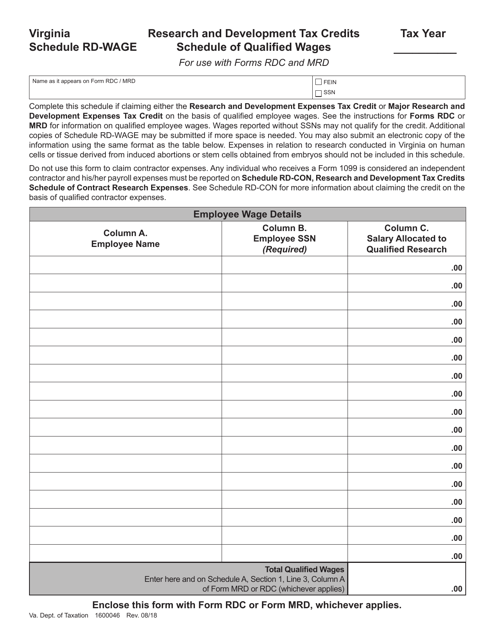

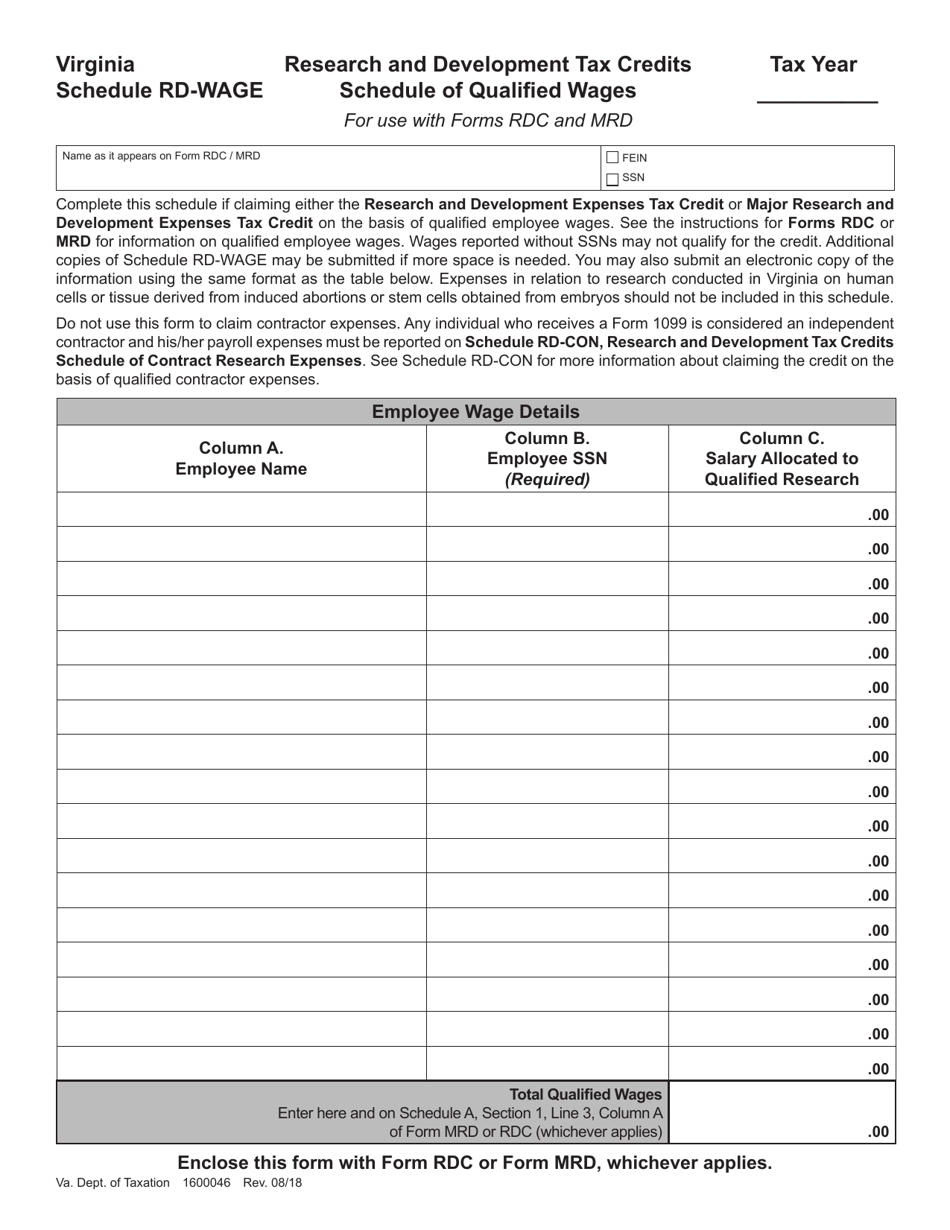

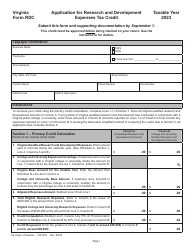

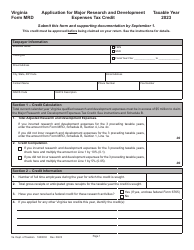

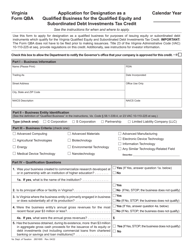

Schedule RD-WAGE Research and Development Tax Credits Schedule of Qualified Wages - Virginia

What Is Schedule RD-WAGE?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RD-WAGE schedule?

A: The RD-WAGE schedule is the Schedule of Qualified Wages for Research and Development Tax Credits in Virginia.

Q: What is the purpose of the RD-WAGE schedule?

A: The purpose of the RD-WAGE schedule is to report qualified wages for research and development tax credits in Virginia.

Q: What are qualified wages?

A: Qualified wages are the wages paid to employees engaged in qualified research activities.

Q: What are research and development tax credits?

A: Research and development tax credits are tax incentives provided to businesses for conducting research and development activities.

Q: Is the RD-WAGE schedule specific to Virginia?

A: Yes, the RD-WAGE schedule is specific to Virginia.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule RD-WAGE by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.