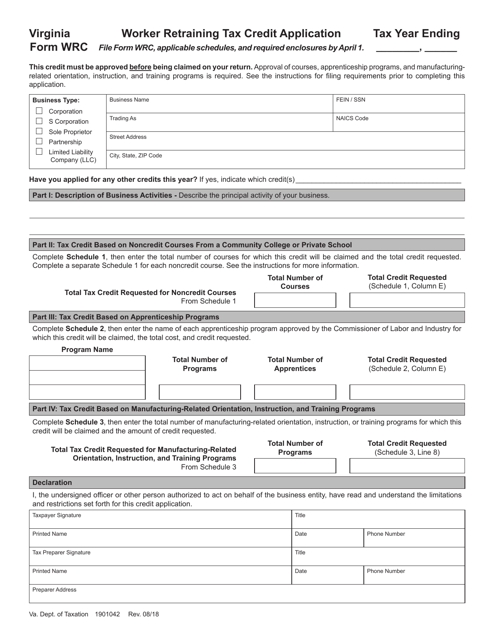

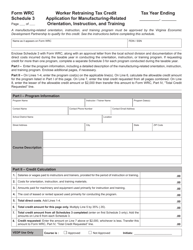

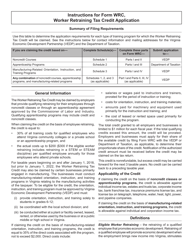

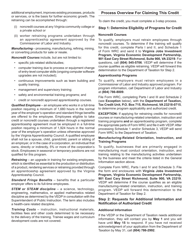

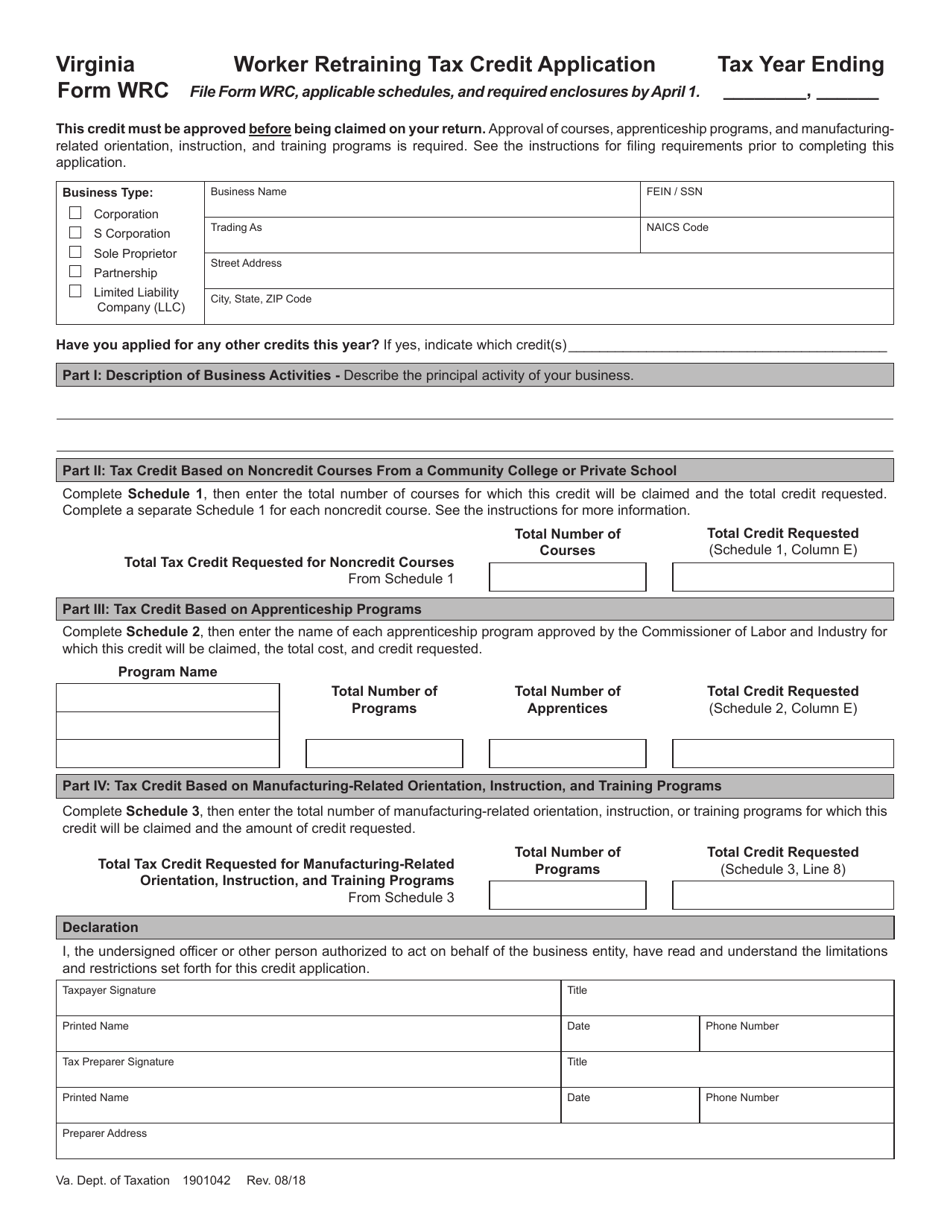

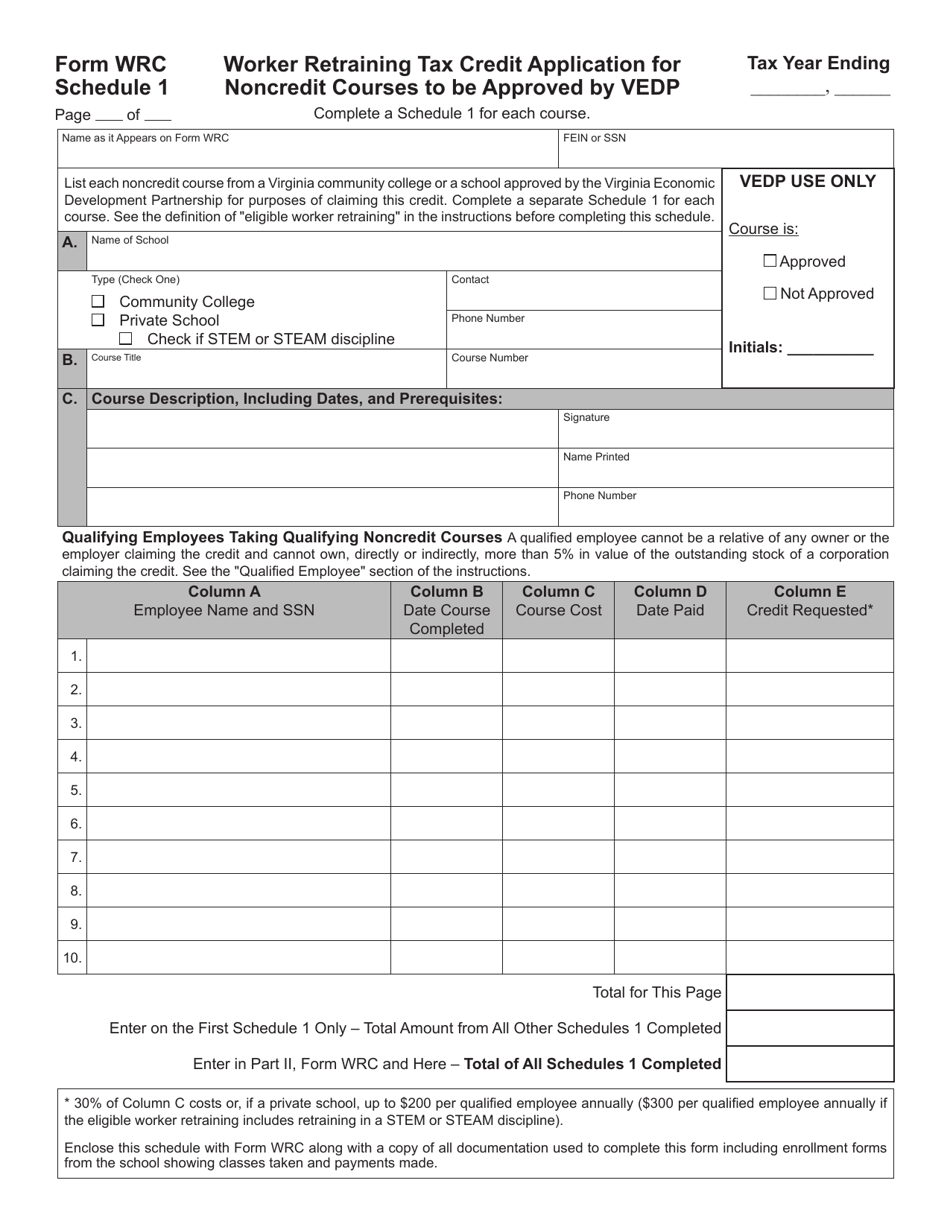

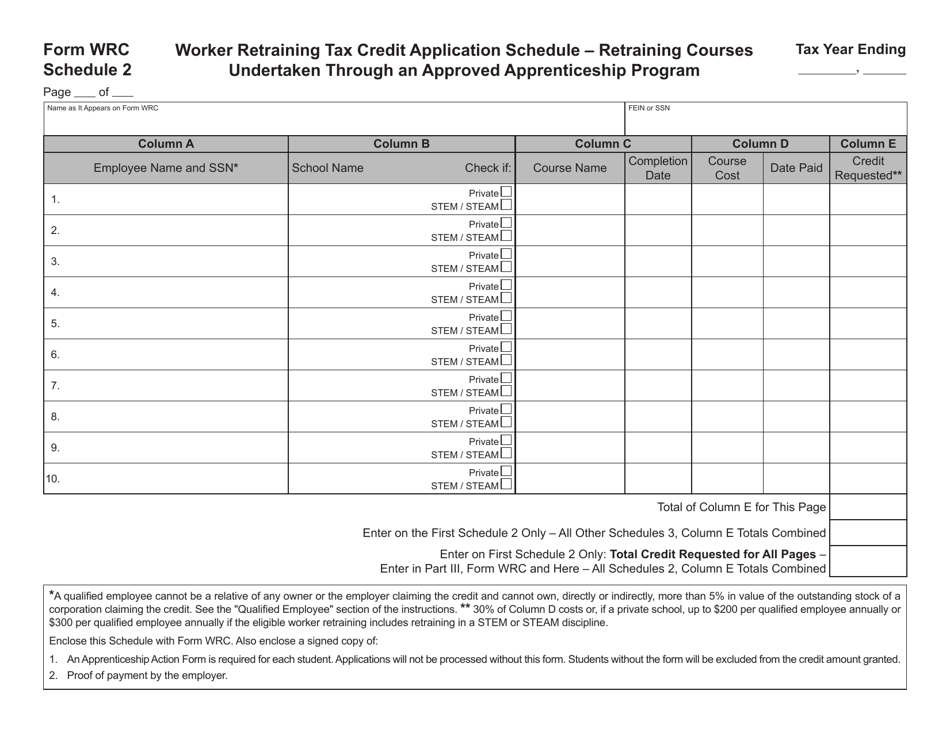

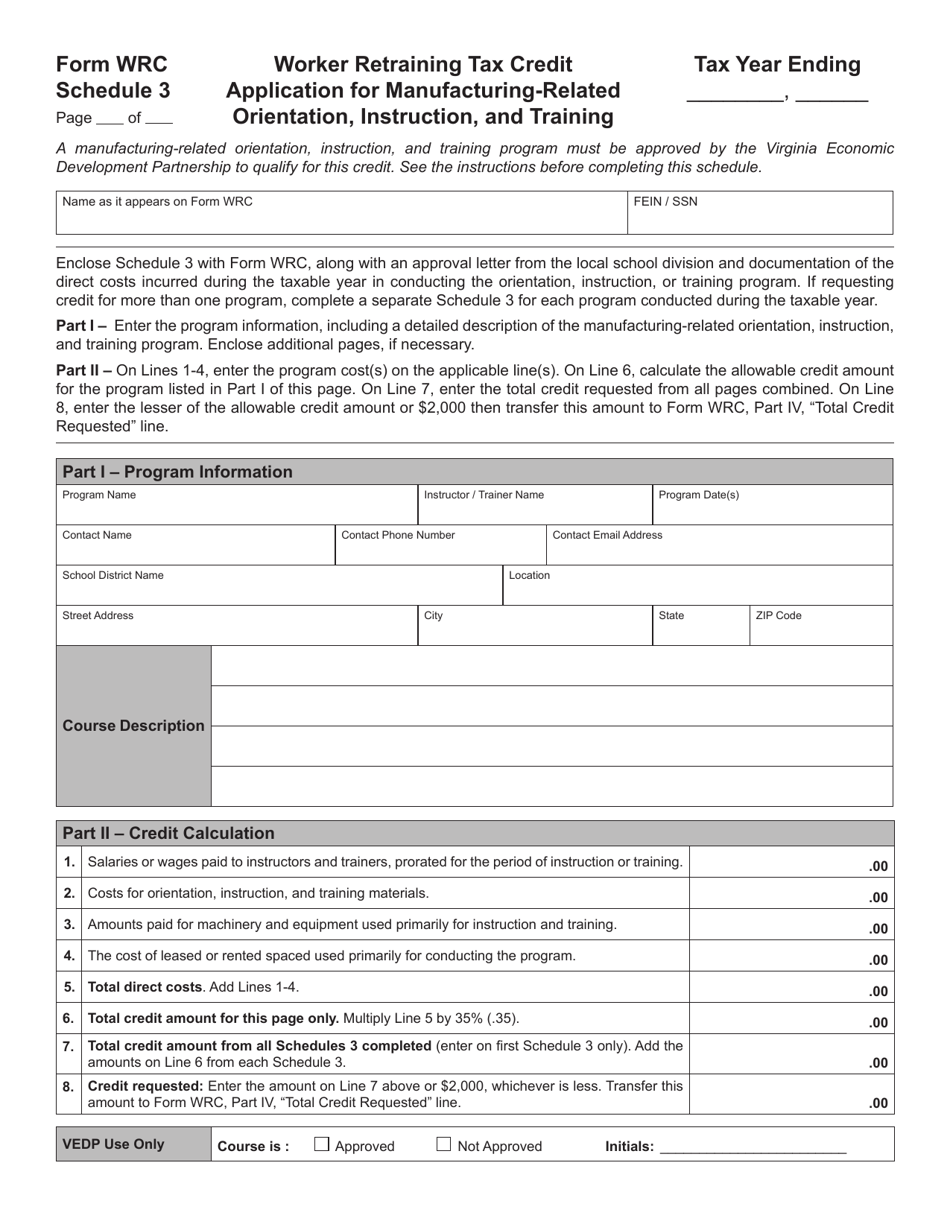

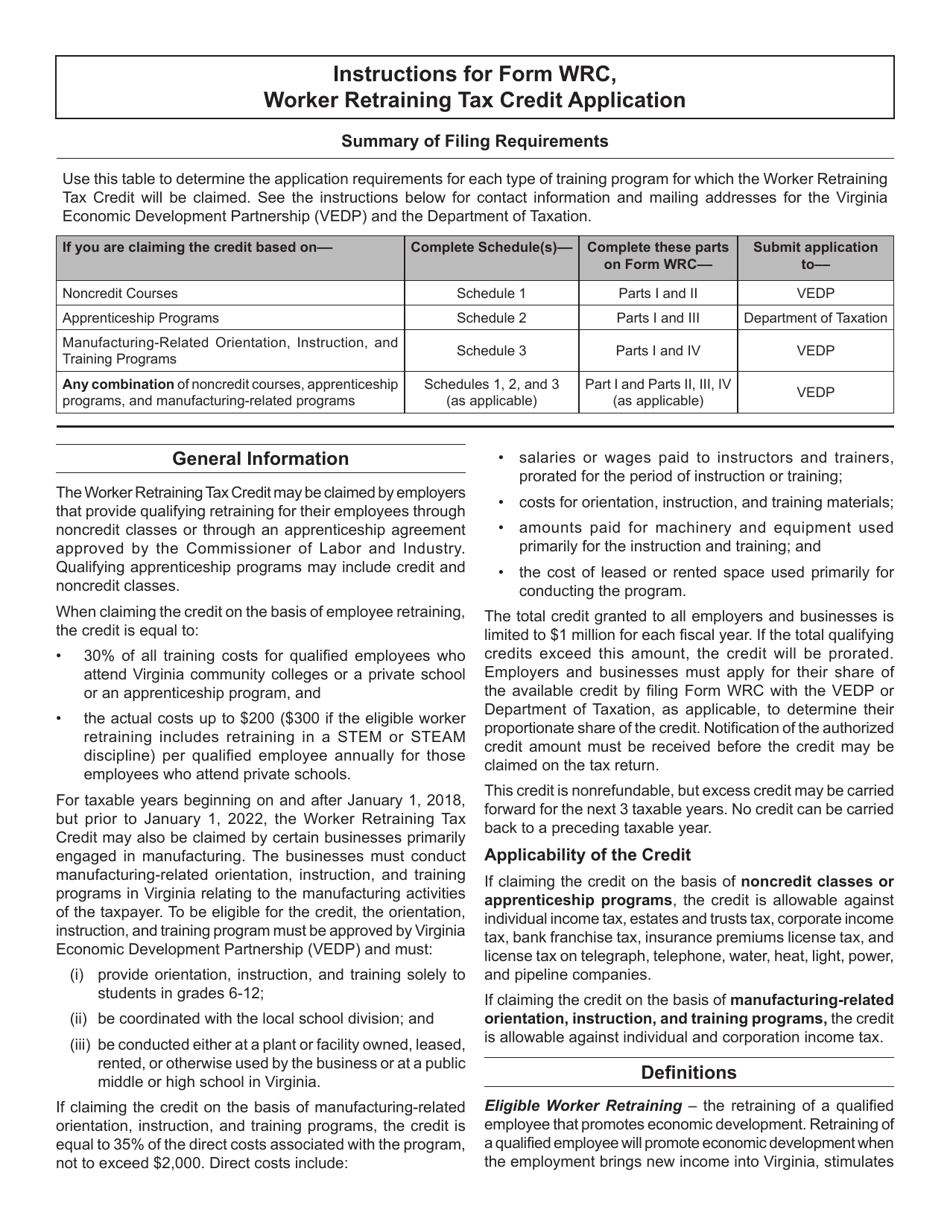

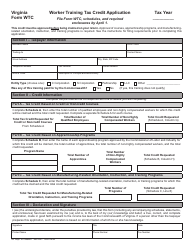

Form WRC Worker Retraining Tax Credit Application - Virginia

What Is Form WRC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form WRC?

A: Form WRC stands for Worker Retraining Tax Credit Application.

Q: What is the purpose of the Form WRC?

A: The purpose of the Form WRC is to apply for the Worker Retraining Tax Credit in Virginia.

Q: Who is eligible for the Worker Retraining Tax Credit?

A: Eligible individuals must be Virginia residents and satisfy certain criteria related to workforce training and education.

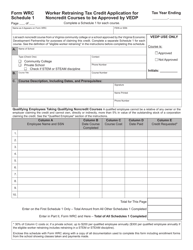

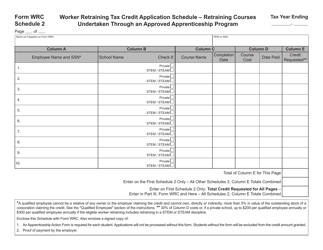

Q: What information is required to complete the Form WRC?

A: The Form WRC requires information such as the taxpayer's personal details, details of the qualifying program, and proof of program completion.

Q: When is the deadline to submit the Form WRC?

A: The deadline to submit the Form WRC is typically the same as the deadline for filing your Virginia income tax return, which is usually April 15th.

Q: Is the Worker Retraining Tax Credit refundable?

A: No, the Worker Retraining Tax Credit is not refundable. It can only be used to offset any tax liability.

Q: Can I claim the Worker Retraining Tax Credit if I am not a Virginia resident?

A: No, only Virginia residents are eligible to claim the Worker Retraining Tax Credit.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WRC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.