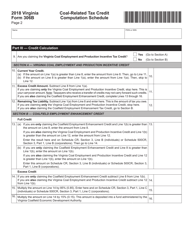

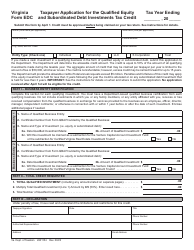

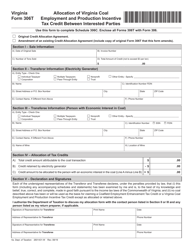

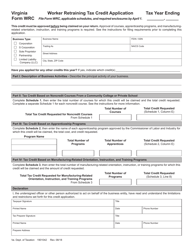

Q: What are Virginia coal-related tax credits?

A: Virginia coal-related tax credits are tax credits provided by the state of Virginia for activities related to coal.

Q: Who can apply for Virginia coal-related tax credits?

A: Any individual or business engaged in activities related to coal in Virginia can apply for these tax credits.

Q: What is the purpose of Form 306?

A: The purpose of Form 306 is to apply for Virginia coal-related tax credits.

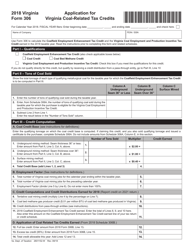

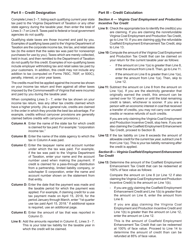

Q: What happens after submitting Form 306?

A: After submitting Form 306, the application will be reviewed by the Virginia Department of Taxation, and if approved, the tax credits will be applied.

Q: Can I claim Virginia coal-related tax credits for previous years?

A: No, Virginia coal-related tax credits can only be claimed for the current tax year.

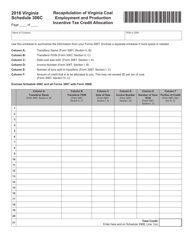

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 306 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.