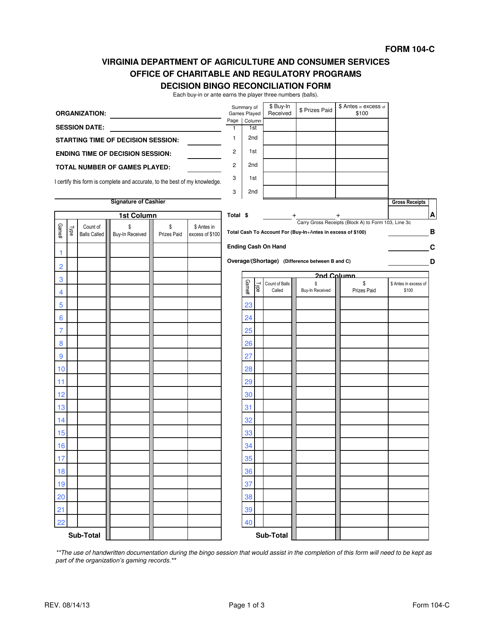

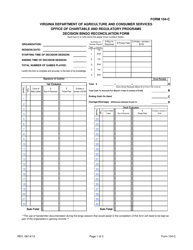

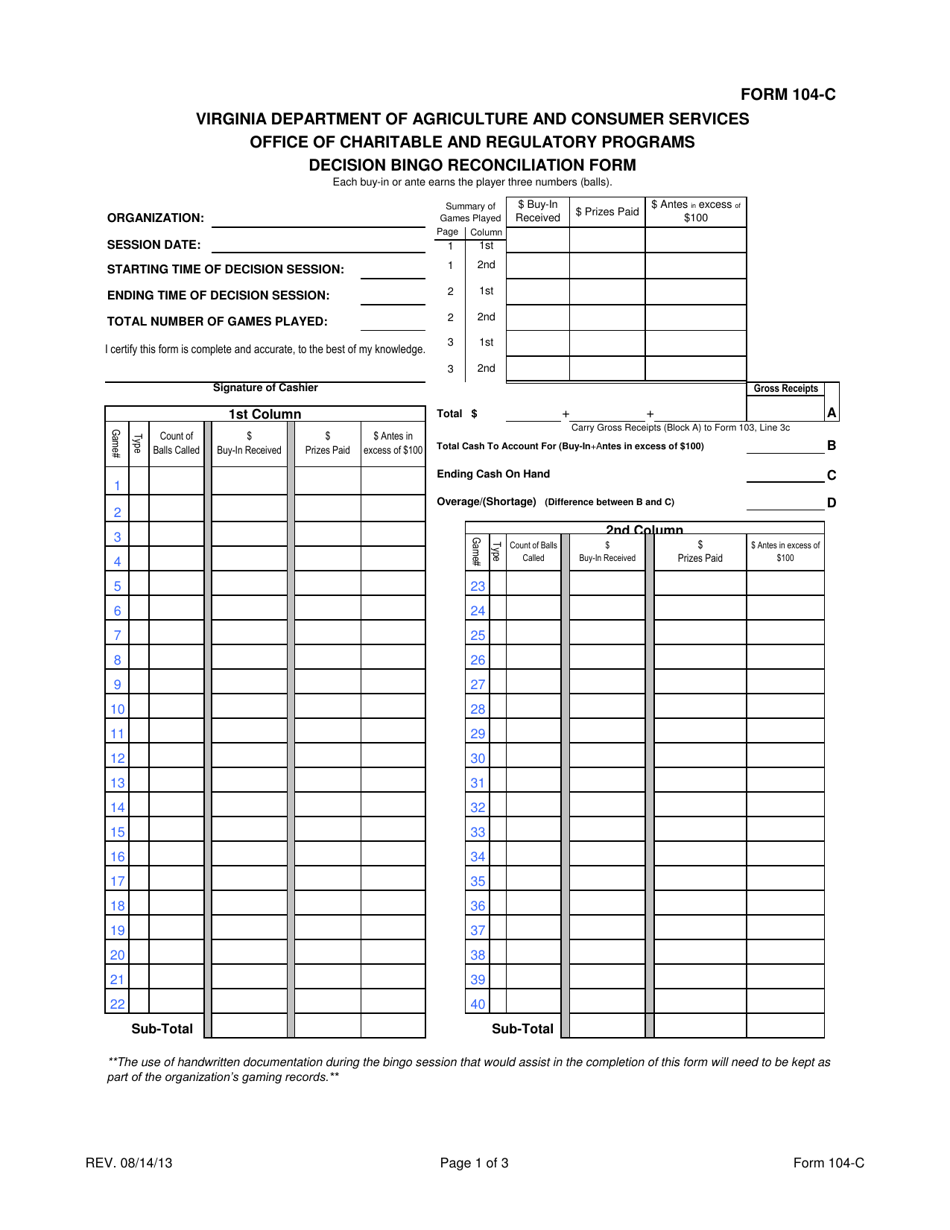

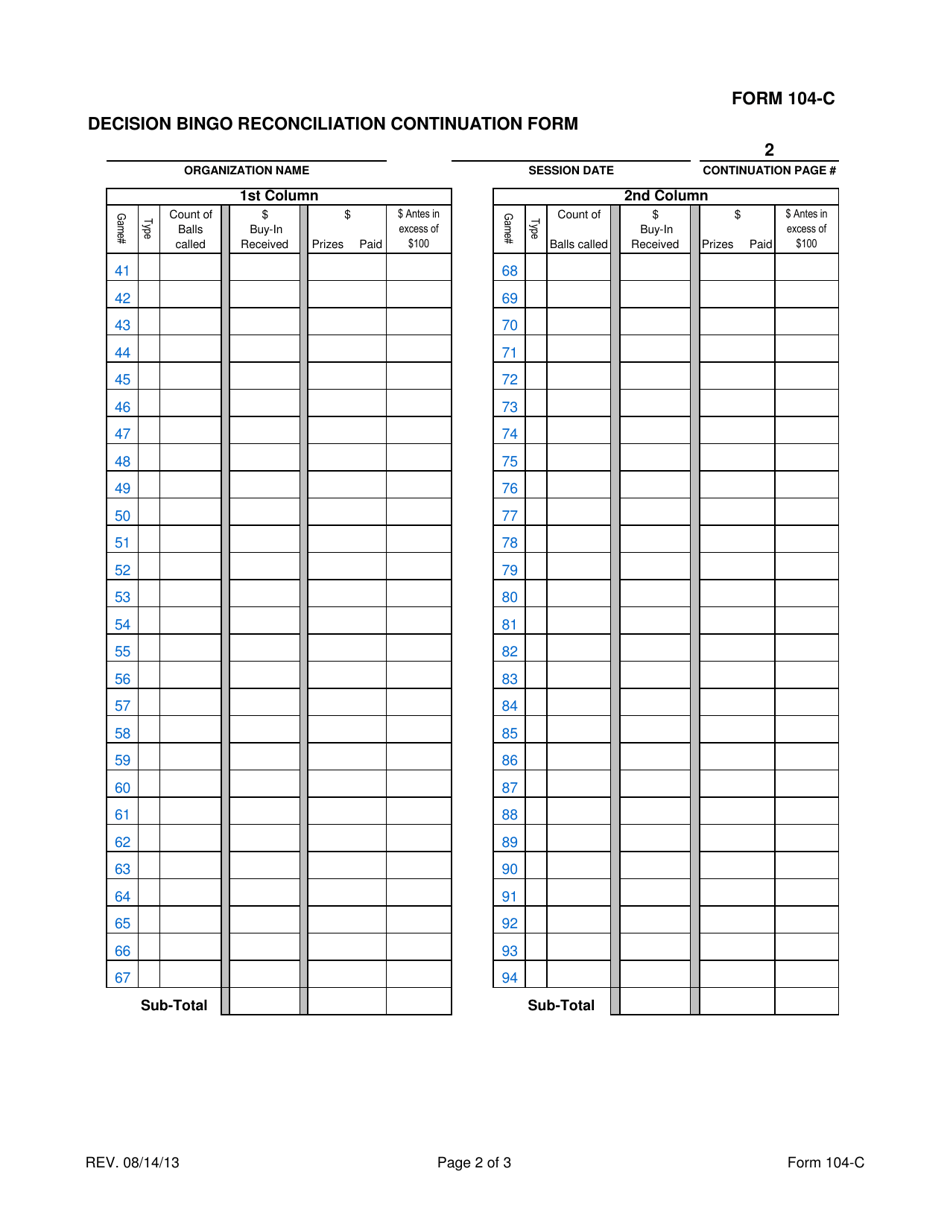

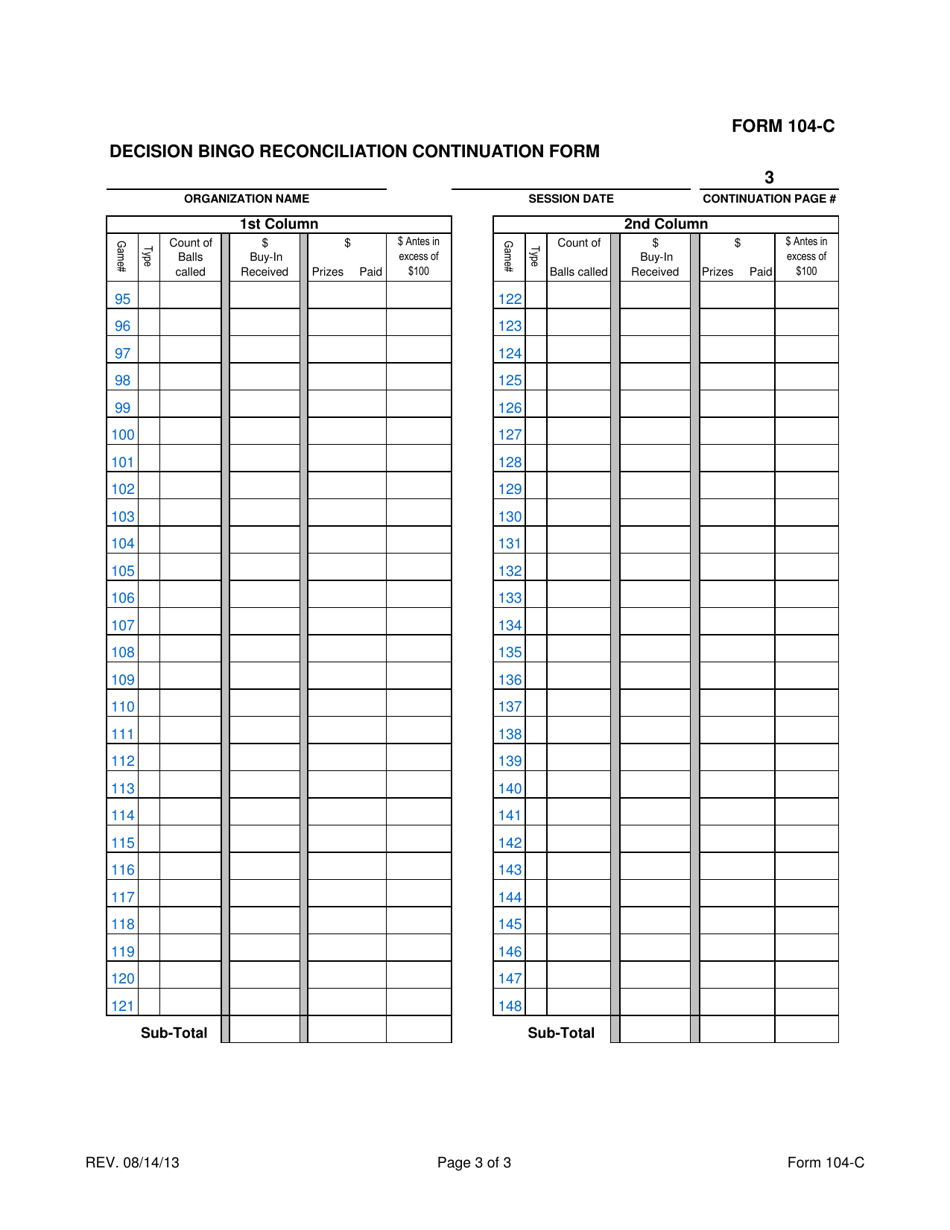

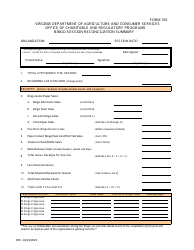

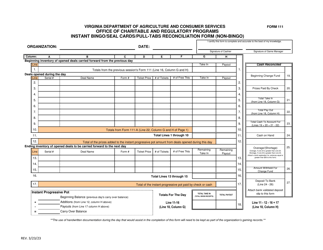

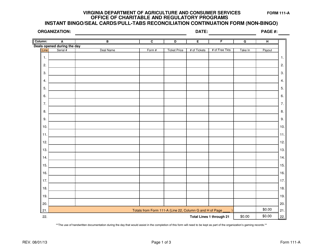

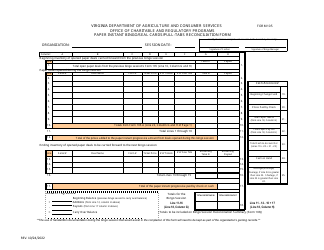

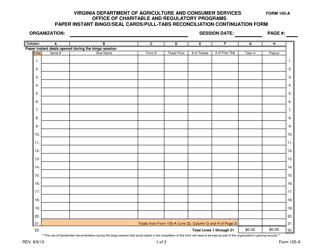

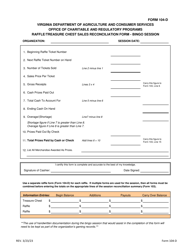

Form 104-C Decision Bingo Reconciliation Form - Virginia

What Is Form 104-C?

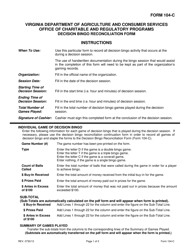

This is a legal form that was released by the Virginia Department of Agriculture and Consumer Services - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 104-C?

A: Form 104-C is the Decision Bingo Reconciliation Form.

Q: What is the purpose of Form 104-C?

A: The purpose of Form 104-C is to reconcile bingo games and report the results to the Virginia Department of Taxation.

Q: Who needs to file Form 104-C?

A: Organizations or individuals who conduct bingo games in Virginia need to file Form 104-C.

Q: When is Form 104-C due?

A: Form 104-C is due on or before the 20th day of the month following the end of the reporting period.

Q: What information is required on Form 104-C?

A: Form 104-C requires information about the total number of games played, the total amount of receipts, prizes paid, and allowable expenses.

Form Details:

- Released on August 14, 2013;

- The latest edition provided by the Virginia Department of Agriculture and Consumer Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 104-C by clicking the link below or browse more documents and templates provided by the Virginia Department of Agriculture and Consumer Services.