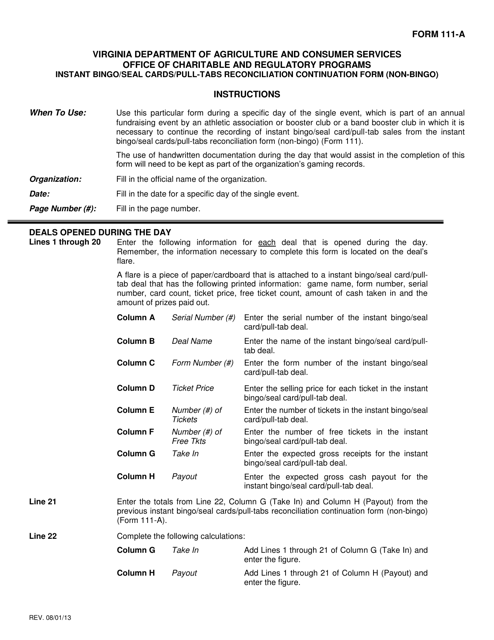

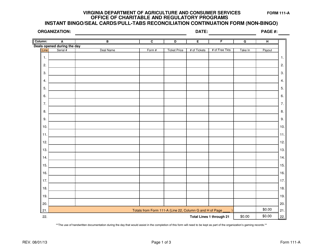

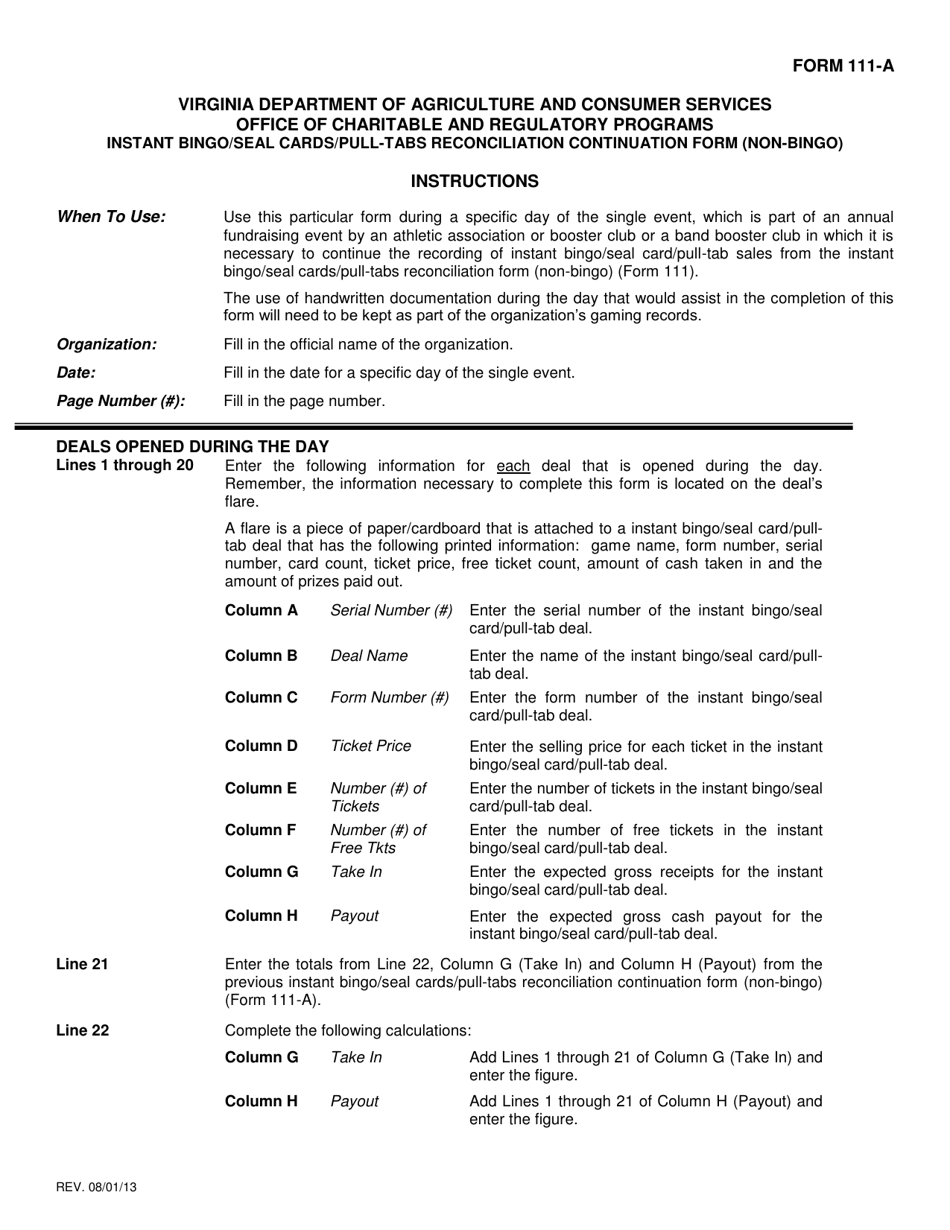

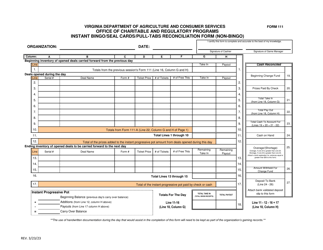

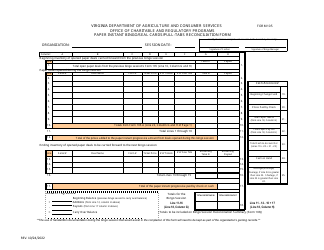

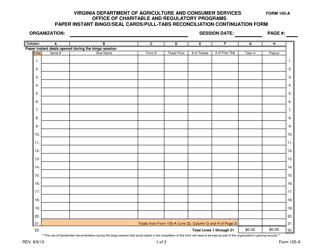

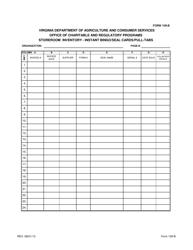

Instructions for Form 111-A Instant Bingo / Seal Cards / Pull-Tabs Reconciliation Continuation Form (Non-bingo) - Virginia

This document contains official instructions for Form 111-A , Instant Bingo/Seal Cards/Pull-Tabs Reconciliation Continuation Form (Non-bingo) - a form released and collected by the Virginia Department of Agriculture and Consumer Services. An up-to-date fillable Form 111-A is available for download through this link.

FAQ

Q: What is Form 111-A?

A: Form 111-A is a reconciliation continuation form for Instant Bingo/Seal Cards/Pull-Tabs in Virginia.

Q: What is the purpose of Form 111-A?

A: The purpose of Form 111-A is to provide a detailed record of Instant Bingo/Seal Cards/Pull-Tabs sales, expenses, and prizes.

Q: Who needs to file Form 111-A?

A: Anyone who is involved in the sale and distribution of Instant Bingo/Seal Cards/Pull-Tabs in Virginia needs to file Form 111-A.

Q: What information is required on Form 111-A?

A: Form 111-A requires information such as the organization's name, address, sales figures, prize payouts, and other related financial information.

Q: Is there a deadline for filing Form 111-A?

A: Yes, Form 111-A must be filed by the due date specified by the Virginia Department of Taxation.

Q: Are there any penalties for not filing Form 111-A?

A: Yes, there may be penalties for failing to file Form 111-A or for filing it late, as determined by the Virginia Department of Taxation.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Agriculture and Consumer Services.