This version of the form is not currently in use and is provided for reference only. Download this version of

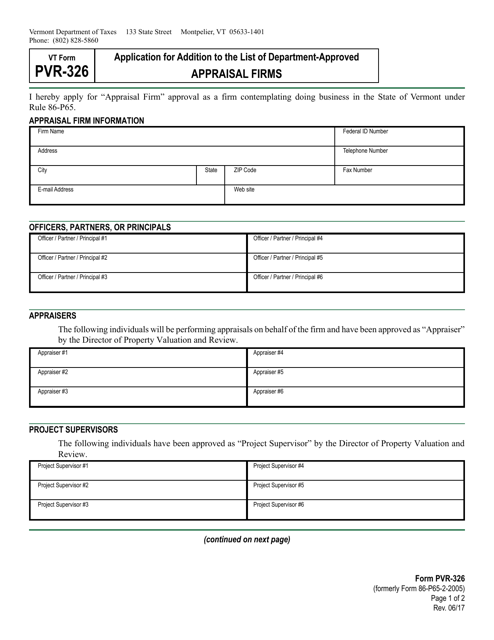

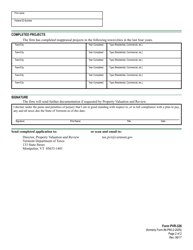

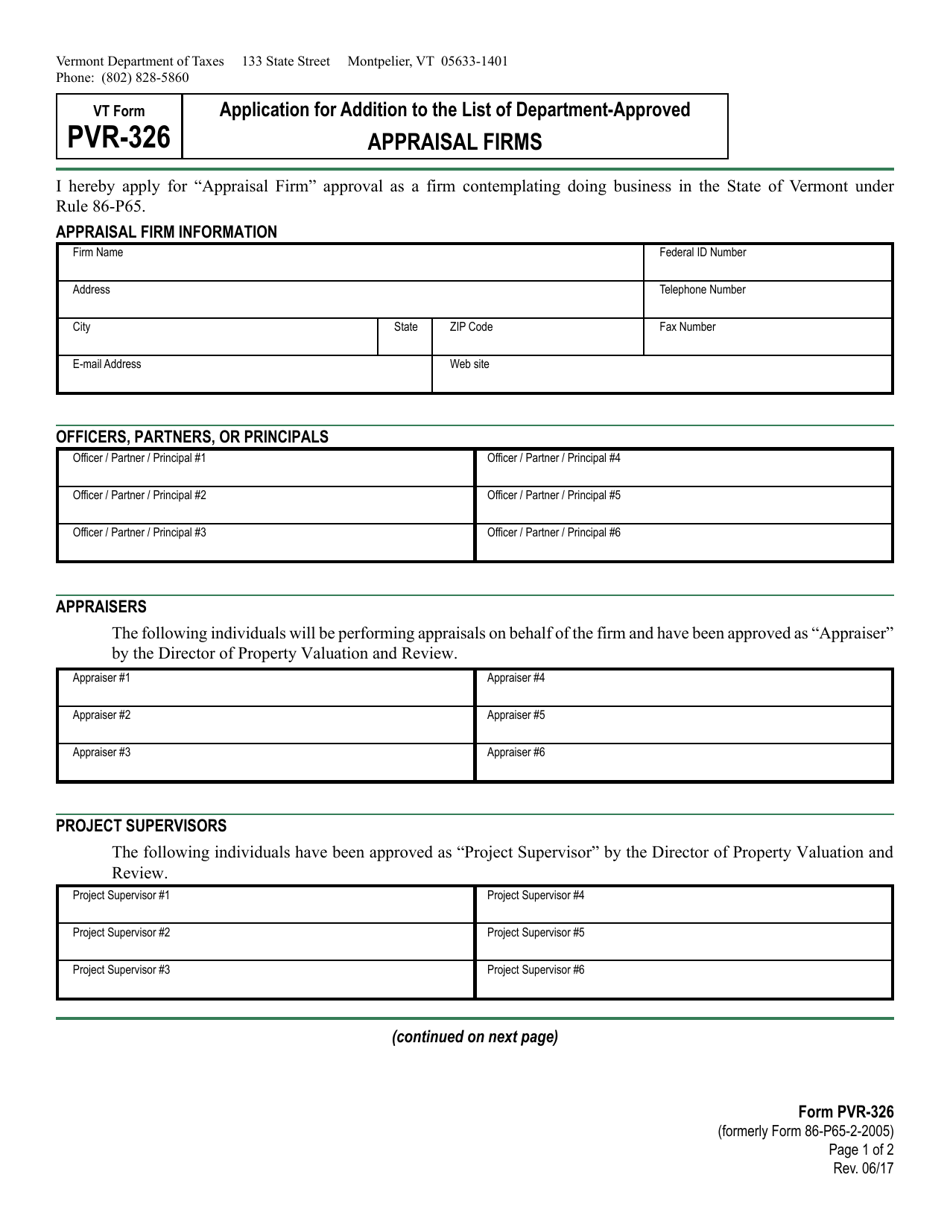

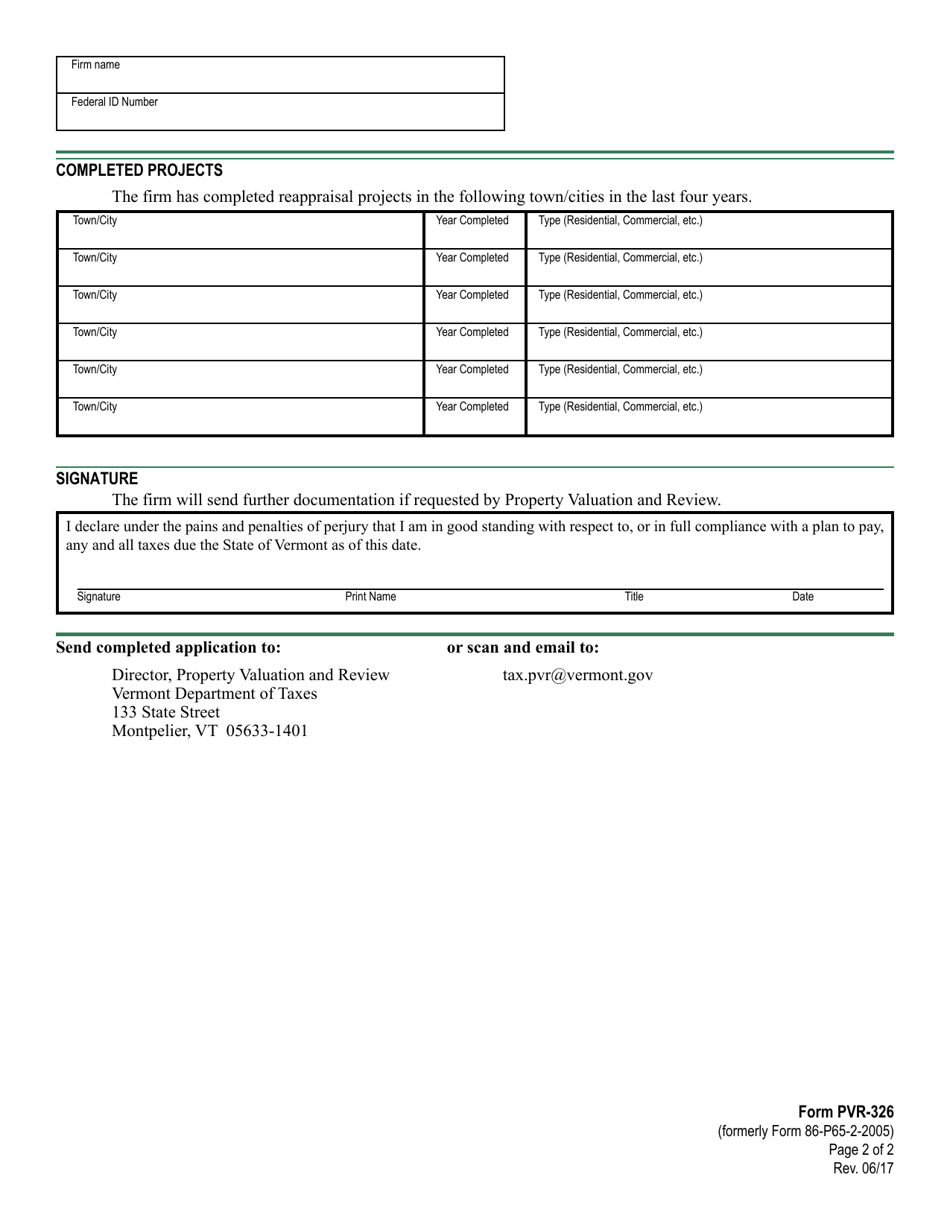

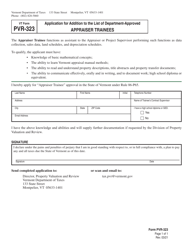

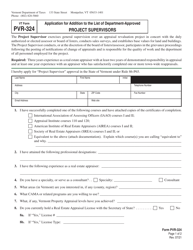

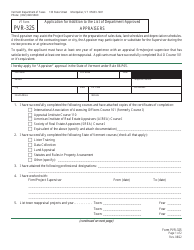

VT Form PVR-326

for the current year.

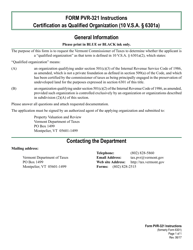

VT Form PVR-326 Application for Addition to the List of Department-Approved Appraisal Firms - Vermont

What Is VT Form PVR-326?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form PVR-326?

A: VT Form PVR-326 is an application for addition to the List of Department-Approved Appraisal Firms in Vermont.

Q: What is the purpose of VT Form PVR-326?

A: The purpose of VT Form PVR-326 is to apply for inclusion on the List of Department-Approved Appraisal Firms in Vermont.

Q: How do I use VT Form PVR-326?

A: You can use VT Form PVR-326 to submit an application for approval as an appraisal firm in Vermont.

Q: Do I need to pay any fees when submitting VT Form PVR-326?

A: There may be fees associated with submitting VT Form PVR-326. Please refer to the instructions on the form for more information.

Q: What happens after I submit VT Form PVR-326?

A: After submitting VT Form PVR-326, the Department of Revenue will review your application and determine if you meet the requirements to be added to the List of Department-Approved Appraisal Firms in Vermont.

Q: Can I appeal if my application on VT Form PVR-326 is denied?

A: Yes, you can appeal the decision if your application on VT Form PVR-326 is denied. Please follow the instructions provided by the Department of Revenue for the appeals process.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form PVR-326 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.