This version of the form is not currently in use and is provided for reference only. Download this version of

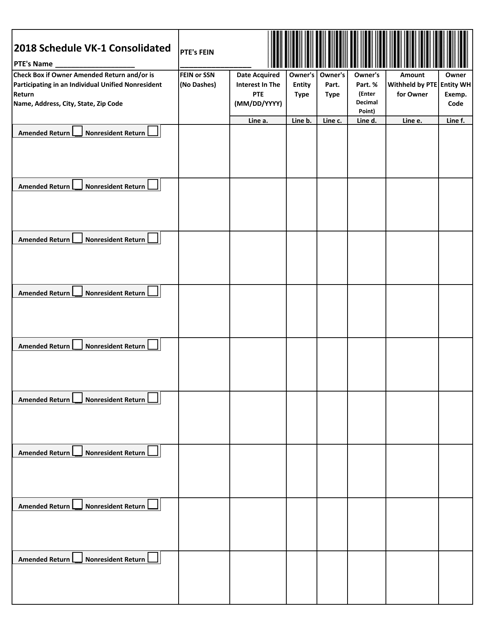

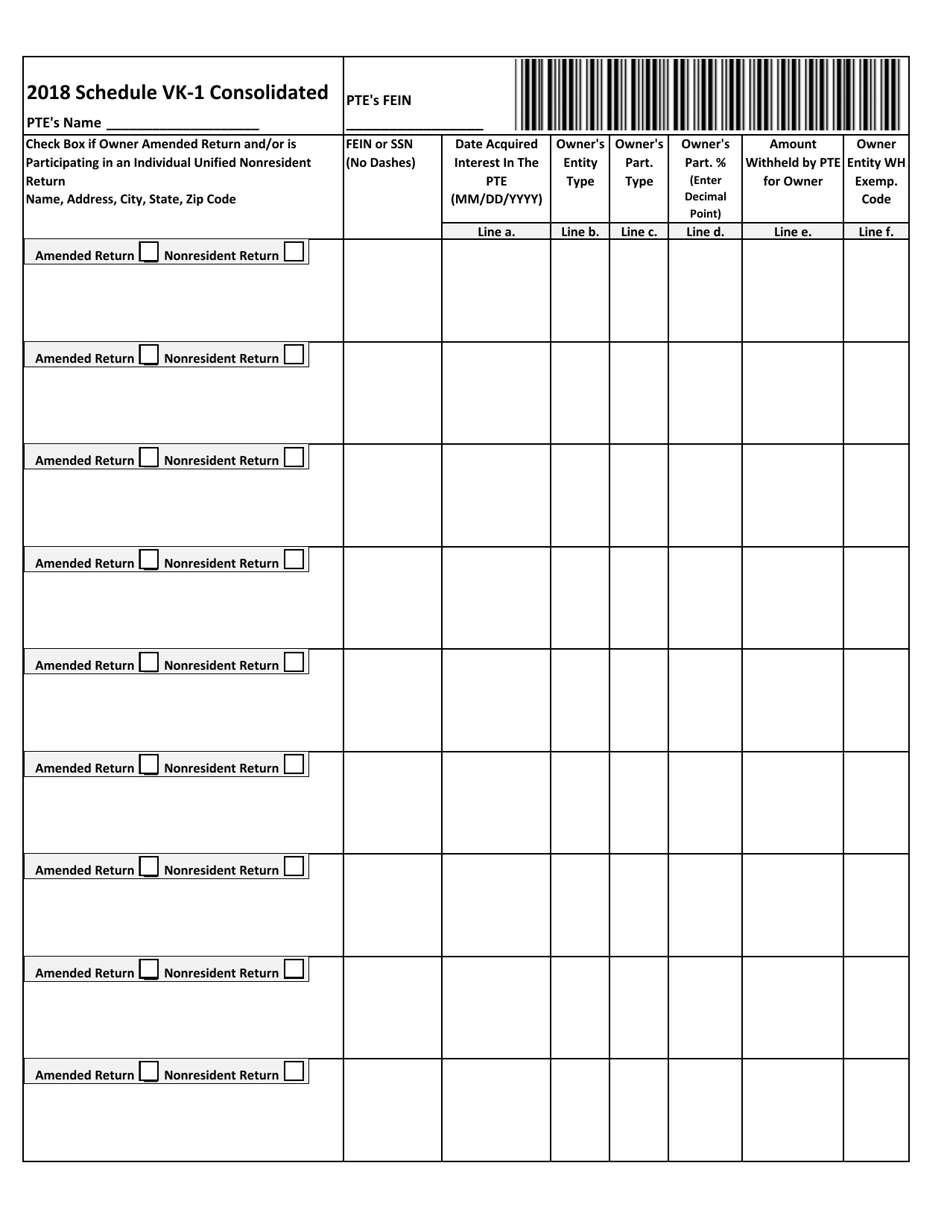

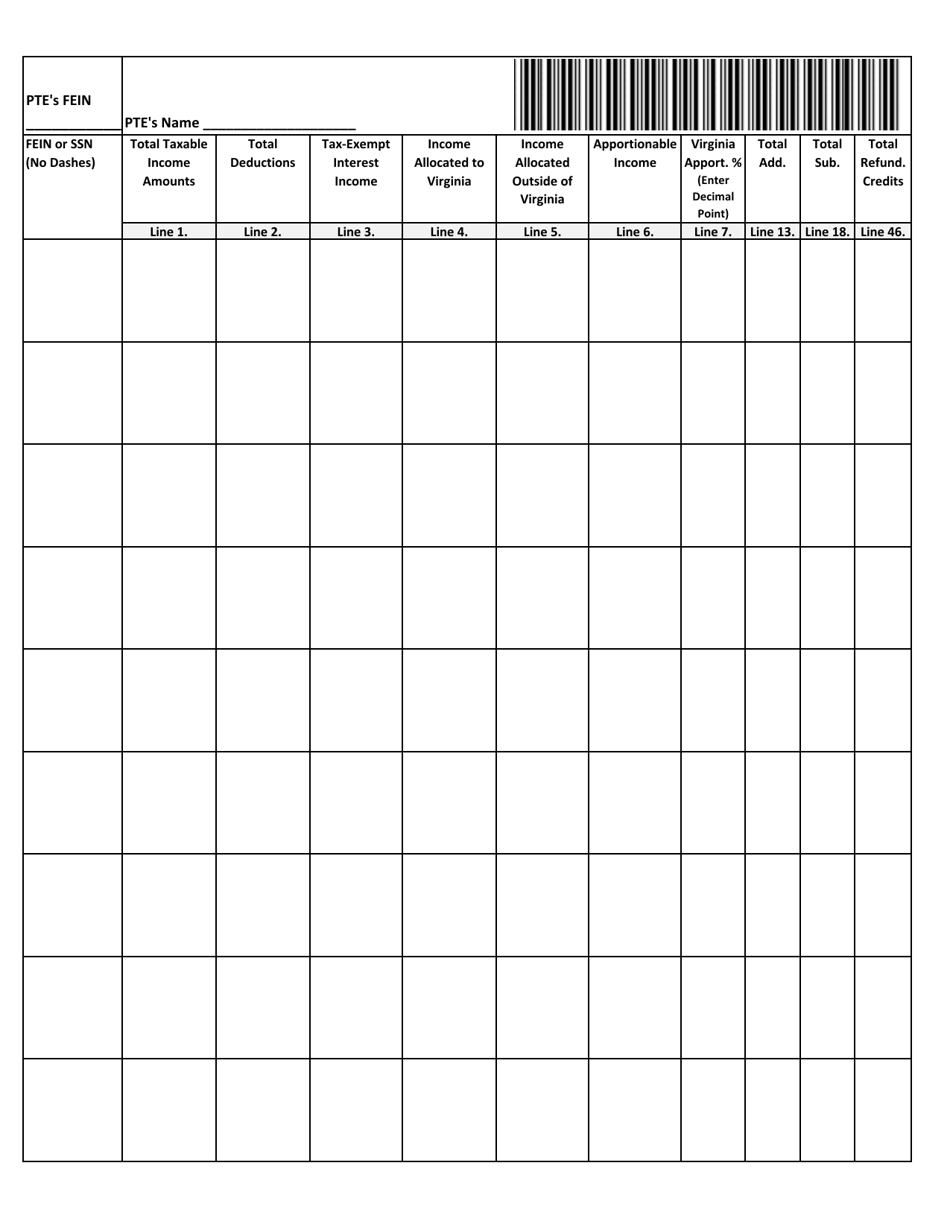

Schedule VK-1 CONSOLIDATED

for the current year.

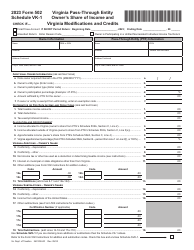

Schedule VK-1 CONSOLIDATED Reporting of Multiple Owners' Shares of Income and Virginia Modifications and Credits - Virginia

What Is Schedule VK-1 CONSOLIDATED?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule VK-1 CONSOLIDATED?

A: Schedule VK-1 CONSOLIDATED is a reporting form used for reporting the shares of income, Virginia modifications, and credits of multiple owners.

Q: Who needs to file Schedule VK-1 CONSOLIDATED?

A: Schedule VK-1 CONSOLIDATED must be filed by companies that have multiple owners or shareholders.

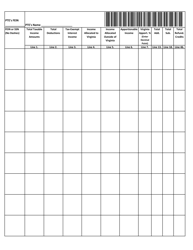

Q: What information is reported on Schedule VK-1 CONSOLIDATED?

A: Schedule VK-1 CONSOLIDATED reports the shares of income, Virginia modifications, and credits for each owner or shareholder.

Q: What is the purpose of filing Schedule VK-1 CONSOLIDATED?

A: The purpose of filing Schedule VK-1 CONSOLIDATED is to accurately report the income, modifications, and credits allocated to each owner or shareholder for tax purposes.

Q: Is Schedule VK-1 CONSOLIDATED specific to Virginia?

A: Yes, Schedule VK-1 CONSOLIDATED is specific to the state of Virginia.

Q: Is Schedule VK-1 CONSOLIDATED required for individual taxpayers?

A: No, Schedule VK-1 CONSOLIDATED is only required for companies with multiple owners or shareholders.

Q: When is Schedule VK-1 CONSOLIDATED due?

A: Schedule VK-1 CONSOLIDATED is typically due by the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing Schedule VK-1 CONSOLIDATED?

A: Yes, failure to file Schedule VK-1 CONSOLIDATED or filing it late may result in penalties and interest.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule VK-1 CONSOLIDATED by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.