This version of the form is not currently in use and is provided for reference only. Download this version of

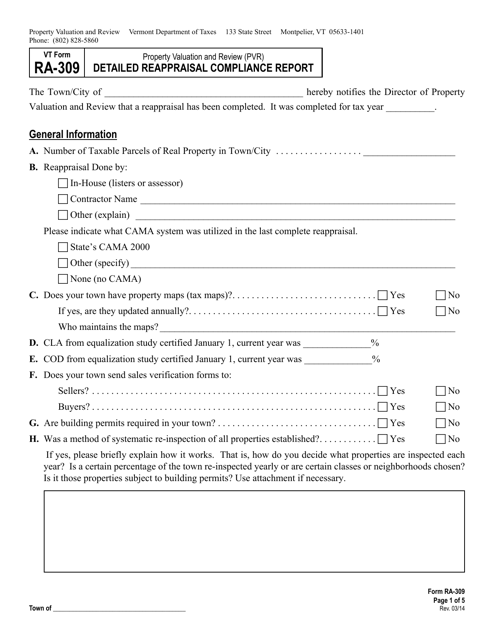

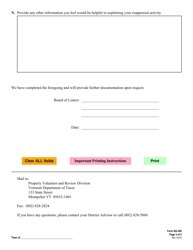

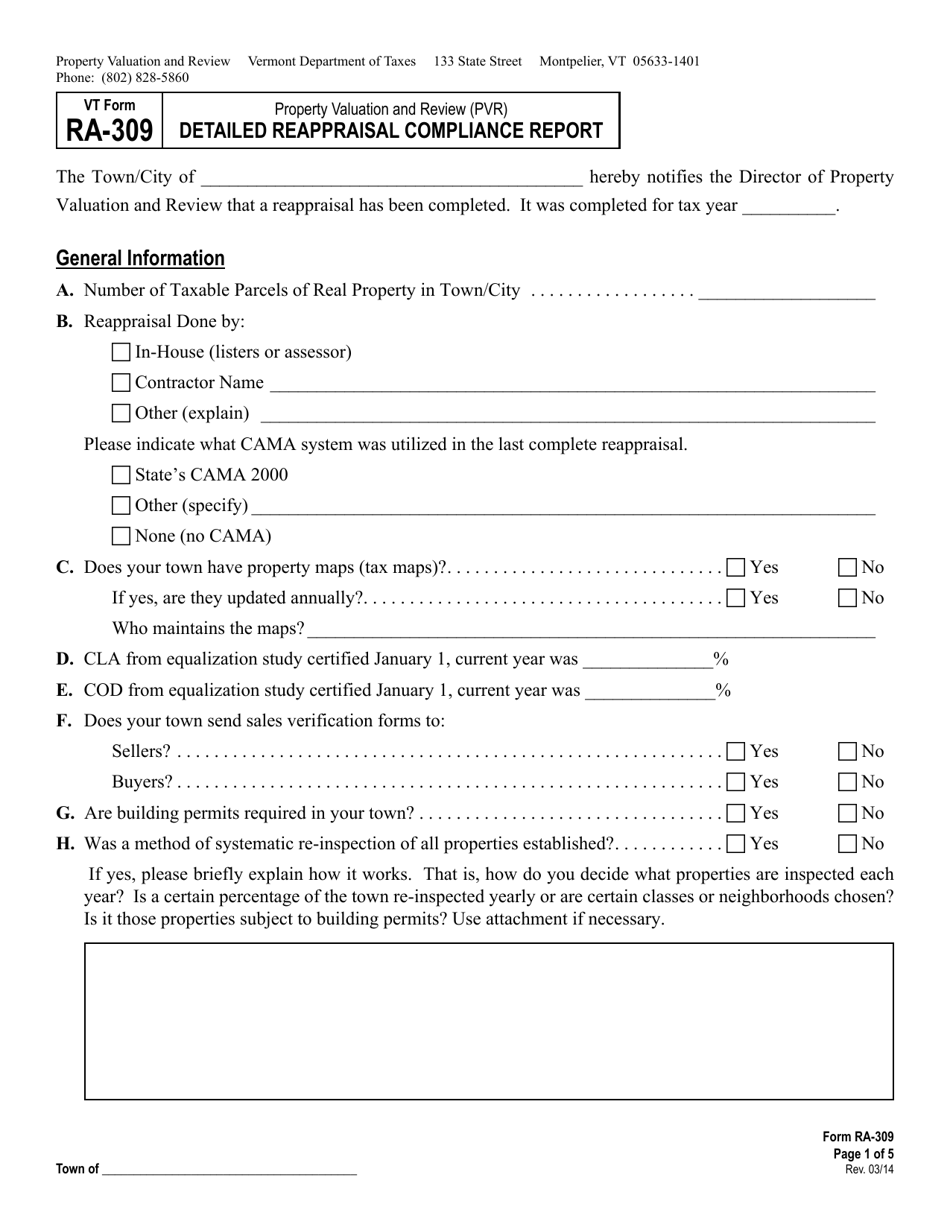

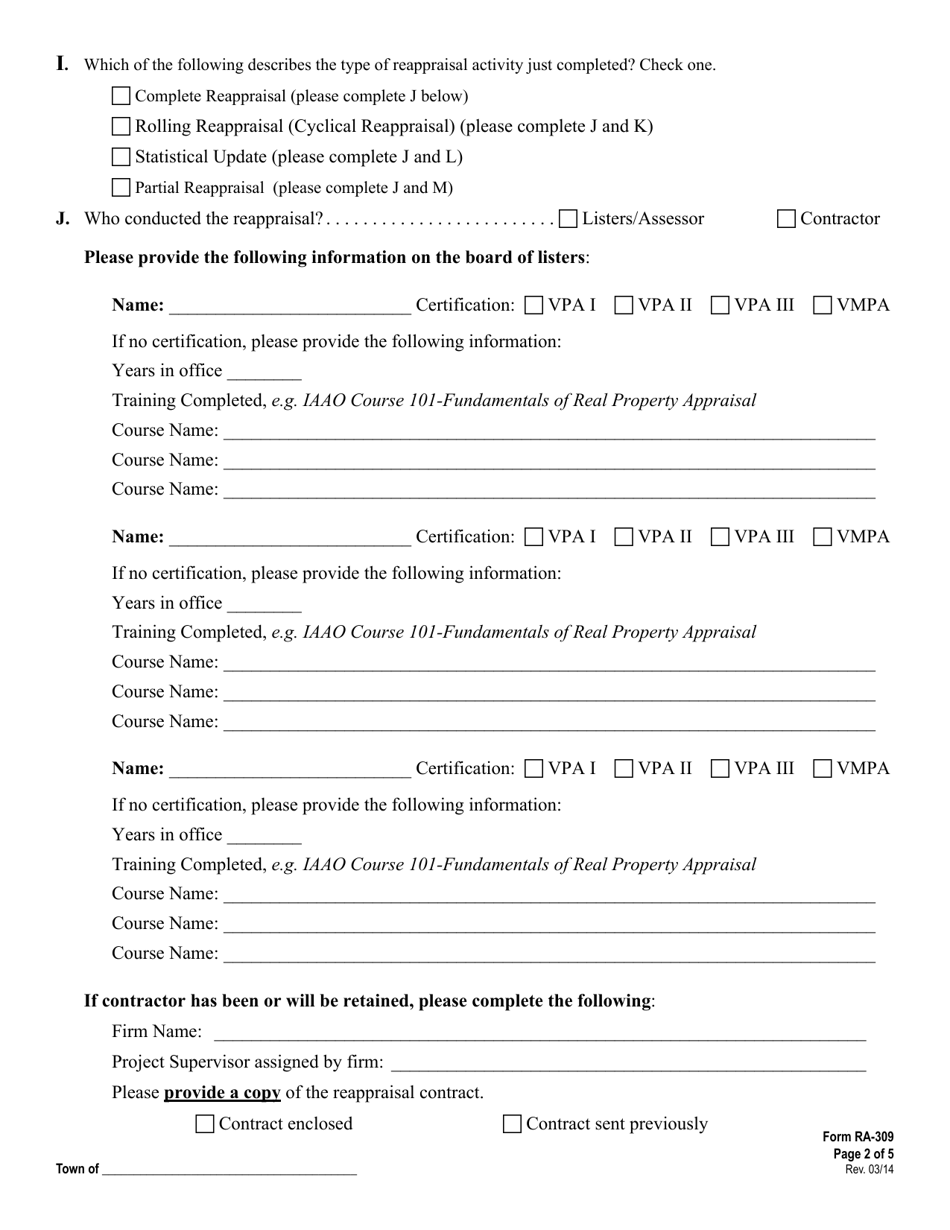

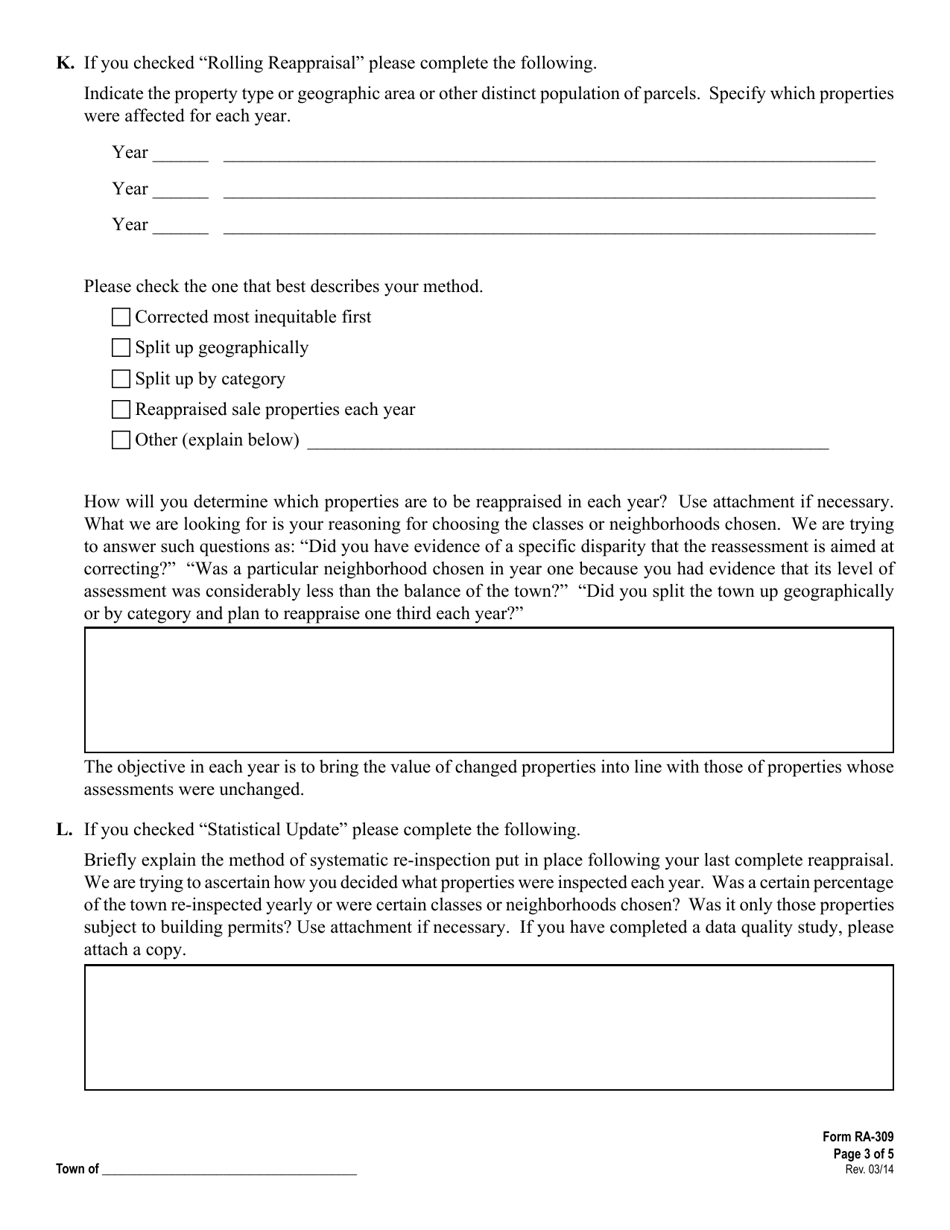

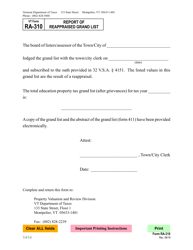

VT Form RA-309

for the current year.

VT Form RA-309 Detailed Reappraisal Compliance Report - Vermont

What Is VT Form RA-309?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form RA-309?

A: VT Form RA-309 is the Detailed Reappraisal Compliance Report used in Vermont.

Q: What is the purpose of the VT Form RA-309?

A: The VT Form RA-309 is used to report detailed compliance with the reappraisal requirements in Vermont.

Q: Who uses the VT Form RA-309?

A: The VT Form RA-309 is used by assessors and appraisal firms in Vermont.

Q: What is a Detailed Reappraisal Compliance Report?

A: A Detailed Reappraisal Compliance Report is a report that provides detailed information on the compliance of a reappraisal process with specific requirements.

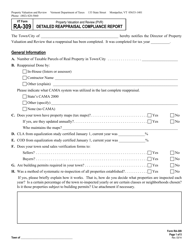

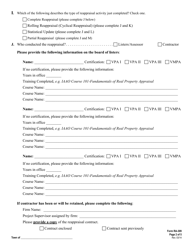

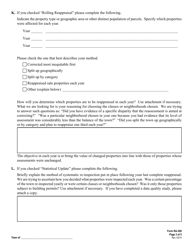

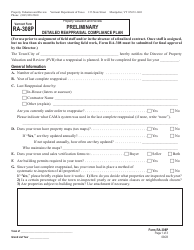

Q: What information is included in the VT Form RA-309?

A: The VT Form RA-309 includes information on the assessment process, data collection, sales ratio studies, appraisal methodology, and other relevant details.

Q: Are there any filing deadlines for the VT Form RA-309?

A: Yes, there are specific filing deadlines for the VT Form RA-309. It is important to check with the Vermont Department of Taxes for the current deadlines.

Q: What are the consequences of not filing the VT Form RA-309?

A: Failure to file the VT Form RA-309 or non-compliance with the reappraisal requirements may result in penalties or other enforcement actions.

Q: Is the VT Form RA-309 the only report required for reappraisal compliance in Vermont?

A: No, there may be additional reports or documentation required for reappraisal compliance in Vermont. It is important to consult the Vermont Department of Taxes for the complete requirements.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form RA-309 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.