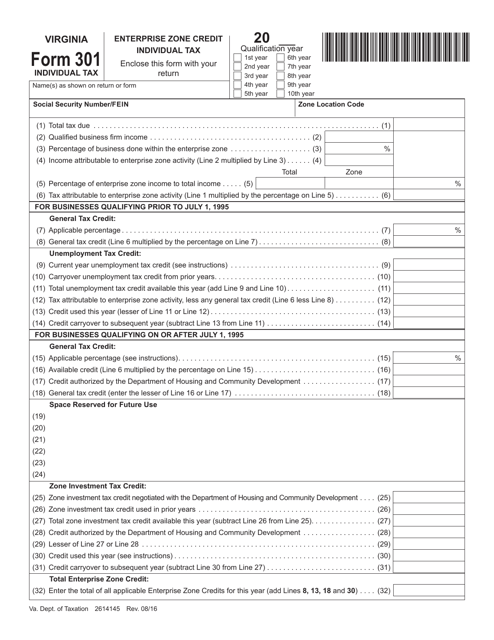

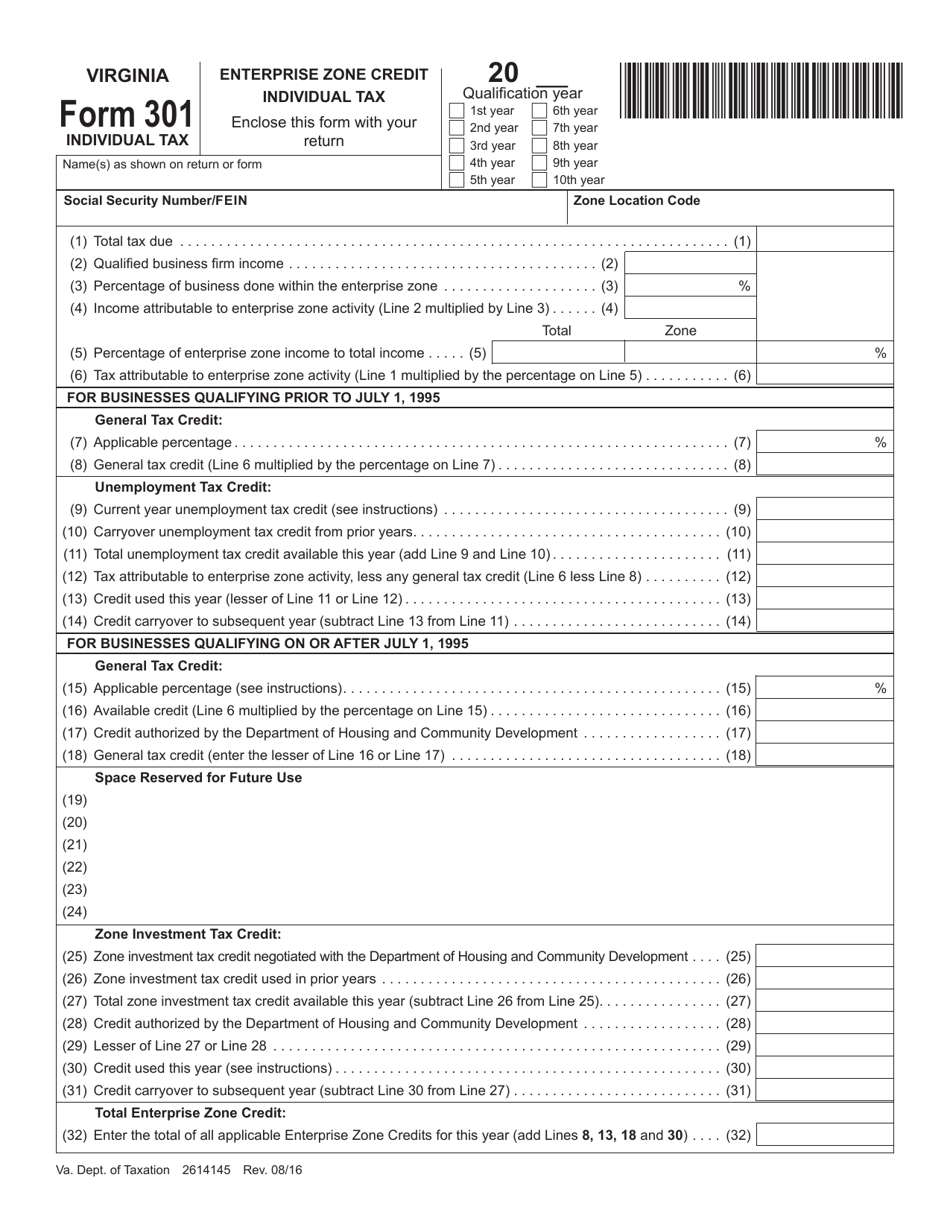

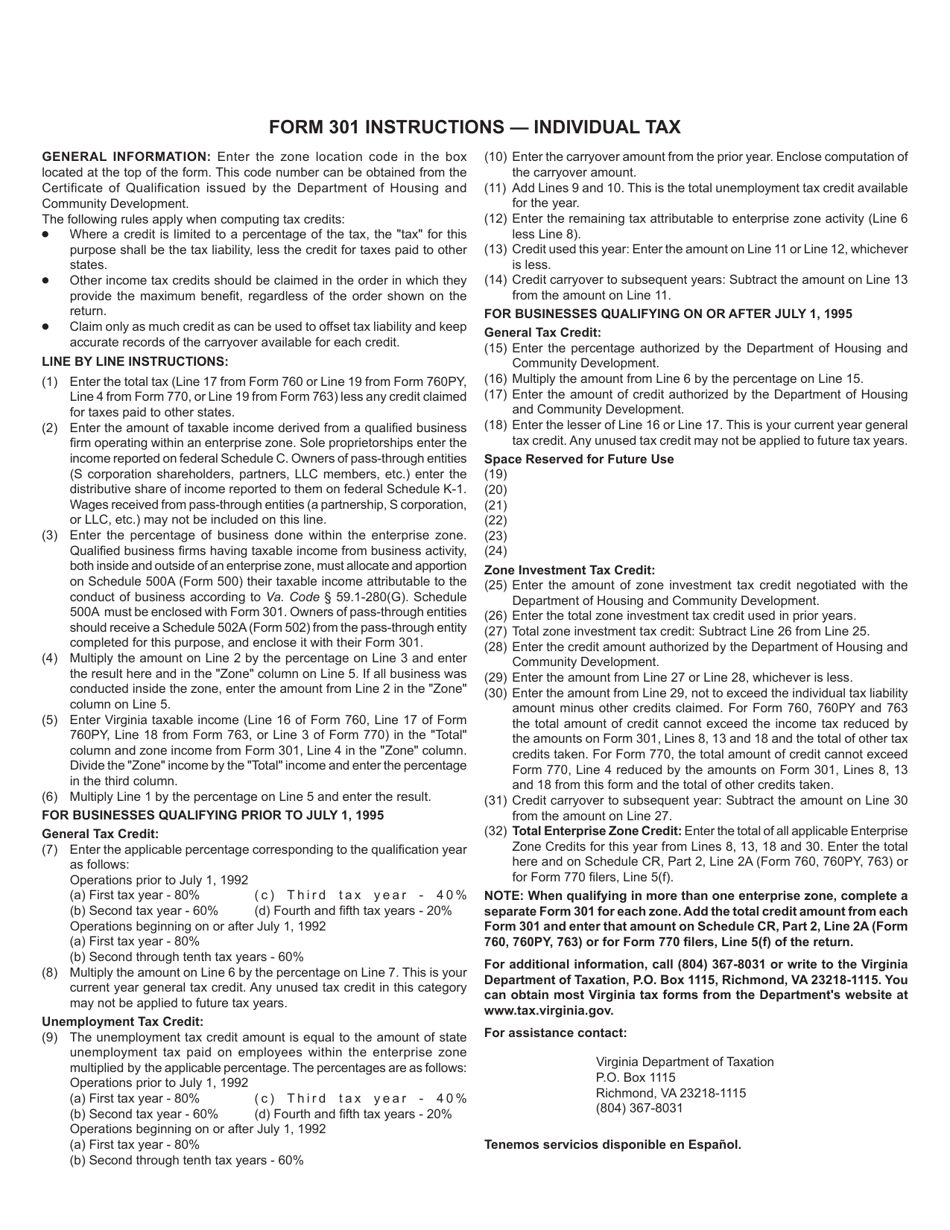

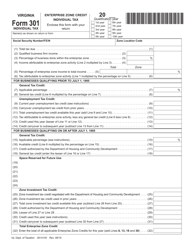

Form 301 Enterprise Zone Credit - Individual Tax - Virginia

What Is Form 301?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 301?

A: Form 301 is a tax form used to claim the Enterprise Zone Credit for individual taxpayers in Virginia.

Q: What is the Enterprise Zone Credit?

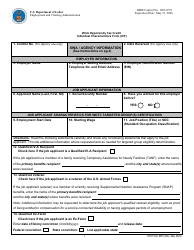

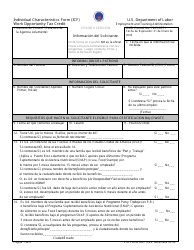

A: The Enterprise Zone Credit is a tax incentive program in Virginia aimed at promoting economic development and job creation in designated enterprise zones.

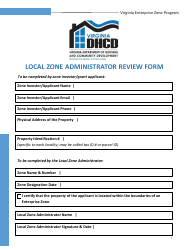

Q: Who is eligible to claim the Enterprise Zone Credit?

A: Individual taxpayers who reside or own a business in a designated enterprise zone in Virginia may be eligible to claim the credit.

Q: How does the Enterprise Zone Credit work?

A: The credit is based on eligible capital investments made by taxpayers in businesses located within the enterprise zone. The credit amount is a percentage of the qualifying investment.

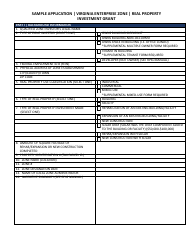

Q: What types of investments qualify for the Enterprise Zone Credit?

A: Qualifying investments may include the purchase or lease of real property, machinery, equipment, and improvements made to existing property.

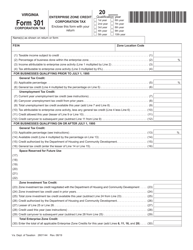

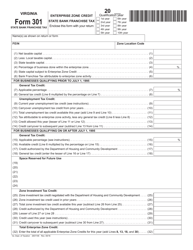

Q: How are Enterprise Zone Credits claimed on Form 301?

A: Taxpayers must provide details and documentation of their qualifying investments on Form 301, including the amount, type of investment, and specific details of the enterprise zone where the investment was made.

Q: Are there any limitations or restrictions on claiming the Enterprise Zone Credit?

A: Yes, there are certain limitations and restrictions, such as a maximum credit amount per taxpayer and requirements related to the creation and retention of jobs within the enterprise zone.

Q: What is the deadline for filing Form 301?

A: Form 301 must be filed with the Virginia Department of Taxation by the due date of the individual's income tax return for the applicable tax year.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 301 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.