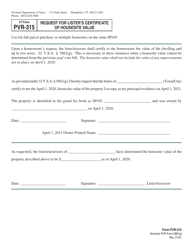

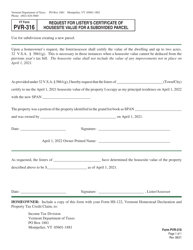

This version of the form is not currently in use and is provided for reference only. Download this version of

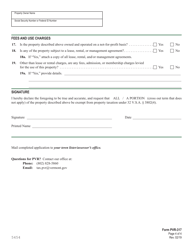

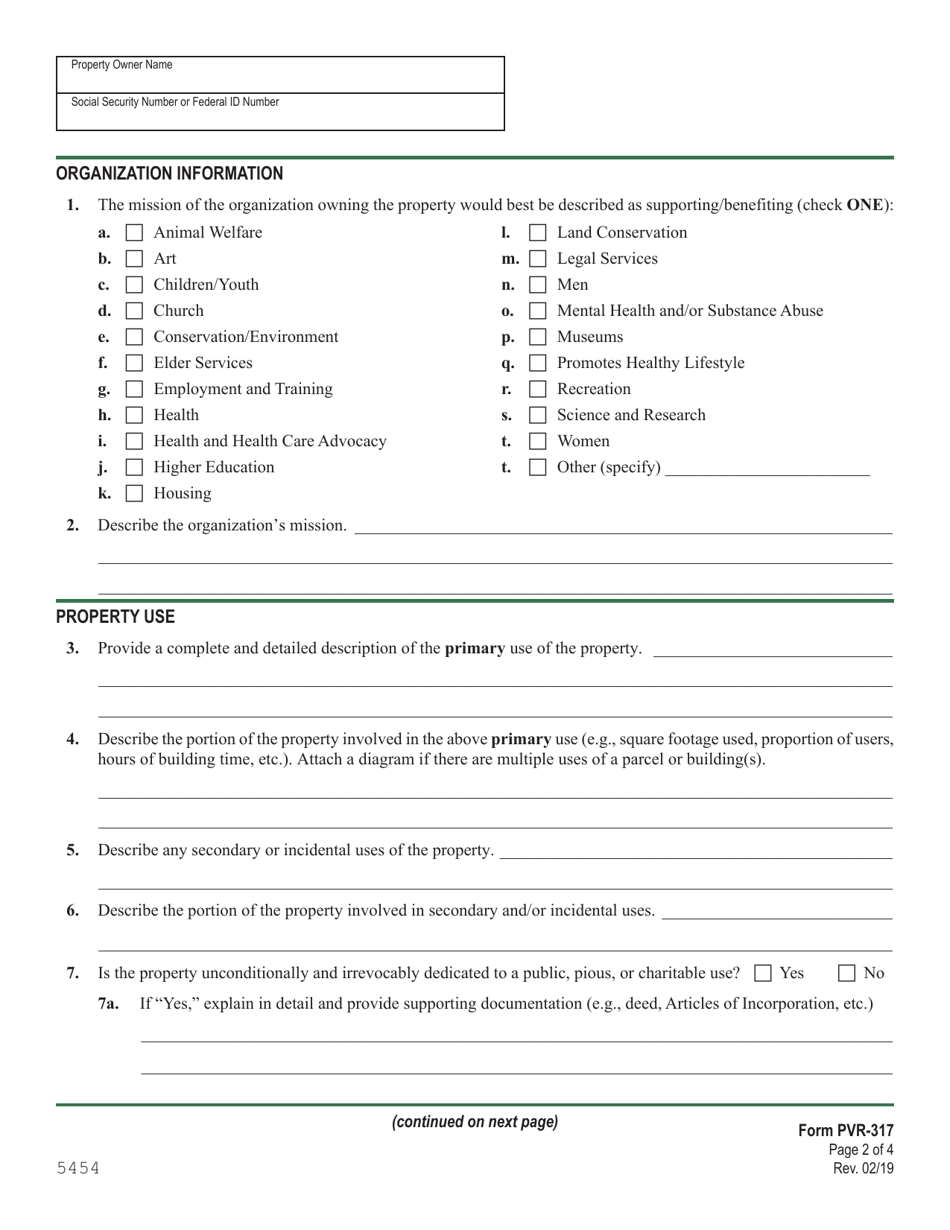

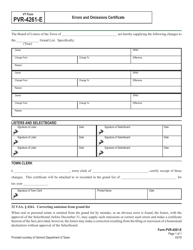

VT Form PVR-317

for the current year.

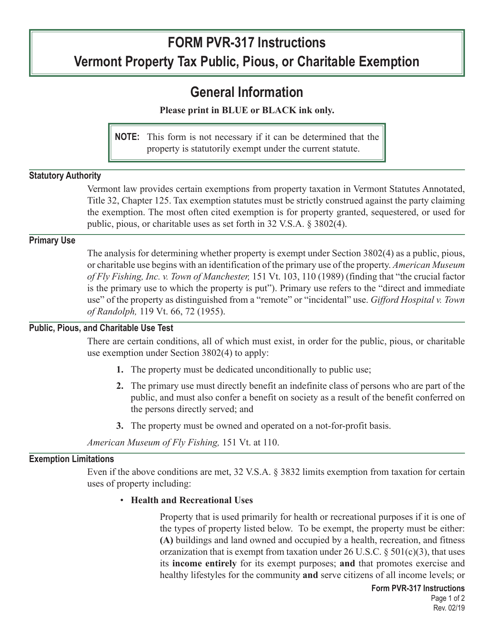

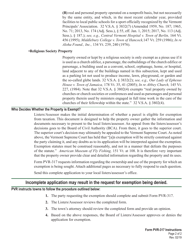

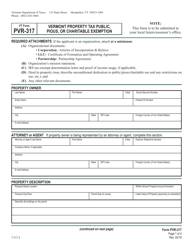

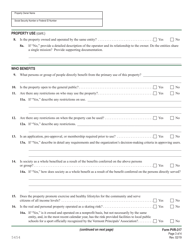

VT Form PVR-317 Vermont Property Tax Public, Pious, or Charitable Exemption - Vermont

What Is VT Form PVR-317?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form PVR-317?

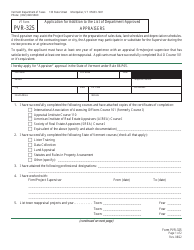

A: VT Form PVR-317 is the form used in Vermont to apply for the Property Tax Public, Pious, or Charitable Exemption.

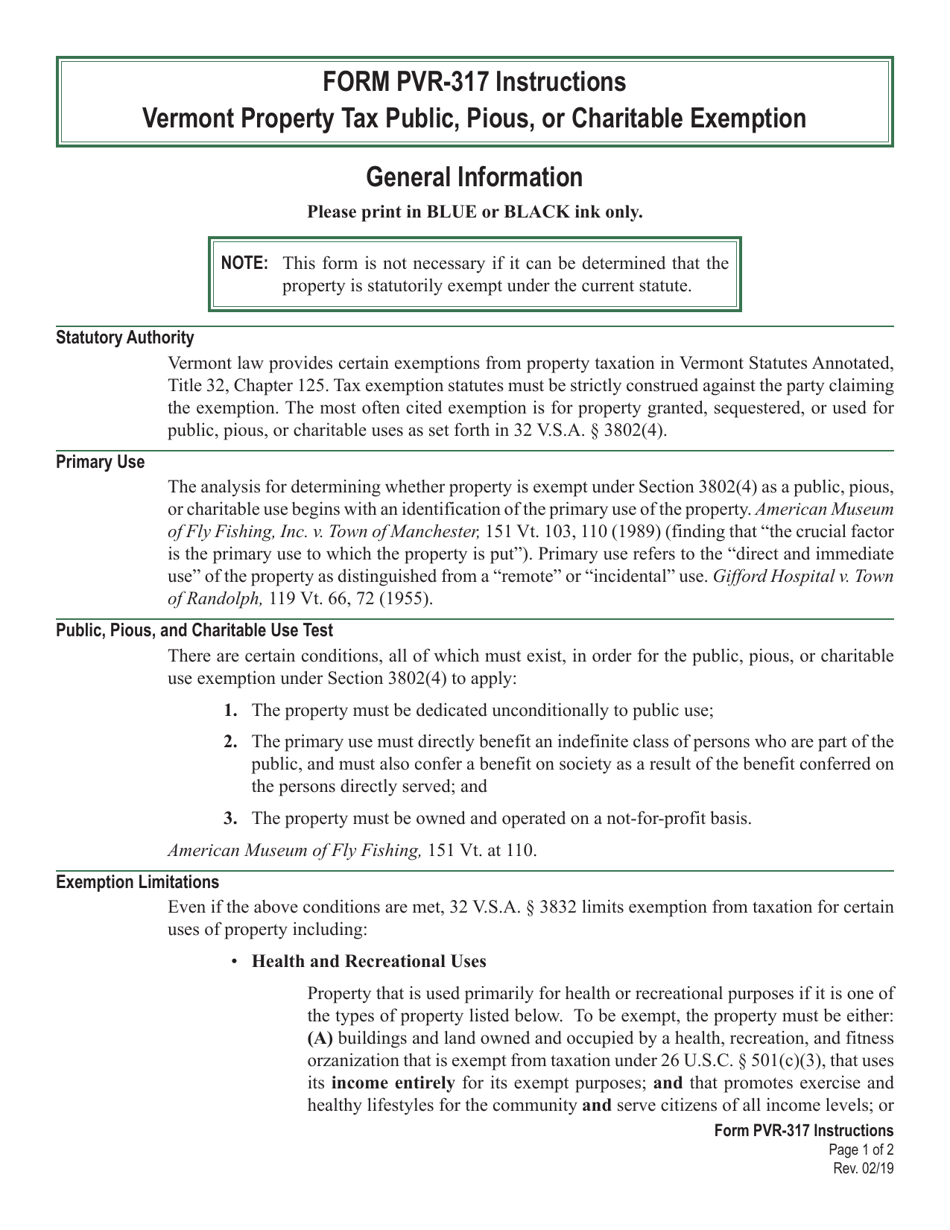

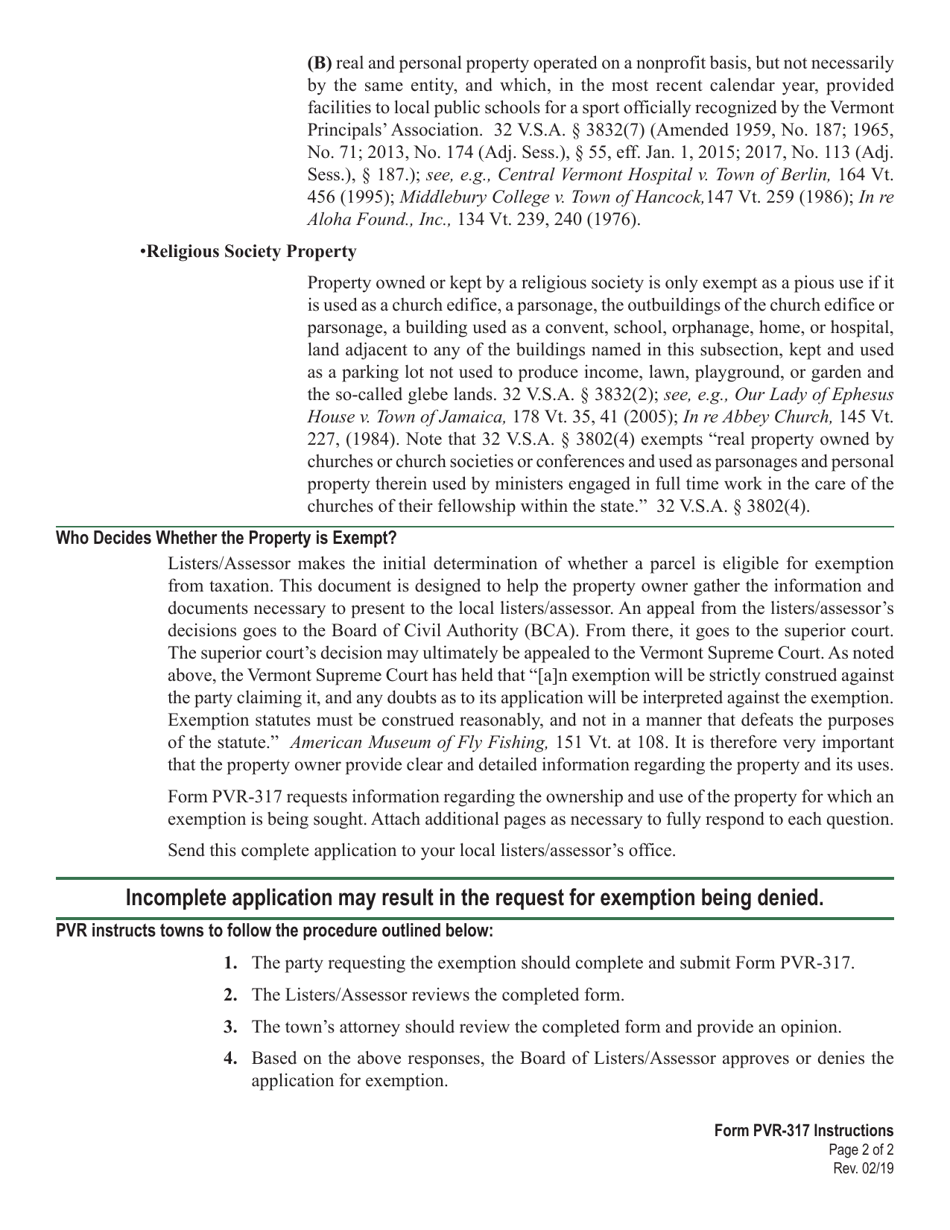

Q: What is the Property Tax Public, Pious, or Charitable Exemption?

A: The Property Tax Public, Pious, or Charitable Exemption in Vermont is a program that provides property tax relief for certain eligible properties used for public, religious, or charitable purposes.

Q: Who is eligible for the Property Tax Public, Pious, or Charitable Exemption?

A: Eligibility for the Property Tax Public, Pious, or Charitable Exemption in Vermont is determined by the use of the property for public, religious, or charitable purposes.

Q: How do I apply for the Property Tax Public, Pious, or Charitable Exemption?

A: To apply for the Property Tax Public, Pious, or Charitable Exemption in Vermont, you need to fill out and submit VT Form PVR-317 to the Vermont Department of Taxes.

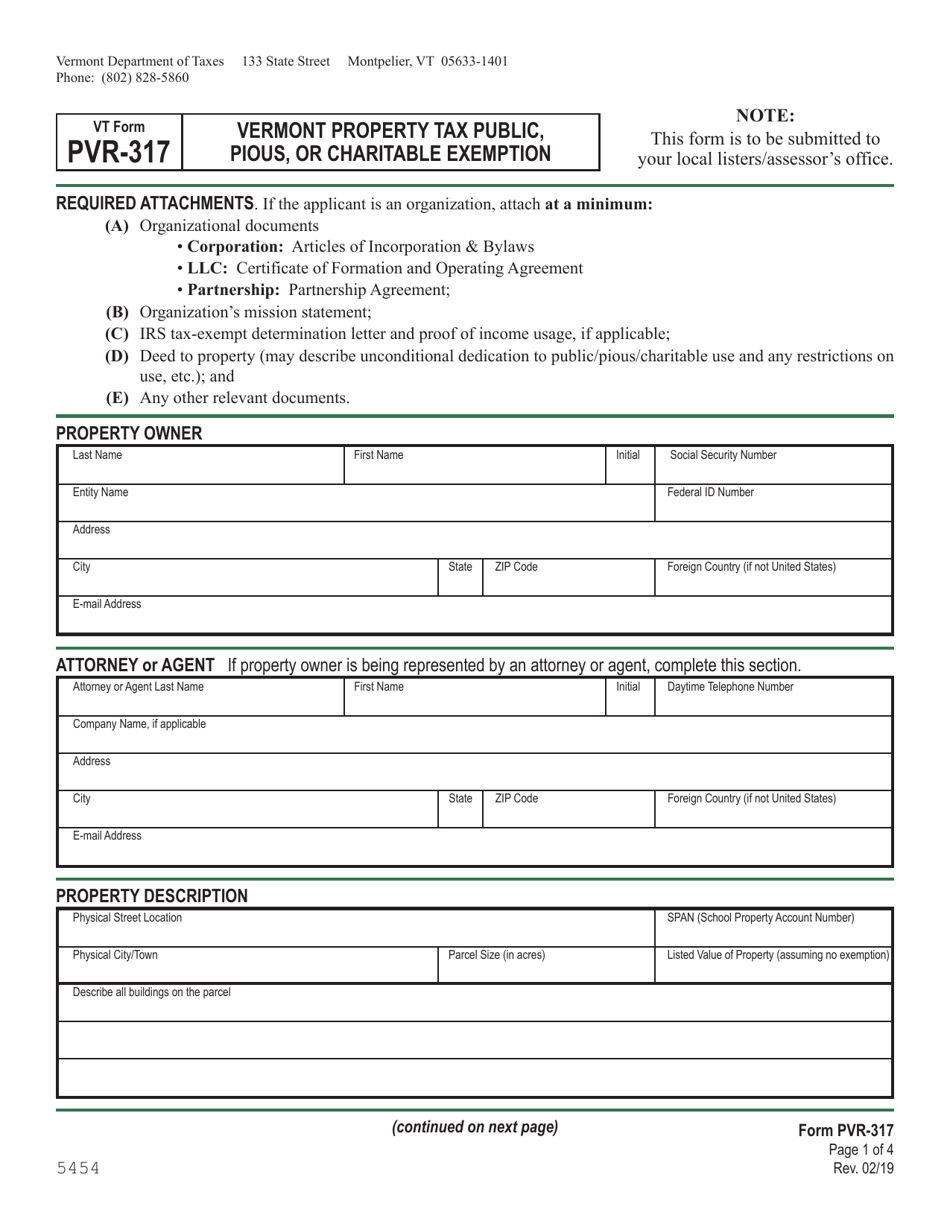

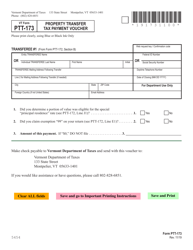

Q: What documents do I need to submit with VT Form PVR-317?

A: The specific documents required may vary depending on the nature of the property and its use. It is recommended to review the instructions provided with VT Form PVR-317 or contact the Vermont Department of Taxes for guidance.

Q: Is there a deadline to submit VT Form PVR-317?

A: Yes, VT Form PVR-317 must be submitted by the April 1st deadline each year to be considered for the Property Tax Public, Pious, or Charitable Exemption for that tax year.

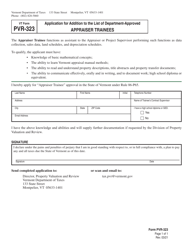

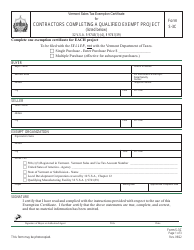

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form PVR-317 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.