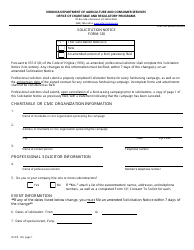

Charitable Solicitation Compliant Form - Virginia

Charitable Solicitation Compliant Form is a legal document that was released by the Virginia Department of Agriculture and Consumer Services - a government authority operating within Virginia.

FAQ

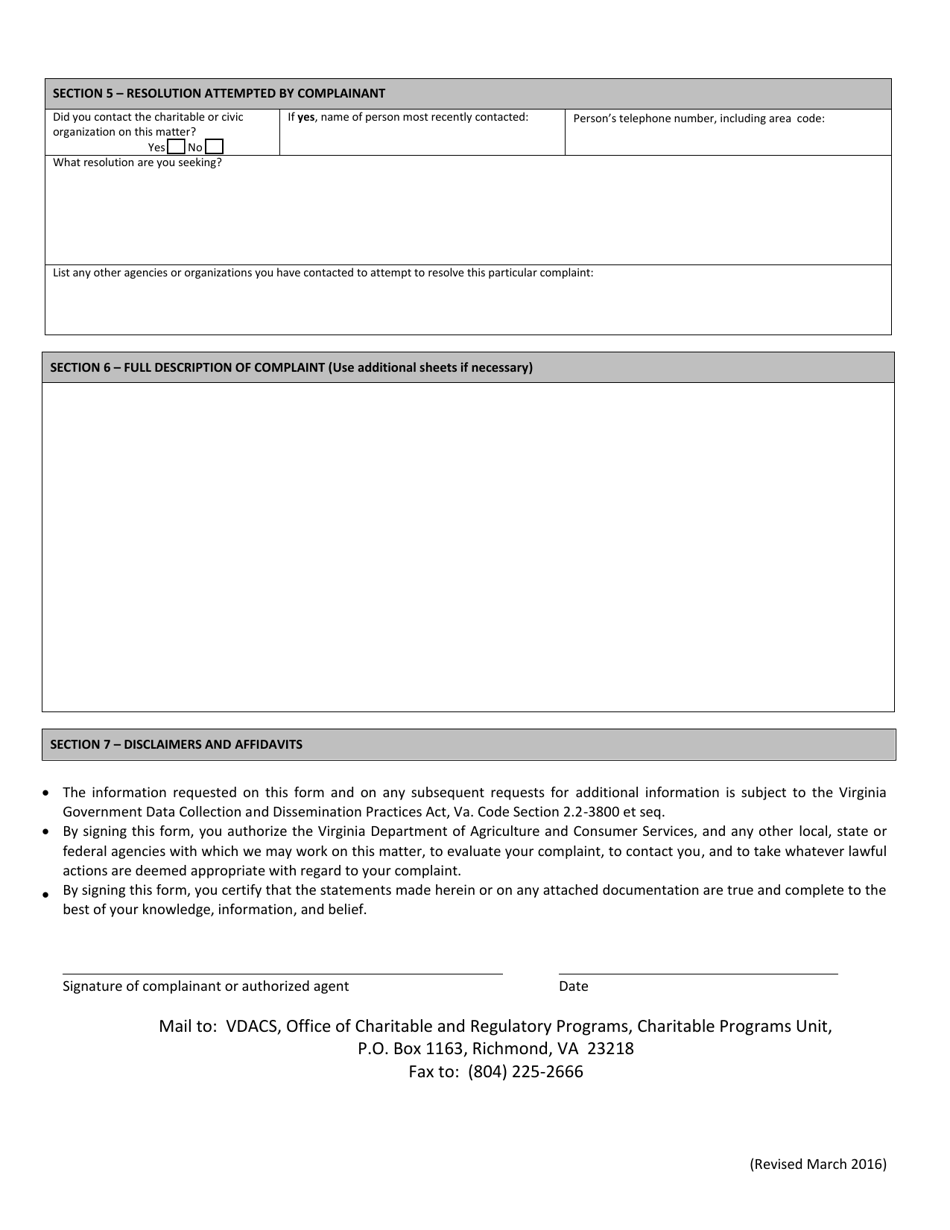

Q: What is a charitable solicitation?

A: Charitable solicitation refers to the act of seeking donations or contributions for a charitable organization.

Q: What does it mean to be compliant with charitable solicitation in Virginia?

A: Being compliant with charitable solicitation in Virginia means following the laws and regulations set forth by the state when seeking donations or contributions for a charitable organization.

Q: Why is it important to be compliant with charitable solicitation in Virginia?

A: It is important to be compliant with charitable solicitation laws in Virginia to maintain the trust and confidence of donors and to ensure transparency and accountability in the use of funds raised for charitable purposes.

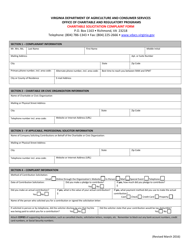

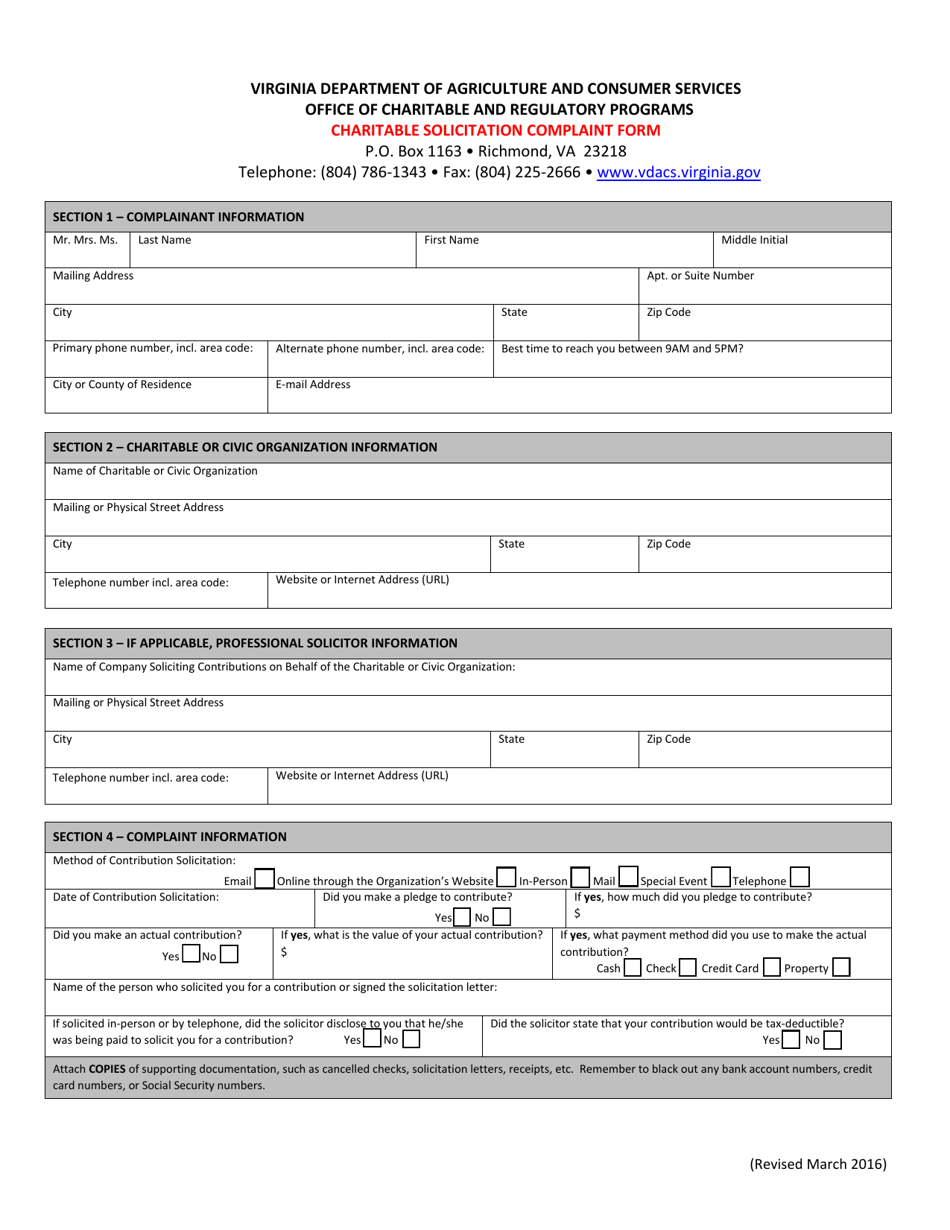

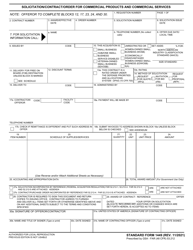

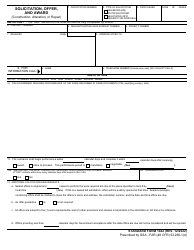

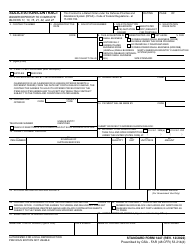

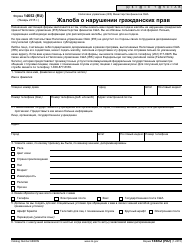

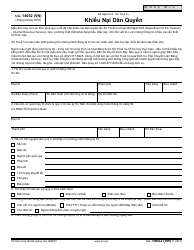

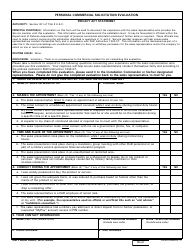

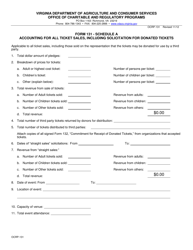

Q: What information is typically required on a charitable solicitation compliant form in Virginia?

A: A charitable solicitation compliant form in Virginia would typically require information about the charitable organization, its purpose, the services it provides, financial statements, and any fees or percentages deducted from contributions.

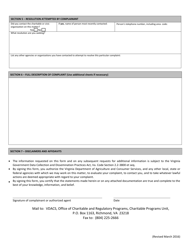

Q: Are there any fees or percentages that can be deducted from contributions in Virginia?

A: In Virginia, fees or percentages deducted from contributions are subject to specific regulations and must be disclosed on the charitable solicitation compliant form.

Form Details:

- Released on March 1, 2016;

- The latest edition currently provided by the Virginia Department of Agriculture and Consumer Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Agriculture and Consumer Services.