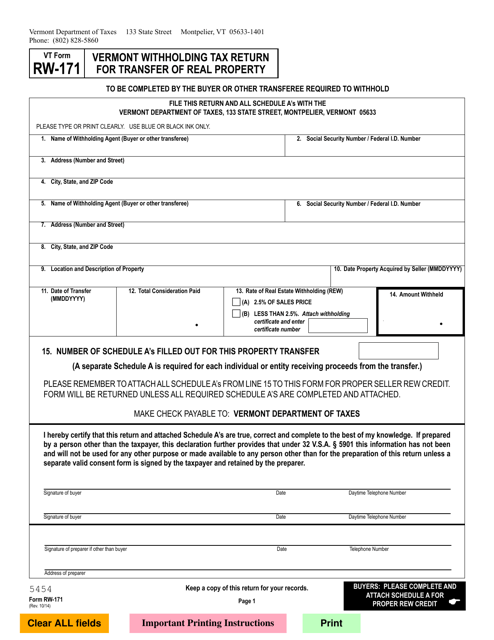

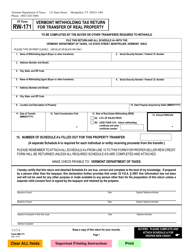

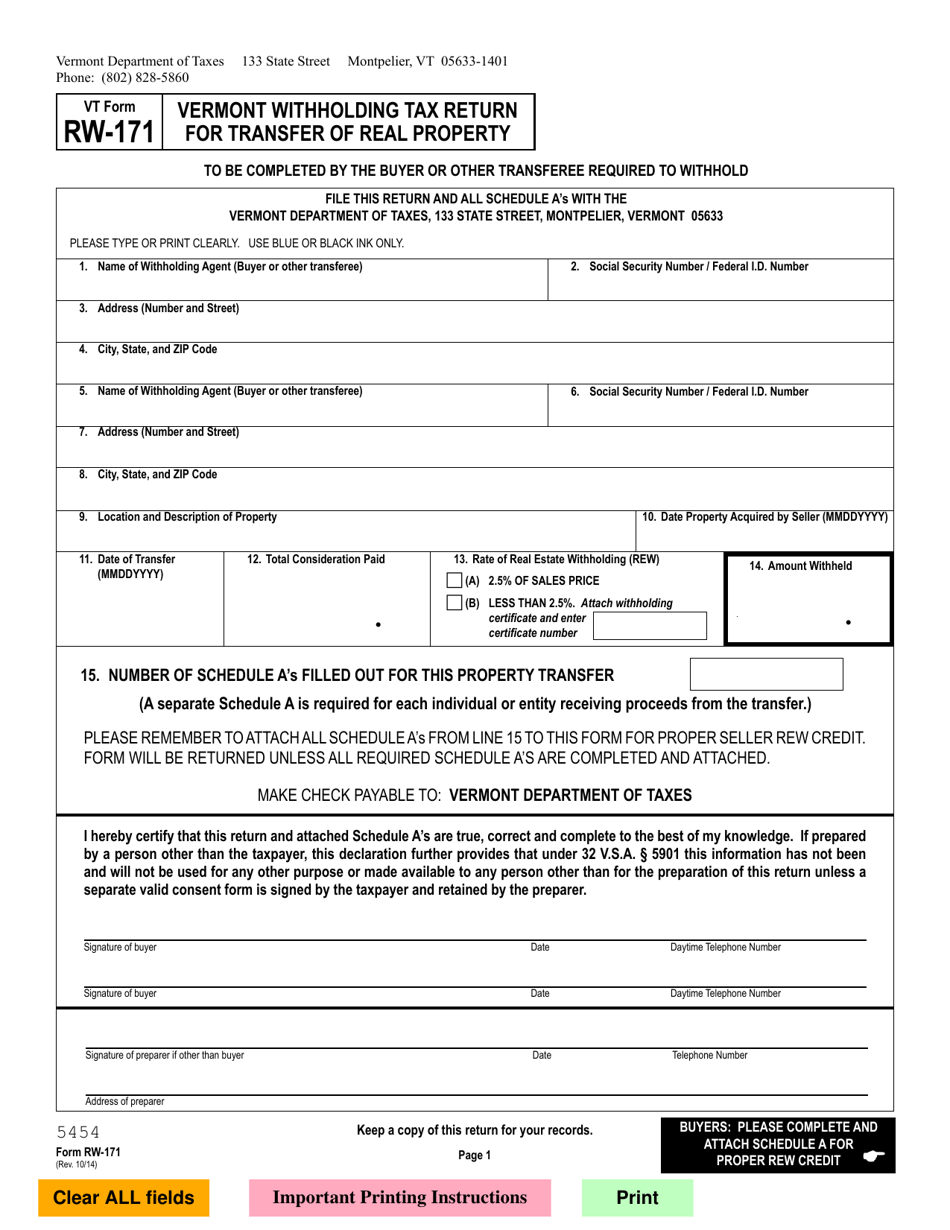

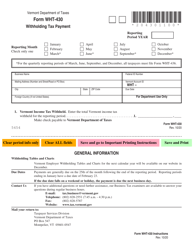

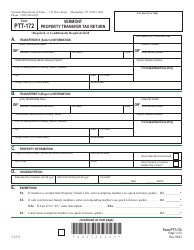

VT Form RW-171 Vermont Withholding Tax Return for Transfer of Real Property - Vermont

What Is VT Form RW-171?

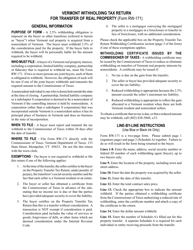

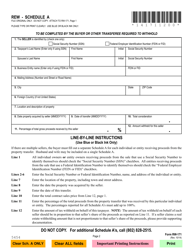

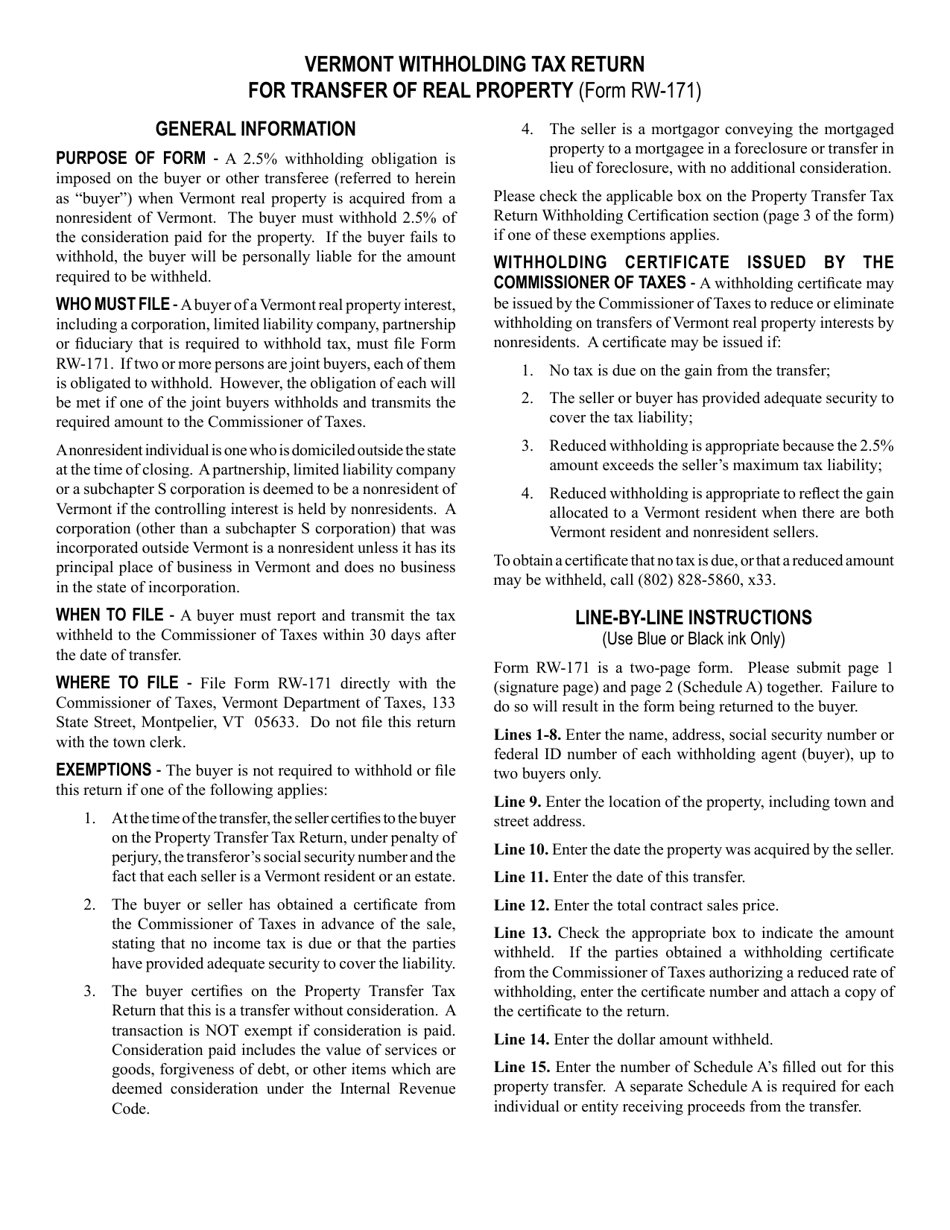

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form RW-171?

A: VT Form RW-171 is the Vermont Withholding Tax Return for Transfer of Real Property.

Q: Who needs to file VT Form RW-171?

A: Anyone who is transferring real property in Vermont may need to file VT Form RW-171.

Q: What is the purpose of VT Form RW-171?

A: The purpose of VT Form RW-171 is to report and remit the withholding tax on the transfer of real property in Vermont.

Q: When is VT Form RW-171 due?

A: VT Form RW-171 is due on or before the date of transfer of the real property.

Q: Are there any penalties for not filing VT Form RW-171?

A: Yes, there are penalties for not filing VT Form RW-171, including interest charges and potential legal action.

Q: Can I file VT Form RW-171 electronically?

A: Yes, you can file VT Form RW-171 electronically through the Vermont Department of Taxes e-file system.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form RW-171 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.