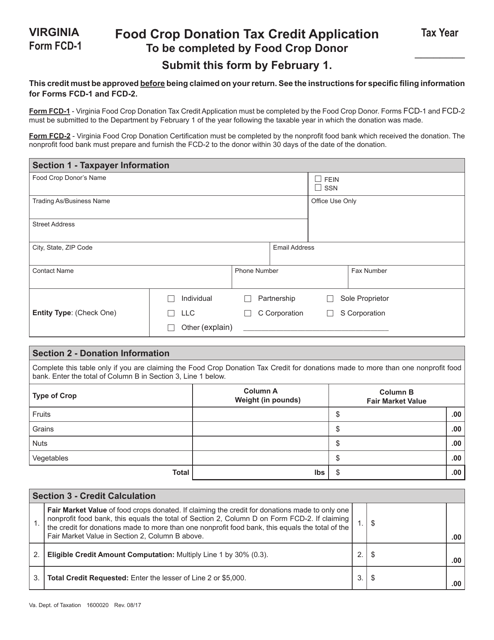

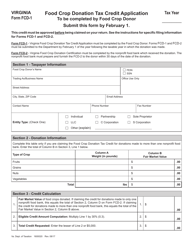

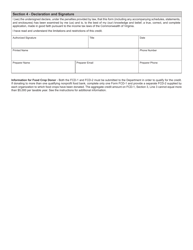

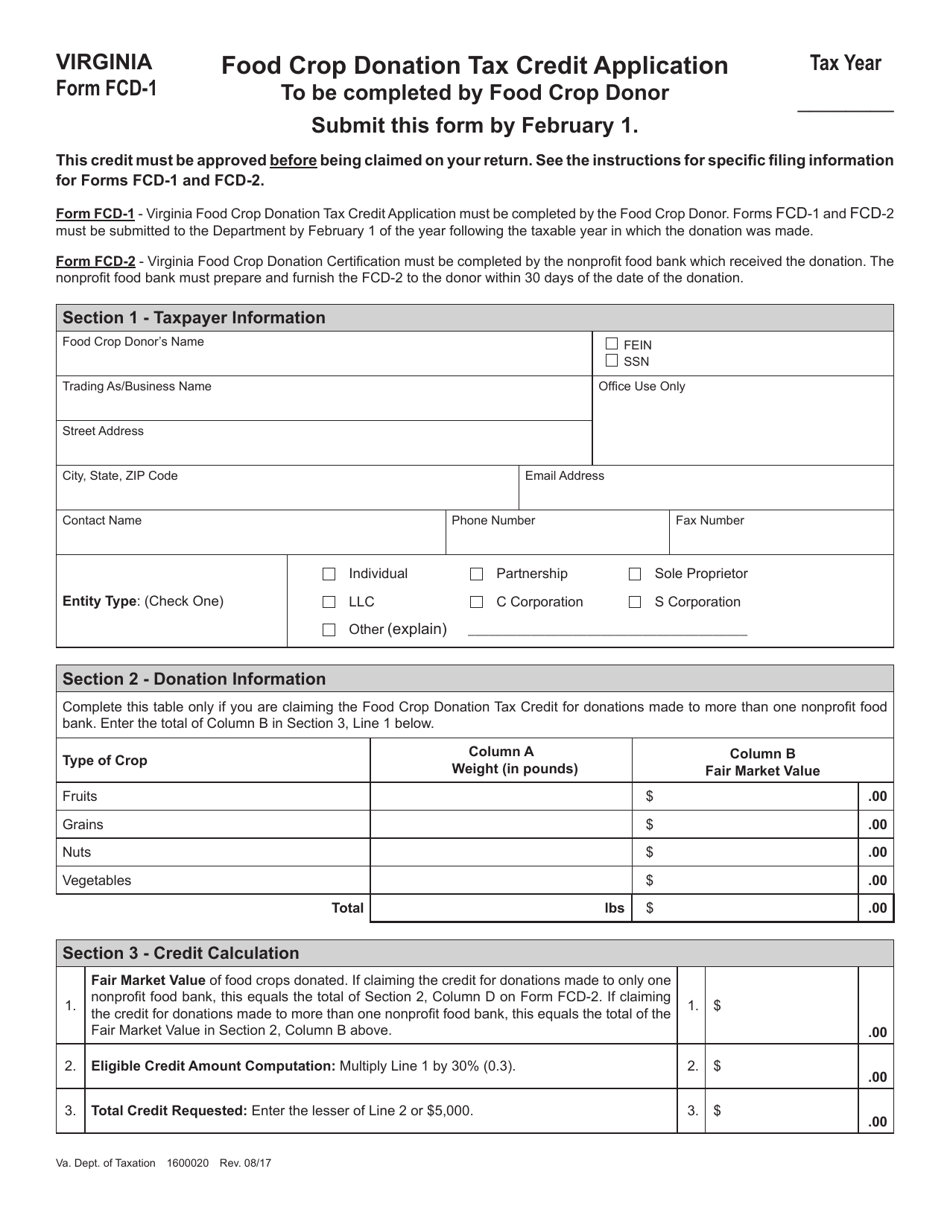

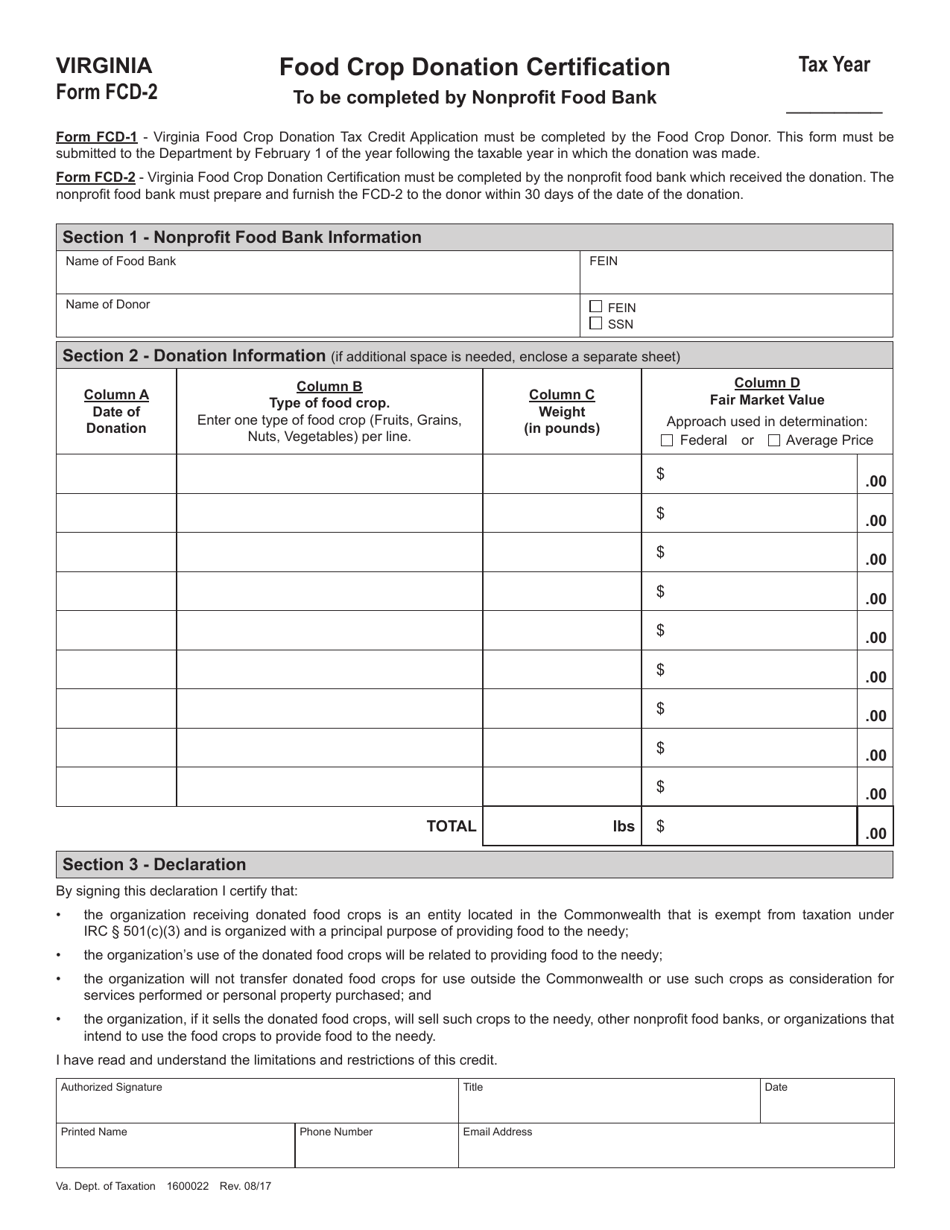

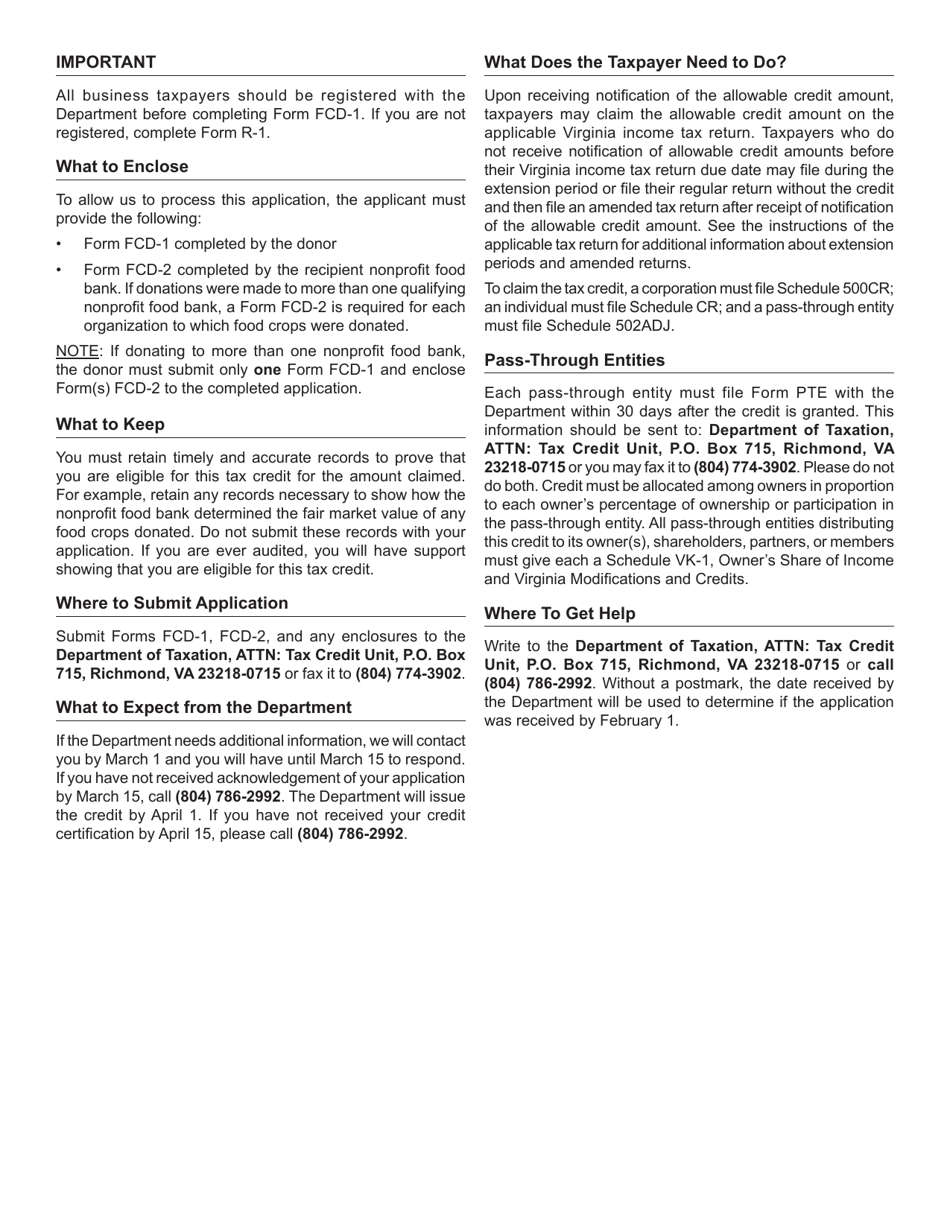

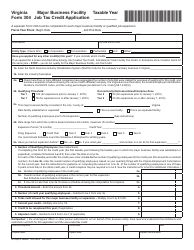

Form FCD-1 Food Crop Donation Tax Credit Application - Virginia

What Is Form FCD-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FCD-1?

A: FCD-1 is the form used for the Food Crop Donation Tax Credit Application in Virginia.

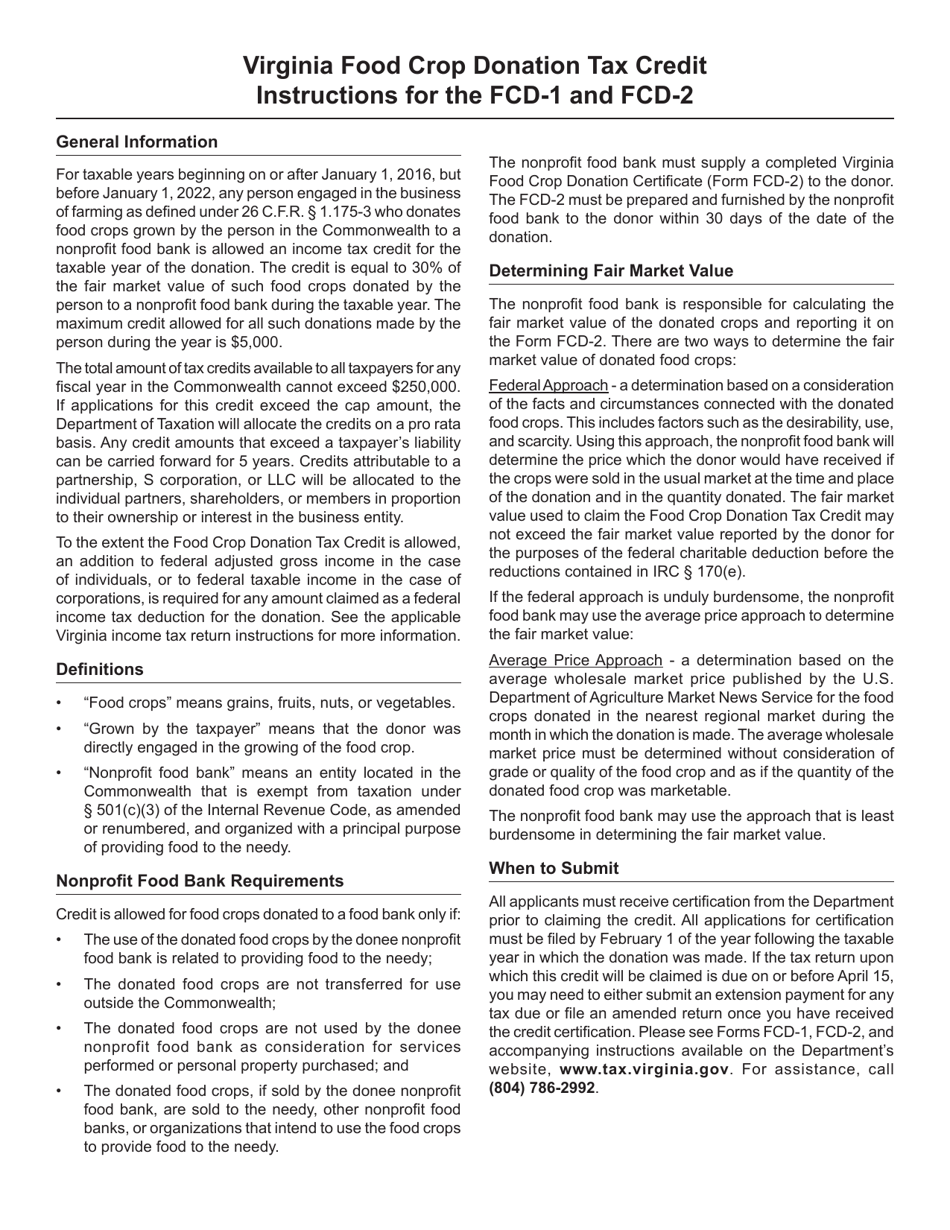

Q: What is the Food Crop Donation Tax Credit?

A: The Food Crop Donation Tax Credit is a credit provided by the state of Virginia for farmers who donate surplus food crops to eligible charitable organizations.

Q: Who is eligible for the Food Crop Donation Tax Credit?

A: Farmers in Virginia who donate surplus food crops to eligible charitable organizations are eligible for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is designed to incentivize farmers to donate excess food crops to help reduce food waste and support charitable organizations.

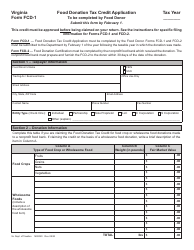

Q: How do I apply for the Food Crop Donation Tax Credit?

A: To apply for the tax credit, farmers need to fill out Form FCD-1, the Food Crop Donation Tax Credit Application, and submit it to the Virginia Department of Agriculture and Consumer Services.

Q: What information is required on the application?

A: The application requires information such as the farmer's name, address, and tax identification number, as well as details about the donated food crops and the charitable organization receiving the donation.

Q: Are there any deadlines for submitting the application?

A: The application must be submitted by December 31 of the year in which the donation was made.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of the fair market value of the donated food crops, up to a maximum credit of $5,000 per year.

Q: When will I receive the tax credit?

A: The tax credit will be applied to the farmer's state income tax liability for the year in which the donation was made.

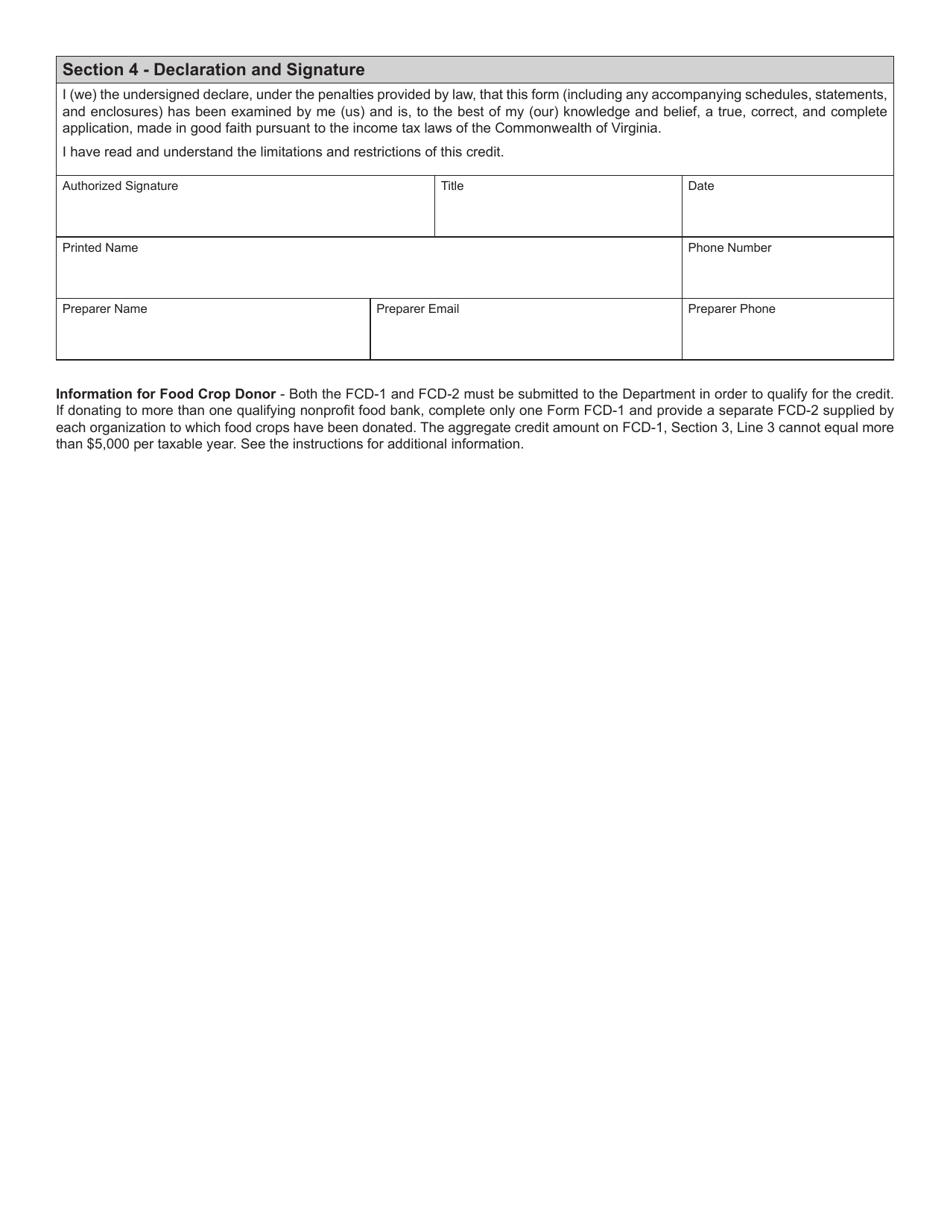

Q: Can the tax credit be carried forward?

A: Yes, any excess credit that cannot be used in the current year can be carried forward for up to 5 years.

Q: Is the Food Crop Donation Tax Credit refundable?

A: No, the tax credit is non-refundable and cannot be carried back.

Q: Are there any additional requirements or restrictions?

A: There are additional requirements and restrictions outlined in the instructions provided with Form FCD-1. Farmers should carefully review the instructions before applying for the tax credit.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FCD-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.