This version of the form is not currently in use and is provided for reference only. Download this version of

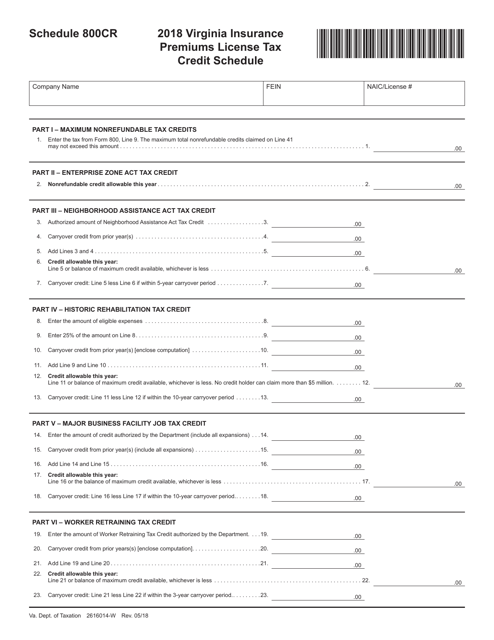

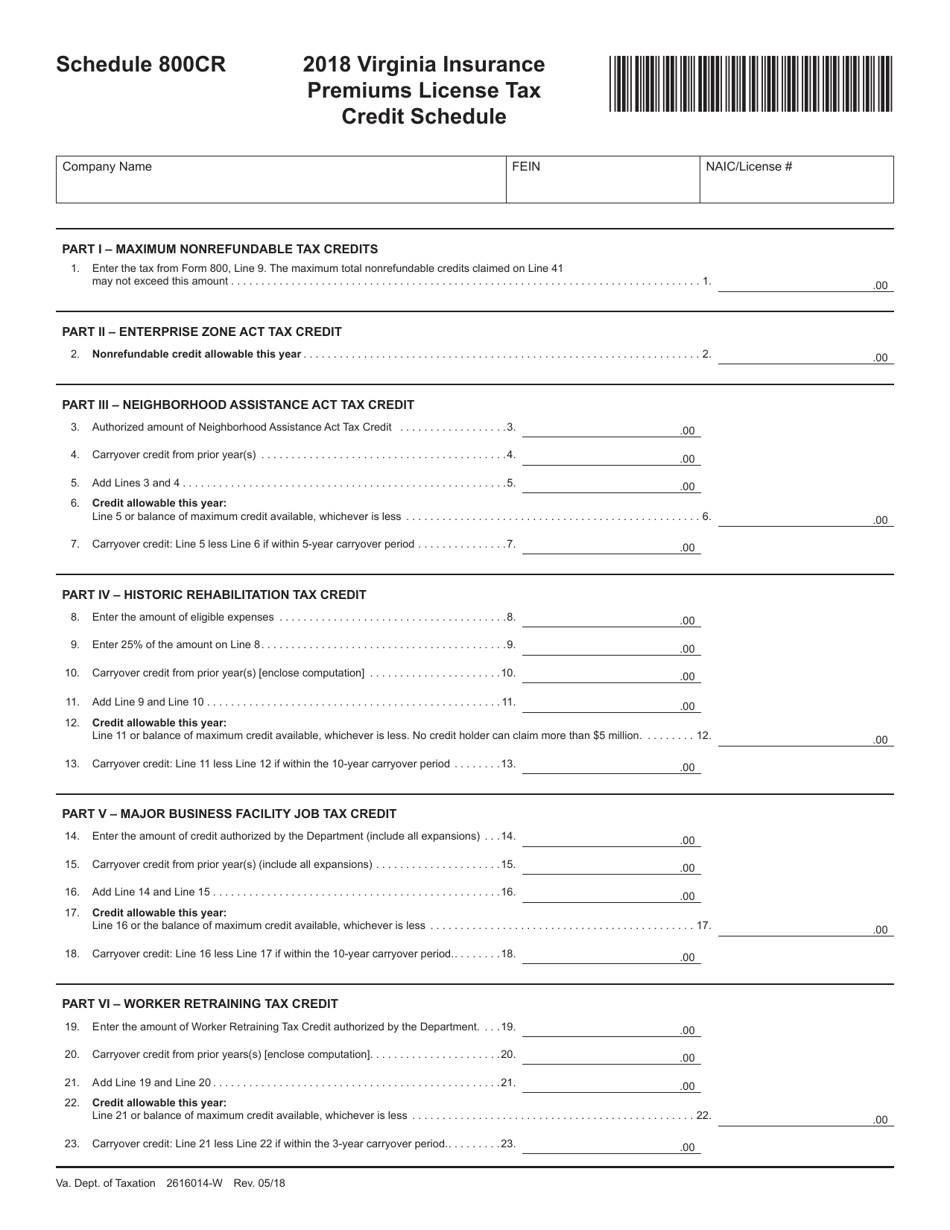

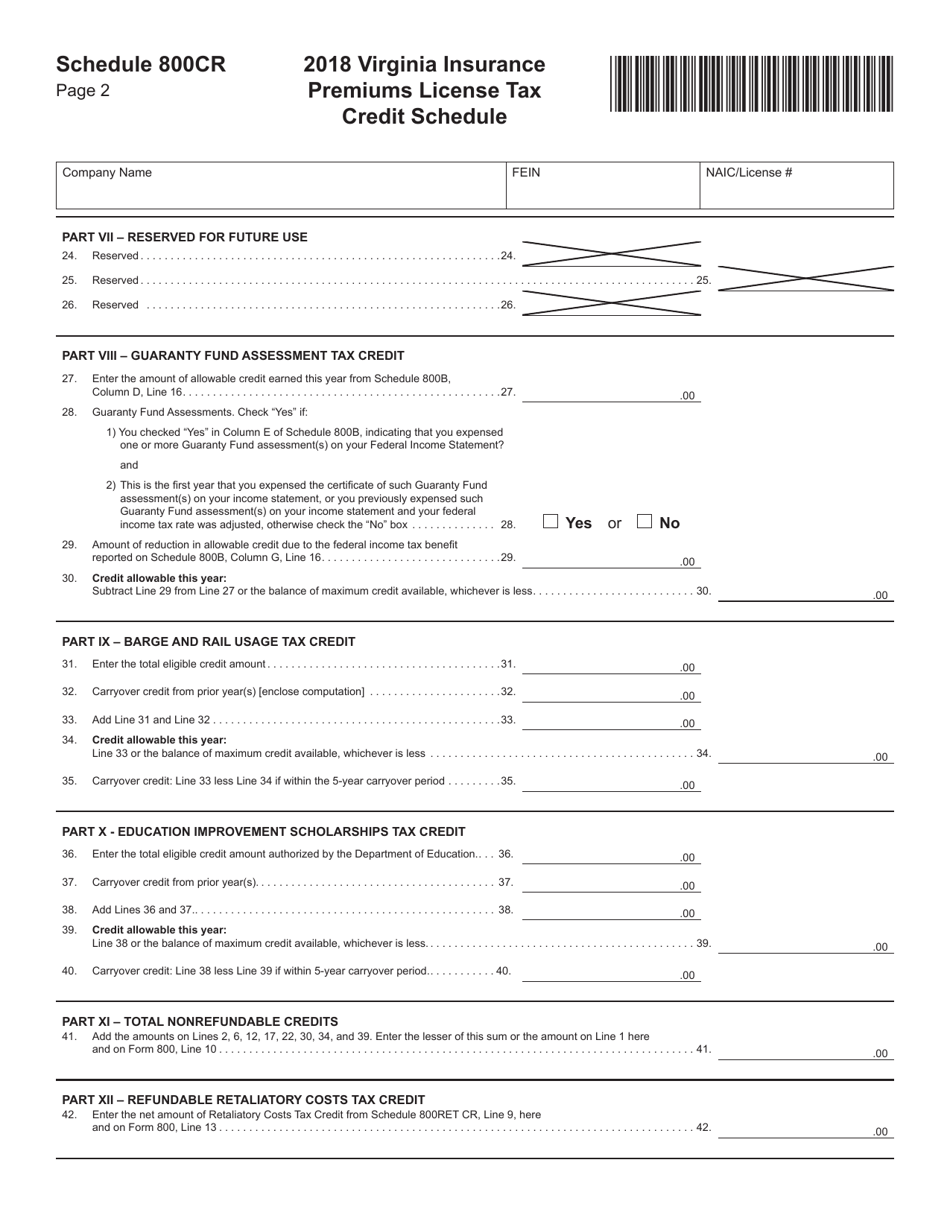

Schedule 800CR

for the current year.

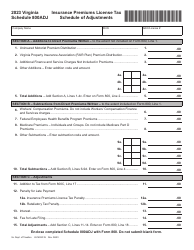

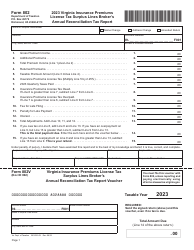

Schedule 800CR Virginia Insurance Premiums License Tax Credit Schedule - Virginia

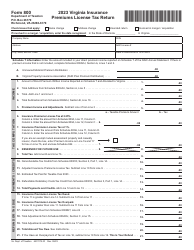

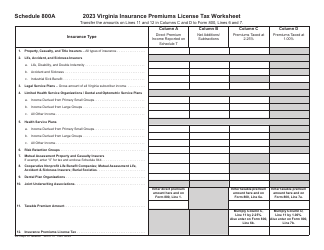

What Is Schedule 800CR?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule 800CR?

A: The Schedule 800CR is a form used in Virginia to claim the Insurance PremiumsLicense Tax Credit.

Q: What is the Virginia Insurance Premiums License Tax Credit?

A: The Virginia Insurance Premiums License Tax Credit is a tax credit available to businesses that pay certain insurance premiums in Virginia.

Q: Who can claim the Insurance Premiums License Tax Credit?

A: Businesses that pay qualifying insurance premiums in Virginia can claim the Insurance Premiums License Tax Credit.

Q: What are qualifying insurance premiums?

A: Qualifying insurance premiums refer to premiums paid for certain types of insurance, such as liability insurance or property insurance.

Q: How do I claim the Insurance Premiums License Tax Credit?

A: You can claim the Insurance Premiums License Tax Credit by completing the Schedule 800CR form and attaching it to your Virginia tax return.

Q: Is the Insurance Premiums License Tax Credit refundable?

A: No, the Insurance Premiums License Tax Credit is not refundable. It can only be used to offset your tax liability.

Q: Are there any limitations on the amount of the tax credit?

A: Yes, there are limitations on the amount of the Insurance Premiums License Tax Credit. The maximum credit amount is $25,000 per taxable year.

Q: Can I carry forward unused tax credits?

A: Yes, if you have unused Insurance Premiums License Tax Credits, you can carry them forward for up to 10 years.

Q: Is there a deadline to claim the Insurance Premiums License Tax Credit?

A: Yes, you must claim the Insurance Premiums License Tax Credit on your Virginia tax return for the tax year in which the premiums were paid.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 800CR by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.