This version of the form is not currently in use and is provided for reference only. Download this version of

Form EDC

for the current year.

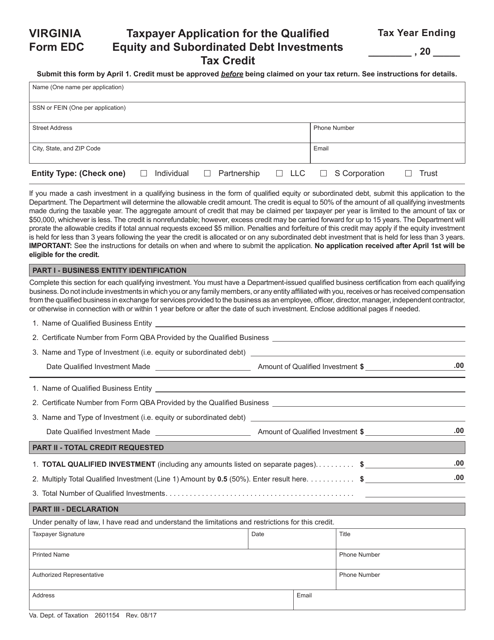

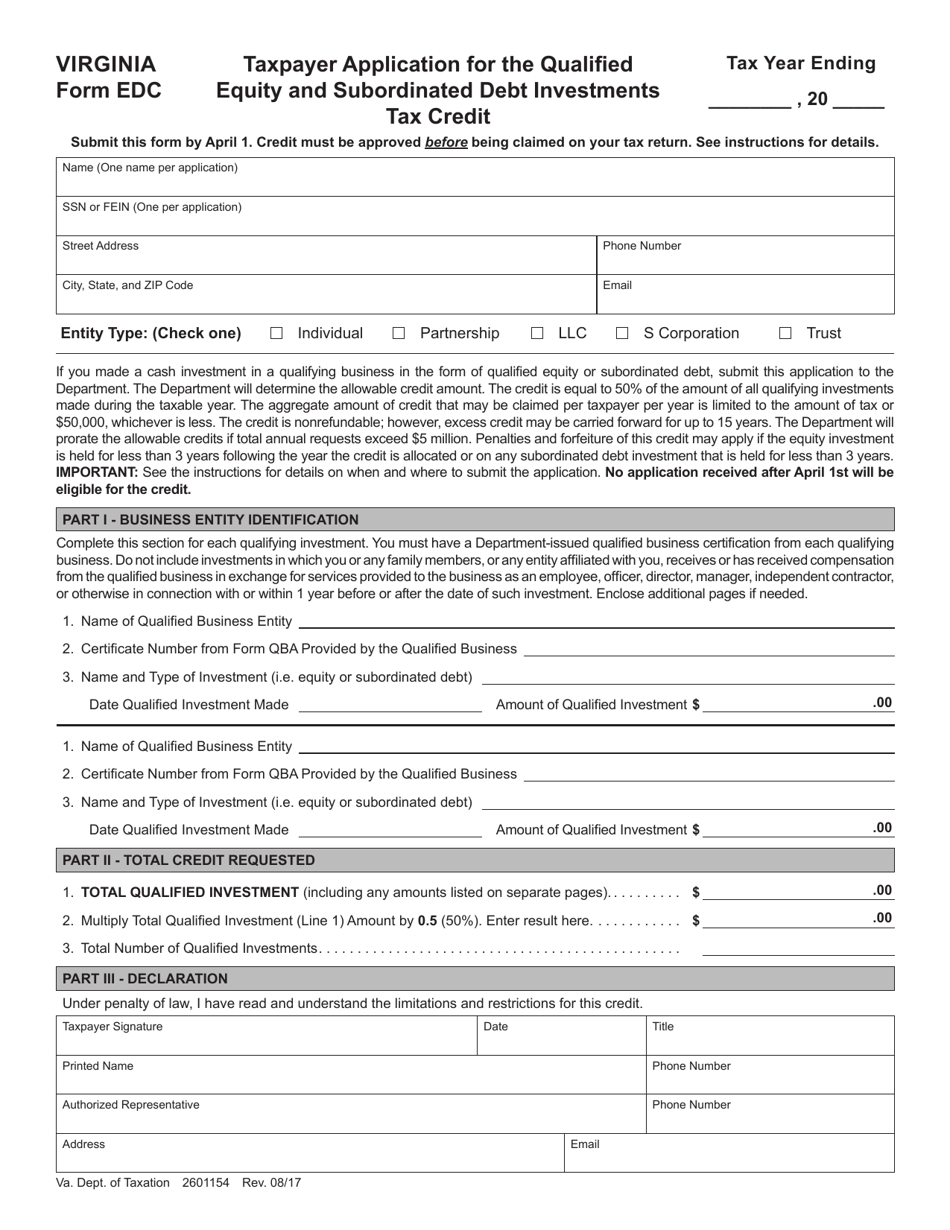

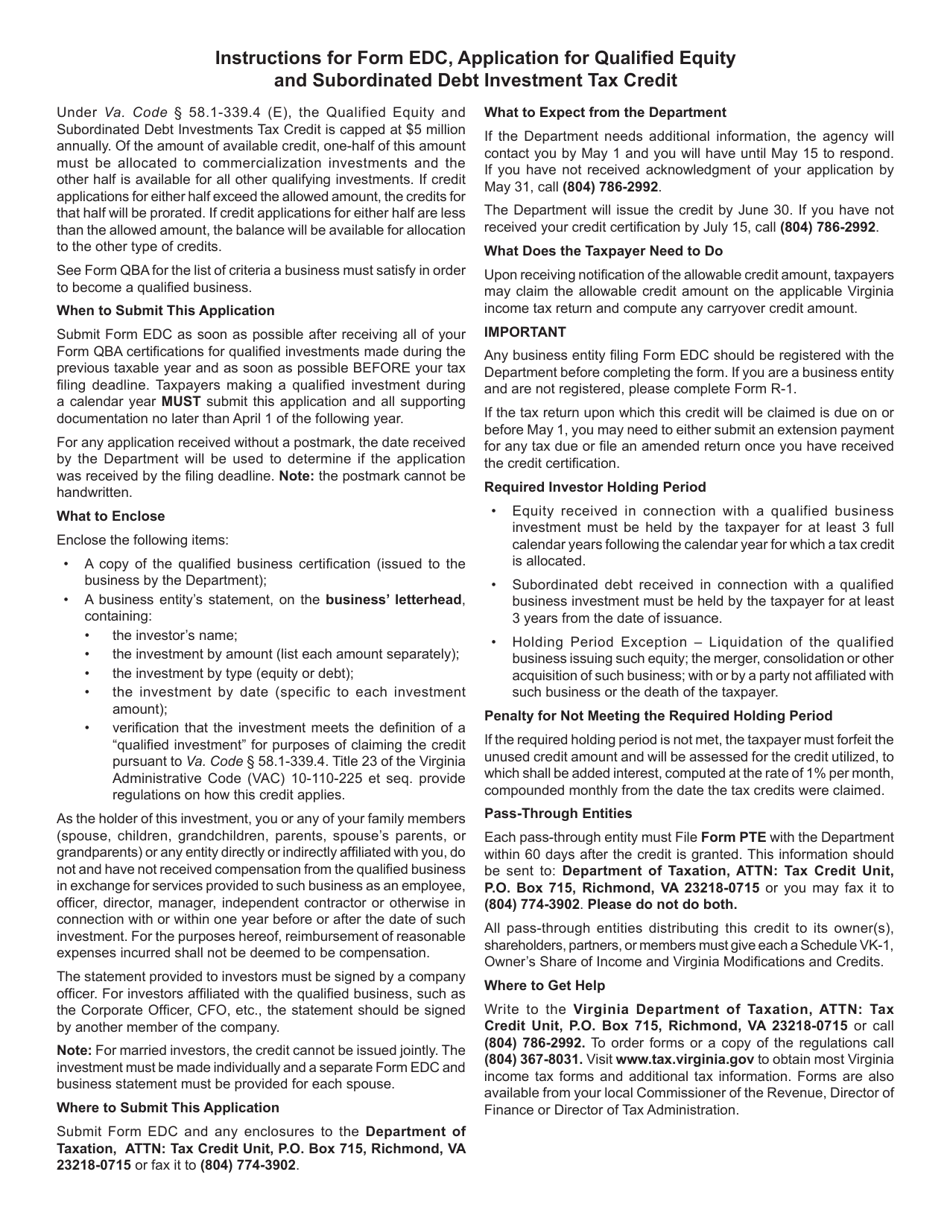

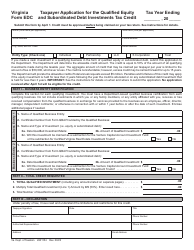

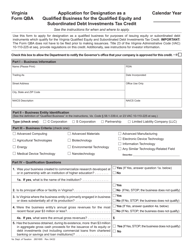

Form EDC Taxpayer Application for the Qualified Equity and Subordinated Debt Investments Tax Credit - Virginia

What Is Form EDC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the EDC Taxpayer Application?

A: The EDC Taxpayer Application is a form used to apply for the Qualified Equity and Subordinated Debt Investments Tax Credit in Virginia.

Q: What is the Qualified Equity and Subordinated Debt Investments Tax Credit?

A: The Qualified Equity and Subordinated Debt Investments Tax Credit is a tax credit offered in Virginia to encourage investment in certain businesses.

Q: Who is eligible to apply for the tax credit?

A: Eligible taxpayers, including individuals, corporations, and partnerships, can apply for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit aims to stimulate economic growth and job creation by attracting investments in qualifying businesses.

Q: Is there a deadline to submit the application?

A: Yes, the deadline for submitting the EDC Taxpayer Application is specified by the Virginia Department of Taxation and may vary each year.

Q: What documentation is required to support my application?

A: You will need to provide supporting documentation such as investment agreements, financial statements, and other relevant information.

Q: What happens after I submit the application?

A: Once your application is received, it will be reviewed by the Virginia Department of Taxation, and you will be notified of the outcome.

Q: If approved, how is the tax credit applied?

A: If approved, the tax credit can be applied against the taxpayer's Virginia income tax liability.

Q: Can the tax credit be carried forward?

A: Yes, any unused portion of the tax credit can be carried forward for up to 10 years.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EDC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.